Sell or Buy? How Crypto Whales Are Reacting to Tariff-Induced Market Decline

Panic sentiment is sweeping across the investment community as the crypto market plunges under pressure from new global tariff policies.

Amidst the chaos, crypto whales show two contrasting trends: aggressive sell-offs to cut losses and strategic accumulation in anticipation of a rebound.

Crypto Market Plummets as Tariff Pressure MountsThe crypto market is in freefall, with both Bitcoin and Ethereum facing steep declines. Bitcoin has dropped below the $75,000 mark, down 5.75% in the past 24 hours. Ethereum has suffered even more, plunging below $1,400—a 9.36% loss over the same period.

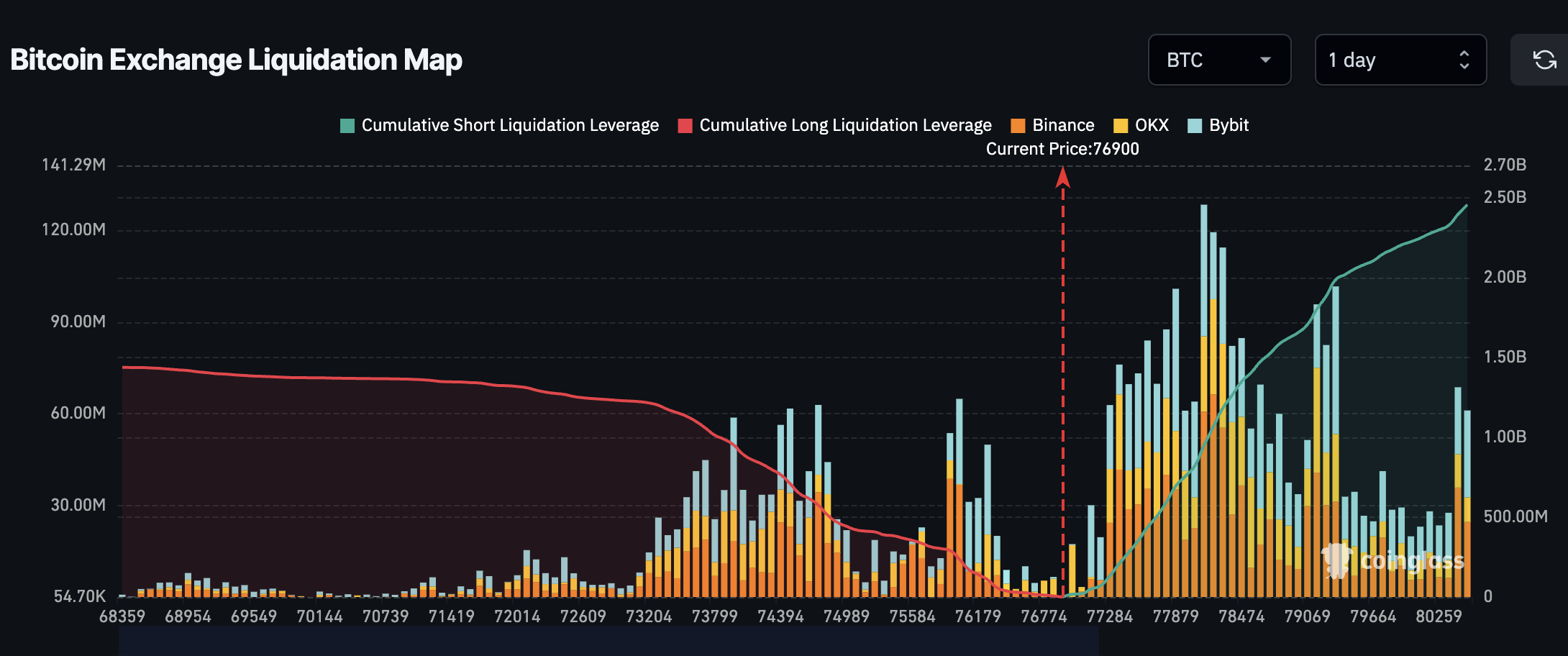

According to data from Coinglass, if Bitcoin breaks below $74,000, liquidation pressure could trigger over $953 million in buy orders across major centralized exchanges. This alarming figure shows the intense selling pressure currently gripping the market.

Bitcoin exchange liquidation map. Source: Coinglass

Bitcoin exchange liquidation map. Source: Coinglass

Market sentiment is also deteriorating. The Fear and Greed Index shows the crypto market is now in a state of “Extreme Fear.” This growing lack of confidence fuels widespread panic selling, pushing major cryptocurrencies to multi-week lows.

