sIntroducing GRC-20: Redefining Knowledge in Web3

The debate between public and private blockchains is central to the future of tokenized assets. Public blockchains, like Ethereum, are open, decentralized networks that offer transparency and security, making them ideal for industries where trust, immutability, and decentralization are key. However, they can suffer from scalability and transaction speed limitations, which may be a concern for businesses with high-volume needs. On the other hand, private blockchains provide a controlled environment, offering faster transaction speeds, more scalability, and greater privacy for sensitive business operations.

They allow businesses to maintain control over who participates in the network, which can be particularly valuable for enterprises in regulated industries. However, they come with trade-offs in terms of decentralization and transparency. When deciding between public and private blockchains for tokenized assets, businesses must weigh factors such as security, scalability, cost, and compliance needs. Understanding these differences is crucial for selecting the right blockchain architecture to meet the specific demands of tokenization, whether it’s for asset-backed tokens, digital securities, or other blockchain-based financial solutions.

What Are Tokenized Assets?Tokenized assets are real-world assets that have been converted into digital tokens on a blockchain, representing ownership or a share of the asset. These assets can range from physical items like real estate, art, and commodities, to financial instruments such as stocks, bonds, or even intellectual property. Tokenization enables fractional ownership, allowing investors to buy portions of high-value assets that would otherwise be difficult to access. Blockchain technology ensures the transparency, security, and immutability of transactions, making the process more efficient and reducing the need for intermediaries.

This also allows for faster and more cost-effective transactions, with the added benefit of global accessibility. The rise of tokenized assets is transforming industries by creating new investment opportunities and improving liquidity. By breaking down barriers traditionally associated with asset ownership, tokenization is paving the way for greater financial inclusion and innovation, offering a way to bridge the gap between traditional finance and the growing digital economy.

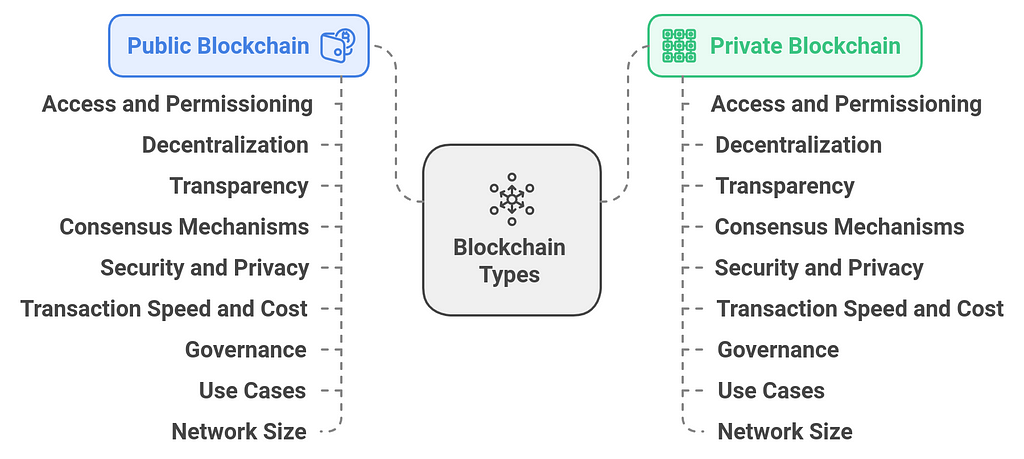

Key Differences Between Public and Private BlockchainsThe distinction between public and private blockchains is fundamental to understanding how blockchain networks are designed and operate. Here’s a detailed comparison to highlight the key differences between these two types of blockchains:

1. Access and PermissioningPublic Blockchain:

1. Access and PermissioningPublic Blockchain:- Open to anyone who wants to participate.

- Anyone can join the network, read the blockchain data, and participate in the consensus process.

- Example: Bitcoin, Ethereum anyone can create a wallet, participate in mining or staking, and view transaction history.

- Access is restricted and permissioned.

- Only authorized participants can join the network and interact with the blockchain.

- Example: Hyperledger, Ripple (for financial institutions) only a select group of organizations or individuals are allowed to participate.

- Highly decentralized no central authority controls the network.

- Control is distributed across many participants (nodes), making it resistant to censorship and tampering.

- Example: In Bitcoin, miners from around the world validate transactions, ensuring no single party has control over the network.

- Centralized control governance and validation are typically managed by a single organization or consortium.

- Though it may use distributed nodes, the network is governed by a central authority that decides who can participate.

- Example: A private blockchain used by a consortium of banks for financial transactions will be managed by the banks, not by a decentralized group of nodes.

- Completely transparent anyone can view transaction data on the blockchain.

- Transactions are publicly available, and the ledger is open to everyone.

- Example: In Ethereum, anyone can explore the blockchain using explorers like Etherscan to track all transactions.

- Limited transparency only authorized participants can access the blockchain data.

- Data privacy is more easily maintained as only trusted parties are allowed to view or interact with the blockchain.

- Example: A private blockchain used by a healthcare consortium may restrict access to patient data and only allow authorized healthcare providers to view records.

- Typically uses consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions, which rely on the decentralized participation of nodes.

- Consensus is achieved without the need for a central authority, ensuring the integrity of the system.

