SUI Price Gains Momentum: Eyeing Key Resistance Levels Amid TVL Growth

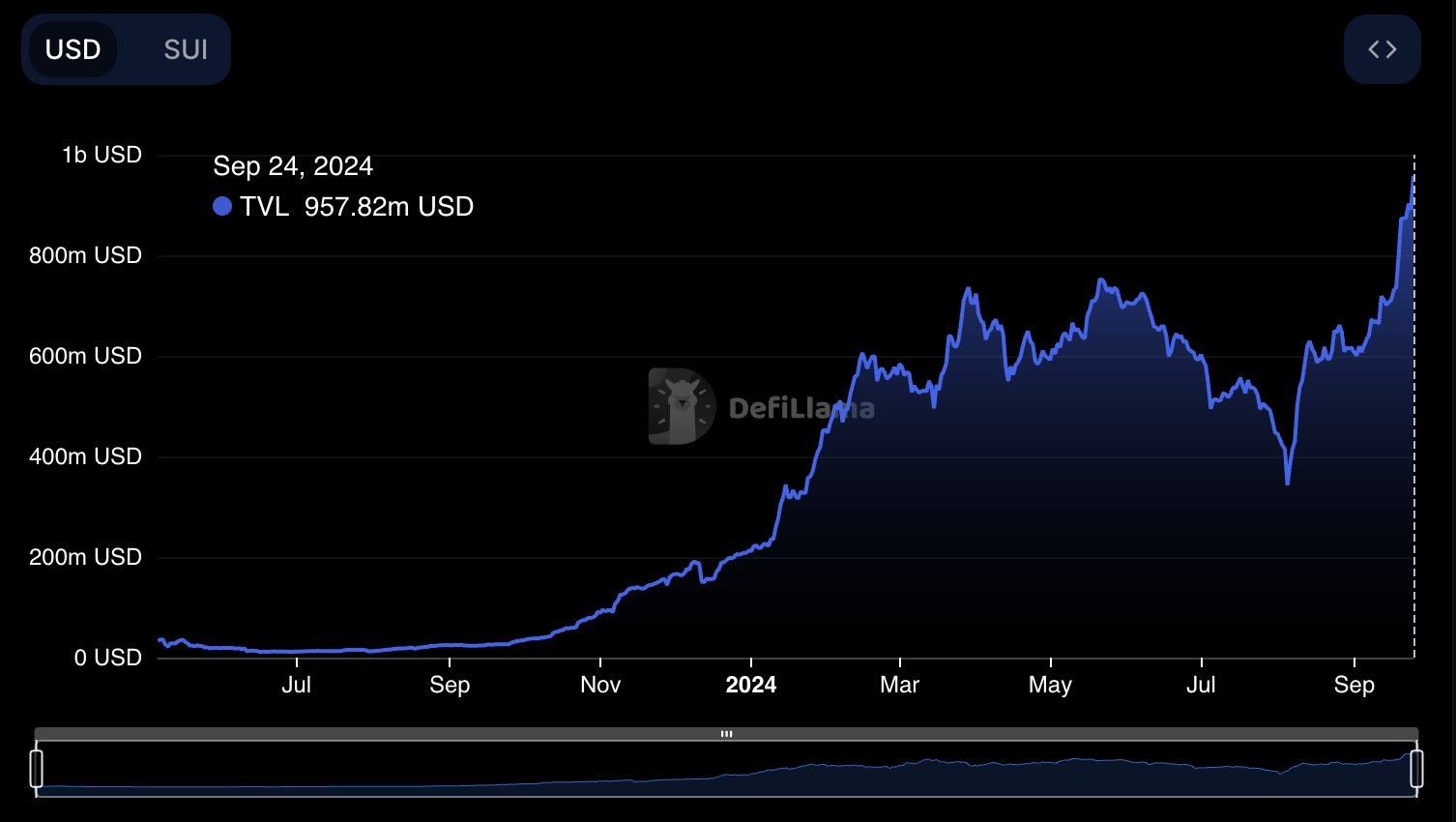

SUI price has been on a strong upward trend, capturing the attention of the crypto community as it nears significant resistance levels. With Total Value Locked (TVL) surging past $957 million, the network’s fundamentals have strengthened, pointing to increasing investor confidence.