Whales Trigger Massive Sell-OffsSeveral crypto whales have opted to liquidate assets during market chaos to minimize risk or avoid forced liquidation. A notable case is the “Long ETH Whale,” which sold 5,094 ETH to lower their liquidation price, accepting an accumulated loss exceeding $40 million. Similarly, Pump.fun reportedly sold 84,358 SOL at an average price of $105.

Even politically linked projects weren’t spared. WLFI, associated with Donald Trump, liquidated 5,471 ETH at an average price of $1,465.

The “7 Siblings” group is suspected of selling MKR, although they still hold 6,293 MKR. Other major moves include three whale wallets unstaking a combined 168,498 SOL worth $17.86 million; one whale withdrawing 4,000 ETH from ether.fi and transferring the entire amount to Binance; two addresses selling a total of 150,000 SOL within the past 14 hours.

These large transactions reflect a growing concern among high-stakes investors amid intensifying market stress.

Smart Money Accumulation: Opportunity Amid the CrisisHowever, not all crypto whales are bearish. Some large investors view this dip as a buying opportunity and accumulate crypto assets.

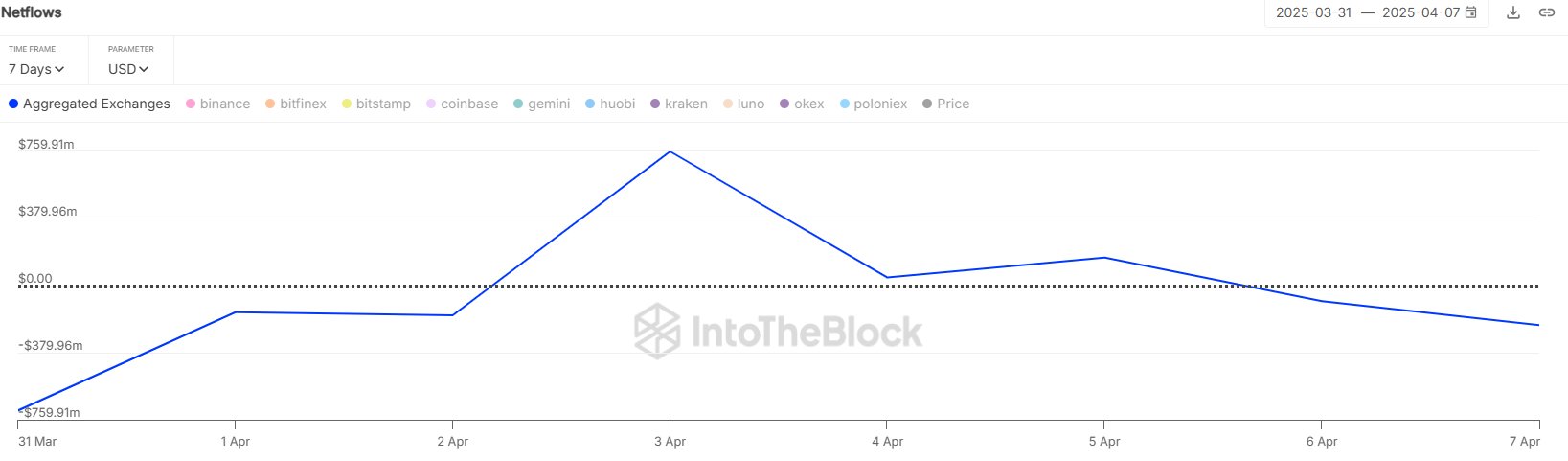

Data from IntoTheBlock reveals that Bitcoin net outflows from centralized exchanges surpassed $220 million yesterday—an indicator of long-term accumulation. In a separate transaction, one whale spent $6.93 million to acquire 4,677 ETH at an average price of $1,481.

Bitcoin netflows from CEX. Source: IntoTheBlock

Bitcoin netflows from CEX. Source: IntoTheBlock

Interestingly, according to analyst Ali, as Bitcoin rebounded from $74,500 to $81,200, 1,715 transactions over $1 million were recorded on-chain. These metrics suggest confidence from “smart money” that a market reversal may exist.

Whale transaction count. Source: Ali

Whale transaction count. Source: Ali

The current crypto crash is closely linked to new US tariff policies, which are raising fears of a global economic downturn. This pressure is weighing on crypto markets and rippling across traditional financial markets, creating a domino effect.

Looking ahead, the market could face two possible scenarios. First, if Bitcoin fails to hold above $74,000, forced liquidations could intensify, pushing prices even lower. Ethereum might fall to the $1,250–$1,300 range if panic persists.

Alternatively, ongoing crypto whale accumulation could fuel a rebound, potentially lifting Bitcoin back to $80,000 and Ethereum above $1,500, especially if there are positive developments from tariff negotiations.

The post Sell or Buy? How Crypto Whales Are Reacting to Tariff-Induced Market Decline appeared first on BeInCrypto.