MicroStrategy marks sixth consecutive week of Bitcoin purchase with additional 15,350 BTC for $1.5 billion

Michael Saylor-led MicroStrategy has purchased 15,350 Bitcoin for $1.5 billion at an average price of $100,386 per coin, according to a Dec. 16 filing with the US Securities and Exchange Commission (SEC).

This latest acquisition marks the sixth consecutive week of Bitcoin purchases by the company, which recently became part of the Nasdaq 100 index on Dec. 13. Over the previous five weeks, MicroStrategy significantly increased its Bitcoin reserve, acquiring 171,430 BTC at a total cost of $15.61 billion.

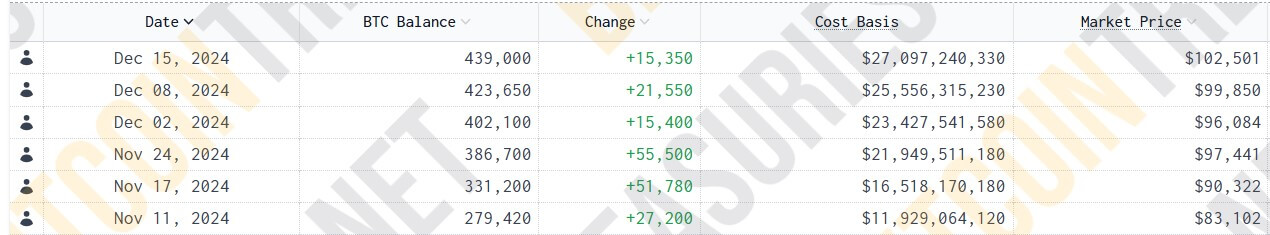

MicroStrategy’s Bitcoin Purchases. (Source: Bitcoin Treasuries)

MicroStrategy’s Bitcoin Purchases. (Source: Bitcoin Treasuries)

With this addition, MicroStrategy now owns 439,000 Bitcoin, representing over 2% of the flagship asset’s total supply. The company’s cumulative investment in Bitcoin stands at $27.1 billion, translating to an average purchase price of $61,725 per Bitcoin. At current market rates of over $104,000, these holdings are worth more than $45.6 billion.

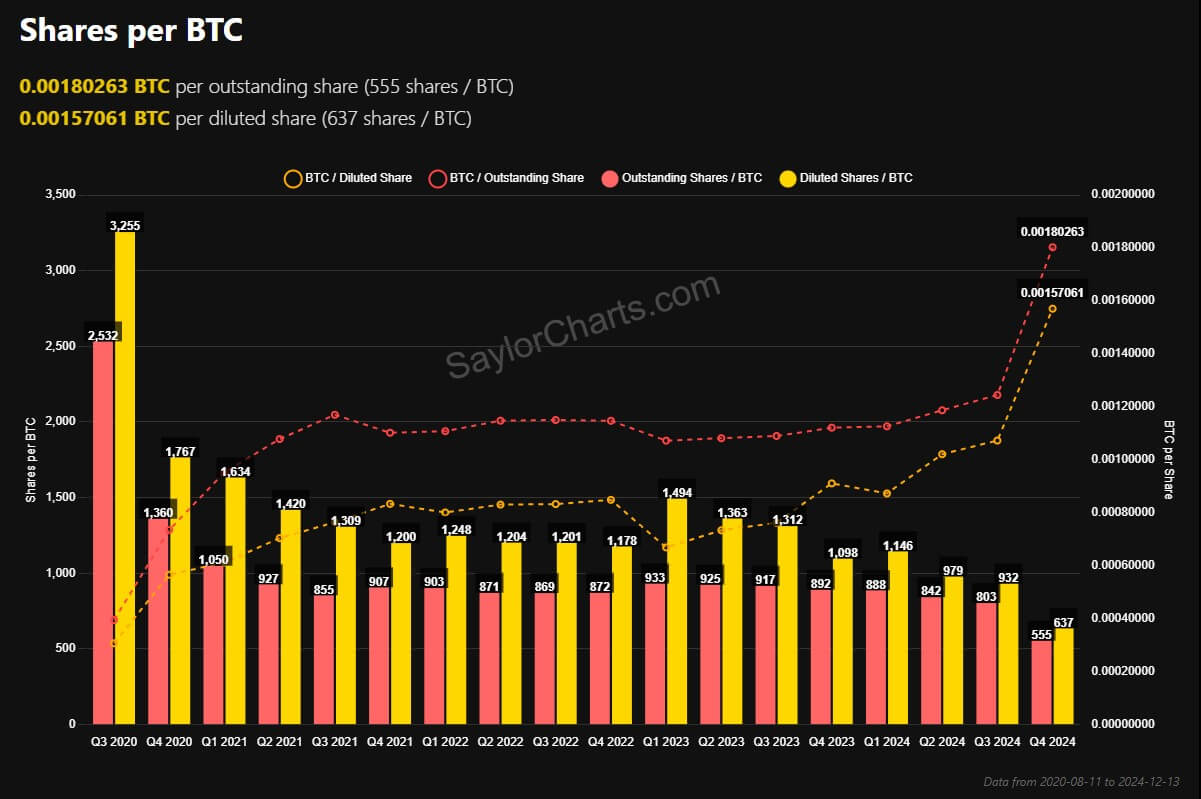

The firm’s executive chairman, Michael Saylor, highlighted how Bitcoin’s strong performance in recent months has translated into impressive returns for the company. Its BTC Yields stood at 46.4% for the quarter and 72.4% for the year.

MicroStrategy’s Shares Per BTC (Source: SaylorCharts)

MicroStrategy’s Shares Per BTC (Source: SaylorCharts)

Meanwhile, news of the latest Bitcoin acquisition and the company’s inclusion in the Nasdaq 100 index has positively impacted its stock. MicroStrategy shares rose 4% in pre-market trading, reaching $425.

The post MicroStrategy marks sixth consecutive week of Bitcoin purchase with additional 15,350 BTC for $1.5 billion appeared first on CryptoSlate.