This rapid growth is positioning SUI as a potential key player among “Ethereum killer” candidates, outpacing competitors like Sei, Mantle, and Aptos. As SUI approaches its all-time high, its bullish technical indicators suggest the possibility of further gains, provided it can overcome upcoming resistance points.

SUI TVL Surge: The Road to $1 Billion and BeyondTotal Value Locked (TVL) in the SUI ecosystem surged to $957 million as of September 24, 2024, a significant increase from $338 million on August 3. TVL represents the amount of capital deposited in decentralized finance (DeFi) protocols within a specific network, encompassing assets involved in activities like staking, lending, and liquidity provision.

A growing TVL is often seen as a bullish indicator because it reflects increasing trust and participation in the network’s protocols, driving up the utility and demand for the native token. When more assets are locked into SUI’s ecosystem, it suggests that users are willing to commit their capital, reducing the circulating supply of the token and potentially leading to upward price pressure.

Read more: Everything You Need to Know About the Sui Blockchain

SUI TVL. Source: DeFiLlama.

SUI TVL. Source: DeFiLlama.

Moreover, when TVL approaches major milestones, such as the imminent $1 billion TVL mark for SUI, it tends to attract attention from a broader range of investors. Reaching this threshold signals strong development and liquidity in the ecosystem. This can lead to greater market confidence, a positive feedback loop of price growth, and further capital inflows.

As TVL continues to rise, the ecosystem’s overall health improves, enhancing liquidity for decentralized applications, increasing transaction volumes, and likely leading to sustained price growth for SUI. With more integrations, like Circle launching USDC on SUI, its TVL could continue growing in the next months.

