Top 10 Web3 Real Estate Startups to Watch in 2025

As the real estate industry embraces the transformative potential of blockchain technology, Web3 startups are emerging as key players in reshaping how we buy, sell, and manage property. In 2025, these innovative companies are set to redefine the landscape of real estate through decentralized platforms, smart contracts, and enhanced transparency, providing users with greater control and security over their transactions. From tokenized real estate investments to virtual property tours, these startups are harnessing the power of Web3 to streamline processes, reduce costs, and democratize access to real estate opportunities.

As we look ahead, it’s crucial to recognize the trailblazers leading this revolution, each offering unique solutions to traditional challenges. Whether you’re an investor seeking new opportunities or a homeowner exploring modern ways to manage property, these top 10 Web3 real estate startups will be instrumental in shaping the future of the industry. Join us as we delve into the most promising names to watch in 2025 and discover how they are paving the way for a more efficient and equitable real estate market.

Table of ContentUnderstanding Web3What is Web3 Real Estate?

Business Scope of Web3 in Real Estate

Importance Of Web3 In Real Estate

Benefits of Web3 Real Estate

The Criteria for Selecting the Top Web3 Real Estate Startups

Top 10 Web3 Real Estate Startups to Watch in 2025

∘ 1. Blockchain App Factory

∘ 2. Inoru

∘ 3. Blocksquare

∘ 4. UBITQUITY

∘ 5. Republic Core LLC

∘ 6. Technoloader Pvt Ltd

∘ 7. RisingMax

∘ 8. APPINVENTIV

∘ 9. LeewayHertz

∘ 10. Antier Solutions

Use Cases Web3 Real Estate

The Future of Real Estate in Web3

ConclusionUnderstanding Web3

Web3 represents the next evolution of the internet, focusing on decentralization, user ownership, and enhanced security. Unlike its predecessor, Web2, which centralized data and services under major corporations, Web3 utilizes blockchain technology to empower individuals by giving them control over their digital assets and personal information. This decentralized approach fosters transparency and trust, allowing users to interact directly with one another without intermediaries. Web3 enables the creation of decentralized applications (dApps) that run on blockchain networks, facilitating various functionalities such as cryptocurrency transactions, tokenized assets, and smart contracts.

These innovations create new opportunities for value exchange, collaboration, and community building, paving the way for a more equitable digital landscape. As Web3 continues to gain traction, it is reshaping industries from finance to real estate and beyond, encouraging innovation and democratizing access to resources. By understanding Web3, individuals can better navigate this emerging landscape and leverage its potential for personal and professional growth.

What is Web3 Real Estate?Web3 real estate refers to the application of decentralized technologies and blockchain principles within the real estate sector, fundamentally transforming how properties are bought, sold, and managed. By leveraging smart contracts, tokenization, and decentralized platforms, Web3 real estate enables greater transparency, security, and efficiency in transactions. Tokenization allows physical assets, like real estate properties, to be divided into digital tokens, making it possible for investors to buy fractional ownership.

This democratizes access to real estate investments, lowering the barrier for entry and opening new opportunities for individuals who may not have the capital for traditional real estate purchases. Furthermore, smart contracts automate transactions and enforce terms without the need for intermediaries, reducing costs and minimizing the risk of fraud. Web3 technologies also enhance property management through decentralized applications that streamline processes like leasing, maintenance, and tenant interactions.

As the real estate industry embraces Web3, it offers innovative solutions to longstanding challenges, promising a more inclusive and efficient marketplace that benefits both investors and property owners.

Business Scope of Web3 in Real EstateThe global Web3 market is anticipated to grow significantly, expanding from $2.28 billion in 2022 to $3.25 billion in 2023. The Asia Pacific region is projected to experience the most rapid growth, with a remarkable compound annual growth rate (CAGR) of 47% from 2023 to 2032. Key regions driving the Web3 market include North America, Europe, and Asia, each contributing to the expansion of blockchain applications across various sectors, including real estate.

In the real estate industry specifically, a substantial smart contract ecosystem valued at $100 million is expected to emerge, streamlining transactions and enhancing transparency. By 2030, the global real estate market is forecasted to reach approximately $6.13 trillion, growing at a CAGR of 5.2%.