- Example: Bitcoin uses PoW to validate transactions and add them to the blockchain.

- Often uses Proof of Authority (PoA), Practical Byzantine Fault Tolerance (PBFT), or other permissioned consensus models, which are faster and less resource-intensive than public blockchain models.

- Since only authorized nodes participate, consensus can be achieved with fewer participants.

- Example: Hyperledger Fabric uses a permissioned model where only known entities (e.g., banks, companies) can validate transactions.

- Security is ensured through cryptographic techniques and decentralization, making it highly resistant to attacks.

- The network relies on the collective participation of nodes to validate transactions and secure the ledger.

- Privacy can be limited as transaction data is visible to anyone, though identities may remain pseudonymous.

- Example: Bitcoin transactions are publicly recorded, though the addresses involved are pseudonymous.

- Security and privacy are higher because only authorized participants have access to the data and are allowed to participate in validation.

- The network can implement stricter privacy controls and regulations (such as KYC/AML compliance) for its members.

- Example: A private blockchain for a supply chain network might ensure that only participating companies can see specific transaction details related to their goods.

- Transactions can be slower and more costly due to network congestion and the resource-intensive nature of consensus mechanisms like PoW.

- Public blockchains often face higher transaction fees, especially when the network becomes congested.

- Example: During periods of high demand, Ethereum’s gas fees can rise significantly.

- Transactions are typically faster and cheaper because fewer participants are involved in the consensus process and the network is permissioned.

- Since there is no need for intensive computational work like PoW, transaction costs are significantly reduced.

- Example: A private blockchain used in financial institutions for cross-border payments will settle transactions quickly and with lower fees compared to public blockchains.

- Governance is decentralized, meaning decisions are made by the community of participants (miners, stakers, etc.).

- Changes to the protocol often require broad consensus from the network, making governance a more democratic but sometimes slower process.

- Example: Ethereum has a decentralized governance structure, with upgrades and protocol changes requiring wide community consensus.

- Governance is centralized, typically controlled by the organization or consortium that operates the network.

- Changes to the protocol or governance structure can be more streamlined and faster, as they are decided by a smaller, more centralized group.

- Example: A private blockchain used by a consortium of banks for trade finance may have a governance model where the consortium’s members vote on changes.

- Best suited for applications that require decentralization, openness, and trustlessness, such as cryptocurrency networks, decentralized finance (DeFi), and public records.

- Often used for applications where transparency and security are paramount.

- Example: Bitcoin (cryptocurrency), Ethereum (smart contracts, DeFi, NFTs).

- Ideal for enterprise use cases where data privacy, control, and compliance are critical, such as supply chain management, enterprise resource planning (ERP), and private financial networks.

- Private blockchains are more suited for organizations that need to keep transaction details confidential and maintain control over who can access the network.

- Example: Hyperledger Fabric (used for supply chain management and financial services), Ripple (used for financial institutions).

- Large, decentralized networks with potentially thousands of participants spread across the globe.

- The size of the network ensures greater security and robustness, but may also lead to scalability challenges.

- Example: Bitcoin’s network involves thousands of nodes distributed across many countries.

- Smaller networks with a limited number of participants, which can lead to more efficient consensus and faster transaction speeds.

- The network is often confined to trusted parties, such as members of a consortium or specific business partners.

- Example: A private blockchain for a healthcare consortium may consist of hospitals, insurance companies, and medical suppliers..

The choice between a public and private blockchain depends largely on the specific needs of the project. Public blockchains excel in applications that prioritize decentralization, transparency, and trustlessness, such as cryptocurrencies and decentralized applications. On the other hand, private blockchains are more suitable for enterprise and industry-specific use cases, where privacy, control, regulatory compliance, and efficiency are critical. Understanding these differences is key to selecting the appropriate blockchain for any given tokenized asset or application.

Understanding Public BlockchainA public blockchain is a decentralized, open-source network that allows anyone to participate, validate transactions, and contribute to the blockchain’s maintenance. It operates on a distributed ledger system, where every participant (node) has access to the entire history of transactions, ensuring transparency and accountability. Public blockchains, such as Bitcoin and Ethereum, rely on consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS) to secure the network and validate transactions.

This structure makes public blockchains highly transparent, secure, and resistant to censorship or tampering. The decentralized nature of public blockchains also eliminates the need for intermediaries, enabling peer-to-peer transactions and reducing costs. However, challenges like scalability and energy consumption can limit their efficiency, especially in high-traffic networks.

Despite these drawbacks, public blockchains are considered ideal for applications requiring trustless and open environments, such as cryptocurrency, decentralized finance (DeFi), and blockchain-based voting systems, where security, openness, and decentralization are crucial.

Key Benefits of Tokenized Assets on Public BlockchainsTokenized assets on public blockchains bring several key benefits to both individual and institutional investors, as well as businesses. These benefits stem from the inherent properties of blockchain technology, including transparency, decentralization, and immutability. Here are the key advantages:

1. Increased Liquidity- Benefit: Tokenizing physical or digital assets can make them more liquid by allowing them to be easily traded on blockchain-based platforms. This is particularly useful for illiquid assets like real estate, fine art, or private equity.

