Large Crypto Traders Now Seeking Higher Returns Amid Signs of Capital Rotation to Altcoins, Says Santiment

Large Bitcoin (BTC) traders may be suddenly rotating capital into altcoins in pursuit of greater returns, according to analytics firm Santiment.

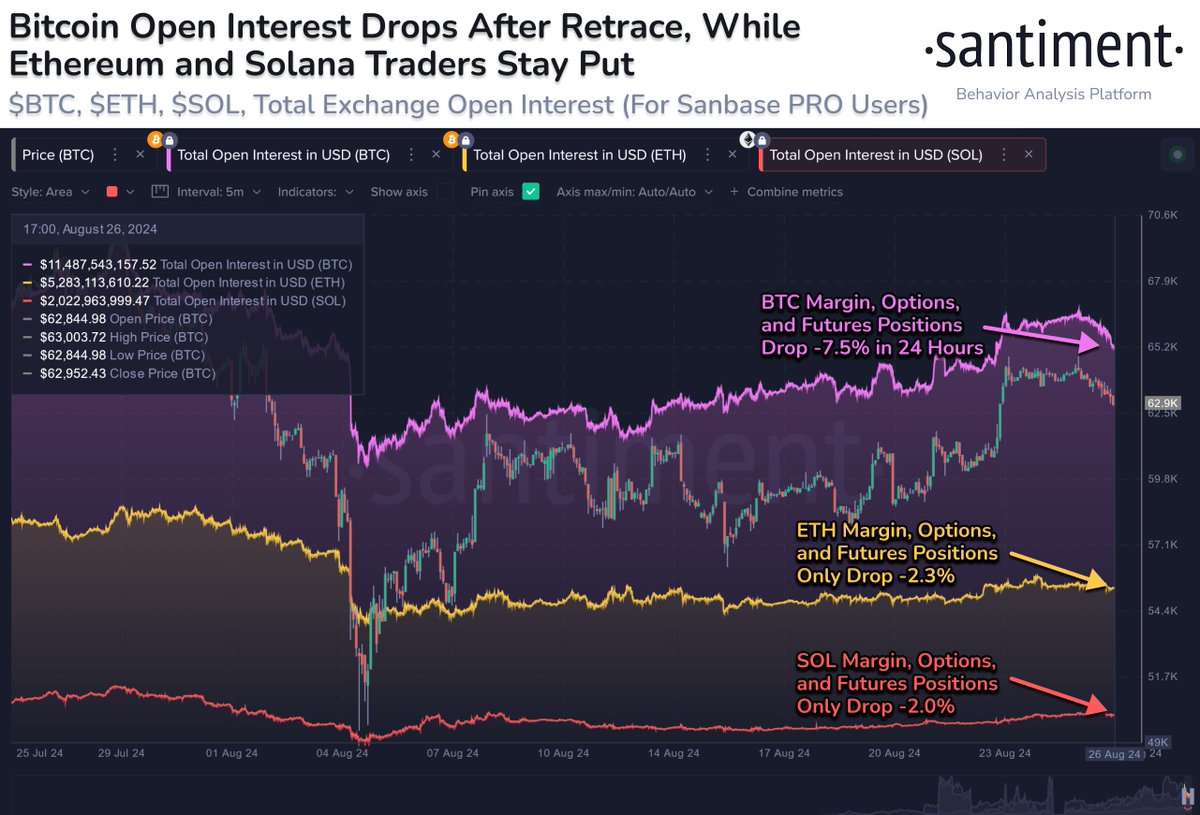

Santiment says on the social media platform X that Bitcoin is seeing a significant decline in open interest while top altcoins like Ethereum (ETH) and Solana (SOL) are not.

Open interest is the total number of outstanding derivatives contracts for a given asset.

“While Bitcoin has seen a mild -2.2% price drop in the past 24 hours [on August 26th], it was enough to cause a much larger -7.5% drop in total open interest on exchanges. For comparison, total open interest toward Ethereum and Solana have barely declined. A few takeaways:

- Shifting focus to altcoins: traders may be seeing increasing potential toward ETH, SOL, and other alts after recovering strongly since the August 5th crash.

- Bitcoin risk reduction: traders are possibly reducing exposure, possibly due to uncertainty. The lack of ETH and SOL open interest is more due to them simply having less sensitivity toward BTC’s price than usual this month.

- Capital rotation: this minor drop may be a signal that a rotation of capital from Bitcoin into altcoins is occurring from large traders, who are diversifying risk and seeking higher returns.”

Source: Santiment/X

Source: Santiment/X

Santiment also suggests the sharp decline in Bitcoin’s open interest may indicate holders are profit taking, believing the crypto king has hit its high price this month.

“Market sentiment: the larger drop in BTC open interest, compared to smaller assets, points to traders potentially seeing the August rebound coming to an end and trying to sell the top (as other Santiment data is also showing evidence of).”

Bitcoin is trading for $59,226 at time of writing, down 5.6% in the last 24 hours. Meanwhile, Ethereum is trading for $2,445 at time of writing, down 8.8% on the day and Solana is trading for $146 at time of writing, down 7.2% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Large Crypto Traders Now Seeking Higher Returns Amid Signs of Capital Rotation to Altcoins, Says Santiment appeared first on The Daily Hodl.