Furthermore, the asset tokenization sector is set for explosive growth, projected to increase fifty-fold from 2022 to 2030, skyrocketing from $310 billion to an astounding $16.1 trillion. This trend signifies a transformative shift in how real estate assets are owned, traded, and managed, highlighting the vast potential of Web3 technologies in the industry.

Importance Of Web3 In Real EstateWeb3 technology is revolutionizing the real estate sector by enhancing transparency, security, and efficiency in transactions. Through the use of blockchain, Web3 enables decentralized ownership and management of properties, allowing for direct peer-to-peer transactions without intermediaries, which reduces costs and speeds up processes. The introduction of smart contracts automates agreements, ensuring that conditions are met before transactions are finalized, further minimizing risks of fraud.

Additionally, asset tokenization allows fractional ownership, making real estate investments accessible to a broader range of investors and promoting liquidity in the market. This democratization of real estate investment fosters inclusivity and empowers individuals by providing them with more control over their assets. Overall, Web3 is paving the way for a more transparent, efficient, and equitable real estate landscape, addressing long-standing challenges and creating new opportunities for both investors and property owners.

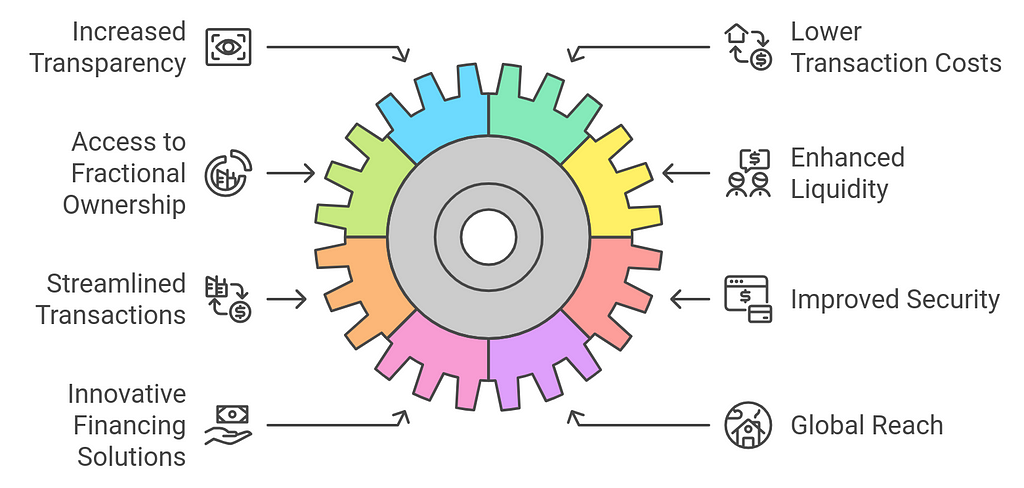

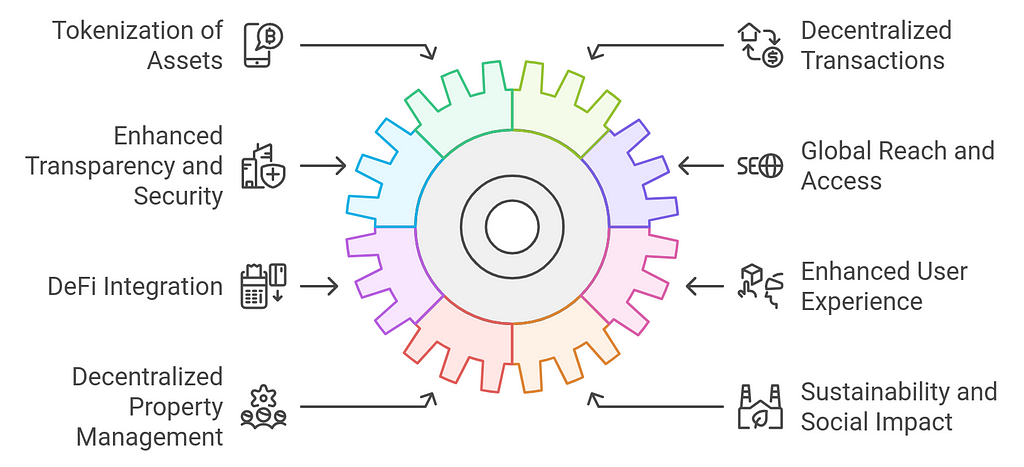

Benefits of Web3 Real EstateWeb3 technology brings several transformative benefits to the real estate sector, enhancing various aspects of property transactions, management, and investment. Here are some of the key benefits:

1. Increased Transparency

1. Increased Transparency- Immutable Records: Blockchain technology ensures that all transactions are recorded immutably, providing a transparent and traceable history of property ownership and transfers.