- Example: Fractionalizing a property by creating tokens representing ownership allows people to buy and sell small portions of the property, creating liquidity in a traditionally illiquid market.

- Benefit: Blockchain eliminates the need for intermediaries (such as brokers, banks, or custodians), reducing transaction fees and making asset transfers more cost-effective.

- Example: Transferring tokenized securities or digital collectibles directly between parties on the blockchain can significantly lower administrative costs, clearing fees, and other overheads.

- Benefit: Blockchain provides a transparent, immutable ledger that records every transaction. This increases trust by allowing all participants to view the asset’s history, ownership, and transaction details.

- Example: When a tokenized piece of art is sold, the blockchain records every past transaction, proving the asset’s provenance and ensuring its authenticity.

- Benefit: Tokenized assets enable a broader range of individuals, including those without access to traditional financial institutions, to invest in high-value assets. Tokenization can reduce the entry barriers by fractionalizing expensive assets.

- Example: A person with a small investment budget could buy a fraction of a tokenized luxury real estate property or a share in a tokenized company, providing access to investment opportunities previously available only to the wealthy.

- Benefit: Tokenized assets are typically issued on public blockchains, which are borderless and accessible globally. This allows assets to be traded by anyone, anywhere, at any time.

- Example: A person in Asia can buy tokenized shares of a U.S.-based company or participate in a global real estate pool without the need for currency exchange or legal hurdles.

- Benefit: Tokenized assets can be governed by smart contracts, which automatically execute predefined actions without human intervention. This enables faster and more efficient transactions, as well as complex multi-party agreements.

- Example: A smart contract could automatically distribute dividends to token holders based on predefined conditions (e.g., the number of tokens owned, or specific asset performance criteria).

- Benefit: Tokenization allows for fractional ownership, enabling people to own a portion of an asset without needing to purchase the entire asset.

- Example: Instead of buying an entire luxury sports car or piece of real estate, an investor can own a fraction (or a specific number of tokens), making it more affordable and diversified.

- Benefit: Blockchain technology allows for near-instantaneous settlement of transactions compared to traditional financial markets, which often take days due to intermediaries and banking hours.

- Example: A buyer and seller of tokenized stocks or commodities can complete the transaction within minutes or hours, instead of waiting days for bank transfers or clearance.

- Benefit: Tokenized assets open up new investment opportunities, including asset classes that were previously difficult to access or invest in.

- Example: Tokenized art, collectible assets, or even intellectual property could be available to a wider range of investors, allowing for more diversified portfolios.

- Benefit: Tokenized assets can be programmed with custom rules and conditions. For instance, tokens can have built-in features like governance rights, dividend payouts, or access to certain privileges.

- Example: A tokenized real estate asset could allow token holders to vote on management decisions, or a token representing shares in a startup could automatically issue dividends when certain revenue thresholds are met.

- Benefit: Blockchain can simplify compliance with regulations by embedding automated checks and transparency into transactions. It can ensure that the asset’s transfer complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

- Example: A tokenized security can automatically validate the identity of participants and prevent unauthorized transactions based on pre-set compliance criteria, reducing legal risks.

- Benefit: Tokenized assets can be easily managed on digital wallets or platforms, providing real-time tracking and portfolio management.

- Example: Investors can view their tokenized asset portfolio in real-time and make adjustments instantly without needing physical certificates or documents.

- Benefit: Tokenized assets can be used as collateral for loans on decentralized finance (DeFi) platforms, providing liquidity to holders without needing to sell the asset.

- Example: An individual with tokenized real estate can use those tokens as collateral for a loan on a DeFi platform, offering easier access to credit.

- Benefit: Public blockchains support decentralized networks, reducing reliance on central authorities like banks or corporations. This decentralization can lead to fairer and more inclusive systems of ownership and governance.

- Example: Tokenized assets can represent decentralized ownership of a project or company, allowing all token holders to have a say in the decision-making process, voting on key issues through decentralized governance mechanisms.

Tokenized assets on public blockchains provide numerous advantages, such as enhanced liquidity, reduced costs, greater transparency, and accessibility to new asset classes. These benefits not only democratize access to high-value assets but also streamline transactions, improve security, and open up innovative financial products. As blockchain adoption continues to grow, tokenization will likely become a significant factor in reshaping traditional financial and asset markets.

Challenges of Tokenized Assets on Public BlockchainsWhile tokenized assets on public blockchains offer numerous benefits, there are also several challenges and risks associated with their adoption and implementation. Here are the key challenges:

1. Regulatory Uncertainty- Challenge: Tokenized assets often exist in a gray area when it comes to regulation. Different jurisdictions have varying laws regarding the ownership and transfer of digital tokens, which can create legal complexity for both asset owners and platforms offering tokenization services.

- Example: In some countries, tokenized real estate or securities may be classified as unregistered securities, leading to legal uncertainty and potential compliance issues.

- Challenge: There is no universal standard for tokenizing assets, meaning different platforms may use different token formats, smart contracts, and protocols. This lack of interoperability makes it harder for tokenized assets to be universally recognized or traded across different blockchain ecosystems.

- Example: A tokenized property asset on one platform may not be easily transferred or sold on another, creating friction for users and reducing liquidity.

