Will Bitcoin repeat last October’s rally? Short-term holders face critical juncture

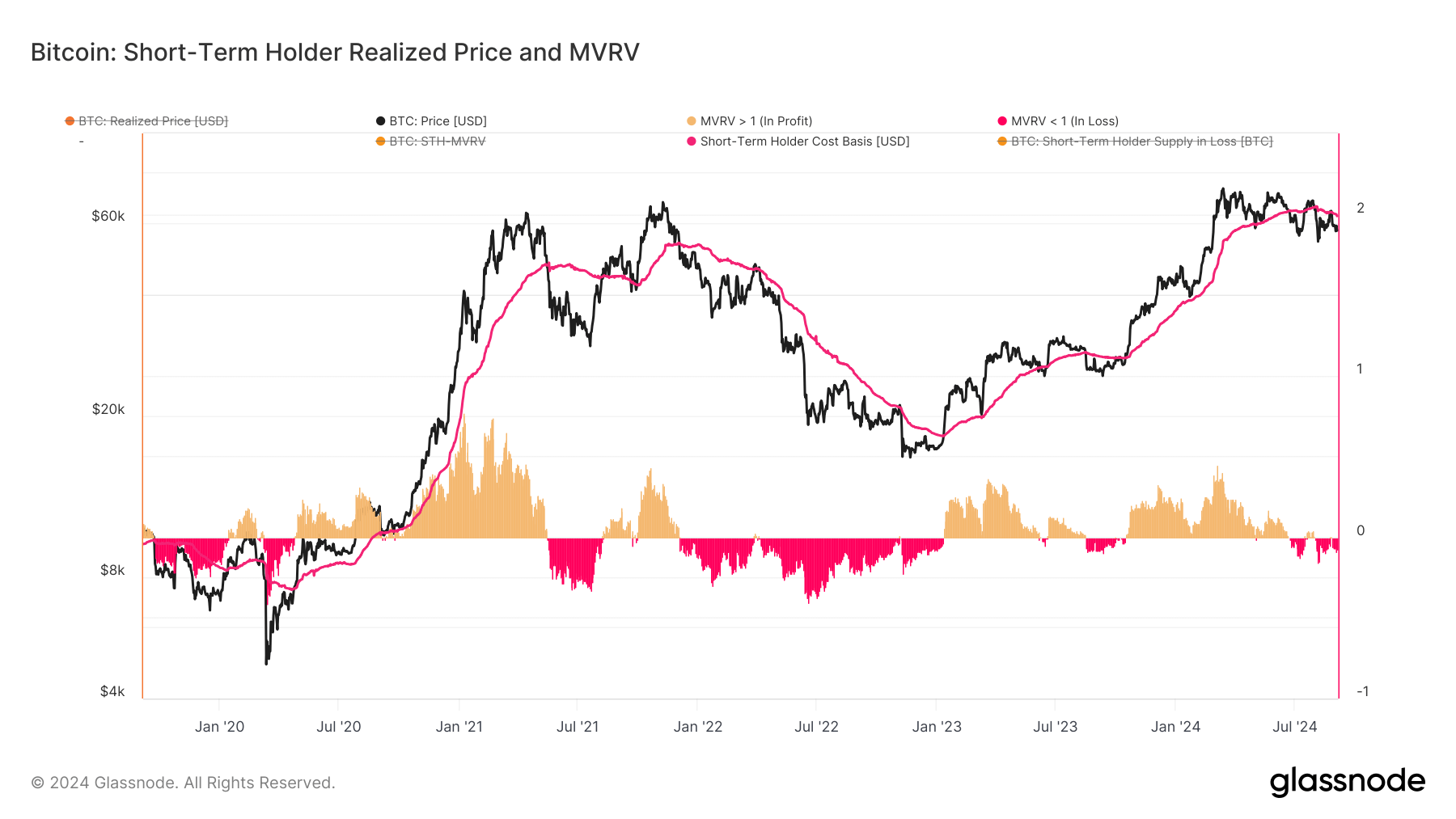

Short-term holders (STH) of Bitcoin, defined as investors who have held onto their BTC for less than 155 days, currently face a challenging market environment. The STH Realized Price (RP), which represents the average price of Bitcoin held by this cohort based on the last on-chain transaction, is presently $62,430. However, Bitcoin’s market price is hovering around $56,500, placing short-term holders at a significant unrealized loss.

Bitcoin: Short Term Holder Realized Price and MVRV: (Source: Glassnode)

Bitcoin: Short Term Holder Realized Price and MVRV: (Source: Glassnode)

Historically, in August 2023, Bitcoin’s price fell below the STH cost basis, dropping to $28,000. The price remained below the STH RP for two months before recovering in October. If the same pattern repeats in 2024, there could be an expectation of Bitcoin prices rising above the STH cost basis in October, while September is usually a bearish month for Bitcoin.

