Venture Capitalists Stay Bullish on Crypto, Inject $190 Million Despite Market Uncertainties

Amidst turbulent market conditions, venture capitalists (VC) remain bullish on the crypto sector’s potential. Despite fluctuating markets, VC firms like ParaFi Capital and Lemniscap have secured substantial investments.

In total, both VC firms plan to inject $190 million into the crypto market.

VC Investments Are Down 50% From March’s PeakParaFi Capital, a prominent digital asset manager in New York, announced a $120 million funding round. This effort includes contributions from well-known investors such as Theta Capital Management and Accolade Partners.

ParaFi’s strategy involves acquiring stakes in various crypto funds. Consequently, the firm wants to amass a portfolio of 30 to 50 such investments over the next three to five years.

“We’ve watched the crypto-fund landscape evolve closely over the years. We believe there will be many more crypto funds as institutional capital enters this space. It’s important to have specialization and focus, whether it’s across geography, theme or type of investment,” Ben Forman, the founder of ParaFi, said.

Read more: How To Fund Innovation: A Guide to Web3 Grants

Meanwhile, Lemniscap, an investment firm known for its global, thesis-driven approach, has launched a $70 million fund. This fund will focus on diverse opportunities within the blockchain ecosystem, ranging from zero knowledge Infrastructure to emerging Bitcoin ecosystems.

Led by Founder and Managing Partner Roderik van der Graaf, Lemniscap aims to provide strategic support to help Web3 startups scale effectively. The firm has made more than 130 crypto investments so far.

“This new fund will give us significant financial firepower to support the next generation of ambitious industry pioneers,” van der Graaf said.

Moreover, several other crypto venture capitals are also expanding their funds. Heavyweights like Paradigm and Pantera Capital have recently announced substantial new funds aimed at fostering the next wave of crypto innovation. Paradigm raised $850 million for its third fund, while Pantera Capital is in the process of raising $1 billion for its Fund V.

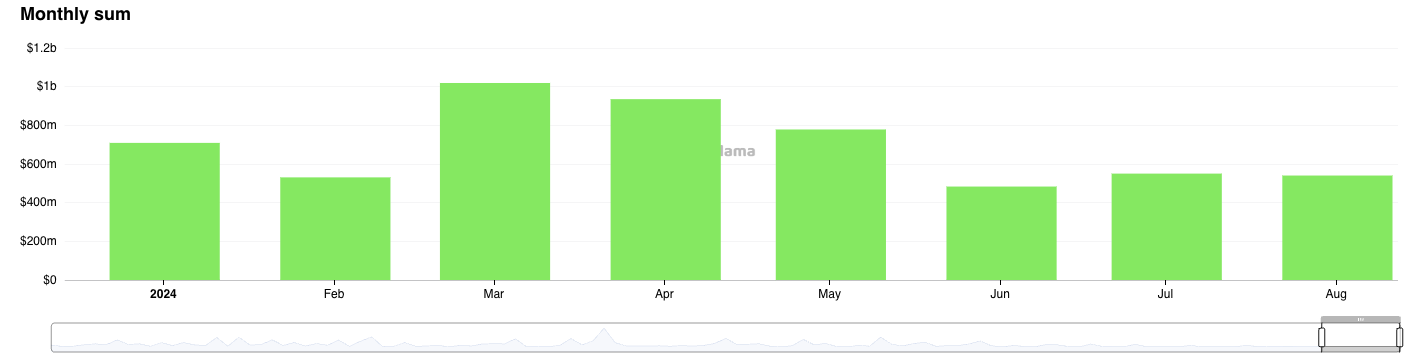

According to DefiLlama, crypto firms have raised over $5.5 billion in funding this year, with $540 million secured in August alone. However, the August fundings are around 50% down from the peak in March.

Read more: Exploring DefiLlama: An Extensive Guide to DeFi Tracking

Monthly Crypto Raises in 2024. Source: DefiLlama

Monthly Crypto Raises in 2024. Source: DefiLlama

Analysts believe that funding has declined due to market uncertainties and regulatory challenges from the US Securities and Exchange Commission (SEC). Recent actions by the SEC, including a Wells notice to the NFT marketplace OpenSea, hint at a possible crackdown.

“This space is just not attractive due to Gary Gensler & the SEC going after anything and everything crypto related. Its to risky for VC money to be exposed to an investment that can get hit with an SEC lawsuit at anytime, not to mention the SEC has gone after VC’s themselves,” crypto analyst Matthew Hyland said.

The post Venture Capitalists Stay Bullish on Crypto, Inject $190 Million Despite Market Uncertainties appeared first on BeInCrypto.