- Challenge: Cryptocurrencies and blockchain-based assets can be highly volatile. If the tokenized asset is tied to a cryptocurrency or its value fluctuates based on market sentiment, investors may face risks that are difficult to predict.

- Example: A tokenized asset linked to a volatile cryptocurrency might see significant value swings, which could discourage investors looking for stable returns.

- Challenge: While blockchain itself is considered secure, the infrastructure around tokenized assets, such as exchanges, wallets, and smart contracts, can still be vulnerable to hacking and fraud. If private keys are stolen or smart contracts are flawed, the entire asset could be compromised.

- Example: There have been instances where blockchain-based exchanges or wallets have been hacked, leading to the theft of tokens or loss of assets.

- Challenge: While tokenization can increase liquidity, it is not guaranteed. If there is low demand or insufficient market depth, tokenized assets may still suffer from liquidity problems, especially for niche or highly specialized assets.

- Example: Tokenized shares of a specific art piece or luxury asset may not have enough buyers, making it difficult to sell or exchange them at market value.

- Challenge: Blockchain networks can become congested, especially in public chains like Ethereum, where high transaction volumes can lead to slow processing times and high gas fees. This affects the efficiency of tokenized asset transfers and their viability for everyday use.

- Example: High transaction fees on Ethereum can make small-value transfers of tokenized assets expensive, reducing the overall appeal of tokenization for low-cost assets or small investors.

- Challenge: The concept of digital ownership can be difficult for traditional investors to understand and manage, especially in cases where tokenized assets require self-custody of private keys. Mismanagement of private keys can lead to the loss of ownership, as tokens are not stored in a central repository but are rather in the control of the individual.

- Example: If a user loses access to their private key or wallet, they may lose access to their tokenized assets permanently, as blockchain transactions are irreversible.

- Challenge: The legal status of tokenized assets in many jurisdictions is unclear. Ownership, transferability, and taxation of tokenized assets are often not well defined, which can create confusion for asset holders, investors, and regulators.

- Example: If tokenized real estate is sold, it may be unclear whether the transaction should be taxed as a sale of real property or as a digital asset, complicating tax reporting for both individuals and institutions.

- Challenge: Public blockchains are transparent, meaning all transactions are visible to anyone who can access the network. While this transparency can enhance trust, it can also raise privacy concerns, particularly when sensitive or personal information is involved.

- Example: If personal data is linked to tokenized assets (e.g., in real estate), the transparency of blockchain could expose sensitive information that users may want to keep private.

- Challenge: While tokenization can reduce certain costs, the initial setup of tokenized assets involves significant operational complexity. Creating, issuing, and managing tokenized assets can require legal expertise, smart contract development, compliance checks, and integration with blockchain networks, all of which can be costly and time-consuming.

- Example: Tokenizing a real estate property involves not only technical development but also legal work to ensure the asset is properly represented on the blockchain and compliant with local laws, which could result in high upfront costs.

- Challenge: Many individuals and institutions are still unfamiliar with blockchain technology and tokenization. The lack of understanding about how tokenized assets work can be a barrier to widespread adoption, particularly in traditional markets where paper-based ownership and record-keeping are the norm.

- Example: Investors or businesses in traditional sectors might be hesitant to adopt tokenized assets due to a lack of understanding or trust in blockchain technology, leading to slow adoption rates.

- Challenge: Public blockchains, particularly those using proof-of-work (PoW) consensus mechanisms (like Bitcoin and Ethereum before its transition to proof-of-stake), consume significant amounts of energy. This has raised concerns about the environmental impact of tokenizing assets on these networks.

- Example: Tokenizing large-scale physical assets on energy-intensive blockchains may contribute to the carbon footprint, which could be an issue for environmentally conscious investors and regulators.

- Challenge: In traditional asset ownership, legal frameworks provide recourse in case of disputes. However, blockchain-based ownership may lack established legal frameworks for resolving disputes, especially across jurisdictions. This can make enforcing contracts or claims related to tokenized assets difficult.

- Example: If a tokenized asset transaction is contested, it may be unclear how to resolve the issue without a clear legal framework, particularly if the transaction crosses borders.

While tokenized assets on public blockchains offer significant opportunities, such as increased liquidity, greater accessibility, and lower transaction costs, they also present challenges related to regulation, security, scalability, and user adoption. These challenges need to be addressed through improved infrastructure, clearer regulations, enhanced user education, and technological advancements to ensure the widespread success of tokenized assets in the future.

Understanding Private BlockchainA private blockchain is a permissioned, centralized network where access and participation are restricted to a select group of trusted entities. Unlike public blockchains, which are open to anyone, private blockchains allow organizations to control who can read, write, or validate transactions. This centralized governance offers enhanced privacy, faster transaction speeds, and greater scalability, making private blockchains well-suited for enterprises and businesses that need to maintain control over their data and operations. Private blockchains can be customized to meet specific business needs, such as compliance with regulatory standards or the need for confidentiality.

They use consensus mechanisms like Practical Byzantine Fault Tolerance (PBFT) or Proof of Authority (PoA) to validate transactions, which are generally more energy-efficient than public blockchains. While private blockchains offer advantages in terms of privacy and efficiency, they sacrifice some of the decentralization and transparency that public blockchains provide. As such, they are ideal for industries like finance, supply chain management, and healthcare, where privacy and control are paramount.

