TRON Achieves 29% Transaction Growth in Q2, But TVL Declines

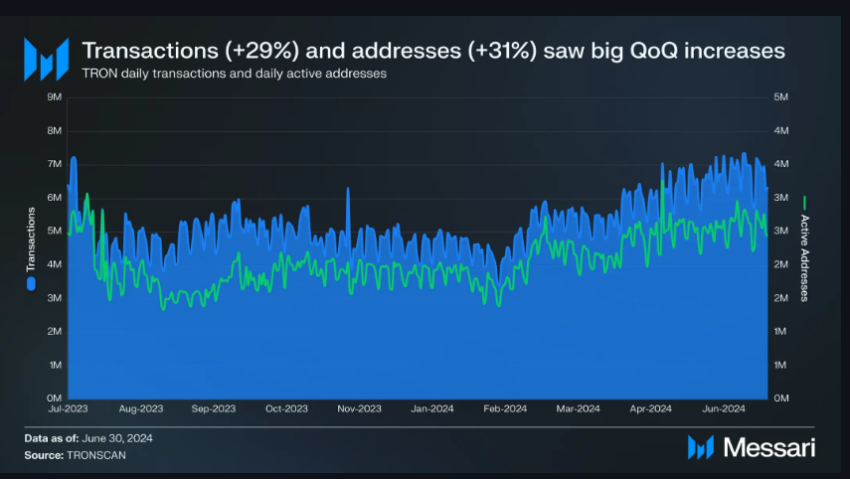

A recent report by Messari revealed that in the second quarter of 2024, TRON saw a significant 29% rise in daily transactions, reflecting its growing adoption in the blockchain ecosystem.

This increase is attributed to its infrastructure, particularly its Proof-of-Stake mechanism and efficient TRON Virtual Machine (TVM). These technologies have enabled TRON to process millions of transactions daily, attracting a growing number of users and developers.

Balancing Growth and Challenges: TRON’s Q2 Financial and Network PerformanceThe report further reveals that TRON’s total revenue for Q2 reached $117.5 million. This figure positions it just behind Ethereum and Solana in the blockchain ecosystem. The network also saw a 31% increase in daily active addresses.

Read more: What Is TRON (TRX) and How Does It Work?

TRON Daily Transactions and Active Addresses. Source: Messari

TRON Daily Transactions and Active Addresses. Source: Messari

TRON stands out as one of the few deflationary layer-1 networks, with its circulating supply of TRX decreasing from 88.2 billion to 87.7 billion during the quarter. This reduction translates to an annualized inflation rate of -2.4%. Juan Pellicer, Senior Researcher at IntoTheBlock, highlighted the significance of TRON’s deflationary nature.

“TRON’s deflationary model is a rare and powerful feature among Layer 1 blockchains. By decreasing the supply of TRX, the network not only adds value to the token but also positions itself as a long-term player in the market,” he told BeInCrypto.

TRON has also solidified its role as a leading platform for stablecoin transactions. As of the most recent data, the market capitalization of stablecoins on the TRON network is nearing $62 billion, with over 48 million holders. The report noted that USDT on TRON reached $57.1 billion by the end of the quarter, a 10% increase from the previous period.

“Approximately 53% of all USDT in circulation is on TRON (flat QoQ),” Messari’s analysts wrote in the report.

While TRON has shown impressive growth in transactions and stablecoin adoption, the network did face a decline in its total value locked (TVL) during Q2 2024, falling 23% quarter-over-quarter from $10.1 billion to $7.8 billion.

Despite the decrease, TRON remains the second-largest network based on TVL. Platforms such as JustLend and JustStables are the top two largest protocols in TRON’s ecosystem, contributing significantly to its TVL. DefiLlama data shows that TRON’s TVL is approximately $7.83 billion at the time of writing.

Read more: TRON (TRX) Price Prediction 2024/2025/2030

As TRON continues to enhance its infrastructure, including plans to integrate Bitcoin layer-2 (L2) solutions and eliminate gas fees, its appeal is expected to grow even further. However, TRON’s continued success will depend on its ability to innovate and expand its DeFi ecosystem.

“TRON must focus on scalability and interoperability to attract more developers and users, enabling it to compete more effectively with other Layer-1s,” Pellicer said.

The post TRON Achieves 29% Transaction Growth in Q2, But TVL Declines appeared first on BeInCrypto.