Solana Sees First Major Inflow in February, Aims To Stay Above $200

Solana has been on a downward trend, shedding nearly 20% of its value since closing at $252.42 on January 19.

However, a rebound may be underway as the coin records its first spot inflow in February, signaling renewed investor interest. This analysis has the details.

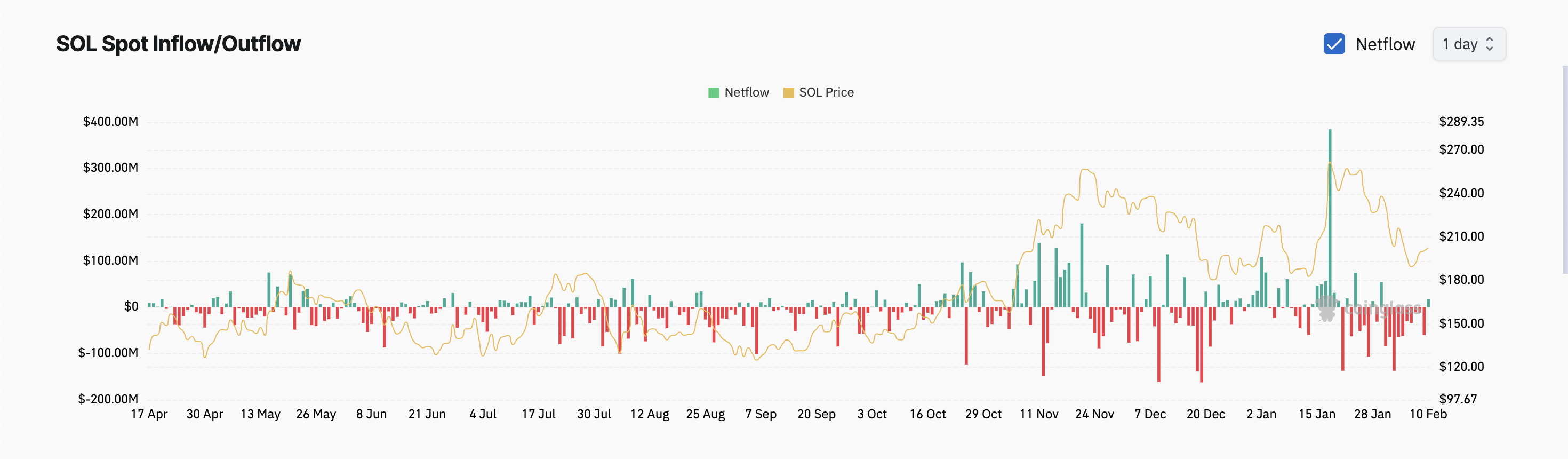

Solana Bulls Attempt a ComebackAccording to Coinglass, SOL’s spot market inflows reached $16 million on Monday, marking its first major inflow in 10 days. This renewed buying interest comes as SOL attempts to hold above the key $200 level.

SOL Spot Inflow/Outflow. Source: Coinglass

SOL Spot Inflow/Outflow. Source: Coinglass

Spot inflows often signal investor confidence or a potential positive shift in market sentiment toward the asset. When an asset experiences spot inflows, it means an increase in the purchase of that asset in the spot market, where transactions are settled immediately.

Therefore, this trend suggests a rise in demand for SOL, as its buyers are willing to acquire it at the current market price.