Benefits of Tokenized Assets on Private BlockchainsTokenized assets on private blockchains offer distinct advantages compared to those on public blockchains, especially in environments where privacy, control, and compliance are paramount. Here are the key benefits of using private blockchains for tokenized assets:

1. Enhanced Privacy and Confidentiality- Benefit: Private blockchains provide a higher level of privacy since transactions and asset ownership records are not publicly visible. Only authorized participants can access transaction data, making it suitable for sensitive information.

- Example: Tokenized assets like real estate, intellectual property, or financial instruments on a private blockchain ensure that ownership details and transaction history remain confidential, protected from the general public.

- Benefit: Private blockchains typically have more stringent access control mechanisms, allowing only trusted participants to join the network. This reduces the risk of hacking, fraud, or unauthorized access.

- Example: A private blockchain used to tokenize corporate assets can ensure that only verified entities, such as board members, investors, or authorized partners, can interact with the tokenized assets, reducing exposure to security threats.

- Benefit: Private blockchains are typically more efficient in terms of transaction speed and cost. Since the network is permissioned and the number of participants is controlled, the blockchain can process transactions faster and at a lower cost compared to public blockchains.

- Example: In a private blockchain for tokenized commodities, participants can quickly settle trades without the congestion or high transaction fees typically found in public blockchains like Ethereum.

- Benefit: Private blockchains allow for greater customization in terms of governance models, consensus mechanisms, and the specific features of tokenized assets. Organizations can tailor the blockchain to suit their particular needs, ensuring that it fits the regulatory and operational requirements.

- Example: A private blockchain used by a consortium of banks can implement a customized consensus algorithm that balances speed, security, and compliance, tailored to the financial sector’s needs.

- Benefit: Private blockchains can be designed with built-in compliance features to meet specific regulatory requirements. These blockchains can include tools for Know Your Customer (KYC), Anti-Money Laundering (AML), and other compliance measures, making them more suitable for industries like finance, healthcare, or real estate.

- Example: A private blockchain tokenizing shares of a company can enforce KYC/AML protocols for participants before allowing them to trade, ensuring that only verified, compliant parties engage in the transactions.

- Benefit: Unlike public blockchains, which often rely on volatile cryptocurrencies for transactions (such as Ethereum or Bitcoin), private blockchains can use stablecoins or even fiat currency for tokenization. This helps mitigate the risk of price fluctuations, making tokenized assets more stable.

- Example: A private blockchain used to tokenize real estate assets might allow users to trade tokens backed by fiat currency or stablecoins, reducing the exposure to the volatility of cryptocurrencies like Bitcoin.

- Benefit: Private blockchains are often more scalable than public ones due to the controlled nature of their networks. Since fewer participants are involved, the blockchain can process a higher volume of transactions without the bottlenecks that can affect public networks.

- Example: In industries where a high number of tokenized assets (such as bonds, stocks, or commodities) need to be processed quickly, private blockchains can handle the load more efficiently without the congestion or high fees that public blockchains often face.

- Benefit: Private blockchains allow organizations to implement custom governance structures for decision-making, including how tokenized assets are issued, transferred, or managed. This provides greater control over the entire lifecycle of tokenized assets.

- Example: A private blockchain for a real estate investment trust (REIT) could have a governance structure that allows token holders to vote on management decisions, such as property acquisitions or distribution of dividends.

- Benefit: Private blockchains can be more easily integrated with existing enterprise systems and other private blockchains. This allows tokenized assets to be transferred, settled, or utilized across different organizations while maintaining control and compliance.

- Example: A private blockchain platform could tokenize assets and allow various corporations to exchange those tokens while maintaining control over the network and ensuring compliance with their internal policies.

- Benefit: Many private blockchains use more energy-efficient consensus mechanisms like Proof of Authority (PoA) or Practical Byzantine Fault Tolerance (PBFT), which significantly reduce the environmental impact compared to public blockchains that rely on energy-intensive Proof of Work (PoW) mechanisms.

- Example: A private blockchain used by a multinational corporation to tokenize its assets might operate with a low-energy consensus mechanism, helping the company reduce its carbon footprint while still benefiting from the advantages of blockchain technology.

- Benefit: Smart contracts on private blockchains can automate the management and transfer of tokenized assets. These contracts can enforce predetermined conditions without human intervention, ensuring that assets are handled according to set rules and agreements.

- Example: A tokenized real estate project on a private blockchain could have automated smart contracts that trigger rental payments, distribute dividends, or transfer ownership automatically when conditions are met.

- Benefit: In a private blockchain, the organization or consortium controlling the network has the ability to directly manage and monitor who participates in the network, reducing the risk of malicious actors.

- Example: A private blockchain used by a group of investors to tokenize luxury assets (e.g., fine art or rare collectibles) can ensure that only verified and trusted participants are able to trade or invest in the tokenized assets, enhancing security.

Tokenized assets on private blockchains offer several significant benefits, including enhanced privacy, faster transaction speeds, greater control, and regulatory compliance. These advantages make private blockchains particularly suited for industries where data privacy, security, and custom governance are important, such as finance, real estate, and healthcare. However, the centralized nature of private blockchains also means they require a higher degree of trust in the organizations or consortiums managing the networks. Nonetheless, for businesses seeking to tokenize assets within a controlled, secure, and compliant environment, private blockchains provide a highly valuable solution.