- Verification of Ownership: The ability to verify ownership and property titles easily reduces disputes and enhances trust between buyers and sellers.

- Reduced Intermediaries: Web3 minimizes the need for intermediaries, such as brokers and agents, which can significantly lower transaction fees.

- Efficient Processes: Automated transactions through smart contracts reduce administrative costs and streamline processes, leading to overall savings.

- Democratized Investment: Tokenization allows properties to be divided into smaller, tradable units, making real estate investment accessible to a wider range of investors, including those with limited capital.

- Diversification Opportunities: Investors can diversify their portfolios by investing in fractional shares of multiple properties rather than committing to entire assets.

- Tokenized Assets: Real estate assets can be traded on blockchain platforms, providing liquidity in a traditionally illiquid market and allowing for faster transactions.

- Marketplaces for Trading: Dedicated marketplaces facilitate the buying and selling of tokenized real estate assets, enhancing market fluidity.

- Automated Processes: Smart contracts automate various aspects of transactions, including payments, compliance checks, and title transfers, leading to faster closing times.

- Simplified Due Diligence: Blockchain’s transparency simplifies the due diligence process by providing immediate access to relevant property information.

- Fraud Reduction: The decentralized and immutable nature of blockchain significantly reduces the risk of fraud, as tampering with records is nearly impossible.

- Secure Transactions: Blockchain transactions are encrypted, enhancing security and protecting sensitive information from unauthorized access.

- Decentralized Finance (DeFi): Real estate investors can access innovative financing solutions through DeFi platforms, such as peer-to-peer lending and crowdfunding, bypassing traditional financial institutions.

- Collateralized Loans: Tokenized properties can be used as collateral for loans, providing liquidity without the need to sell assets.

- Cross-Border Transactions: Web3 enables seamless cross-border transactions, making it easier for investors to buy and sell properties internationally.

- Access to Diverse Markets: Investors can tap into global real estate markets without the complexities of traditional buying processes.

- Decentralized Autonomous Organizations (DAOs): DAOs can empower communities to participate in real estate governance and decision-making, aligning developments with community interests.

- Crowdfunding for Local Projects: Local communities can come together to fund real estate projects that benefit their neighborhoods, fostering social cohesion.

- Environmental Tracking: Blockchain can track energy use and sustainability measures in real estate developments, promoting environmentally friendly practices.

- Smart City Initiatives: Integrating real estate with IoT and blockchain supports smart city initiatives, optimizing resource usage and enhancing urban living.

The adoption of Web3 technologies in real estate offers a host of benefits that can revolutionize the industry. From enhanced transparency and lower costs to increased accessibility and innovative financing solutions, these advancements are set to create a more efficient, secure, and equitable real estate market. As the sector continues to evolve, embracing Web3 will be key to unlocking new opportunities and driving growth in the future.

