Whales and Sharks Gobble Up Over $7,863,000,000 in Bitcoin As ‘Impatient’ Traders Drop Their Holdings: Santiment

A prominent analytics firm says deep-pocketed Bitcoin investors are gobbling up massive amounts of BTC at the expense of retail traders.

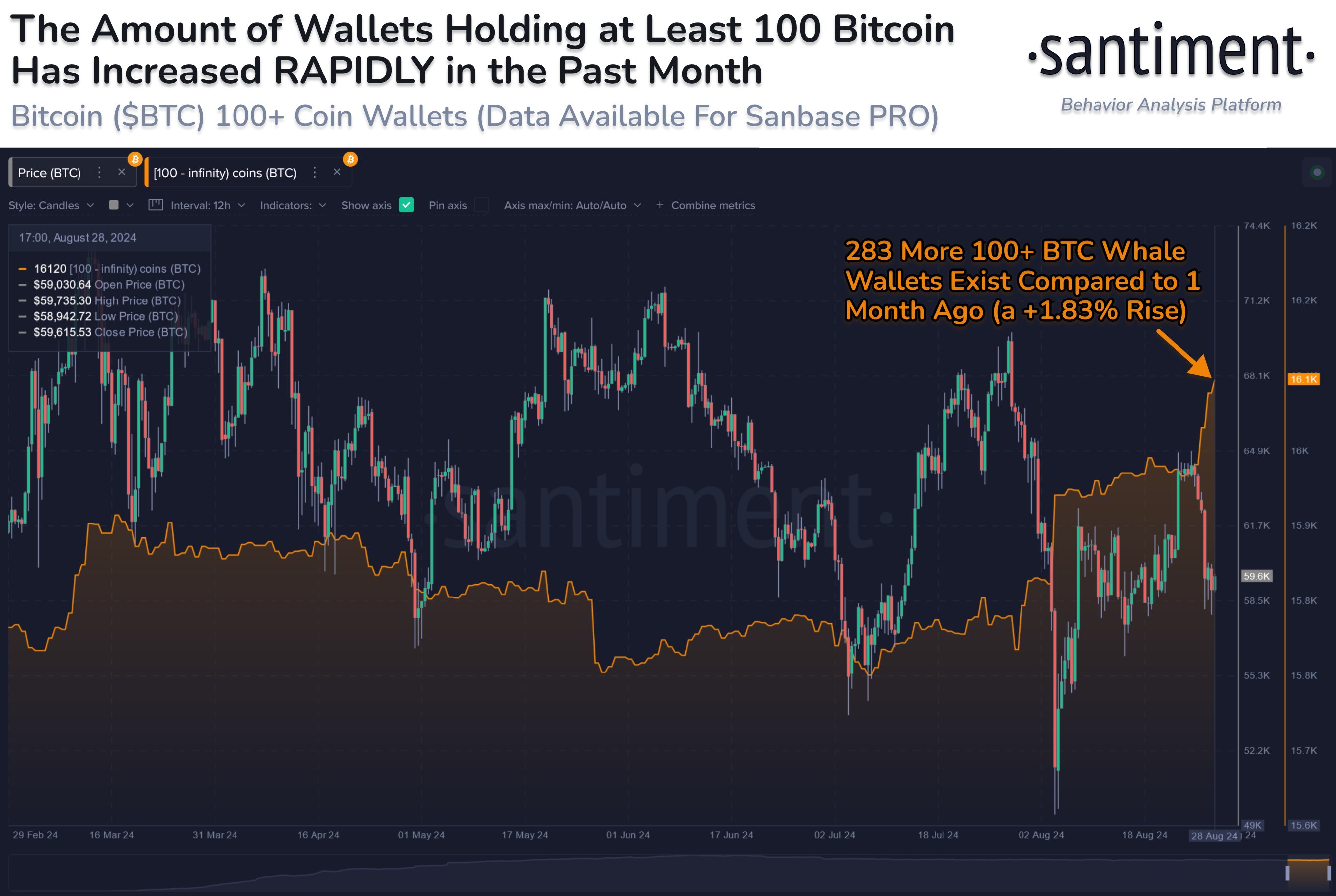

In a new post on the social media platform X, Santiment says the number of crypto wallets holding at least 100 BTC has increased rapidly over the last 30 days.

“As crypto prices have let retail traders down, Bitcoin whales are growing in number. A net gain of +283 wallets holding at least 100 BTC has emerged in just one month. The now 16,120 such wallets on the network have broken a 17-month high.”