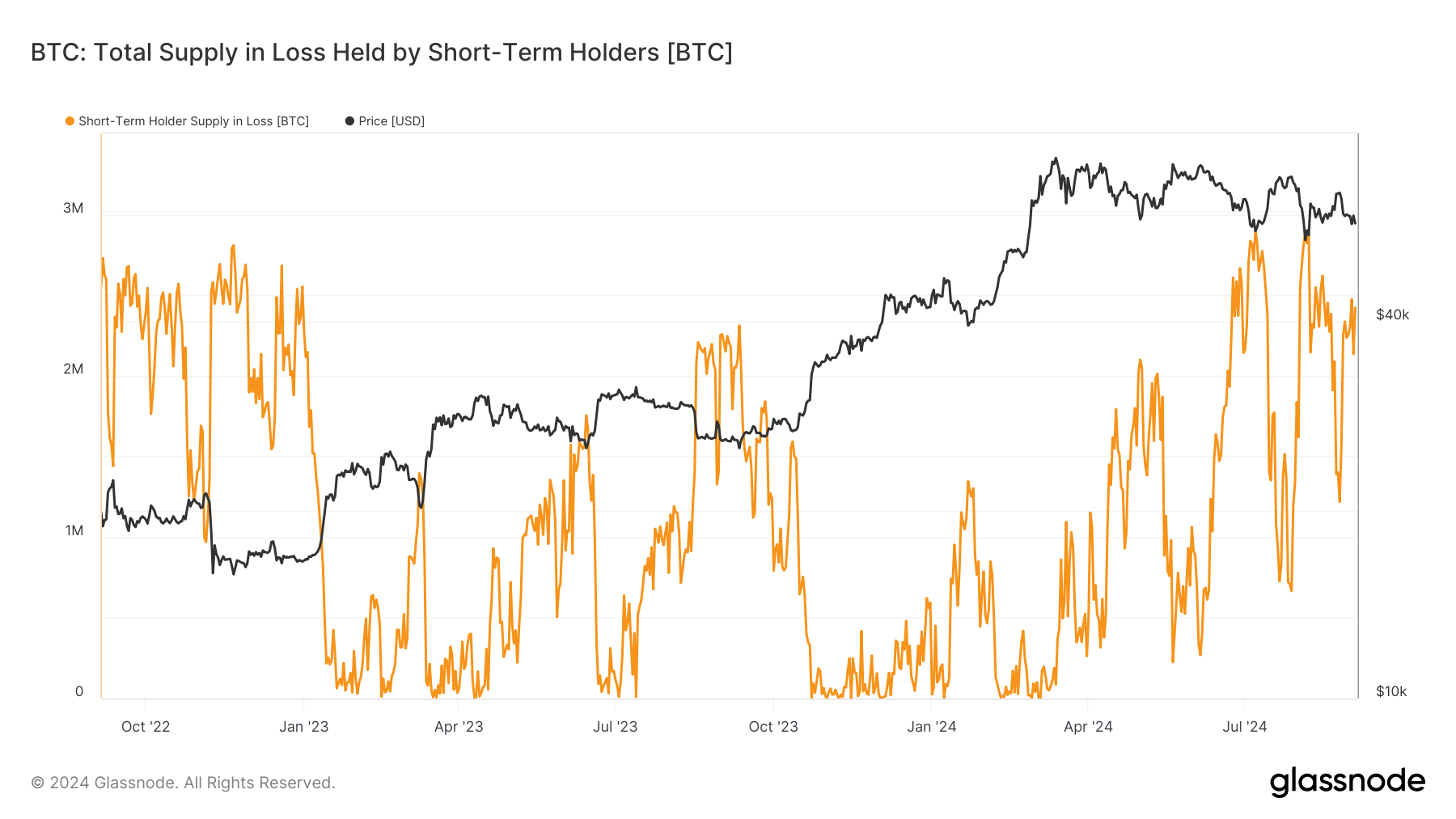

Currently, short-term holders collectively hold nearly 2.5 million BTC at a loss. This could lead to increased selling pressure, which may drive prices even lower if these investors decide to cut their losses. The market is watching closely to see whether the price will recover or if this large cohort of investors will trigger further downside pressure. The question remains: will we see a repeat of last year’s recovery?

BTC: Total Supply in Loss held by Short-Term Holders: (Source: Glassnode)

BTC: Total Supply in Loss held by Short-Term Holders: (Source: Glassnode)

The post Will Bitcoin repeat last October’s rally? Short-term holders face critical juncture appeared first on CryptoSlate.