PlanB Criticizes Ethereum as a Centralized Pre-Mined Coin

PlanB, a well-known Bitcoin analyst famous for the Stock-to-Flow (S2F) model, recently criticized Ethereum as ETH’s price and dominance have dropped significantly since the beginning of the year.

His criticism raises doubts about Ethereum, the second-largest cryptocurrency by market cap, focusing on its core mechanisms, particularly its use of Proof of Stake (PoS) instead of Proof of Work (PoW).

Why Does PlanB Call Ethereum “Centralized” and “Pre-Mined”?PlanB referenced an old post by Vitalik Buterin from 2022, in which Buterin criticized the Stock-to-Flow model for creating a “false sense of certainty” regarding Bitcoin’s price. PlanB seized this opportunity to mock Ethereum, noting that the ETH/BTC trading pair had reached a nine-year low. He referred to Ethereum as a “shitcoin,” citing its centralized structure, pre-mined supply, use of Proof of Stake (PoS) over Proof of Work (PoW), and its flexible supply schedule.

“I know it’s impolite to gloat and all that, but I think shitcoins like ETH, that are centralized & premined, have PoS instead of PoW, switch supply schedule at will, are harmful and deserve all the mockery they get,” PlanB said.

PlanB is not the only one who holds these views. Ethereum’s transition to PoS through “The Merge” reduced its energy consumption by over 99%. However, some experts believe this shift undermined the network’s long-term value.

Meltem Demirors, an executive at Crucible Capital, called the move a trillion-dollar mistake. She believes it diluted Ethereum’s core network and hindered innovation in GPU hardware.

In addition to criticizing PoS, PlanB also brought up Ethereum’s pre-mine controversy.

ETH’s tokenomics reveal that developers pre-mined over 72 million ETH in the early stages—about 60% of the circulating supply. This could give a small group excessive control, especially under PoS, where large holders have more influence over transaction validation.

“Premine is really a big red flag but I guess some people just don’t care,” PlanB added.

These criticisms gained traction as Ethereum dominance hit a five-year low and ETH has dropped nearly 60% since late last year.

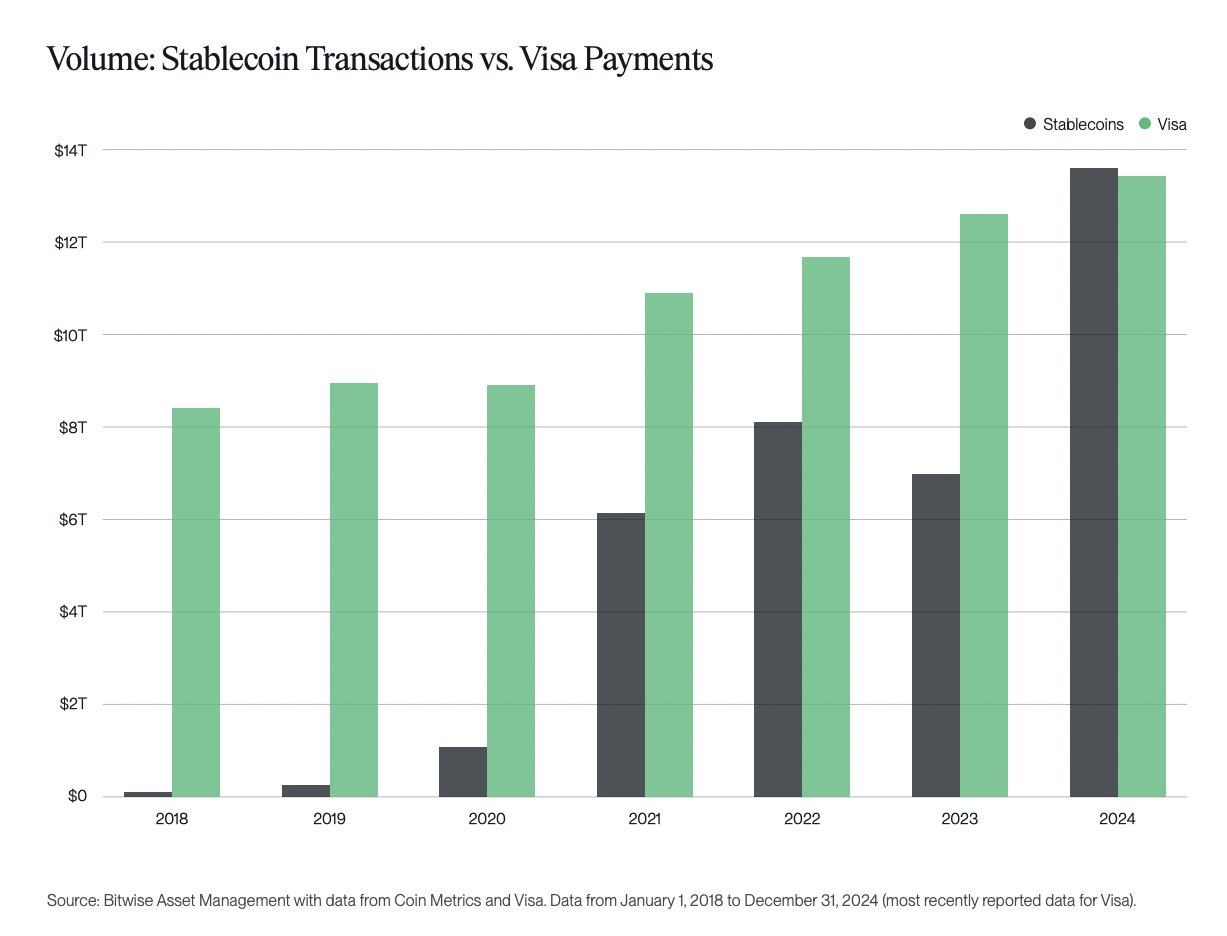

Despite Criticism, Ethereum Plays a Growing Role in Real-World ApplicationsIn response, analyst Danny Marques highlighted ETH’s growing relevance. He noted that the Ethereum network processed a massive amount of stablecoin transactions in 2024, more than Visa. A Bitwise report shows stablecoins processed nearly $14 trillion, exceeding Visa’s $13 trillion, while ETH-based stablecoin supply accounts for over 50% of the total stablecoin supply.

Stablecoin Transactions vs. Visa Payment. Source: Bitwise.

Stablecoin Transactions vs. Visa Payment. Source: Bitwise.

Investor Wise also pointed out that Ethereum hosts 56% of all real-world asset (RWA) value, including stablecoins.

Additionally, investor AllThingsEVM.eth argued that Ethereum is becoming less centralized each year, while Bitcoin is becoming more centralized. He cited the growing trend of nation-states and institutions stockpiling BTC.

“Tell me what happens when nation states are the largest holders of BTC while mining rewards get more and more sparse. Will the network be more decentralized when the US or China is running the majority of miners to ‘secure’ their stake? Or will BlackRock create its own hard fork when it feels its need to upgrade issuance?” he said.

Despite ongoing criticism, Ethereum keeps improving its performance and scalability. Recently, co-founder Vitalik Buterin proposed replacing the Ethereum Virtual Machine (EVM) with RISC-V. This upgrade aims to boost smart contract performance and scalability while maintaining backward compatibility with existing contracts.

The post PlanB Criticizes Ethereum as a Centralized Pre-Mined Coin appeared first on BeInCrypto.