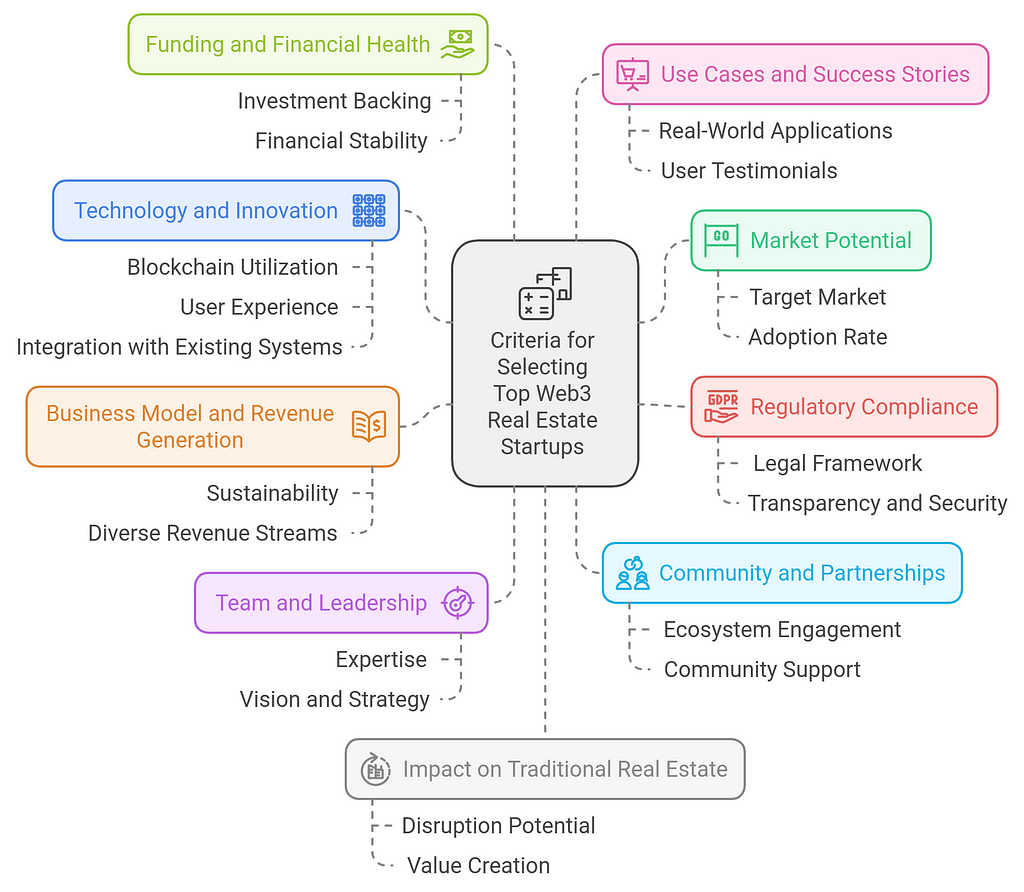

The Criteria for Selecting the Top Web3 Real Estate StartupsSelecting the top Web3 real estate startups involves several criteria to evaluate their potential, impact, and innovation within the blockchain and real estate sectors. Here are key criteria to consider:

1. Technology and Innovation

1. Technology and Innovation- Blockchain Utilization: Assess how effectively the startup leverages blockchain technology (e.g., for smart contracts, tokenization, or decentralized finance).

- User Experience: Evaluate the ease of use of their platform and how it enhances the real estate transaction process.

- Integration with Existing Systems: Consider how well the startup integrates with current real estate technologies and practices.

- Target Market: Analyze the size and growth potential of the market segment the startup is addressing.

- Adoption Rate: Look at current user adoption and the potential for future growth within the target audience.

- Legal Framework: Ensure the startup operates within the legal frameworks governing real estate and cryptocurrency in relevant jurisdictions.

- Transparency and Security: Assess their commitment to transparency and security measures to protect user data and assets.

- Sustainability: Evaluate the startup’s business model for long-term sustainability and scalability.

- Diverse Revenue Streams: Look for multiple avenues for revenue generation, such as transaction fees, subscription models, or value-added services.

- Expertise: Review the experience and backgrounds of the founding team, particularly in real estate, technology, and blockchain.

- Vision and Strategy: Assess the clarity of the startup’s vision and strategic plans for growth and development.

- Ecosystem Engagement: Consider the startup’s involvement in the broader Web3 and real estate ecosystems, including collaborations with other companies and participation in industry events.

- Community Support: Look at their ability to build and maintain a supportive community of users and investors.

- Investment Backing: Analyze the startup’s funding history, including notable investors and rounds of funding.

- Financial Stability: Review financial statements and projections to determine the startup’s fiscal health.

- Real-World Applications: Evaluate successful case studies or pilot projects that demonstrate the practical applications of their technology.

- User Testimonials: Consider feedback from users to understand the real-world impact of the startup’s solutions.

- Disruption Potential: Assess how the startup can disrupt traditional real estate practices and what unique advantages it offers.

- Value Creation: Determine how the startup contributes to efficiency, cost reduction, or enhanced services in the real estate sector.

- Growth Plans: Look for a clear roadmap for product development, market expansion, and technology enhancement.

- Adaptability: Consider the startup’s ability to pivot or adapt to changing market dynamics and user needs.

