Institutional Investors Find Crypto Inevitable, OKX Research Says

Research commissioned by OKX exchange discovered institutional investors view entry into the digital asset space as inevitable. The report cites a “growing consensus” among institutional investors that digital assets like cryptocurrencies, NFTs, and tokenized private funds are critical to portfolio asset allocations.

Institutional interest in the crypto space continues to increase, partly inspired by the advent of Bitcoin ETFs (exchange-traded funds) in the US, which delivered BTC to Wall Street.

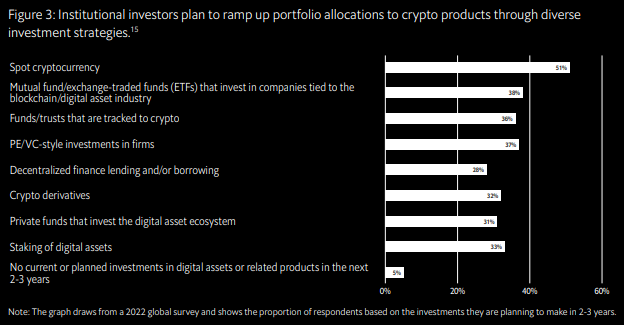

Institutional Investors Find Digital Assets InevitableOKX’s report cited responses from TradFi titans like Citi, Al Mal Capital, Skybridge Capital, and VanEck, among others. Based on the study, institutional investors intend to ramp up their allocations to crypto, leveraging a range of investment strategies.

The low correlation between digital assets and traditional assets fuels institutional interest, making them valuable for diversification. With the growing availability of investment vehicles such as ETFs and derivatives, institutions are increasingly optimistic about integrating digital assets into their portfolios.

“Approximately 51% of investors considering spot crypto allocations, 33% considering staking of digital assets, and 32% considering crypto derivatives. 69% of institutional investors anticipated increasing their allocations to digital assets and/or related products in the next two to three years,” read the report.

Institutional Investors Plan to Ramp Up Portfolio Allocations, Source: OKX Institutional

Institutional Investors Plan to Ramp Up Portfolio Allocations, Source: OKX Institutional

Institutions currently allocate an average of 1% to 5% of their portfolios to digital assets, depending on their risk tolerance. They anticipate increasing this allocation to 7.2% by 2027.

This growing interest is driven by the emergence of institutional-grade custodians and the availability of crypto ETFs. As the digital asset ecosystem matures, traditional investors are expected to work more closely with digital-native custodians.

“As the institutional digital asset custody market grows, such criteria security, regulatory compliance, and efficiency, as are expected to become more refined, further facilitating institutional adoption of digital assets. According to our research brief, the institutional digital asset custody market is projected to experience a compound annual growth rate of over 23% through 2028, and 80% of traditional and crypto hedge funds that invest in digital assets use a third-party digital asset custodian,” OKX Chief Commercial Officer Lennix Lai told BeInCrypto.

Read more: 12 Best Altcoin Exchanges for Crypto Trading in August 2024

Institutional investors are also focusing on understanding and adapting to changing regulations to align with best practices. They are staying updated on changes in key financial centers to ensure a more secure market. The alignment of local and regional regulations, like the MiCA framework in Europe, is helping to make global adoption of digital assets more achievable.

Crypto Narratives Drawing Institutional InterestIndeed, institutional interest in crypto markets continues to grow, driven by developments such as crypto ETFs, Decentralized Physical Infrastructure Networks (DePIN), and Real-World Assets (RWAs). The market capitalization of DePIN is approaching $19 billion, with key projects like Render and Bittensor leading the sector.

Experts believe that DePIN and RWA trends will fuel the next wave of crypto adoption. Institutional investors, including Andreessen Horowitz, are also making notable moves in this space.

“We’re seeing a promising trajectory towards the tokenization of assets like stocks, bonds and even real estate. This emerging trend has the potential to dramatically increase the liquidity and accessibility of these asset classes. Imagine being able to trade a fraction of a commercial building as easily as you buy shares of a public company today — that’s the kind of democratization of finance we’re looking at,” Lennix Lai shared with BeInCrypto.

Read More: How To Fund Innovation: A Guide to Web3 Grants

Tokenized RWAs have become one of the most prominent trends in 2024, bridging the gap between traditional and decentralized finance. The tokenized RWA market, valued at over $10 billion, caters to institutional clients looking for secure banking partners and custody solutions for their crypto assets.

Blockchain technology, through asset tokenization, offers a safer alternative to less secure exchanges or wallet providers. This process also streamlines operations and creates new opportunities for the financial sector.

“While it’s too early to say if tokenized assets will become as liquid and accessible as traditional equities and bonds in the near term, the long-term potential is immense. As blockchain technology continues to mature, regulatory frameworks evolve and digital security practices improve, we expect to see institutional investors becoming increasingly comfortable with integrating tokenized assets into their portfolios,” Lai added.

The post Institutional Investors Find Crypto Inevitable, OKX Research Says appeared first on BeInCrypto.