NFTevening Report: Bitcoin Millionaires Rise 22x Faster Than Stock Investors

With Bitcoin’s (BTC) recent achievement of the $100,000 milestone, crypto once again demonstrated its unmatched ability to generate wealth. A recent report shows the pace of growth for Bitcoin millionaires compared to those who invest in stocks.

This breakthrough moment, explored by NFTEvening and Storible, among others, reflects Bitcoin’s wealth-creation capabilities compared to traditional investments like stocks.

Report Shows Bitcoin’s Meteoric Wealth CreationBeyond validating the faith of early adopters, Bitcoin’s climb to $100,000 also created a staggering number of new millionaires and billionaires. In a recent study by NFTEvening and Storible, researchers tracked over 17,000 Bitcoin wallets with balances exceeding $1 million on Dune Analytics.

Specifically, the research focused on wallets that built wealth incrementally, excluding those with initial balances over $1 million or investments exceeding $100,000. This ensured an emphasis on retail investors rather than institutional players. The findings showed:

- 14,211 New BTC Millionaires: Over 14,000 individuals saw their investments balloon to millionaire status as Bitcoin crossed the $100,000 milestone.

- 4 New BTC Billionaires: Four fortunate investors joined the billionaire ranks, highlighting Bitcoin’s potential for exponential financial growth.

To contextualize Bitcoin’s performance, the analysts proceeded to compare equivalent investments in top stocks by market capitalization over the same period. The statistics were striking when comparing Bitcoin’s wealth-creation speed with that of blue-chip stocks. Per the report:

- Millionaire Creation: With a $4,000 investment, Bitcoin investors typically take 10.3 years (or 3,775 days) to reach millionaire status. This represents a 250X return on investment (ROI) since 2010. Conversely, the same investment in blue-chip stocks during the same period would grow to just $45,000—barely a fraction of Bitcoin’s potential.

- Billionaire Creation: A $30,500 investment in Bitcoin has historically required 12.7 years (or 4,645 days) to achieve billionaire status, yielding a jaw-dropping 32,787x ROI. In stark contrast, a similar investment in stocks would reach just $950,000 in value over the same timeframe.

These findings further highlight the stark contrast between Bitcoin and traditional investment vehicles. Nevertheless, the research did not stop there. It proceeded to compare Bitcoin to market leaders.

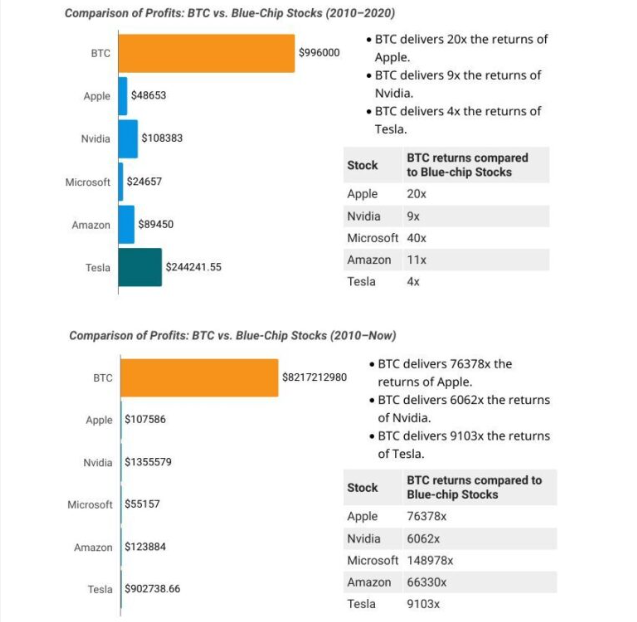

Bitcoin Returns Dwarf Apple, Nvidia, and Tesla Since 2010When pitted against the top 10 largest stocks by market capitalization, Bitcoin’s performance dwarfs even the most successful companies. Specifically:

- 2010-2020 Returns: Bitcoin delivered 20X the returns of Apple, 9X those of Nvidia, and 4X Tesla’s gains.

- 2010-Present Returns: Bitcoin’s ROI surged to 76,378X Apple’s, 6,062X Nvidia’s, and 9,103X Tesla’s returns.

BTC Investors Become Millionaires 22x Faster Than Stock Investors. Source: NFTEvening

BTC Investors Become Millionaires 22x Faster Than Stock Investors. Source: NFTEvening

This finding aligns with a recent survey conducted by ReviewExchanges, concerning how US investors responded to Bitcoin’s $100,000 milestone. As BeInCrypto reported, an overwhelming 72% of respondents view cryptocurrency as a major future investment. This cohort cited optimism around Bitcoin ETFs, political shifts, and growing mainstream acceptance.

On the other hand, 83% of investors reported earning less than $10,000. At the same time, a striking 79% of crypto holders admitted to missing out on major gains during this bull run. This highlights the importance of timing in crypto investments, reflecting how late market entries or smaller initial investments cost investors potential gains.

Nevertheless, investors should avoid relying solely on surveys and instead conduct thorough research to make well-informed decisions. Amid growing traction and accelerated mainstream adoption, Bitcoin and crypto appear set to continue reshaping wealth distribution.

BTC Price Performance. Source: BeInCrypto

BTC Price Performance. Source: BeInCrypto

At the time of writing, Bitcoin was trading at $102,496. This represents a minor retraction of almost 2% since Thursday’s session opened, as crypto markets reel from the Federal Reserve’s recent interest rate decision.

The post NFTevening Report: Bitcoin Millionaires Rise 22x Faster Than Stock Investors appeared first on BeInCrypto.