By analyzing these criteria, stakeholders can identify the most promising Web3 real estate startups poised for success in the evolving landscape of real estate technology.

Top 10 Web3 Real Estate Startups to Watch in 20251. Blockchain App Factory

Blockchain App Factory is a pioneering company specializing in developing customized blockchain solutions for various sectors, including real estate. Their expertise lies in creating decentralized applications (dApps) that facilitate seamless property transactions and management. By leveraging blockchain technology, Blockchain App Factory enhances transparency and security in real estate deals, allowing users to track ownership and transaction histories in real time. Their tokenization services enable real estate assets to be fractionally owned, making investments accessible to a broader audience.

Additionally, they provide smart contract development, automating the execution of agreements and minimizing the need for intermediaries. As the demand for decentralized solutions grows, Blockchain App Factory is well-positioned to lead the way in transforming how real estate transactions are conducted, making them faster and more efficient.

2. Inoru

Inoru is a Web3 development company recognized for its innovative approach to real estate solutions. They specialize in building decentralized platforms that streamline property transactions and enhance user experiences. Inoru’s expertise in blockchain technology allows them to create secure and transparent systems for buying, selling, and managing real estate assets. Their services include the development of tokenization platforms, enabling fractional ownership of properties, which democratizes access to real estate investments.

Inoru also focuses on integrating features like virtual property tours and automated processes through smart contracts, enhancing the overall efficiency of real estate transactions. With a commitment to delivering cutting-edge solutions, Inoru is a startup to watch in 2025 as it continues to drive innovation in the real estate industry.

3. Blocksquare

Blocksquare is a transformative platform revolutionizing real estate investment through blockchain technology. Their primary focus is on tokenizing real estate assets, allowing investors to purchase fractions of properties via digital tokens. This approach not only increases liquidity in the real estate market but also opens opportunities for smaller investors to participate in high-value assets. Blocksquare leverages blockchain’s transparency and security to provide detailed ownership histories and streamline transactions, significantly reducing costs and complexities associated with traditional real estate dealings.

Moreover, their platform supports the creation of decentralized applications (dApps) tailored to real estate, enabling developers to build custom solutions that cater to various market needs. As the demand for more inclusive and efficient real estate investment solutions rises, Blocksquare is positioned to be a leader in this evolving landscape, making it a startup to watch in 2025.

4. UBITQUITY

UBITQUITY is at the forefront of integrating blockchain technology into real estate transactions. This innovative startup aims to simplify the property buying and selling process through its secure and transparent platform. UBITQUITY utilizes blockchain to provide a decentralized ledger that tracks ownership records and transaction histories, ensuring that all parties have access to accurate and tamper-proof information. Their platform supports various functionalities, including smart contract implementation, which automates the execution of agreements and reduces reliance on intermediaries.

UBITQUITY’s focus on enhancing transparency and security in real estate dealings makes it an essential player in the Web3 landscape. As the industry increasingly seeks innovative solutions to combat fraud and streamline transactions, UBITQUITY’s offerings are set to gain significant traction in 2025 and beyond.

5. Republic Core LLC

Republic Core LLC is a notable player in the Web3 real estate sector, specializing in tokenized real estate investments. Their platform enables investors to access high-quality real estate opportunities through fractional ownership, making it easier for individuals to diversify their portfolios without significant capital outlay. Republic Core LLC emphasizes transparency and compliance, ensuring that all transactions adhere to regulatory standards while providing users with detailed insights into their investments.

By leveraging blockchain technology, the company enhances the security and efficiency of property transactions, allowing for seamless trading and management of real estate assets. With a strong focus on democratizing access to real estate investment, Republic Core LLC is set to play a pivotal role in the industry, making it a startup to watch in 2025.

6. Technoloader Pvt Ltd

Technoloader Pvt Ltd is a prominent Web3 development company that offers innovative solutions for the real estate sector. With a focus on blockchain technology, Technoloader provides services such as property tokenization, decentralized finance (DeFi) integration, and smart contract development. Their expertise enables real estate developers and investors to create secure and transparent platforms for buying, selling, and managing properties.