Source: Santiment/X

Source: Santiment/X

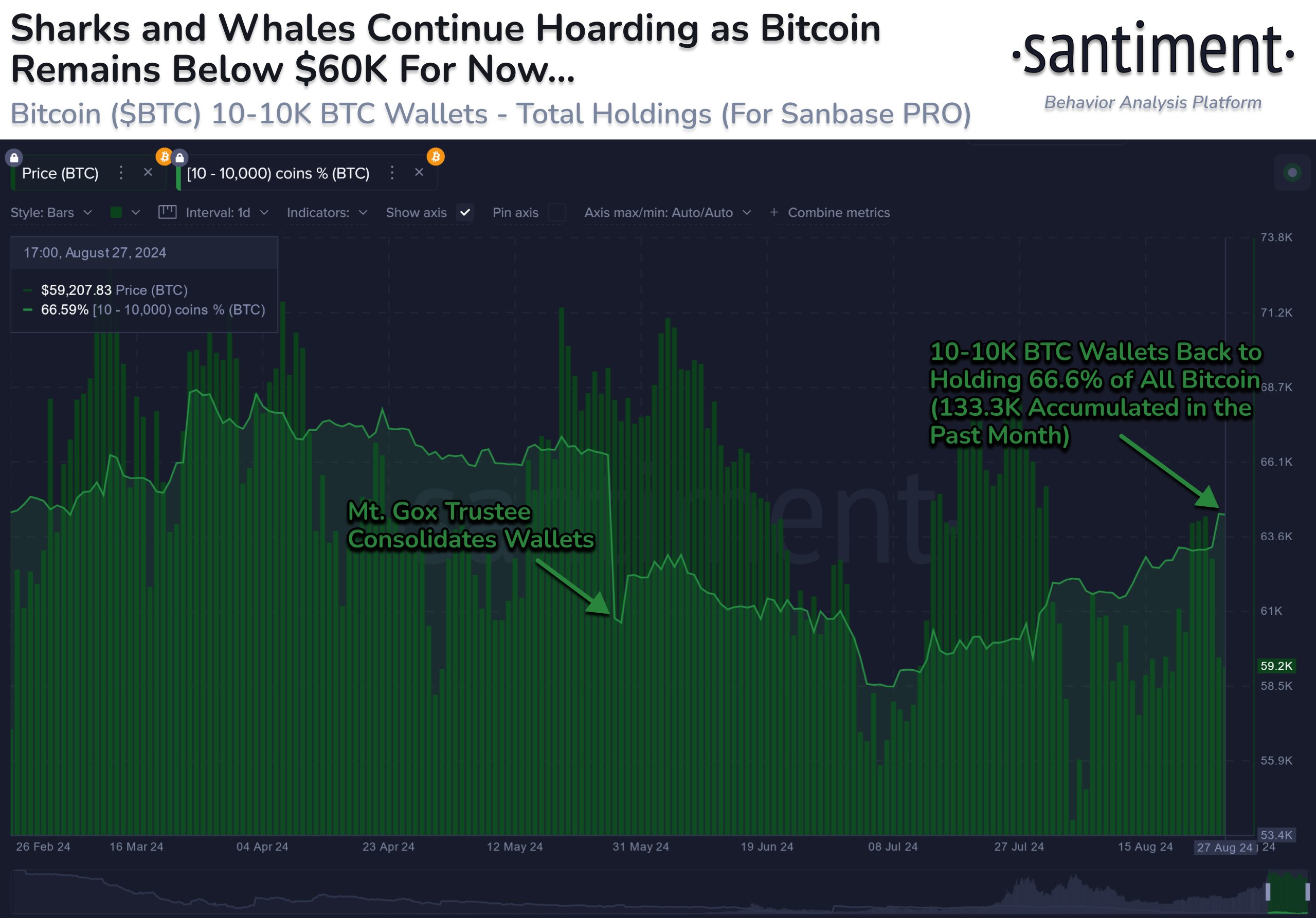

Santiment also says that Bitcoin sharks, or entities holding at least 10 BTC, are loading up on the crypto king.

Furthermore, the analytics firm says Bitcoin whales and sharks have added more than $7.863 billion worth of BTC to their stacks in just one month.

“Over the past month, wallets with 10-10,000 BTC have collectively accumulated 133,300 more coins while smaller traders continue to impatiently drop their holdings to them.”