Challenges of Tokenized Assets on Private BlockchainsWhile tokenized assets on private blockchains offer numerous advantages, they also present several challenges that need to be addressed for successful implementation. These challenges primarily stem from the controlled, permissioned nature of private blockchains, as well as issues related to governance, scalability, and interoperability. Here are the key challenges:

1. Centralization and Trust- Challenge: Private blockchains are typically controlled by a single organization or a consortium, which means they are more centralized than public blockchains. This creates a reliance on the trusted authority that governs the network. The level of decentralization is much lower, which can limit the inherent trustlessness of blockchain systems.

- Example: In a private blockchain tokenizing financial assets, participants must trust the governing entity to enforce rules fairly, and any failure in governance or security could undermine the credibility of the entire system.

- Challenge: One of the main benefits of public blockchains is transparency, where every transaction is visible to anyone on the network. In private blockchains, however, transaction data is only accessible to authorized participants, which reduces the level of transparency. This can make it harder for external parties (such as auditors or regulators) to verify the integrity of the system.

- Example: A private blockchain used for tokenized commodities may allow only specific parties to see the transaction history, making it difficult for third parties to independently verify the asset’s provenance or ownership.

- Challenge: The legal and regulatory frameworks around tokenized assets, especially in private blockchains, can be complex and vary widely across jurisdictions. Ensuring that the private blockchain complies with local laws, such as securities regulations, data protection laws, and anti-money laundering (AML) requirements, is crucial but can be difficult.

- Example: A private blockchain that tokenizes real estate assets may face challenges in ensuring compliance with different real estate laws in multiple regions, potentially leading to legal complications if tokenized assets are traded across borders.

- Challenge: Private blockchains are often isolated from public blockchains, meaning tokenized assets on a private blockchain cannot easily interact with assets or networks on public blockchains. This lack of interoperability can limit the flexibility and utility of tokenized assets, especially if the goal is to facilitate cross-platform transactions.

- Example: A private blockchain used for tokenizing shares in a private company may have difficulty integrating with public exchanges or token markets, restricting its liquidity and accessibility to a wider audience.

- Challenge: Building and maintaining a private blockchain for tokenized assets can be costly. Setting up the necessary infrastructure, developing smart contracts, ensuring security, and managing ongoing governance can require significant investment. Additionally, private blockchains often require dedicated teams to oversee operations and ensure compliance.

- Example: A company wishing to tokenize a portfolio of assets on a private blockchain may need to hire blockchain developers, security experts, and legal consultants, leading to high initial setup costs and ongoing maintenance expenses.

- Challenge: While private blockchains are often more efficient than public ones, they can still face scalability issues when the network grows or when transaction volumes increase. The need for centralized control and permissioning can limit the scalability of private blockchains, especially in cases where many different parties need to participate.

- Example: A private blockchain designed for tokenizing trade finance assets may struggle to scale as the number of participants and transactions grows, leading to slower transaction times and higher costs as the network becomes more congested.

- Challenge: Governance in private blockchains can be complex and contentious, especially if multiple organizations are involved in decision-making. Deciding who controls the network, how changes to the protocol are made, and how disputes are resolved can lead to challenges in maintaining fairness and preventing conflicts of interest.

- Example: A consortium of banks using a private blockchain to tokenize financial instruments may have disagreements over the governance model or decisions regarding network upgrades, which could cause operational delays or disruptions.

- Challenge: Because private blockchains often rely on a central authority or a small group of trusted entities, there is an increased risk of a single point of failure. If the central authority is compromised (due to hacking, fraud, or mismanagement), the entire network could be vulnerable.

- Example: In a private blockchain used by a single bank to tokenize loan portfolios, a breach of the bank’s systems or a failure of the bank’s governance could lead to the loss of control over the tokenized assets or a disruption in the network.

- Challenge: Despite the advantages of private blockchains, users may still be hesitant to adopt tokenized assets, especially if they perceive the network as overly controlled or opaque. For private blockchains to succeed, they need to build trust with users and stakeholders.

- Example: Investors may be reluctant to participate in tokenized real estate offerings on a private blockchain because they are concerned about the governance, transparency, or risks associated with the centralized control of the blockchain.

- Challenge: Although private blockchains provide more privacy than public blockchains, they still need robust security measures to prevent unauthorized access and ensure data privacy. The security of the private blockchain depends on the strength of the consensus mechanism and the access control protocols in place.

- Example: If a private blockchain tokenizing healthcare assets doesn’t have adequate encryption or access control measures, sensitive patient data or medical records could be exposed to unauthorized parties, leading to legal and reputational risks.

- Challenge: Integrating private blockchains with traditional legacy systems (such as banking infrastructure, ERP systems, or supply chain management platforms) can be technically complex and resource-intensive. Ensuring seamless interaction between tokenized assets on the blockchain and traditional asset management systems is a challenge.

- Example: A company tokenizing its inventory on a private blockchain may need to integrate the blockchain with its existing inventory management system, which could involve significant technical work and adaptation of legacy software.