By leveraging blockchain’s decentralized nature, Technoloader enhances the efficiency of transactions and reduces the costs associated with traditional real estate processes. Their commitment to delivering high-quality solutions tailored to market needs positions Technoloader as a key player in the Web3 real estate landscape. As the industry continues to evolve, Technoloader’s contributions will be crucial in shaping the future of property transactions, making it a startup to watch in 2025.

7. RisingMax

RisingMax is an innovative Web3 startup focused on transforming the real estate landscape through blockchain technology. They specialize in developing decentralized applications (dApps) that streamline property transactions and enhance user experiences. RisingMax’s platform emphasizes transparency, allowing users to access verified ownership records and transaction histories, which are securely stored on the blockchain. Their services also include tokenization, enabling fractional ownership of real estate assets, making investment opportunities more accessible to a wider audience.

Additionally, RisingMax integrates smart contracts to automate various processes, reducing the need for intermediaries and enhancing the overall efficiency of real estate dealings. As the demand for blockchain solutions in real estate continues to grow, RisingMax is poised to be a leading force in the industry, making it a startup to watch in 2025.

8. APPINVENTIV

APPINVENTIV is a dynamic Web3 development company specializing in creating innovative solutions for the real estate sector. Their expertise lies in developing decentralized applications (dApps) that utilize blockchain technology to enhance property transactions and management. APPINVENTIV’s platform offers features such as tokenization, allowing real estate assets to be divided into digital tokens for fractional ownership, thereby democratizing access to investments. By implementing smart contracts, they automate transaction processes, minimizing the reliance on intermediaries and reducing costs.

APPINVENTIV also focuses on user experience, ensuring that their applications are intuitive and accessible to both investors and property owners. As the real estate industry increasingly turns to blockchain solutions for efficiency and transparency, APPINVENTIV stands out as a startup to watch in 2025, driving innovation and reshaping the way real estate transactions are conducted.

9. LeewayHertz

LeewayHertz is a leading Web3 development company known for its expertise in blockchain solutions across various sectors, including real estate. They specialize in building decentralized applications (dApps) that enhance property transactions through secure and transparent processes. LeewayHertz offers services such as tokenization of real estate assets, enabling fractional ownership and making investments more accessible to a broader audience. Their platform utilizes smart contracts to automate transactions, ensuring that agreements are executed seamlessly without the need for intermediaries.

By focusing on user-friendly interfaces and comprehensive security measures, LeewayHertz provides a robust foundation for real estate stakeholders looking to leverage blockchain technology. As the demand for innovative solutions in the real estate market grows, LeewayHertz is positioned to make a significant impact, making it a startup to watch in 2025.

10. Antier Solutions

Antier Solutions is a prominent player in the Web3 real estate sector, specializing in blockchain development and decentralized finance (DeFi) solutions. Their expertise in tokenization allows real estate assets to be divided into digital tokens, enabling fractional ownership and broadening investment opportunities for individuals. Antier Solutions focuses on creating secure and transparent platforms that enhance the efficiency of real estate transactions through smart contracts, which automate processes and reduce the need for intermediaries.

By leveraging blockchain technology, they provide real estate stakeholders with greater control over their assets, improved liquidity, and access to a wider range of investment options. As the real estate industry increasingly seeks innovative solutions to address traditional challenges, Antier Solutions is set to play a significant role in shaping the future of property transactions, making it a startup to watch in 2025.

