UK Crypto Regulation: How a Bitcoin Reserve Could Outpace Global Competition

The post UK Crypto Regulation: How a Bitcoin Reserve Could Outpace Global Competition appeared first on Coinpedia Fintech News

Right now, with a Bitcoin holding of 61,000 BTC, the United Kingdom is the third largest Bitcoin holder, after the United States (207,189 BTC) and China (194,000). Devere Group CEO Nigel Green recently advised the UK government to follow Donald Trump’s strategy to create a Bitcoin national reserve. Could the BTC reserve strategy transform the UK? Let’s listen to what Green has to say!

Nigel Green’s Vision for a UK Bitcoin ReserveRecently, US President-elect Donald Trump proposed his plan to create a Bitcoin reserve in the United States. The plan has been received well by most. Many experts think that Trump’s move would help the US economy overcome significant challenges, including inflation and public debt.

Financial expert Nigel Green also praised the United States’s new Bitcoin reserve strategy. Highlighting the prime benefits of the move, he advised the United Kingdom to adopt a similar strategy to boost the economy.

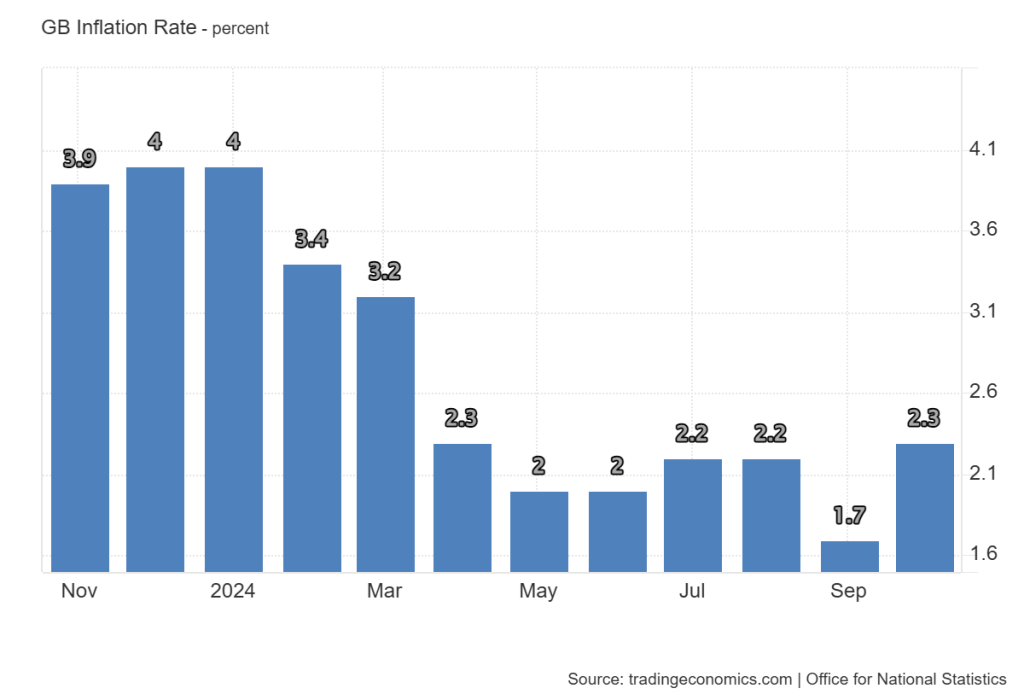

Strategic Benefits of a Bitcoin ReserveThe global market is notoriously volatile. Key issues faced by many Western countries, including the UK, are inflation and rising public debt. The national debt of the United Kingdom now stands at 2.8 trillion Euro – roughly equivalent to the value of all the goods and services produced in the UK in a year.

In the last financial year alone, the UK government borrowed at least 125.1B Euro. Last month, the government borrowed nearly 17.4B Euro – the second highest borrowing in October since 1993. The annual inflation rate in the United Kingdom sharply grew from 1.7% to 2.3% in October.

Green highlighted the unique advantages of a Bitcoin reserve strategy to address critical economic issues like inflation, currency devaluation and market volatility. He also pointed out its potential to attract crypto entrepreneurs and blockchain innovators, thereby stimulating economic growth.

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; } .entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; } .entry ul.article-inside-link li:last-child { display: none; }- Also Read :

- Crypto Regulations in the United Kingdom 2024

- ,

Global Competition and the Risk of Falling Behind

Emphasising the risk of falling behind in the race for global technology and financial leadership, Green noted that many nations have already crafted their own crypto strategies.

Recently, marking an end to the long-standing rule of the Conservative Party, Keir Starmer, a Labour Party leader, was elected as Prime Minister.

Financial experts like Green seem confident that the new Labour party leadership would be open to revolutionary policies, like creating a UK Bitcoin reserve, to swiftly improve the country’s economic health.