Is Bonk’s Drop Today a Prime Buying Opportunity, or Does Pepe Unchained Presale Hold the Key to Massive Growth?

As the recent election season heats up, meme coins like Bonk face mounting market pressure, making technical analysis crucial for investors aiming to capitalize on potential price movements.

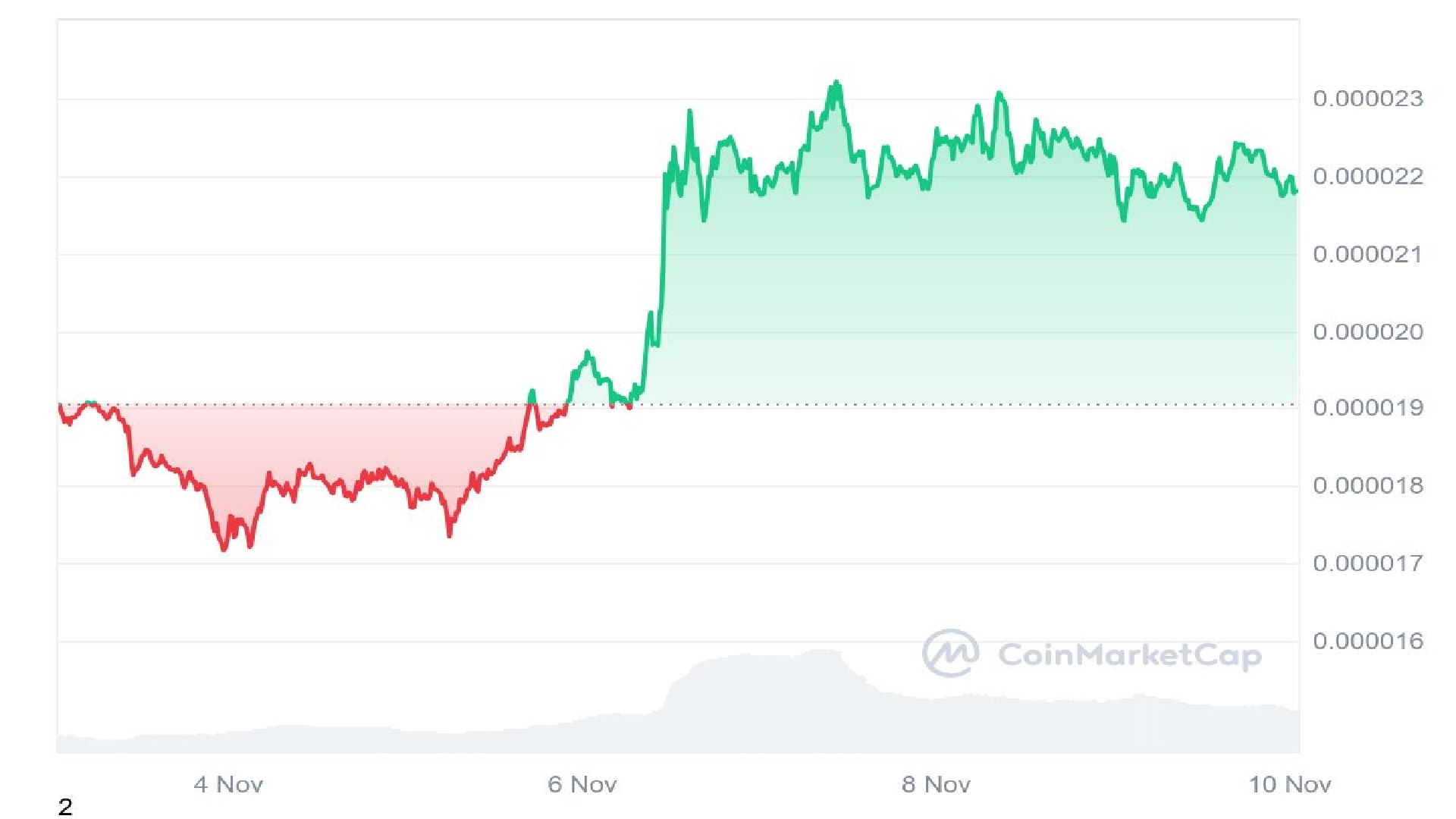

With Bonk currently holding above a $1.6 billion market cap, it remains resilient among over 9,900 cryptocurrencies. Despite recent sideways or downward movement, the token has shown signs of strength, maintaining its position in the top 100 by market cap.

