Majority of Americans Say Inflation Will Make Santa ‘Less Generous’ This Holiday: Survey

A new survey suggests most Americans are having a tougher time than usual buying gifts this holiday season.

In its new Holiday Shopping Survey, WalletHub surveyed 210 individuals and then normalized the results by age, gender and income to accurately reflect U.S. demographics.

The results paint a relatively bleak picture of the American consumer.

According to the survey, 68% of people say “Santa will be less generous this year due to inflation,” and 31% say they’ll spend less on holiday shopping this year than in 2023.

Nearly half still have debt from last year’s holiday season, and 52% of people will apply for a new credit card in order to do their holiday shopping.

Sixteen percent say they won’t pay off their holiday shopping debt until spring 2025.

Seventy-two percent say their charitable giving is also being affected by inflation.

Despite the apparent financial stress of the holiday season, 72% answered “Yes” when asked if holiday shopping was worth it.

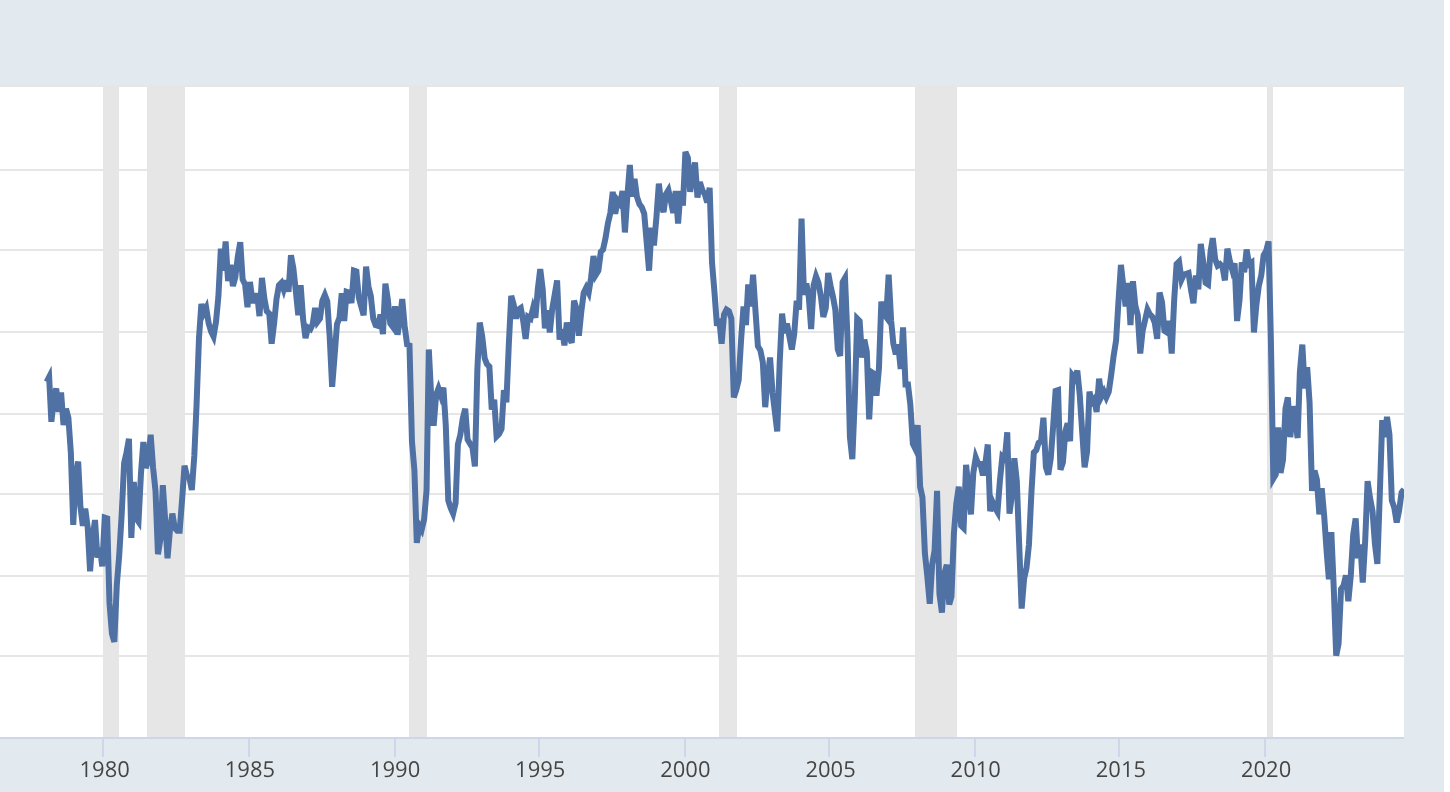

According to data from the St. Louis Fed, US consumer sentiment – measured by the University of Michigan – rose slightly to 70.5. Generally, a reading below 70 is considered “negative.”

Consumer sentiment has been in a downtrend since February 2020.

Source: St. Louis Fed

Source: St. Louis Fed

According to Surveys of Consumers Director Joanne Hsu at the University of Michigan, there is currently a political divide in the US in regard to inflation expectations and consumer sentiment.

“Democrats voiced concerns that anticipated policy changes, particularly tariff hikes, would lead to a resurgence in inflation. Republicans disagreed; they expect the next president will usher in an immense slowdown in inflation. As such, national measures of sentiment and expectations continue to reflect the collective economic experiences and observations of the American population as a whole.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Majority of Americans Say Inflation Will Make Santa ‘Less Generous’ This Holiday: Survey appeared first on The Daily Hodl.