Odds of 50bps Fed rate cut surge as Bitcoin remains stable at $58k

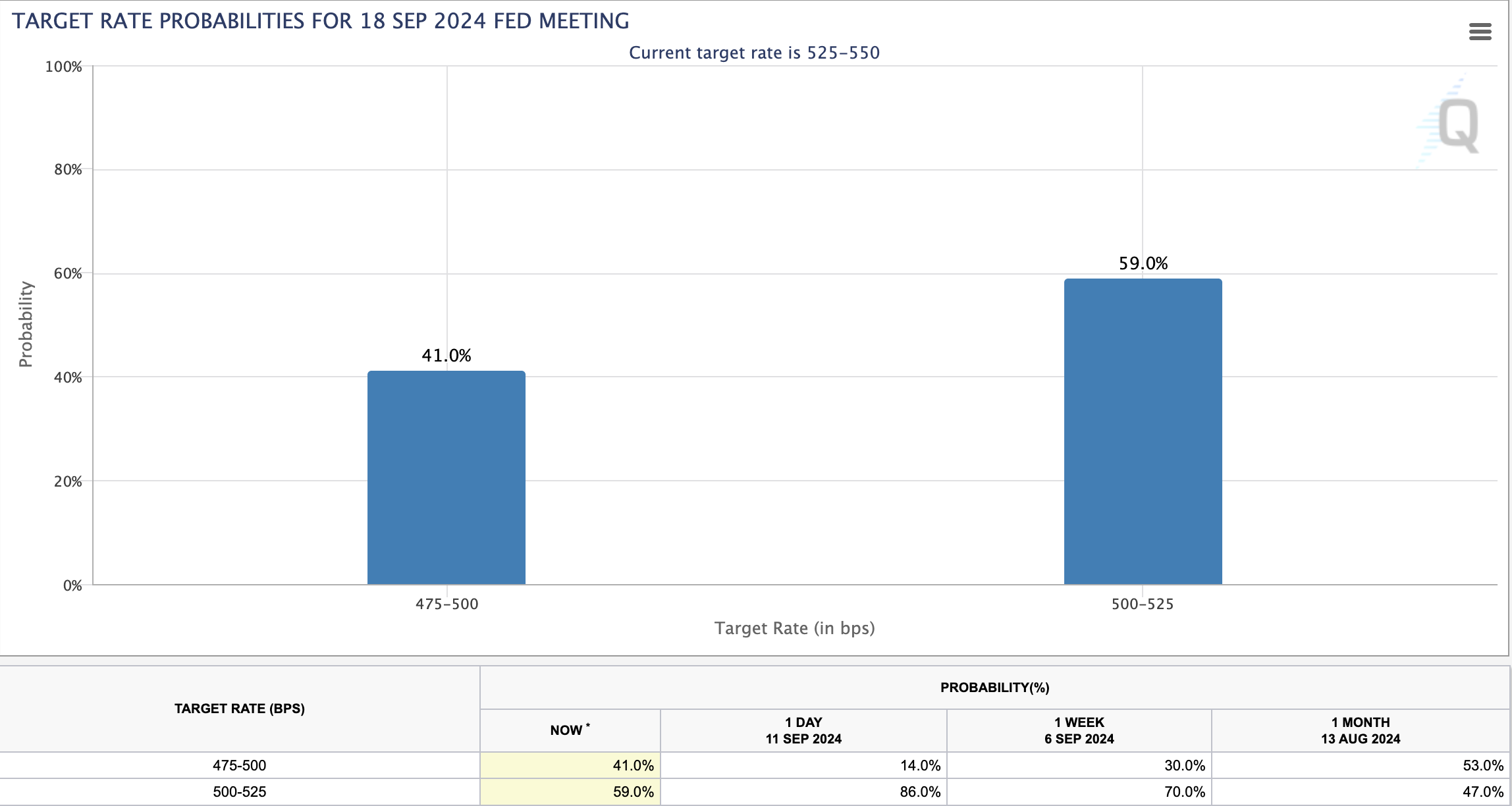

Odds of a 50 basis point rate cut at the Federal Reserve’s upcoming Sept. 18 meeting have surged from 14% to 41%, according to recent market data. This shift coincides with significant stock market gains over the past two days and steady futures markets overnight, suggesting a lack of stress signals from equities.

Odds of 50bps rate cut (FedWatch)

Odds of 50bps rate cut (FedWatch)

Analysts attribute the change in rate cut expectations to a recent Wall Street Journal article by Nick Timiraos, which some interpret as a signal from the Federal Reserve. Jim Bianco of Bianco Research noted the market’s reaction to the article, emphasizing that the increased odds of a larger rate cut occurred shortly after its publication.

Spencer Hakimian, Founder of Tolou Capital Management, observed that someone placed a significant after-hours bet on a 50 basis point cut, causing market-implied odds to jump from 15% to 36% almost instantly. This sudden change has raised questions among investors about the potential direction of Fed policy.

Gold prices have responded by rallying from $2,512 to $2,568, potentially indicating concerns about the appropriateness of a 50 basis point cut. Bitcoin also rallied earlier, rising from $55,700 to $58,000 before stabilizing, though its movement preceded these events by 24 hours.

Despite the increased odds of a more significant rate cut, stock markets do not appear to exhibit signs of stress. The lack of volatility seems to leave some analysts puzzled by the shift in expectations, as traditional indicators may not suggest an urgent need for aggressive monetary easing.

Hakimian responded to Bianco, saying,

“I am unsure myself. I was camp 25 due to the pricing. But now I am unsure.”

The post Odds of 50bps Fed rate cut surge as Bitcoin remains stable at $58k appeared first on CryptoSlate.