Bitcoin ETFs Hit Milestone With Over 1,000 Institutional Investors

Since their debut in the US market in January 2024, spot Bitcoin exchange-traded funds (ETFs) have been a magnet for institutional investors. These ETFs allow for direct portfolio inclusion of Bitcoin, bypassing the challenges of direct purchase and secure storage.

The market’s response has been overwhelmingly positive, with more than 1,000 institutional investors signing on within just two 13F filing periods. The 13F filings, mandatory quarterly disclosures for institutional investment managers, reflect a growing and sustained interest in Bitcoin ETFs.

BlackRock’s Bitcoin ETF Has 661 Institutional HoldersEric Balchunas, a Bloomberg senior analyst, discussed Bitcoin ETFs’ extraordinary growth. Moreover, he contrasted them with typical ETFs, which often struggle to draw substantial early institutional attention.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

BlackRock’s iShares Bitcoin Trust (IBIT) is particularly noteworthy. It boasts 661 institutional holders and 20% of its shares held by institutions and large advisors. Balchunas predicts this figure could double next year.

Furthermore, a significant shift has been observed among top US hedge funds. 60% of these funds now hold Bitcoin ETFs, up sharply since earlier in the year.

Notably, none of these funds sold their stakes during the second quarter; many increased their holdings. Major players like Citadel Investments, Millennium Management, Mariner Investment, and Fortress Investment are among those who have upped their investments.

The appeal of Bitcoin ETFs extends beyond hedge funds. Remarkably, 13 of the top 25 registered investment advisors in the US now report exposure to Bitcoin through these ETFs. Firms such as Cambridge Associates and Hightower Advisors are gradually increasing their investments, signaling a broader institutional trust in Bitcoin’s value.

This institutional support is transforming the perception and utility of cryptocurrencies. Following the launch of Bitcoin ETFs, Ethereum ETFs were also introduced, drawing even more traditional investment into the crypto sphere.

The influence of these ETFs on the crypto market is undeniable. This growth is reflected in the sharp rise in the number of Bitcoin millionaires, which has jumped 111% to 85,400 globally, as reported by Henley & Partners.

Read more: Who Owns the Most Bitcoin in 2024?

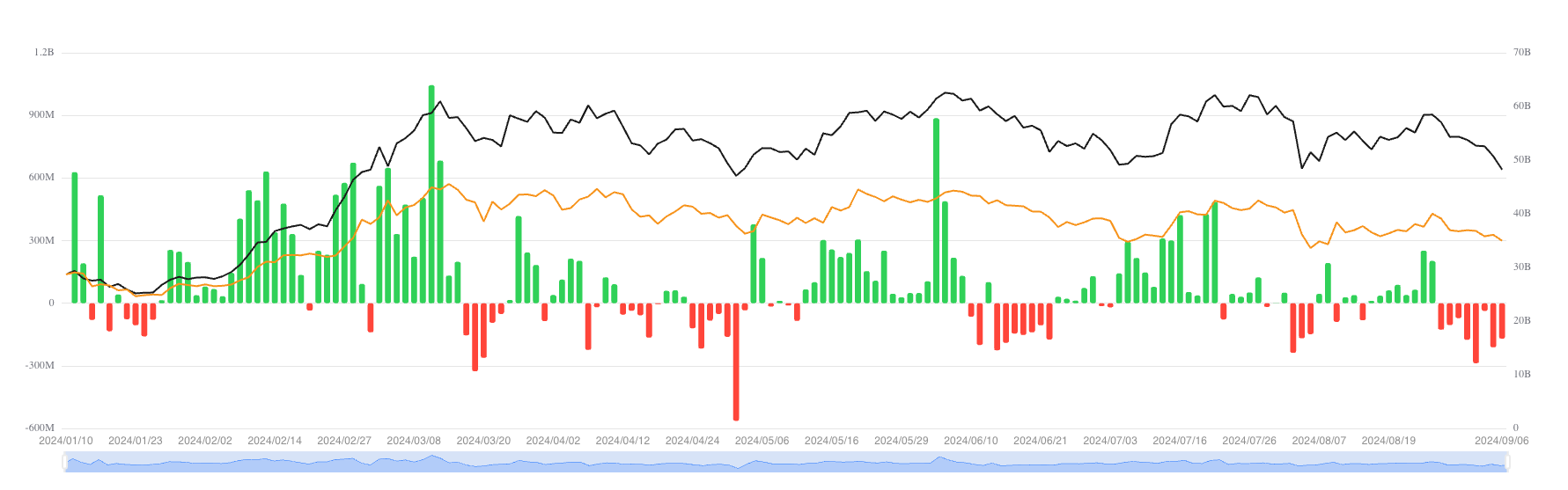

However, despite these gains, challenges persist. US Bitcoin exchange-traded funds have experienced their longest streak of daily net outflows since their debut. Investors have withdrawn roughly $1.2 billion from these funds over eight days through early September.

Total Spot Bitcoin exchange-traded funds Net Flows. Source: SoSoValue

Total Spot Bitcoin exchange-traded funds Net Flows. Source: SoSoValue

This trend highlights the broader market’s current risk aversion, seen during this tumultuous financial period. Yet, Balchunas remains positive.

“That said, they have seen a ‘touch’ of outflows. $287 million outflows for 1 month = 0.5% of aum and the 787 million for 1 week = 1.5%. In other words, close to 99% of the investors have hung tough yet again,” Balchunas said.

The post Bitcoin ETFs Hit Milestone With Over 1,000 Institutional Investors appeared first on BeInCrypto.