Starknet (STRK) Price Jumps 10% After Staking Announcement: What’s Next

Starknet (STRK) recently launched the first phase of its staking program, triggering a 10% price surge in just one day. This sudden price movement has attracted the attention of traders, as the token approaches key resistance levels. Despite the strong momentum, technical indicators are painting a mixed picture of the asset’s outlook.

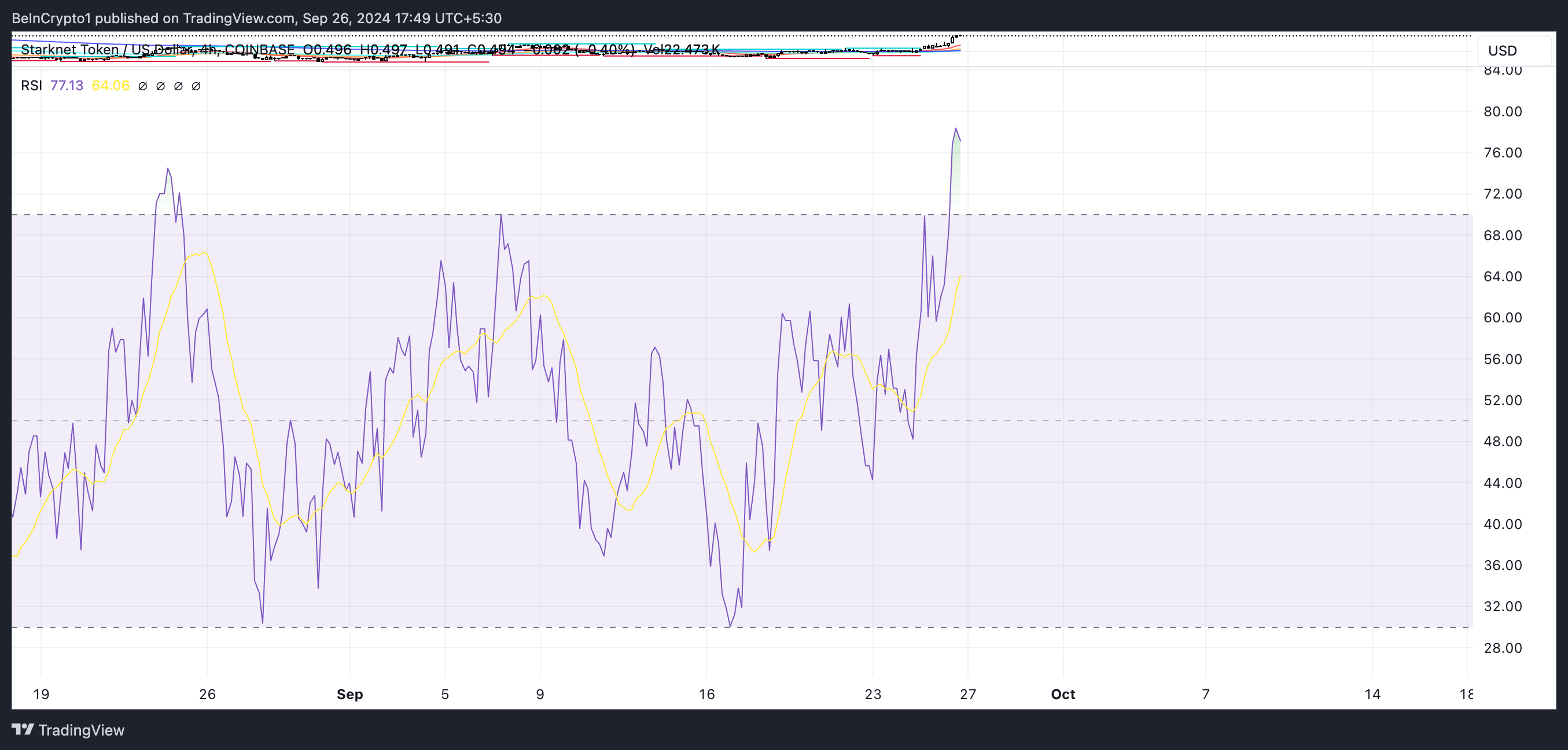

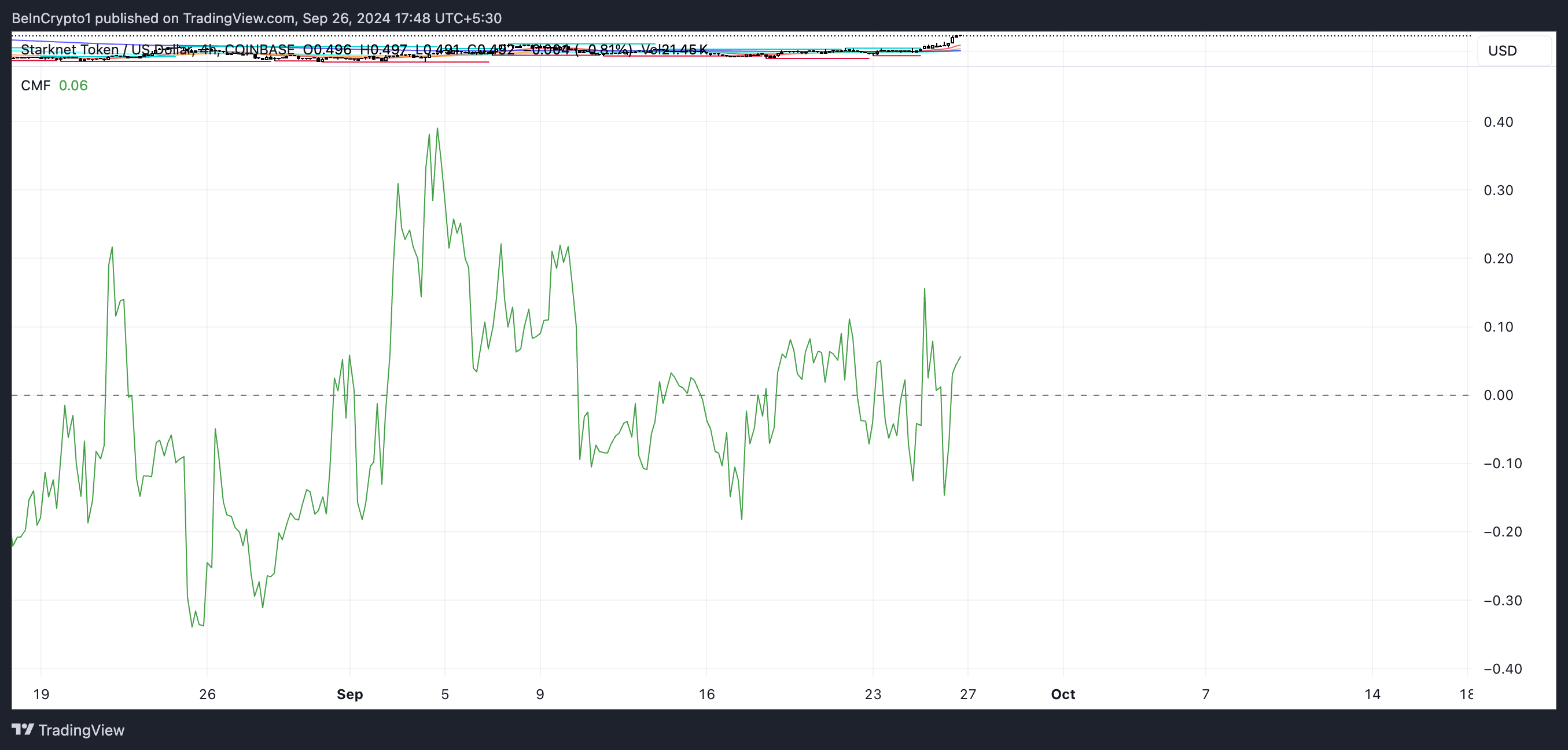

The Relative Strength Index (RSI) is signaling an overbought condition, which suggests that STRK could struggle to maintain its upward trajectory. At the same time, the Chaikin Money Flow (CMF) shows only moderate buying pressure, raising questions about the sustainability of the current rally.

Starknet RSI Is Showing an Overbought StateStarknet’s RSI has surged to 77, up from 48 just two days ago, indicating that the price has seen a significant increase in a short period. This sharp rise suggests that Starknet is now in overbought territory, potentially signaling a price correction.

RSI, or Relative Strength Index, is a technical indicator that measures the speed and magnitude of price changes. It operates on a scale of 0 to 100, with levels above 70 considered overbought and levels below 30 considered oversold.

Read more: A Deep Dive Into Starkware, StarkNet, and StarkEx

STRK RSI. Source: TradingView.

STRK RSI. Source: TradingView.

If Starknet’s RSI decreases from its current level, it could provide a cooling-off period, giving the price room to stabilize and potentially attract new buyers at lower levels. However, if the RSI remains at 77 or above 70, it might indicate that buying pressure has peaked, which may limit further upward movement and even prompt a sell-off.

STRK Chaikin Money Flow Is Currently Moderately PositiveSTRK Chaikin Money Flow (CMF) is currently at 0.06, showing a mild but noticeable positive buying pressure. While this suggests that there is some interest in the asset, the buying pressure isn’t particularly strong, meaning the inflow of capital is modest.

