Top 5 Layer 1 Blockchains to Watch in 2024 and Beyond

The fast-changing blockchain world, once led by Ethereum, is now seeing new Layer-1 blockchains emerge, each with unique advantages, making it important to have a mix of assets for long-term success.

Ethereum struggles with scalability and high fees, which has led to the rise of alternative Layer-1 networks. These new blockchains often provide faster speeds, lower costs, and specialized features that meet various needs in the blockchain space.

Instead of one main platform, the future will likely involve many specialized chains, driven by the growing complexity of blockchain apps and the demand for custom solutions.

With the blockchain space evolving quickly, it’s important to keep an eye on the most promising new networks. Here are five Layer-1 blockchains that could make big moves soon.

InjectiveA new Layer-1 blockchain within the Cosmos ecosystem, Injective has quickly gained attention for its innovative features and strong performance. As an interoperable platform, it bridges Ethereum-based assets, expanding its potential for DeFi applications.

At the core of its ecosystem, the Injective Hub allows users to engage in DeFi activities such as token swaps, staking, and governance. This decentralized platform operates with a native Layer-1 token that fuels its economic growth.

Injective excels in key blockchain metrics such as block size, block time, processing speed, and finality. These advantages reduce latency and enhance responsiveness, making it ideal for high-frequency trading applications.

Injective pushes blockchain technology further with features like tokenizing real-world assets and Frequent Batch Auctions, strengthening its position in MEV resistance and ensuring a more secure network.

Its commitment to efficiency shows in gas compression, delivering the lowest Layer-1 transaction fees in the industry.

NearNear Protocol, a leading Layer-1 blockchain, excels in sustainability and high performance. As the first carbon-neutral Layer-1 blockchain, it pioneers the environmentally conscious blockchain space.

Focusing on speed, low transaction fees, and climate-neutral goals, Near aligns with the rising demand for sustainable blockchain technologies. Its role in carbon scoring highlights its importance in climate-focused blockchain initiatives.

The end goal of NEAR's Sharding design is complex at an implementation level, but for developers, users, and apps, it is abstracted away to the point of simplicity.

You will never have to track the shard you're interacting with or deployed on.

It just works.… pic.twitter.com/VjpB35g3qs

— NEAR Protocol (@NEARProtocol) August 31, 2024

Offering up to 100,000 transactions per second, Near significantly outperforms Ethereum in scalability. Lower transaction costs further make it a strong choice for developers and users seeking efficiency in blockchain platforms.

Near prioritizes developer experience with support for various programming languages and tools such as NEAR Studio, streamlining the creation and deployment of decentralized applications (dApps).

With interoperability tools like the Rainbow Bridge, Near facilitates cross-chain transfers, enhancing accessibility and broadening its collaborative potential with other blockchain networks.

AvalancheAvalanche, a future-proof and developer-friendly Layer 1 blockchain protocol, launched in 2020. Designed for speed, versatility, security, affordability, and accessibility, it processes up to 4,500 transactions per second with near-instant transaction times.

The native token, AVAX, powers transaction fees, network security, and serves as a unit of account within the Avalanche ecosystem. Avalanche, as an open-source project, delivers a high-fidelity network that balances speed, cost-efficiency, user-friendliness, and decentralization.

Acquiring AVAX is key to paying transaction fees, interacting with smart contracts, and earning staking rewards on the network.

AVAX holds significant potential, especially as DeFi and dApps grow on the Avalanche network. With a market cap of about $8.7 billion, AVAX remains undervalued relative to its growth potential. As blockchain adoption rises, Avalanche could experience substantial gains.

BNB ChainBNB Chain ranks among the largest blockchains by transaction volume and daily active users. Created in 2022 through the merger of Binance Smart Chain and Binance Chain, it operates as a community-driven, open-source, and decentralized ecosystem.

Maintaining compatibility with Ethereum Virtual Machine, BNB Chain uses robust consensus mechanisms and functions as a multi-chain hub. With a market capitalization of $40.9 billion (excluding stablecoins), the native token, BNB, stands as the third largest, underscoring the strength of the BNB Chain ecosystem.

Attracting developers and projects, BNB remains a key player in the cryptocurrency landscape. Having reached an all-time high of around $710, analysts see further growth potential, predicting that BNB could hit $1,500 in the next bull run, presenting a strong investment opportunity.

SolanaSolana, a highly scalable Layer 1 blockchain designed for mass adoption, was founded in 2017 as an open-source project by Solana Labs, with backing from the Solana Foundation.

Known for its superior transaction speed and lower fees compared to rivals like Ethereum, Solana has become a top choice for meme coin projects.

With a current value of $130 per coin and a market cap of $60 billion, Solana shows significant growth potential. Its price surpassed $200 in March, indicating it may be undervalued. As more individuals enter the crypto market and the meme coin sector expands, Solana’s popularity is expected to rise further.

ConclusionThese five Layer 1 blockchains provide a strong base for any crypto portfolio. Each one has its own strengths and benefits, making them promising for growth and investment.

Active development keeps these blockchains ahead in technology. They address issues and add new features, helping them adapt to changing market needs and stay competitive.

