Uniform trajectory in Bitcoin futures suggests stable market expectations across major exchanges

DEFINITION: The Futures Term Structure is a graphical representation of the pricing for futures contracts expiring at increasingly distant dates into the future. The most common state of the graph, an upward slope, indicates a premium must be paid to purchase exposure, or delivery, of an asset in the future. A downward slope conversely indicates a discounted rate on delivery of an asset in the future. Trends and dislocations within the graph can paint a picture of supply, demand, and liquidity for futures contracts expiring on different dates.

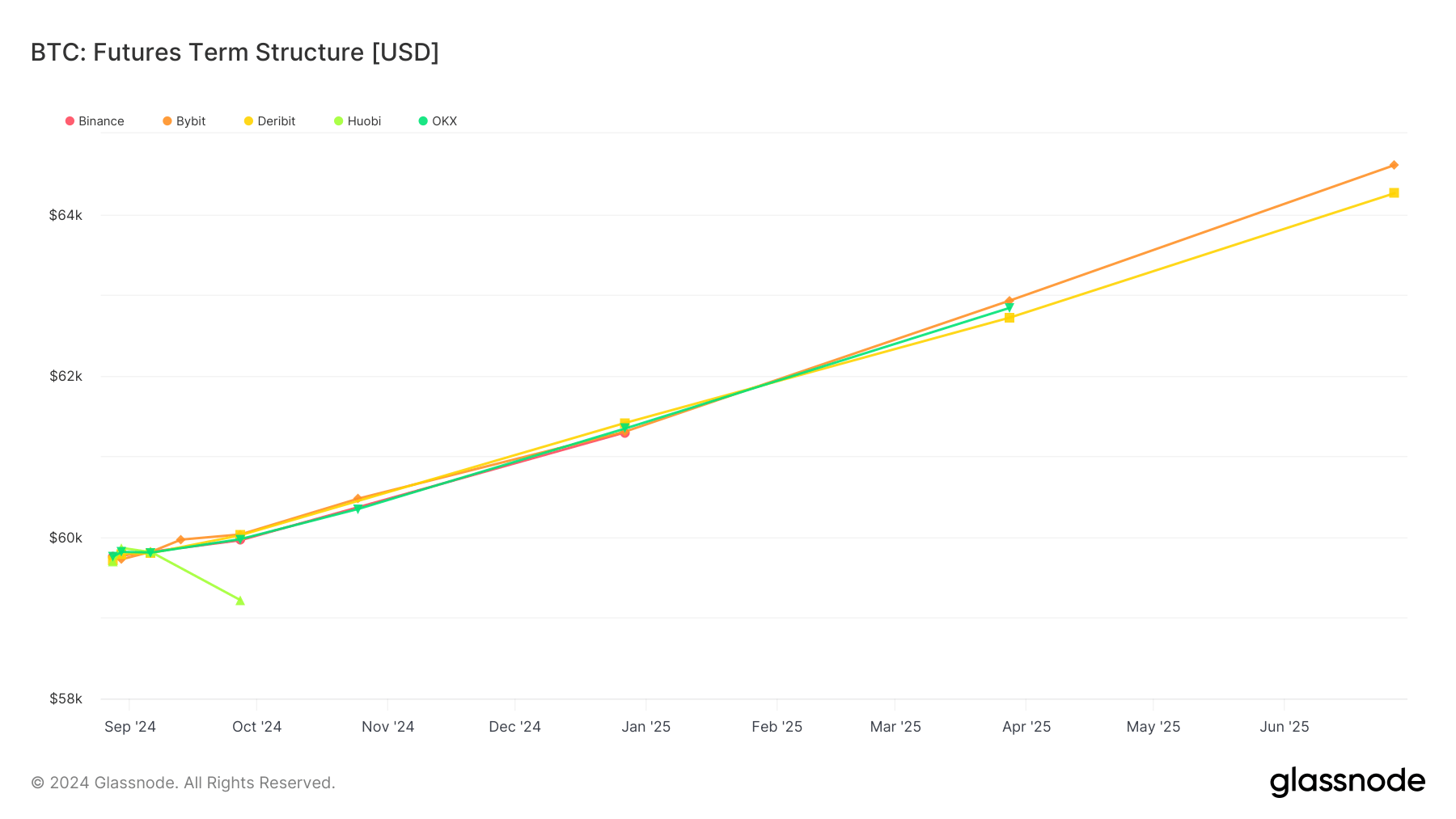

Bitcoin futures contracts exhibit a consistent upward slope across major exchanges, indicating an anticipated premium in the asset’s future price. As of September, the structure shows futures contracts starting around $60,000, with gradual increases extending into mid-2025.

Notably, all tracked exchanges — Binance, Bybit, Deribit, Huobi, and OKX — maintain a near-identical trajectory, reflecting a consensus in market sentiment.

This uniformity suggests stable expectations in the Bitcoin futures market, with no significant price divergence between exchanges. The upward-sloping term structure aligns with typical market behavior, where distant future contracts trade at a higher price than near-term ones. This is likely due to a combination of demand for longer-term exposure and confidence in Bitcoin’s sustained growth post-halving.

The brief dip in Huobi’s futures contracts in September highlights potential short-term volatility or liquidity imbalances, but it quickly aligns with the broader market trend. This alignment underscores the market’s overall stability and resilience.

BTC: Futures Term Structure: (Source: Glassnode)

BTC: Futures Term Structure: (Source: Glassnode)

The post Uniform trajectory in Bitcoin futures suggests stable market expectations across major exchanges appeared first on CryptoSlate.