Source: Santiment/X

Source: Santiment/X

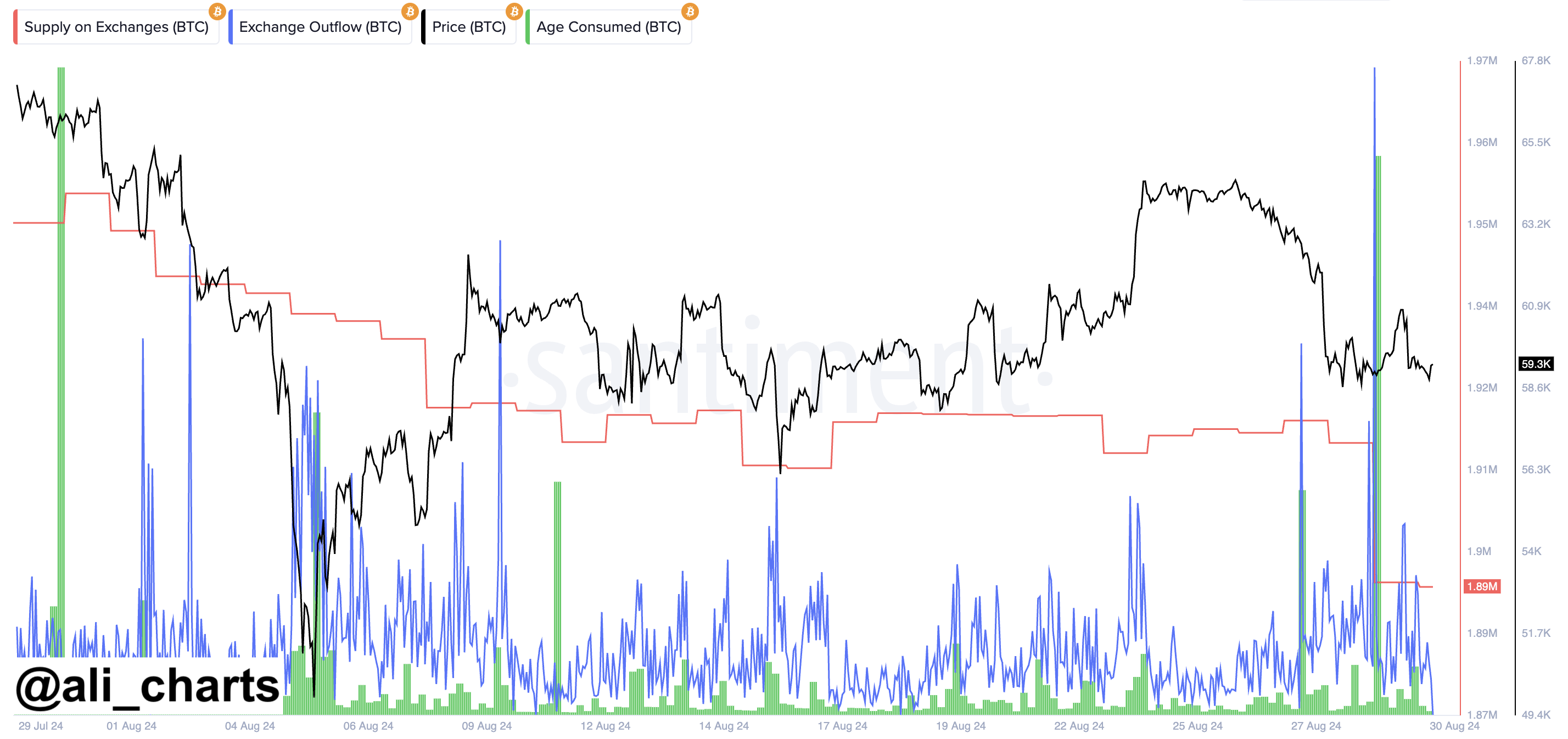

Using data provided by Santiment, on-chain analyst Ali Martinez tells his 69,800 followers on the social media platform X that Bitcoin supply on crypto exchanges took a massive nosedive after BTC broke below $60,000 last week.

“Seems like some major players bought the Bitcoin dip! On-chain data from Santiment reveals a 40,000 BTC drop in exchange supply over 48 hours, equivalent to about $2.40 billion. This aligns with a notable surge in exchange outflows!”

Source: Ali Martinez/X

Source: Ali Martinez/X

At time of writing, Bitcoin is trading for $59,000, down slightly on the day.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Lemberg Vector studio

The post Whales and Sharks Gobble Up Over $7,863,000,000 in Bitcoin As ‘Impatient’ Traders Drop Their Holdings: Santiment appeared first on The Daily Hodl.