How to Create Arithmetic Operations Smart Contract in Blockchain Using Solidity

By Hedy Bi, OKG Research

Recently, Harvest International became the first organisation to submit an application for a Bitcoin spot ETF to the Hong Kong Securities and Futures Commission (SFC), marking the official kick-off of the development of Bitcoin spot ETFs in Hong Kong. As early as December 22nd last year, the SFC issued “Circular on SFC-authorised funds with exposure to virtual assets”, stating that it was prepared to accept applications for the authorization of virtual asset spot ETFs. The launch of a Bitcoin spot ETF, whether in Hong Kong or the United States, signifies an important step towards the standardization of virtual assets as financial products.

The introduction of a Bitcoin spot ETF is similar to packaging real estate into Real Estate Investment Trusts (REITs) or launching physically-backed gold ETFs. It aims to address market limitations caused by the unique characteristics of the underlying assets through the standardization of these financial products. For example, when investors choose to invest in real estate, the large investment amount required for real estate as a single asset may be a barrier. Investing in real estate through REITs provides a more convenient and smaller investment option for investors. Similarly, the storage issue of physical gold can be addressed through the introduction of gold ETFs. As a virtual asset, Bitcoin presents certain barriers to investors due to its technical uniqueness and the inconsistency of global regulatory processes. By standardizing Bitcoin into a Bitcoin spot ETF, the aim is to better meet investors’ needs and allow institutional investors to participate.

Standardization allows for the transfer of risk to more specialized risk managersFrom a risk management perspective, the introduction of standardized financial products can reduce the direct risks faced by investors. However, standardization does not mean the elimination of risk; rather, it shifts the risk to fund managers and custodians with more professional experience.

The virtual asset market is still in its early stages, with relatively low levels of popularity and market size, making it vulnerable to abuse by malicious actors. However, if virtual assets like Bitcoin can establish standardized channels, investors will be able to access accurate information quickly and choose investment channels they trust and are familiar with, without facing an environment of information asymmetry and mistrust. This reduces the risk of falling victim to financial fraud. It provides investors with more protection and security, enabling them to make investment decisions with greater confidence.

Additionally, according to the latest data from OKLink in January, 37.2% of security incidents were attributed to phishing attacks. If individual investors are not familiar with virtual assets, they can reduce the risk of being exploited by malicious actors and falling victim to phishing attacks by investing through the familiar form of an ETF via standardized operations for spot ETFs.

For fund managers, a Bitcoin spot ETF is no longer just about tracking an index and managing cash. It also involves the custody of Bitcoin. Therefore, fund management companies and custodians need to develop corresponding risk management strategies to ensure the sound operation of the fund and the interests of investors.

Figure: Risk Management Transfer and the Need for Onchain RegTech for Virtual Assets (VA), Note: Model based on Promitheas Peridis (2023), “Securitisation in the era of Blockchain: Credit funds, CLOs, Tokenisation, and the question of investor protection and financial stability, EBI (European Banking Institute) Working Paper Series.”