- Challenge: Tokenizing real-world assets (like real estate, art, or commodities) on a private blockchain can be complex. Determining how to represent these assets digitally, ensuring that they remain tied to their real-world counterparts, and addressing legal ownership can be challenging.

- Example: Tokenizing a piece of real estate on a private blockchain may require extensive legal work to ensure that the token represents actual ownership, and that the tokenization process complies with property laws and regulations.

While private blockchains offer significant benefits for tokenized assets, such as privacy, control, and regulatory compliance, they also present unique challenges. These challenges include centralization risks, limited transparency, scalability issues, complex governance, and legal uncertainties. Addressing these challenges requires careful planning, technical expertise, and a clear governance model to ensure that tokenized assets on private blockchains are both secure and effective. As the technology matures, it is likely that solutions will emerge to mitigate some of these issues, but they remain important considerations for businesses and industries looking to leverage private blockchains for tokenization.

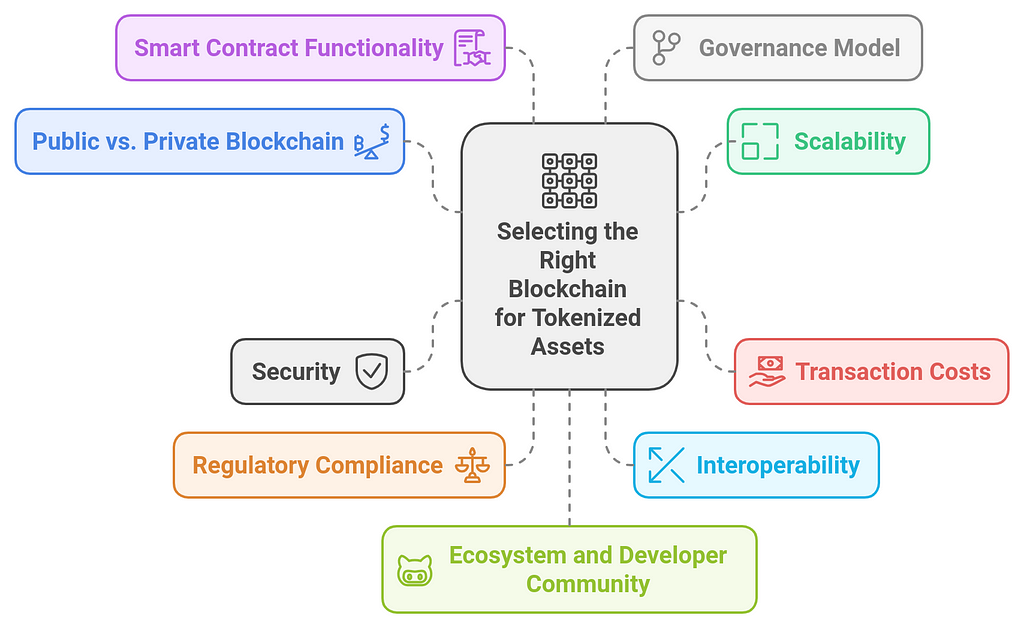

Factors to Consider When Selecting the Right Blockchain for Tokenized AssetsSelecting the right blockchain for tokenized assets is crucial for ensuring the security, scalability, and compliance of the tokenization process. Different blockchains offer various features that may be more or less suitable depending on the specific needs of the assets being tokenized. Here are the key factors to consider when choosing the right blockchain:

1. Public vs. Private Blockchain

1. Public vs. Private Blockchain- Consideration: The choice between a public or private blockchain depends on factors such as privacy, control, and regulatory compliance.

- Public Blockchain: Offers transparency and decentralization but may not provide sufficient privacy or control for certain tokenized assets.

- Private Blockchain: Provides greater privacy and control over participants but may involve more centralization.

- Example: A financial institution might prefer a private blockchain for tokenizing assets like securities to ensure privacy and compliance, while a decentralized application (DApp) may opt for a public blockchain for broader accessibility and transparency.

- Consideration: The blockchain should be able to handle the transaction volume and speed requirements of tokenized assets. Scalability refers to how well the blockchain can grow in terms of user base, transaction volume, and data storage without sacrificing performance.

- Example: Tokenizing assets like real estate or commodities, which may involve a high number of transactions, requires a blockchain that can handle large volumes efficiently without slowing down or increasing costs.

- Consideration: Transaction fees are an important factor when selecting a blockchain, as they can significantly affect the economics of tokenized assets. Some blockchains, especially public ones, can have high transaction fees during periods of congestion.

- Example: Tokenizing real estate or small-value assets may not be feasible on high-fee blockchains (e.g., Ethereum) if transaction costs are too high, but may be more suitable on blockchains with lower fees (e.g., Binance Smart Chain or layer-2 solutions).

- Consideration: Blockchain security is essential to protect the value of tokenized assets and the integrity of the system. The blockchain’s consensus mechanism, encryption standards, and overall architecture should be robust against attacks, fraud, and vulnerabilities.

- Example: Tokenized assets in sectors like healthcare or finance require a blockchain with strong security features to protect sensitive data and ensure that transactions are immutable and verifiable.

