Institutions Bet Big on Crypto as 57% Plan to Increase Allocations, Sygnum Survey Finds

Institutional interest in cryptocurrency has reached new heights. A recent survey by Sygnum Bank revealed that 57% of institutional investors and finance professionals plan to increase their exposure to crypto assets.

This enthusiasm reflects a substantial shift in how major players view the long-term value of digital assets.

Shifting Sentiments and Increased Allocations, Sygnum’s FindingsThe survey represents insights from banks, hedge funds, multi-family offices, asset managers, and other investment-focused entities. It was conducted across 27 countries with over 400 respondents, with respondents averaging over a decade of experience.

Notably, about one-third (33.33%) of these participants are Sygnum clients. The findings highlight a rising appetite for high-risk investments in crypto and show growing confidence in the digital assets space.

Among the key takeaways is that nearly 65% of respondents maintain a bullish long-term view of crypto. Meanwhile, 63% plan to allocate more funds in the next three to six months. Additionally, 56% are expected to adopt a bullish stance within a year, potentially fueled by Bitcoin’s recent surge toward all-time highs (ATH).

More than half of the survey respondents already hold over 10% of their portfolios in crypto. Meanwhile, 46% plan to increase their allocations within six months, while 36% are waiting for optimal entry points. This commitment signals an enduring belief that digital assets can offer superior returns to traditional investments—a view shared by nearly 30% of survey respondents.

When it comes to investment strategy, single-token holdings are the most popular approach. Based on the research, 44% of participants opt to invest in individual tokens. Actively managed exposure, where portfolios are adjusted based on market performance, follows closely with a 40% preference.

This continued commitment to increasing crypto exposure, even amid market fluctuations, signals the growing perception of digital assets as a “megatrend” investment.

“This report tells the story of progress and calculated risk, the use of a diverse set of strategies to leverage opportunities, and most of all, the continued belief in the market’s long-term potential to reshape traditional financial markets,” said Lucas Schweiger, Sygnum’s Digital Asset Research Manager.

Strategic Approaches and Investment TrendsLayer-1(L1) blockchains, which serve as foundational platforms for building decentralized applications (dApps), rank as the top investment interest. Web3 infrastructure and decentralized finance (DeFi) ventures follow closely.

Interestingly, tokenized assets, including corporate bonds and mutual funds, have gained more traction than real estate investments, which led to 2023. This shift highlights how crypto adoption is influencing traditional sectors, offering new possibilities for asset tokenization.

Previously, regulatory uncertainty was seen as the biggest hurdle for institutional crypto investments. However, the survey highlights that 69% of respondents now see regulatory clarity improving, shifting concerns toward asset volatility and security. This indicates a maturing market where investors prioritize effective risk management over regulatory barriers.

The appetite for deeper insights into market-specific risks is evident. Up to 81% of participants stated that access to better information would encourage them to increase their allocations. This shift suggests that market intelligence, strategic planning, and technological research are critical factors for institutions venturing into the crypto playing field.

Institutional enthusiasm for crypto is part of a broader trend across the US. Digital assets are no longer just speculative plays for individual investors. As BeInCrypto reported, crypto is increasingly seen as a long-term investment opportunity rather than a gamble.

Furthermore, the introduction of Bitcoin ETFs (exchange-traded funds) has added credibility to crypto as an asset class. Political influences also play a significant role. President-elect Donald Trump’s recent win could bolster crypto’s status in the US, with some analysts believing that his pro-business stance may further enhance institutional involvement in the sector.

This could bring additional visibility to the industry and potentially lead to more favorable regulations that further incentivize long-term investments in digital assets. Nevertheless, some market observers are skeptical about the implication of the growing institutional adoption of crypto, with the likes of BlackRock and MicroStrategy progressively growing their Bitcoin portfolios.

“Does this not defeat the whole purpose of “decentralization”? BlackRock will be the biggest hodler, it doesn’t get much more centralized than that,” one X user noted.

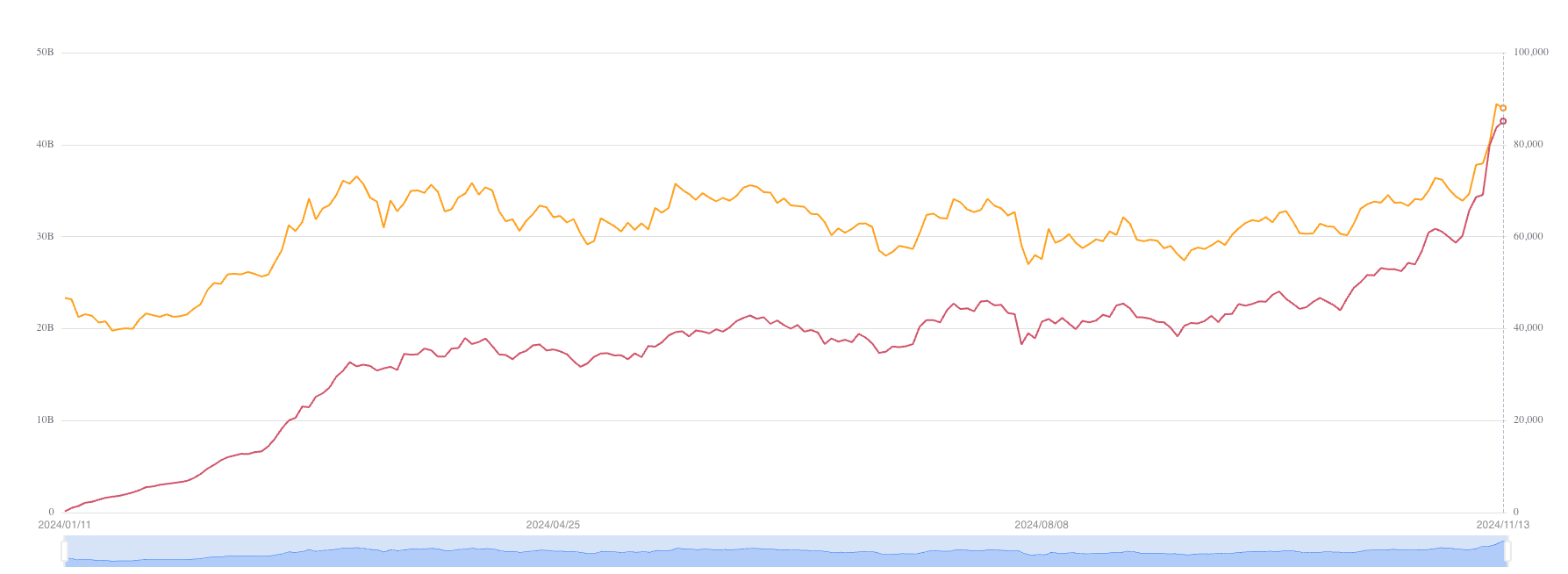

BlackRock iShares Bitcoin Trust (IBIT) Net Assets. Source: SoSoValue

BlackRock iShares Bitcoin Trust (IBIT) Net Assets. Source: SoSoValue

The Sygnum survey echoes recent findings, where BeInCrypto reported that over 80% of crypto investors are optimistic about the future. Many believe the current bull market is poised to continue.

The post Institutions Bet Big on Crypto as 57% Plan to Increase Allocations, Sygnum Survey Finds appeared first on BeInCrypto.