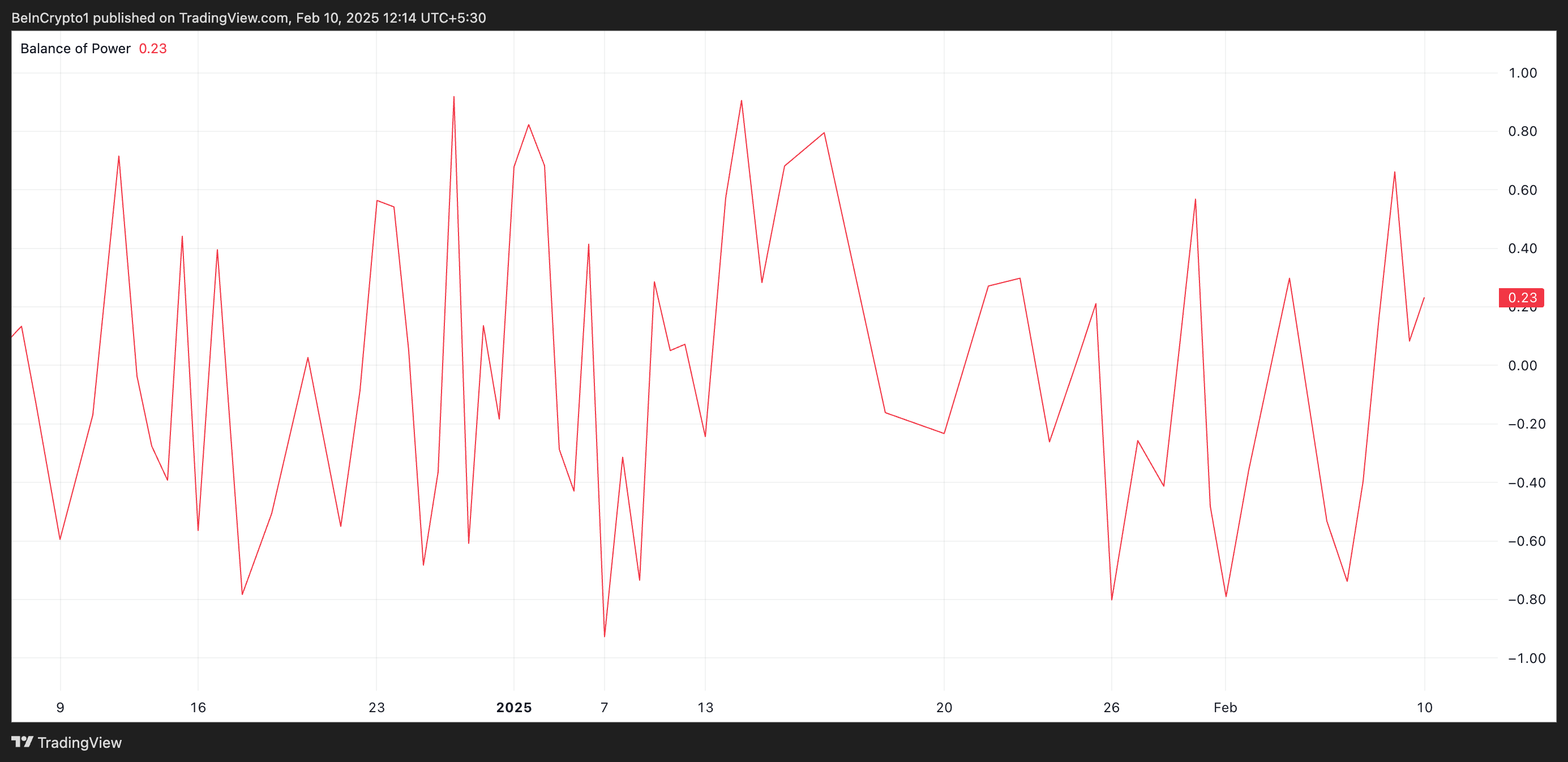

Furthermore, the coin’s positive Balance of Power (BoP) confirms this resurgence in SOL’s buying pressure among market participants. At press time, the momentum indicator is at 0.23, reflecting the accumulation trend.

SOL BoP. Source: TradingView

SOL BoP. Source: TradingView

The BoP measures the strength of an asset’s buyers against its sellers by comparing price movements within a given period. A positive BoP indicates buyers are in control, suggesting upward momentum and potential price appreciation.

SOL Price Prediction: Holding This Support Could Spark a RallyOn the daily chart, Solana tests a key support zone formed at the lower boundary of an ascending parallel channel it has traded within for several months.

Holding this level is crucial, as maintaining support could reinforce its current bullish momentum and strengthen the ongoing uptrend. If SOL stays above this support, it may attract further buying interest and push toward $258.66.

SOL Price Analysis. Source: TradingView

SOL Price Analysis. Source: TradingView

However, a break below this line would signal weakening momentum, potentially leading to a deeper pullback to $113.88.

The post Solana Sees First Major Inflow in February, Aims To Stay Above $200 appeared first on BeInCrypto.