- Consideration: The blockchain should be able to comply with relevant regulations governing the asset class being tokenized, such as KYC (Know Your Customer), AML (Anti-Money Laundering), and securities regulations. Some blockchains offer built-in compliance features or allow for the customization of rules to meet local legal requirements.

- Example: A blockchain used to tokenize securities must ensure that it can enforce KYC and AML regulations, making it compatible with financial regulations such as those from the SEC (Securities and Exchange Commission) in the U.S.

- Consideration: Interoperability refers to the ability of a blockchain to communicate and work with other blockchains and traditional systems. This is important for tokenized assets that may need to interact with other tokens, asset registries, or external platforms.

- Example: If a company tokenizes assets on one blockchain but needs to enable trading or settlement with users on a different blockchain, the chosen blockchain must support cross-chain functionality or have bridging capabilities.

- Consideration: Smart contracts are self-executing contracts with terms directly written into code. The ability to program complex logic, automate transactions, and ensure trust without intermediaries is essential for tokenizing assets. The chosen blockchain should support smart contracts that are flexible, secure, and scalable.

- Example: Tokenized real estate or intellectual property may require smart contracts for managing ownership transfers, payment distributions, or automated regulatory compliance.

- Consideration: The blockchain’s governance structure determines how decisions are made, how upgrades are implemented, and how disputes are resolved. A well-defined governance model is crucial for long-term stability and the successful operation of tokenized assets.

- Example: In a private blockchain used by a consortium of banks, a clear governance model is needed to ensure that all participants have a say in protocol changes and that the rules are consistently enforced.

- Consideration: A vibrant ecosystem and active developer community are crucial for the ongoing development, support, and improvement of the blockchain. A strong community can help troubleshoot issues, provide tools, and ensure long-term viability.

- Example: Choosing a blockchain with an established ecosystem, like Ethereum, gives access to a large pool of developers, resources, and pre-built solutions that can speed up the tokenization process.

- Consideration: The blockchain should support recognized token standards (e.g., ERC-20, ERC-721, ERC-1155) for ease of integration, market adoption, and liquidity. Token standards ensure that the assets created are interoperable with wallets, exchanges, and other platforms.

- Example: If tokenizing non-fungible assets (e.g., art, collectibles), Ethereum’s ERC-721 standard would be preferable as it is widely accepted and supported by most NFT platforms.

- Consideration: The environmental impact of the blockchain is a growing concern, especially for organizations committed to sustainability. Proof-of-Work (PoW) blockchains are energy-intensive, while newer consensus mechanisms, such as Proof-of-Stake (PoS), are more energy-efficient.

- Example: For an organization that wants to tokenize assets in an environmentally conscious manner, opting for blockchains like Ethereum 2.0 (PoS) or Tezos (PoS) would be more appropriate than Bitcoin (PoW).

- Consideration: The blockchain should be able to process transactions in a timely manner, particularly for tokenized assets that require quick settlement or updates. High latency can cause delays in asset transfers or updates to ownership records.

- Example: Tokenizing high-frequency assets like stocks or bonds might require a blockchain with fast transaction finality and low latency to ensure that asset transfers occur swiftly and efficiently.

- Consideration: Depending on the asset type, custodianship and control may be important factors. Private blockchains allow for more centralized control over the assets and custodianship, while public blockchains give more autonomy to individual users.

- Example: A private blockchain used to tokenize luxury assets (like fine art) may provide more control over asset custodianship to prevent fraud, while a public blockchain might allow for decentralized custody where asset owners hold control of their private keys.

- Consideration: The blockchain should enable liquidity and easy access to markets for tokenized assets. A blockchain with a large user base and robust infrastructure is more likely to provide access to exchanges, wallets, and other liquidity platforms.

- Example: Tokenized assets on Ethereum or Binance Smart Chain can be easily traded across multiple decentralized exchanges (DEXs) and centralized exchanges (CEXs), ensuring that assets remain liquid and tradable.

When selecting the right blockchain for tokenized assets, it is important to weigh factors like privacy, scalability, security, regulatory compliance, and interoperability. The optimal blockchain will depend on the type of asset being tokenized, the transaction requirements, the target market, and legal considerations. Each blockchain offers a unique set of features, so businesses must carefully evaluate their needs before making a decision. Ensuring the chosen blockchain aligns with business goals and regulatory requirements will lead to successful tokenization of assets.

ConclusionIn conclusion, the choice between public and private blockchains for tokenized assets depends on the specific needs and goals of the business. Public blockchains are ideal for those seeking maximum transparency, decentralization, and a global, open ecosystem. They provide a level of security and trust that is essential for applications like cryptocurrency and decentralized finance (DeFi). However, the trade-off comes in terms of scalability and transaction costs, which can become limiting for high-volume use cases. Private blockchains, while offering greater control, faster transaction speeds, and more privacy, may compromise some of the fundamental principles of decentralization and transparency.

They are often better suited for enterprises that require strict compliance, privacy, and governance but are less concerned with maintaining a fully decentralized environment. Ultimately, the decision should be based on factors such as regulatory requirements, business scale, and the type of assets being tokenized. Both blockchain types have their merits, and in some cases, a hybrid approach may provide the best of both worlds, enabling businesses to harness the strengths of each.

Public vs. Private Blockchains: Which is Better for Tokenized Assets? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.