As blockchain technology gains traction in industries like finance and supply chain management, these networks are becoming more valuable. The rising recognition of blockchain’s benefits is likely to boost demand for these key platforms.

Their core strengths—such as scalability, security, and ease of use for developers—set them up for future growth. Their capacity to manage high transaction volumes, maintain strong security, and attract developers to build new applications are important factors for their long-term success.

Investing in these Layer 1 blockchains lets you tap into the growing blockchain ecosystem. These foundational networks are set to play a crucial role in the future of decentralized technologies, offering significant opportunities for growth and value increase.

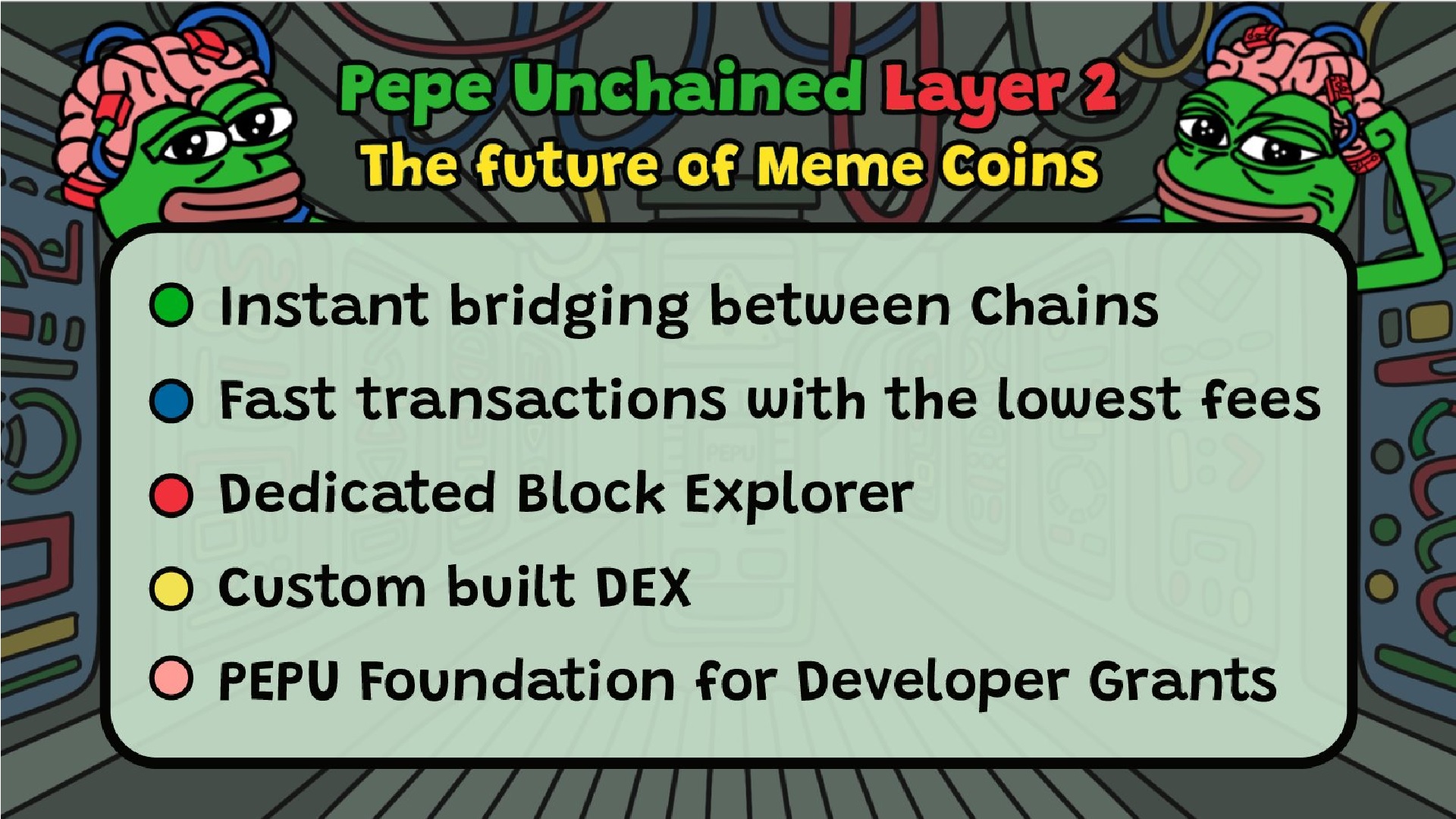

If you’re interested in exploring other opportunities, consider Pepe Unchained. While currently on presale, it is a project developing its own Layer-2 blockchain. Pepe Unchained aims to lower transaction costs, provide ultra-fast speeds, and improve efficiency.

Pepe Unchained is more than just a meme coin; it’s a notable project focused on enhancing Pepe’s functionality and addressing scalability issues for its investors. To participate in the $PEPU token presale, go to pepeunchained.com.

Related- 14 Best Altcoins to Buy in September 2024

- 16 Best Cryptocurrency to Invest in 2024 – Compare Top Crypto to Buy Now

The post Top 5 Layer 1 Blockchains to Watch in 2024 and Beyond appeared first on ReadWrite.