Will Dogecoin Price Rally 32%? Bullish Divergence Suggests Big Move

The post Will Dogecoin Price Rally 32%? Bullish Divergence Suggests Big Move appeared first on Coinpedia Fintech News

Dogecoin (DOGE), the world’s biggest meme coin with a market cap of over $13.35 billion is poised for a significant upside rally. On a daily chart, DOGE is flashing a bullish divergence in the Relative Strength Index (RSI), indicating a potential trend reversal from a downtrend to an uptrend.

Bullish Divergence in DogecoinSince the beginning of August 2024, DOGE has been forming a lower low, while the technical indicator RSI has been making higher lows. This indicates that the selling pressure that DOGE has been experiencing for a longer period could decrease in the coming days. Traders and investors see bullish divergence as a potential buy signal.

Dogecoin Price PredictionAccording to expert technical analysis, DOGE is currently at a crucial support level of $0.095. Additionally, it is trading above the 200 Exponential Moving Average (EMA) on a weekly time frame, indicating it is in an uptrend.

Source: Trading View

Source: Trading View

Based on the historical price momentum, whenever the DOGE price reaches to this support level it typically sees an upside rally of 15% to 20%. However, due to the bullish divergence, there is a high possibility that it could soar by 32%, reaching up to the $0.128 level this time.

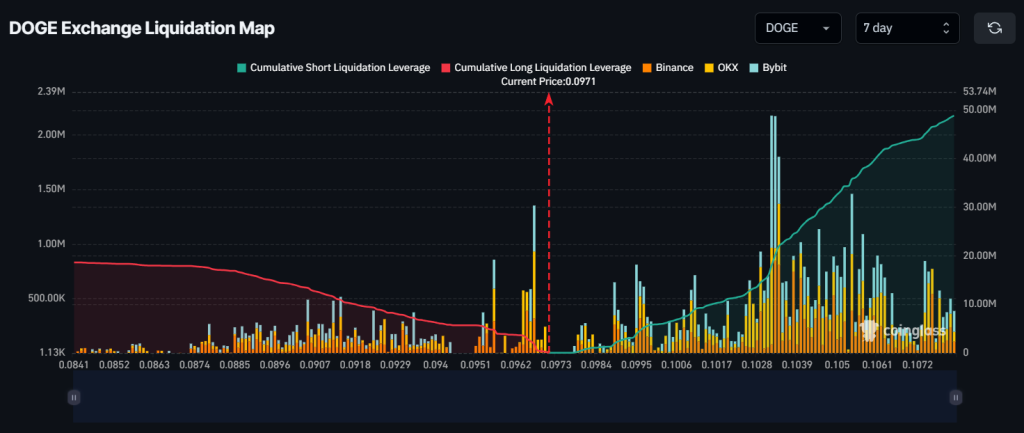

Bullish On-Chain MetricsCoinGlass’s DOGE exchange liquidation data shows that short sellers are still dominating and potentially liquidating long positions on daily and weekly time frames. On a weekly time frame, the major liquidation levels are at $0.0956 on the lower side and $0.103 on the upper side, as traders are over-leveraged at these levels.

Source: CoinGlass

Source: CoinGlass

If the sentiment remains bearish and DOGE fails to hold the $0.0956 level or 200 EMA, nearly $4.78 million worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to the $0.103 level, approximately $22 million worth of short positions will be liquidated.

The trading bets by short sellers are nearly 4 to 5 times higher than bulls’ long positions, which simply indicates the dominance of the bears.

Rising Open Interest and Price MomentumAt press time, Dogecoin (DOGE) is trading near $0.0968 and has experienced a price drop of nearly 2% in the last 24 hours. Despite the price decline, its open interest has increased by 1% in the past hours and 1.5% in the last four hours. This rising open interest shows growing investors’ and traders’ interest in DOGE amid the market downturn.