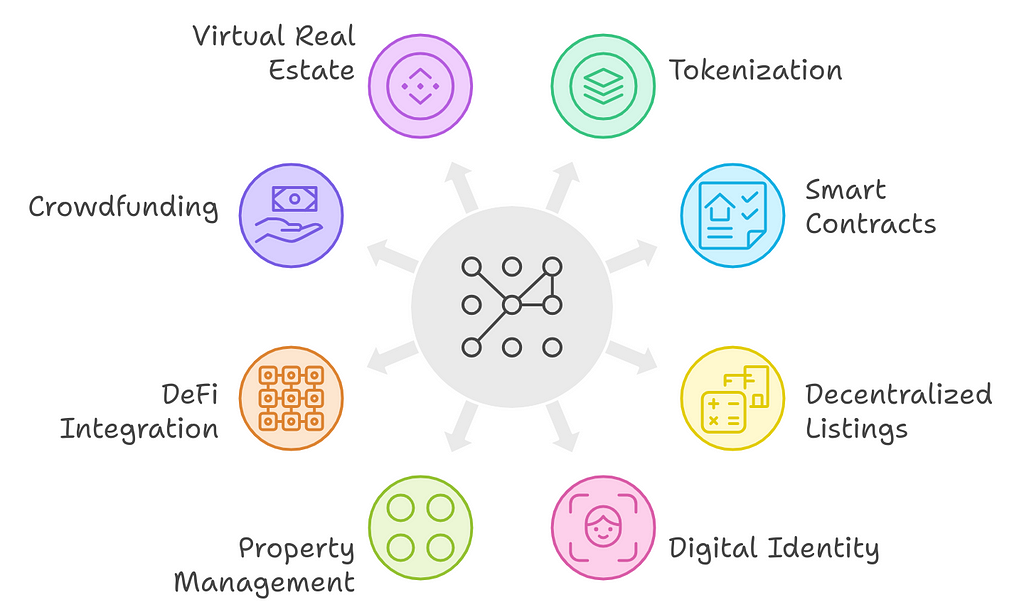

Use Cases Web3 Real EstateWeb3 technology is transforming the real estate industry by providing innovative solutions that enhance efficiency, transparency, and accessibility. Here are some compelling use cases for Web3 in real estate:

1. Tokenization of Real Estate Assets

1. Tokenization of Real Estate Assets- Fractional Ownership: Properties can be tokenized into digital shares, allowing multiple investors to own a fraction of a property. This lowers the barrier to entry for real estate investment and diversifies portfolios.

- Real Estate Investment Trusts (REITs): Tokenized REITs allow investors to buy and sell shares on the blockchain, providing liquidity and access to a broader range of real estate assets.

- Automated Transactions: Smart contracts can automate the entire buying process, including payment processing, title transfer, and recording with minimal human intervention.

- Escrow Services: Smart contracts can act as escrow agents, holding funds until all conditions of the agreement are met, ensuring security for both parties.

- Peer-to-Peer Marketplaces: Platforms can facilitate direct listings and transactions between buyers and sellers without intermediaries, reducing costs and increasing efficiency.

- Decentralized Verification: Blockchain can provide a transparent history of property listings, ensuring authenticity and reducing fraud.

- KYC and AML Compliance: Blockchain can streamline Know Your Customer (KYC) and Anti-Money Laundering (AML) processes through secure digital identities, reducing the burden on real estate professionals.

- Title and Ownership Verification: Digital identities linked to property ownership can simplify the verification of titles, reducing disputes and title fraud.

- Rent Collection: Smart contracts can automate rent collection, ensuring timely payments and reducing administrative overhead for landlords.

- Maintenance Management: Tenants can submit maintenance requests through decentralized platforms, triggering smart contracts that automatically handle repairs or payments to service providers.

- Real Estate Loans: Investors can access decentralized lending platforms to obtain loans using tokenized properties as collateral, bypassing traditional banks.

- Yield Farming: Property owners can participate in yield farming with their tokenized assets, earning passive income through various DeFi protocols.

- Real Estate Crowdfunding Platforms: Investors can pool resources through blockchain-based crowdfunding platforms to finance real estate projects, democratizing access to investment opportunities.

- Community Investment Initiatives: Local communities can fund development projects that benefit their neighborhoods, fostering engagement and support.

- Building Energy Efficiency: Blockchain can track energy usage and sustainability measures in real estate developments, allowing for transparency in environmental impact.

- Smart City Initiatives: Integrating real estate with IoT devices and blockchain can support smart city initiatives, optimizing resource usage and enhancing urban living.

- Metaverse Properties: Virtual real estate in metaverse platforms can be bought, sold, and rented using blockchain technology, creating new opportunities for investment and development in digital spaces.

- Virtual Property Tours: Utilizing VR and AR technologies, potential buyers can experience virtual property tours, enhancing the property viewing process.

- Decentralized Autonomous Organizations (DAOs): DAOs can govern real estate projects or investments, allowing community stakeholders to participate in decision-making and management processes.

- Collective Ownership Models: Communities can collectively own and manage properties through tokenized shares, ensuring that developments align with the community’s interests.

The use cases for Web3 in real estate illustrate the technology’s potential to revolutionize the industry by making it more transparent, efficient, and accessible. As adoption grows, these innovative applications are likely to reshape how properties are bought, sold, and managed, ultimately benefiting investors, developers, and consumers alike.