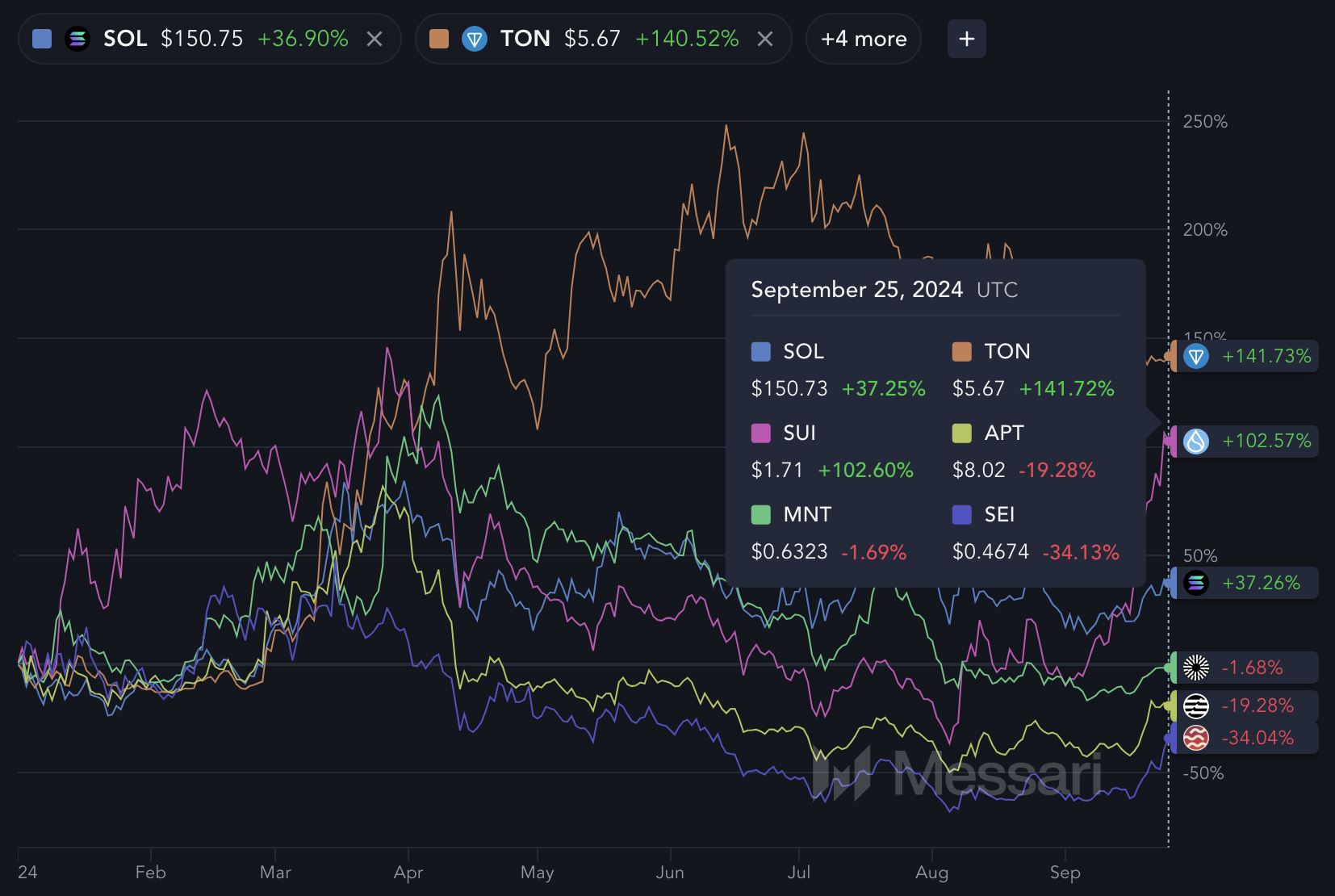

SUI Is Outpacing Other “Ethereum Killers”When looking at the performance of “Ethereum killer” candidates, Solana remains the clear frontrunner. It currently has a price of $150.75 and a 37.25% increase year-to-date. Its dominance is well established, with a massive market cap of around $70 billion.

However, TON is also gaining significant attention, boasting a 140.52% increase and a market cap of $14 billion. Despite these two giants, there seems to be room for another major player in the space.

Among the contenders, Sui stands out, especially when compared to other up-and-coming chains like Sei, Mantle, and Aptos. Sei and Mantle show negative returns (-34.13% and -1.69%, respectively). Aptos has seen a significant drop (-19.28%).

On the other hand, Sui has managed to more than double in value, growing by 102.60% YTD.

SUI and other “Ethereum Killers”. Source: Messari.

SUI and other “Ethereum Killers”. Source: Messari.

Crypto could easily accommodate another “Ethereum killer” with a market cap exceeding $10 billion. With Solana already far beyond that level and TON at $14 billion, SUI momentum suggests it could be the next chain to cross this significant threshold.

Its strong growth metrics and improving adoption rates place it in a prime position to compete on the same level as Solana and TON, potentially becoming a key player in the multi-chain future of decentralized applications.

SUI Price Prediction: $2.20 By October?SUI is currently trading around $1.70, still 28% behind its all-time high of $2.18. Its price has been on a strong upward trajectory recently, with several EMA lines stacking in a bullish configuration. Exponential moving averages are trend-following indicators that give more weight to recent price action.

In this chart, the EMAs are clearly aligned in a bullish pattern, with shorter-term EMAs above longer-term EMAs. This type of alignment indicates strong upward momentum in the market.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

SUI EMA Lines and Support and Resistance. Source: TradingView.

SUI EMA Lines and Support and Resistance. Source: TradingView.

If SUI can continue its current trend and break above key resistance levels at $1.95 and $2.07, the price could be poised to challenge its previous all-time high of $2.18 and potentially move even higher, targeting $2.20 or more.

However, a failure to break these resistance levels could lead to a pullback. In that case, the nearest support level is around $1.41, where the price could stabilize before attempting another upward move.

The post SUI Price Gains Momentum: Eyeing Key Resistance Levels Amid TVL Growth appeared first on BeInCrypto.