Why Is Crypto Going Up: Analyst Gives Reasons For BTC Pumping And Its Next Move

The cryptocurrency market is experiencing a noticeable pump, driven by a confluence of factors that are aligning at this moment.

This surge has brought excitement back into the space, marking four consecutive days of green movement. The overall market capitalization has jumped $2.3T, reflecting a clear influx of capital.

Enthusiasts and investors are beginning to sense a shift in sentiment, with conversations across social media, particularly X, brimming with renewed optimism. It seems that the anticipated “Uptober” rally might be delayed but is beginning to take shape.

Several key factors are contributing to this upswing, and it’s crucial to understand what’s fueling this movement and where the market could be headed next.

Bitcoin Surges Past $67K as ETF Inflows and U.S. Election Hopes Fuel Market OptimismBitcoin has breached the significant $67,000 mark, even reaching highs of $68,276 within the past 24 hours. This is a strong indicator of the market’s recovery and growing strength.

One of the primary catalysts behind Bitcoin’s rise is the introduction and success of Bitcoin ETFs (Exchange Traded Funds). In recent days, Bitcoin ETFs have seen over $2 billion in inflows, with $1.5 billion flowing in the day prior.

$67,484.93#Bitcoin #BTC $BTC $USD

— Bitcoin (@Bitcoin) October 17, 2024

These ETFs are drawing in traditional finance investors who are interested in cryptocurrency but are more comfortable investing through established financial products rather than directly holding Bitcoin on exchanges.

This influx represents a new class of investors—mainstream participants who previously stayed on the sidelines. These inflows are crucial because they signal the mainstream adoption of Bitcoin, offering a pathway for traditional finance to engage with digital assets.

As more capital moves into these ETFs, Bitcoin’s price is likely to see further upward pressure. Another important element is the growing excitement surrounding the U.S. presidential election, which is fast approaching in under a month.

Political factors often have a direct influence on financial markets, and in this case, former President Donald Trump’s favorable position toward Bitcoin is worth noting. Trump has publicly declared support for Bitcoin and is critical of the current regulatory stance led by SEC Chair Gary Gensler.