The Future of Real Estate in Web3The future of real estate in the Web3 landscape holds exciting possibilities driven by advancements in blockchain technology, decentralized finance, and the growing demand for transparency and efficiency. Here’s a look at how Web3 is poised to transform the real estate sector:

1. Tokenization of Assets

1. Tokenization of Assets- Fractional Ownership: Web3 enables the tokenization of real estate assets, allowing for fractional ownership. This opens up real estate investment to a broader audience, lowering barriers to entry.

- Liquidity: Tokenized assets can be traded on blockchain-based platforms, providing liquidity in a traditionally illiquid market.

- Smart Contracts: These self-executing contracts automate transactions and reduce the need for intermediaries, lowering costs and speeding up processes.

- Peer-to-Peer Transactions: With decentralized platforms, buyers and sellers can transact directly, further reducing transaction costs and improving efficiency.

- Immutable Records: Blockchain provides a secure and immutable ledger of property ownership and transaction history, reducing fraud and enhancing trust.

- Clear Title and Ownership Verification: Streamlined verification processes minimize disputes over property ownership and title issues.

- Cross-Border Transactions: Web3 facilitates seamless cross-border transactions, making it easier for investors to access international real estate markets.

- Access to Diverse Investments: Investors can diversify their portfolios by accessing properties in different geographical locations without the complexities of traditional buying processes.

- Innovative Financing Options: DeFi platforms offer alternative financing solutions such as peer-to-peer lending, allowing property owners and investors to secure funding without traditional banks.

- Yield Farming and Staking: Real estate investors can earn passive income by participating in DeFi activities with their tokenized assets.

- Virtual and Augmented Reality: Web3 can leverage VR and AR technologies for immersive property viewing experiences, making the buying process more engaging and informative.

- User-Centric Platforms: Platforms designed with user experience in mind can streamline the property search, transaction, and management processes.

- Community Governance: Property management could be governed by decentralized autonomous organizations (DAOs), allowing stakeholders to participate in decision-making processes.

- Automated Management Solutions: Smart contracts can automate rent collection, maintenance requests, and other management tasks, improving efficiency for landlords and tenants alike.

- Green Building Initiatives: Web3 can support sustainable real estate development through transparent tracking of energy use and sustainable practices.

- Affordable Housing Solutions: Tokenization and decentralized financing can be leveraged to create affordable housing projects that attract socially conscious investors.

- Smart Contracts for Compliance: Smart contracts can be programmed to automatically ensure compliance with local regulations, reducing the burden on investors and developers.

- Digital Identity Verification: Blockchain can provide secure and verifiable digital identities, streamlining KYC processes for buyers and sellers.

- Knowledge Sharing Platforms: Web3 can foster communities that share knowledge about real estate investment, technology, and market trends, empowering individuals to make informed decisions.

- Supportive Ecosystems: Collaboration among startups, investors, and technology providers can create a thriving ecosystem that accelerates innovation in real estate.

The integration of Web3 technologies in real estate has the potential to create a more transparent, efficient, and accessible market. As these technologies mature and regulatory frameworks evolve, the real estate industry is likely to see significant transformation, benefiting investors, property owners, and consumers alike. The future holds immense promise for those who embrace these innovations and adapt to the changing landscape.

ConclusionThe rise of Web3 technology in the real estate sector marks a pivotal shift toward greater transparency, efficiency, and accessibility. As we have explored the top 10 startups poised to make a significant impact in 2025, it is evident that these companies are not only leveraging blockchain to enhance traditional real estate practices but are also pioneering new business models that challenge the status quo. By introducing innovations like tokenization, decentralized finance, and virtual property management, they are creating a more inclusive marketplace that empowers both investors and consumers.

These startups are setting the stage for a future where real estate transactions are faster, safer, and more affordable. As we move forward, it will be exciting to witness how these trailblazers navigate the evolving landscape and adapt to regulatory challenges while continuing to deliver value to their users. The potential for growth and disruption in the industry is immense, making it essential for investors, homeowners, and industry professionals to keep a close eye on these innovators. The future of real estate is being reshaped before our eyes, and these startups are leading the charge into this new era.

Top 10 Web3 Real Estate Startups to Watch in 2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.