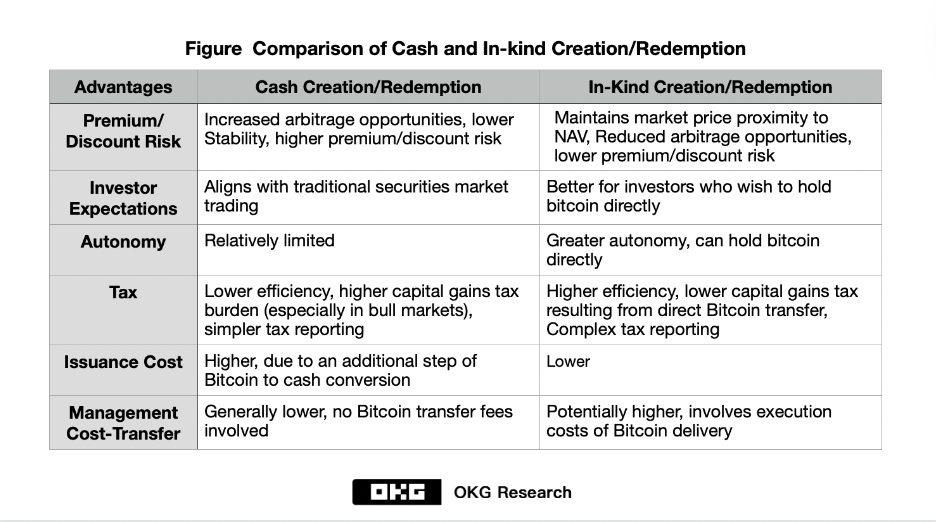

Figure: Risk Management Transfer and the Need for Onchain RegTech for Virtual Assets (VA), Note: Model based on Promitheas Peridis (2023), “Securitisation in the era of Blockchain: Credit funds, CLOs, Tokenisation, and the question of investor protection and financial stability, EBI (European Banking Institute) Working Paper Series.”According to the latest disclosure by the SFC in Hong Kong, there is an advantage of Bitcoin spot ETFs in Hong Kong compared to the United States. In Hong Kong, investors is allowed to do both cash and in-kind creation/redemption in Bitcoin spot ETFs, while in the United States, only cash creation/redemption is allowed. This will become a major advantage for the Bitcoin spot ETF market in Hong Kong. Consequently, operations such as the exchange, custody, and regulation of onchain assets will pose new challenges for fund management firms and regulatory bodies.

Onchain Risks Managed by Onchain Technology

Onchain Risks Managed by Onchain TechnologyIn order to upgrade risk management for new assets like Bitcoin, financial institutions and regulatory bodies should prioritize onchain compliance and risk prevention. Based on the general process of ETFs and the involvement of “spot ETFs” and the “In-Kind Creation/Redemption”, all institutions involved should utilize onchain RegTech tools for compliance and risk management. These tools are primarily used to confirm the asset risks associated with onchain addresses and continuously monitor asset flows for suspicious transactions.

When selecting onchain analysis tools, financial institutions and regulatory bodies should consider two key points based on the field research conducted by the OKG Research on local institutions in Hong Kong. Firstly, the tools need to have a comprehensive and extensive address label database to identify and manage onchain addresses of financial institution clients. Secondly, in continuous risk monitoring, the response speed of onchaintechnology tools is crucial.

Due to the unique nature of blockchain technology, although transactions on onchain addresses are immutable, transparent, and publicly accessible, the anonymity it provides poses challenges for institutions in compliance and risk management. To address this anonymity challenge, a viable solution is to compare addresses with those already marked as high-risk, such as sanctions, money laundering, and phishing, to determine if the onchain addresses have been involved in high-risk transactional activities. In terms of response speed, if the screening process is too slow, it will hinder the competitiveness of virtual asset transactions. The specific process is that once RegTech tools identify suspicious transactions, such as OKLink, risk monitoring can be conducted within milliseconds, allowing for swift actions such as determining risk levels and implementing risk control measures like account freezing or transaction refusal.

Figure OKLink Onchain AML Supporting Compliance for Bitcoin Spot ETF from Issuance to Trading, Note: This is a rough process diagram. It is a more rigorous practice for all intermediaries to be supported by RegTech in terms of RegTech requirements.

Figure OKLink Onchain AML Supporting Compliance for Bitcoin Spot ETF from Issuance to Trading, Note: This is a rough process diagram. It is a more rigorous practice for all intermediaries to be supported by RegTech in terms of RegTech requirements.Not only should onchain risks and compliance be managed by onchain technology, but in terms of institutional responsibilities, the SFC of Hong Kong has also provided clear guidelines in the “Circular on the Offering of Virtual Asset Funds by SFC-authorized Funds.” It states that the trustee/custodian of SFC-authorized virtual asset funds can only delegate the custody function of virtual assets to a virtual asset trading platform (VATP) holding an SFC license or a financial institution or local subsidiary that complies with the virtual asset custody standards published by the Hong Kong Monetary Authority (HKMA).

Figure: Excerpt from the “Circular on SFC-authorised funds with exposure to virtual assets”

Figure: Excerpt from the “Circular on SFC-authorised funds with exposure to virtual assets”Based on the current development of financial institutions and Virtual Asset Service Providers (VASPs) in Hong Kong, financial institutions and licensed VATPs will be responsible for custodial services of fiat currency and virtual assets, respectively. The cooperation between the two will be crucial for the success of the Bitcoin Spot ETF.

The launch of the Bitcoin Spot ETF signifies an important step towards standardizing virtual assets as financial products. By standardizing virtual assets like Bitcoin into an ETF, investors can conveniently participate in the market using familiar means and transfer risks to professional fund managers and custodians. Unlike ETFs based on other underlying assets, Bitcoin Spot ETFs emphasize compliance and security. In the risk management process, the institution that demonstrates more professional capabilities and provides a more secure investment environment for virtual asset investors will be more competitive. This also means that choosing professional onchain RegTech tools will be the key to success for financial institutions.

OKG Research aims at outputing in-depth analysis and professional content which covers topics such as technology application and innovation, technology and social evolution, and financial technology challenges. It is committed to promoting the application and sustainable development of digital technologies such as blockchain, cybersecurity, RegTech etc.

Twitter: OKG Research

Analyzing Onchain Compliance in the Standardization Journey of Crypto Financial Products: A Case… was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.