Analyzing Bonk’s current price action helps evaluate potential pullbacks and identify profitable entry points for investors, while also highlighting opportunities within other meme coins during times of Bonk’s volatility.

Bonk (BONK) price analysisBonk is currently priced around a $1.6 billion market cap, with recent trading sessions showing a slight daily dip, providing an attractive buy-the-dip opportunity for investors.

Over the past week, Bonk’s price has risen by 16.88%, demonstrating resilience as it maintains its position above the billion-dollar threshold—a promising sign of investor confidence.

However, with Bitcoin’s market dominance and recent minor corrections, Bonk’s price may remain volatile, especially as investors brace for the potential impact of election-driven market shifts.

The recent election has likely had an impact on broader market sentiment, potentially leading to a pullback across various altcoins. In the wake of this high-stakes political event, Bonk could experience a dip in value, following a typical pattern seen in assets during periods of political uncertainty.

With technical indicators suggesting potential support and resistance levels, this period may present opportune buying levels for those looking to capitalize on market volatility. The Bonk price chart reveals a few key trend lines and support levels.

The asset has shown limited upside momentum in recent weeks, mostly moving sideways. However, significant trend lines established from high points in May through July suggest that Bonk may be nearing a critical pivot point.

A major descending trend line extending from the highs of May to the recent levels indicates a strong area of resistance for Bonk, which could play a key role in predicting potential pullbacks or reversals.

Additionally, Bonk has a historically strong horizontal support level, which has acted as both support and resistance in the past. The last test of this level saw a strong upward reaction, making it a potentially attractive buy zone.

Bonk (BONK) price predictionGiven Bonk’s current position, there are a couple of scenarios that may unfold in the short term. The first involves a significant pullback and potential buying opportunity. With the election now concluded, volatility may lead to a major pullback in altcoins, including Bonk.

A 20-30% decrease could bring Bonk to a level where substantial buying momentum has historically been present. Should Bonk dip by 30%, investors might see a prime entry opportunity with the potential for a 20% bounce upon recovery.

Alternatively, a moderate decline to Bonk’s horizontal support level is also possible, with a 16% pullback bringing it closer to a level that has held strong support in the past, leading to aggressive upward moves.

If Bonk reaches this level again, a solid bounce could occur, offering a favorable entry point for those seeking shorter-term gains. For long-term holders, Bonk presents potential even if prices experience further pullbacks.

Dollar-cost averaging (DCA) can be an effective strategy in volatile markets, allowing investors to build a position at various price points and smooth out market fluctuations.

For those confident in Bonk’s long-term potential, averaging down from these levels could yield attractive returns over time, as Bonk continues to show substantial daily trading volume, often exceeding $100 million—a clear sign of sustained interest.

Bonk’s consistent trading volume and strong market presence, despite being a meme coin, suggest potential longevity in the crypto market.

While it may be affected by broader market trends, its high liquidity and resilience make it a promising asset for both short-term trading and long-term holding.

If you’re looking for investment opportunities that could offer big returns and increase in value during the next bull run, check out our guide here for the best crypto presales of 2024.

Pepe Unchained: 2024’s Hottest Alternative for High-Growth Crypto InvestmentPepe Unchained, now in an extended presale period, is positioning itself as a major upcoming project in the meme coin space with a Layer 2 blockchain aimed specifically at meme coin ecosystems.

The project is focused on building a substantial infrastructure, including a Layer 2 network featuring decentralized applications, a bridge, block explorer, developer grants, and staking, all tailored to support meme coins.

A recent milestone for Pepe Unchained is the launch of a decentralized application that enables users to create new meme coins on its platform, a feature similar to Solana’s Pump.fun.

This development reflects the project’s progress and enhances its attractiveness, setting the stage for long-term success through active user engagement and steady adoption.

We are floored with the support coming in for PEPU!