Telegram’s TON Ecosystem Drives Binance’s Latest Token Listings

Binance lists five TON tokens, surprising the market. Colin Wu and WuliGy discussed the TON ecosytem and how it interacts with exchanges like Binance.

New markets and new users from this popular social media app can offer great benefits to exchanges.

Binance Targets New Markets on TelegramOn an episode of the Wu Blockchain podcast, Colin Wu sat down with WuliGy to discuss one question: why is Binance listing so many TON tokens?

Binance has endured price shakeups at the same time after listing the NEIRO meme coin, so this and other questions are especially relevant to the broader market. How will TON distinguish itself? What is Binance’s long-term goal?

Read More: What Are Telegram Mini Apps? A Guide for Crypto Beginners

The pair claimed that Binance is listing these five TON tokens to bank on new regional access. Notcoin triggered a wave of new TON investment when Binance added it in May 2024, ushering in a wave of mini apps.

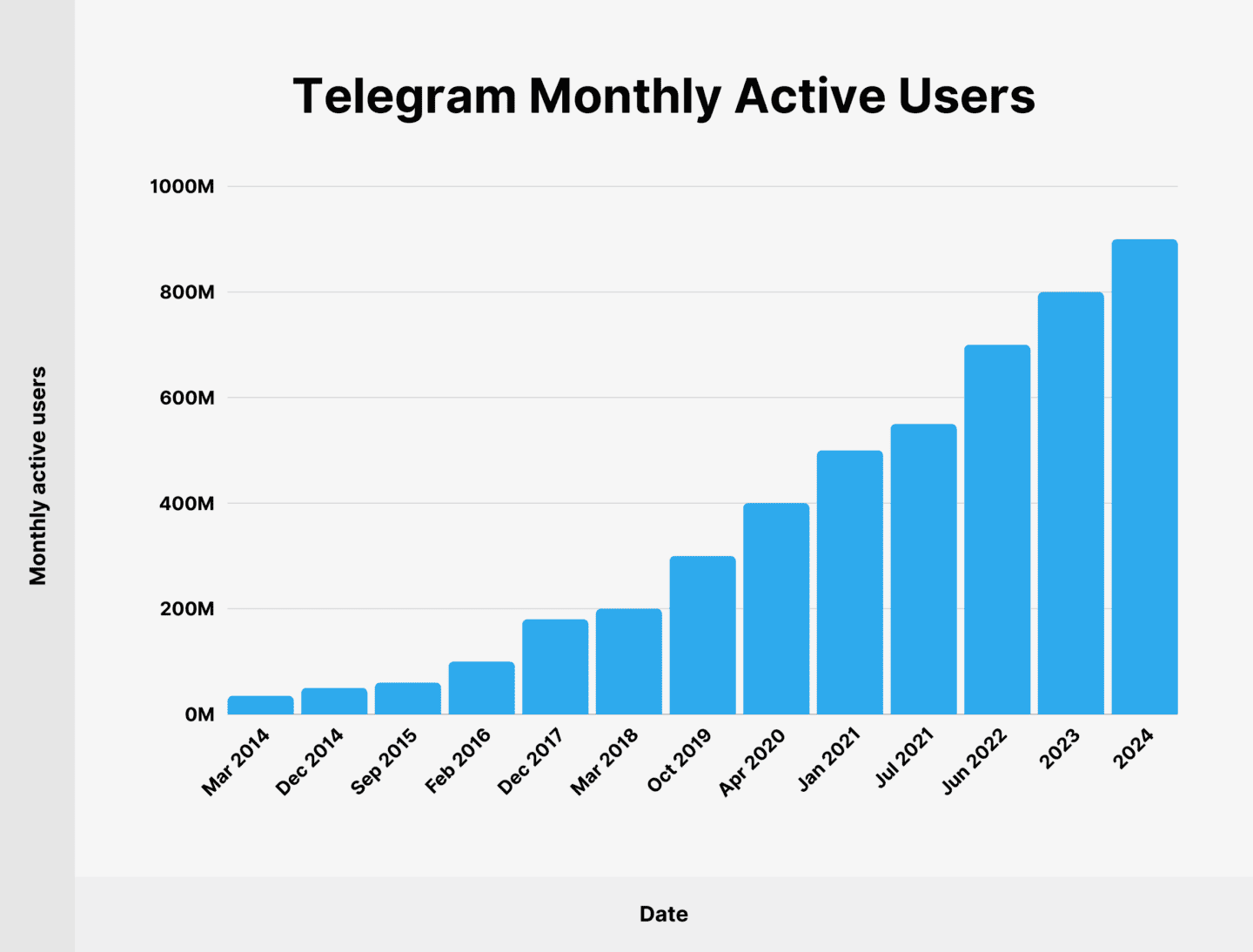

As far as exchanges like Binance are concerned, the name of the game is “attract new users.” Telegram has nearly 1 billion active users, and even tiny percentages of these could mean big daily trade volumes. Moreover, new markets for users also attract Binance.

“The ecosystems behind these tokens have huge potential, especially in regions like CIS, South Asia, and areas where credit cards are less common. As they gradually embrace Web3 and crypto payments, the potential for growth is immense,” WuliGy said.

Telegram User Growth. Source: Backlinko

Telegram User Growth. Source: Backlinko

Telegram is particularly attractive for this, with its higher levels of adoption outside the West. Telegram’s servers host channels with tens of thousands of members, and there are deep connections within language groups.

For example, Russian-speaking developer’s teams from different TON projects are often “backed by connected teams,” said WuliGy. Even when different projects are theoretically totally separate, these same devs are often close peers.

Daily Users for Juicy Trade VolumesThe two men drew several comparisons between TON and other projects to help clarify strengths and weaknesses. For example, they compared it favorably to GameFi, which has already peaked in popularity.

Both models involve earning tokens by playing games and other tasks, but TON is more unpredictable in its rewards. This entices users to participate more in hopes of a big winner, and Telegram has an ever-expanding pool of new users.

Read More: Tap-to-Earn: What to Know About the Crypto GameFi Trend

TON coins are also more attractive than meme coins, from Binance’s perspective. WuliGy stated that “from a user perspective, both meme coins and TON ecosystem projects appeal to users who are chasing high returns.”

However, a meme coin user might buy an asset and forget it, treating it dispassionately and selling it only to staggering losses. The appeal of TON tokens is in daily tasks, a system of constant engagement that WuliGy calls “stronger stickiness.”

This stickiness can hopefully translate to short-term trading volume, and that’s the whole appeal for Binance. Underperforming listings are forgotten, but a long-term user will have to process TON token sales through an exchange. That juices daily trade volume numbers and makes an exchange seem bigger.

WuliGy added that these projects are so cheap that VC money is only useful in the earliest stages, and Colin agreed. Colin claimed that Telegram is the social media giant with the most crypto integration, and it’s developed its own model.

These mini-apps have represented the first and second wave of Telegram-based crypto asset listings. In all likelihood, more are coming.

The post Telegram’s TON Ecosystem Drives Binance’s Latest Token Listings appeared first on BeInCrypto.