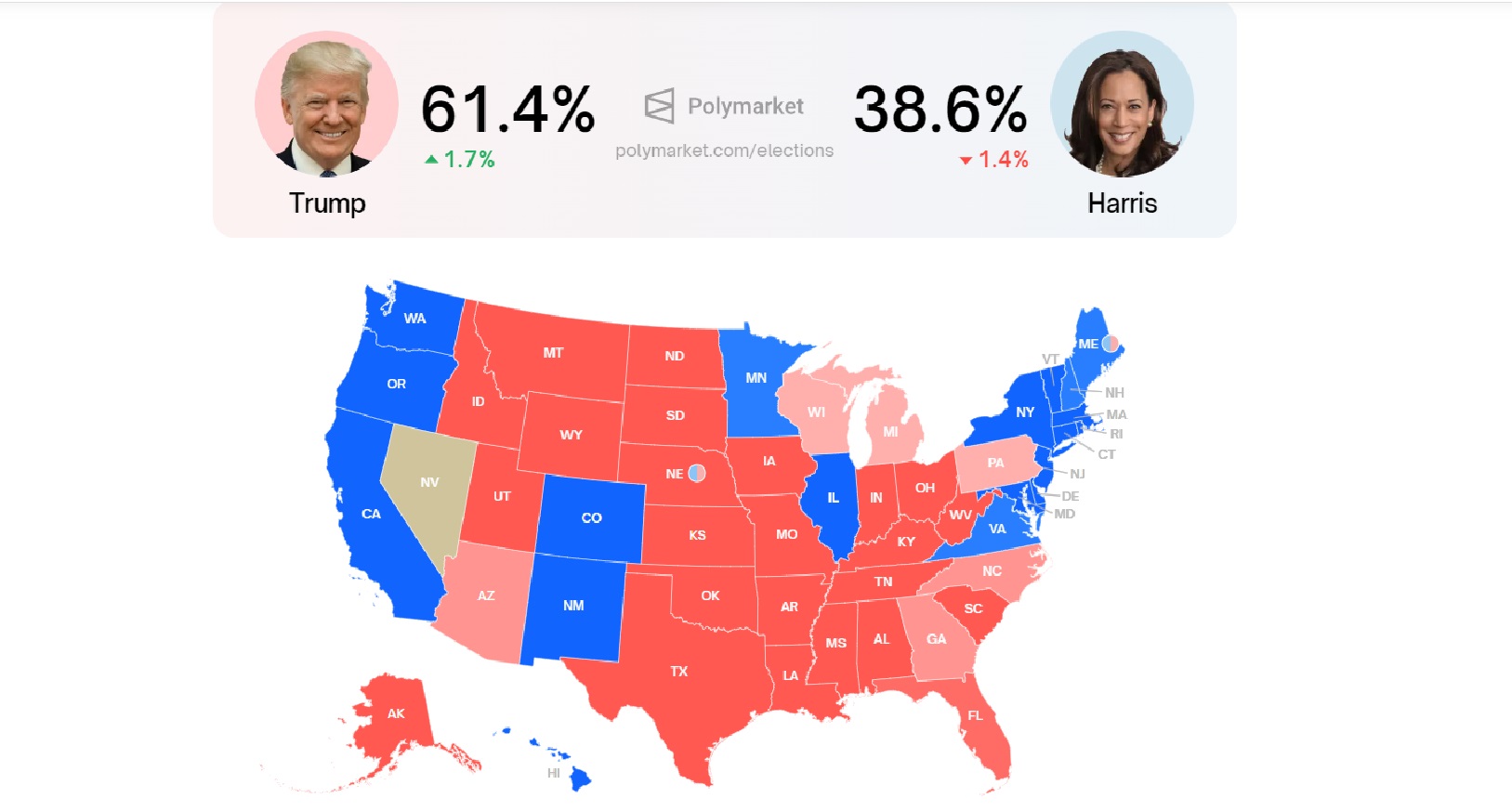

Trump has mentioned that he plans to remove Gensler if re-elected, a move that many in the crypto community view as positive for the industry. According to data from Polymarket.com, Trump’s odds of winning are strong, currently at 61.4% with his main rival, Kamala Harris, trailing at 38.6%.

This growing confidence in Trump’s potential victory could be contributing to the positive sentiment in the market, as many expect a more favorable regulatory environment for crypto under his administration.

Bitcoin Halving History and Geopolitical Factors Set Stage for Potential Surge to $150K by 2025Historically, Bitcoin halving events have had a significant impact on the price of the asset and the broader market. The most recent halving occurred in April 2024, and if history is any guide, the months following a halving—specifically October, November, and December—have historically seen major gains.

In the 2020 and 2016 halving cycles, Bitcoin experienced substantial price increases in the latter part of the year. Many analysts are predicting that Bitcoin could rise to $150,000 by mid-to-late Q1 of 2025, which is more than twice its current price.

Bitcoin is the dominant asset in the cryptocurrency market, representing about 57% of the total market capitalization, so its movement directly affects the broader market.

This surge in Bitcoin could set off a domino effect, lifting other blue-chip altcoins and eventually filtering down to meme coins. Geopolitical factors, particularly the Israel-Iran conflict, have recently weighed on global markets, including cryptocurrencies.

The market was slow to rise at the start of October due to the uncertainty caused by ongoing tensions. However, as the situation has stabilized, or at least calmed down, the market has become less cautious and is now more willing to invest in riskier assets like cryptocurrencies.

With Bitcoin leading the way, it’s expected that other assets will follow. Altcoins typically rise after Bitcoin, though they may lag slightly behind. Ethereum and other major altcoins are expected to see notable gains in the coming months.

Meme coins, which are often a reflection of retail investor interest, could also see a new wave of growth. With a market capitalization of about $54.1 billion, meme coins play an important role in the broader market.

Investors are closely watching this space, and if the positive sentiment continues, meme coin investments could experience a sharp increase as retail investors return. For those seeking alternative investments, check out our 2024 guide to the best meme coins to buy.

RelatedThe post Why Is Crypto Going Up: Analyst Gives Reasons For BTC Pumping And Its Next Move appeared first on ReadWrite.