The CMF is a widely used technical indicator that combines both price and volume data to determine whether money is flowing into or out of an asset. It operates on a scale from -1 to +1, with values above 0 showing net buying pressure and values below 0 indicating net selling pressure.

A reading closer to +1 signals strong buying interest, while closer to -1 suggests significant selling. With STRK’s current CMF at 0.06, the market is showing some support from buyers, but it’s not overwhelmingly bullish.

STRK Chaikin Money Flow. Source: TradingView.

STRK Chaikin Money Flow. Source: TradingView.

For STRK price to maintain a steady increase or even continue rising significantly, stronger buying pressure would typically be necessary. A CMF value of 0.06 may indicate that while there is some demand, it’s not enough to fuel a breakout or protect the price from falling if selling pressure starts to rise.

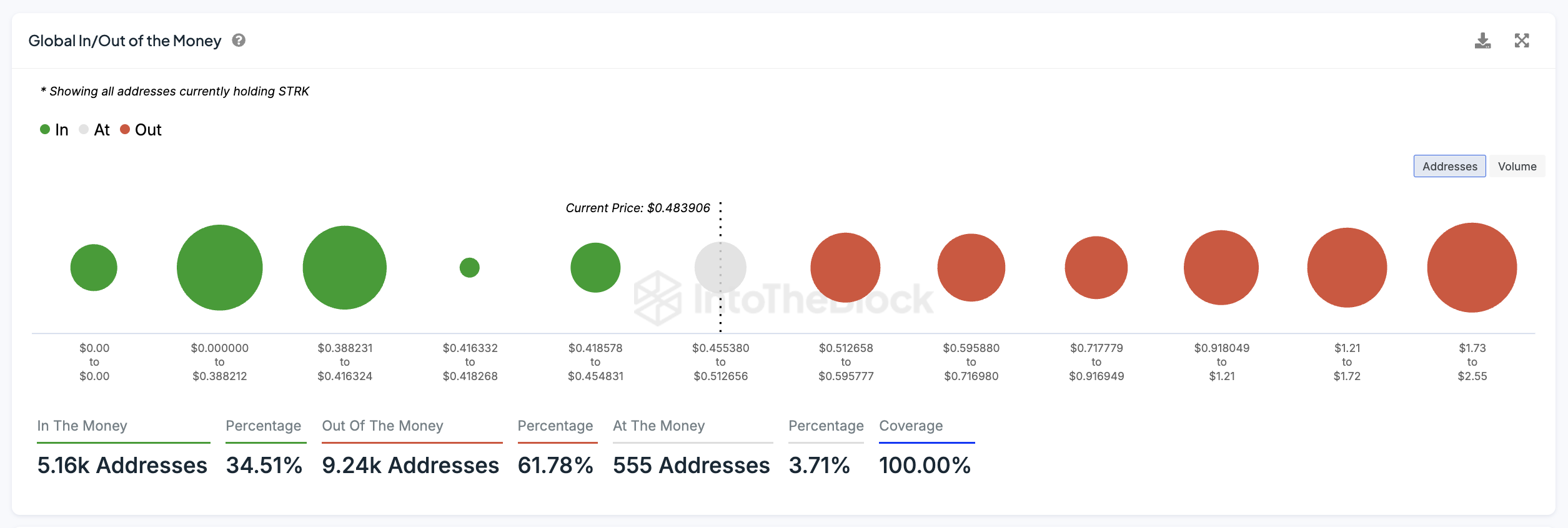

Starknet Price Prediction: Strong Resistance AheadThere are strong resistance levels for Starknet (STRK) at $0.51 and $0.59, where a significant number of addresses are holding tokens at higher prices, potentially leading to selling pressure.

If these resistance zones are broken, STRK could see an upward move toward the next major resistance at $0.91, where fewer addresses are holding coins allowing for the possibility of a quicker price rise if buying pressure continues.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

STRK Global In/Out of the Money. Source: IntoTheBlock

STRK Global In/Out of the Money. Source: IntoTheBlock

The Global In/Out of the Money metric offers a useful view of the addresses holding STRK at various profit levels. Addresses classified as “In the Money” (holding STRK at a profit) are likely to take profits when the price rises, contributing to resistance at key price levels. On the other hand, addresses “Out of the Money” (holding STRK at a loss) may increase selling pressure as they look to minimize their losses.

On the downside, the support zone between $0.41 and $0.45 is relatively weak, suggesting this level could be tested soon. If buyers don’t step in to support the price in this range, STRK could experience a further drop, potentially as low as $0.38, where a stronger concentration of holders is present. This cluster could act as a more reliable support level, providing some stability if the price retreats.

The post Starknet (STRK) Price Jumps 10% After Staking Announcement: What’s Next appeared first on BeInCrypto.