XRP Profit Taking Hits 13-Month High, Price May Fall Below $0.50

XRP price has struggled to gain momentum in recent weeks, failing to register any meaningful increase for over a month and a half.

The lack of upward movement has left investors growing impatient. As a result, many have started to cash out their holdings, adding to the pressure on the cryptocurrency.

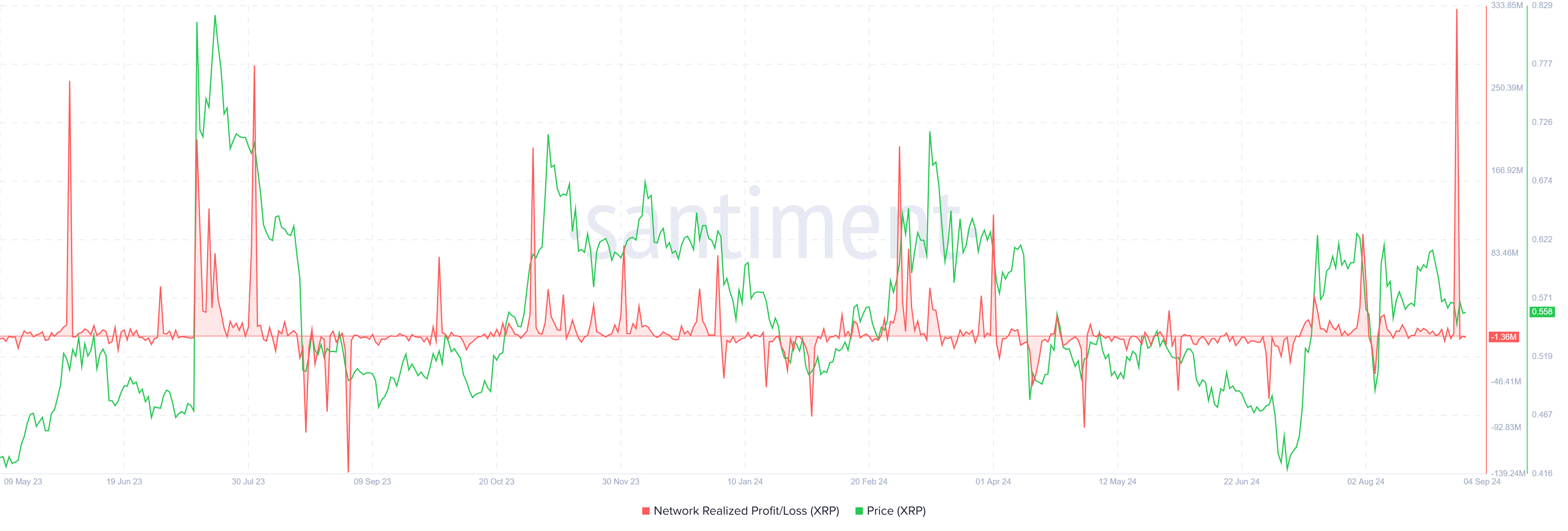

Crucial XRP Investors Move to Book ProfitsXRP price is largely driven by a surge in realized profits, which have hit a 13-month high. This indicates that a large number of investors are taking profits, likely because they no longer believe in short-term price growth.

The wave of selling could create downward pressure on XRP, pushing the price closer to the $0.50 mark or even lower if the trend continues. This spike is also a sign of declining confidence among investors.

Read more: XRP ETF Explained: What It Is and How It Works

XRP Realized Profits. Source: Santiment

XRP Realized Profits. Source: Santiment

Interestingly, this is no ordinary profit-taking. The age consumed metric—a measure of the movement of long-term holders’ assets—has experienced its largest spike since December 2022. This indicator shows that long-term investors are now moving their holdings, typically a sign that these holders are losing patience.

A spike in the age-consumed metric usually precedes a period of volatility as long-term investors reenter the market. This could signal a significant shift in market momentum, with more experienced holders losing confidence in XRP’s short-term recovery. Since these investors are the backbone of an asset, their actions could drive XRP’s price to decline further.

XRP Age Consumed. Source: Santiment

XRP Price Prediction: A Drop Ahead

XRP Age Consumed. Source: Santiment

XRP Price Prediction: A Drop Ahead

XRP price is currently trading at $0.550, which is already below the 38.2% Fibonacci retracement level at $0.553. If the price fails to reclaim this critical level as support, it could fall further, testing the 23.6% Fibonacci line next. The $0.499 retracement level often serves as the “bear market support floor.”

Historically, the $0.499 level has acted as a strong support line for XRP. It is likely that if XRP reaches this price, the decline will halt as buyers look to accumulate at $0.499.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

On the other hand, XRP has not shown significant declines in the past 72 hours, which indicates that a steep drop could be avoided. If the cryptocurrency manages to reclaim $0.553 as a support level, it could invalidate the current bearish outlook. In this scenario, XRP may have a shot at rebounding to $0.60, offering a potential bullish reversal.

The post XRP Profit Taking Hits 13-Month High, Price May Fall Below $0.50 appeared first on BeInCrypto.