How Can You Build an Aviator Prediction Bot for Accurate Forecasting?

As the world embraces digital innovation, Real-World Asset (RWA) tokenization has emerged as a groundbreaking trend, enabling the seamless transformation of physical assets into blockchain-based tokens. This shift is revolutionizing industries by increasing liquidity, accessibility, and transparency. With the tokenization of real estate, commodities, art, and more, investors now have the opportunity to diversify their portfolios and gain exposure to assets once considered illiquid or difficult to access.

In 2025, several companies are leading the charge in RWA tokenization, offering cutting-edge solutions that bridge the gap between traditional assets and the decentralized financial ecosystem. These top 10 companies are at the forefront of this transformation, combining blockchain technology with real-world asset expertise to create innovative platforms for secure and efficient investments. Whether you’re a seasoned investor or just starting to explore RWA tokenization, this list provides a valuable insight into the top players shaping the future of asset ownership and investment opportunities in the digital age.

Table of ContentWhat is RWA Tokenization?Why Invest in RWA Tokenization Companies?

Top 10 RWA Tokenization Companies To Invest In 2025

· 1. Blockchain App Factory

· 2. Inoru

· 3. Propy

· 4. Red Swan

· 5. Token Capital

· 6. tZERO

· 7. Polymath

· 8. Antier Solutions

· 9. Tokeny Solutions

· 10. Kryptobees

Strategies Used To Check Top Tokenization Of Real-world asset Companies

The Future of RWA Tokenization in 2025 and Beyond

ConclusionWhat is RWA Tokenization?

RWA tokenization refers to the process of converting real-world assets, such as real estate, art, commodities, and even financial instruments, into digital tokens on a blockchain. This innovative approach allows traditional, physical assets to be represented digitally, enabling fractional ownership, greater liquidity, and easier transferability. Through blockchain technology, tokenized assets are secured, transparent, and immutable, ensuring that ownership records are accurate and tamper-proof.

By breaking down these assets into smaller, tradable units, RWA tokenization makes it possible for a broader range of investors to access high-value markets that were previously difficult to enter due to high capital requirements or lack of liquidity. Additionally, tokenization streamlines the process of asset transfer, reducing costs and complexities associated with traditional asset transactions.

This revolutionizes how we think about ownership and investment, opening up new avenues for individuals and institutions alike. As more industries adopt tokenization, it is expected to play a crucial role in the future of finance, providing greater efficiency, accessibility, and opportunities for global investment.

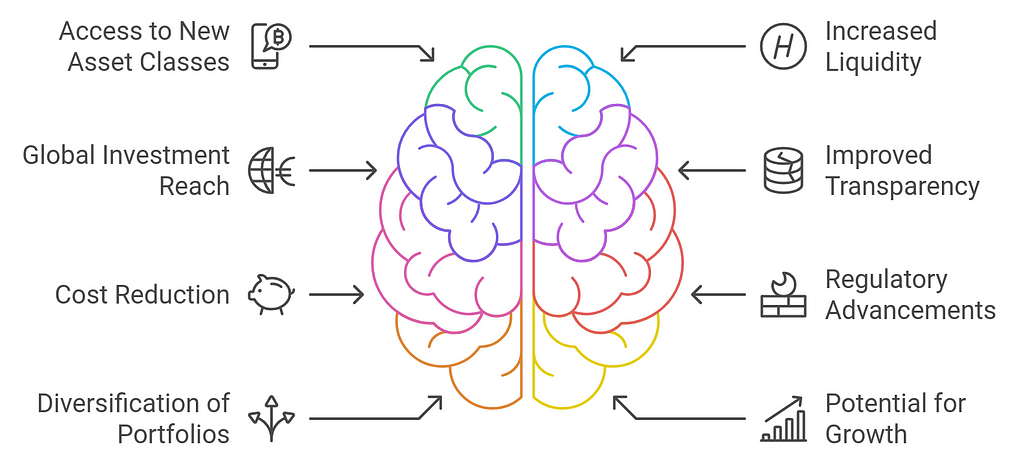

Why Invest in RWA Tokenization Companies?Investing in Real-World Asset (RWA) tokenization companies presents a unique opportunity in the evolving intersection of blockchain technology and traditional finance. RWA tokenization refers to the process of converting physical or real-world assets, such as real estate, commodities, or even fine art, into digital tokens on a blockchain. This trend is gaining traction due to the potential to unlock liquidity, increase transparency, and streamline operations within various asset classes. Here’s why investing in RWA tokenization companies could be a smart choice:

1. Access to New, High-Value Asset Classes

1. Access to New, High-Value Asset Classes- Unlocking Liquidity in Illiquid Markets: Many traditional assets, such as real estate, private equity, and luxury goods, have historically been illiquid, meaning they are difficult to trade or exchange. Tokenization allows these assets to be divided into smaller, tradable units, increasing market access and liquidity. Investors can now participate in markets previously restricted to large institutions or high-net-worth individuals.

- Fractional Ownership: Tokenization enables fractional ownership of high-value assets, allowing retail investors to participate in investment opportunities that were previously out of reach. This democratization of asset ownership can lead to a broader and more diverse investor base.

- 24/7 Market Access: Traditional markets typically operate within specific hours, but tokenized assets can be traded 24/7 on blockchain-based platforms, providing greater flexibility for investors. This always-on market model enhances liquidity and makes it easier to buy and sell assets at any time, improving price discovery.

- Faster Transactions: Tokenized assets benefit from faster settlement times compared to traditional markets, which can take days to settle transactions. Blockchain transactions can be executed in real-time, leading to greater operational efficiency and reduced costs for buyers and sellers.

- Cross-Border Investment: Tokenization allows investors from different countries to participate in asset classes and markets that were once difficult to access due to geographical and regulatory barriers. For example, an investor in Asia could easily buy fractional shares of a real estate asset in the U.S. or Europe through a tokenized platform.

- Instant and Low-Cost Transfers: Blockchain’s decentralized nature means that token transfers can happen without intermediaries, such as banks or brokers. This reduces transaction costs, enabling smaller investors to access previously costly markets and global investments.

- Immutable Record-Keeping: Blockchain technology ensures that the ownership and transaction history of tokenized assets are recorded in an immutable ledger. This creates an unprecedented level of transparency, allowing investors to trace the history of an asset, verify ownership, and review transaction records without relying on a centralized party.

- Enhanced Security: Tokenized assets benefit from blockchain’s strong security features, including encryption and decentralized verification. The risk of fraud or unauthorized access is minimized, and investors can be confident in the authenticity and security of their holdings.

- Reduced Intermediary Costs: Traditional asset transactions often involve multiple intermediaries, such as brokers, custodians, and lawyers, all of which add to the cost and complexity of transactions. By digitizing assets and utilizing smart contracts, tokenization eliminates many of these intermediaries, reducing the overall cost of transactions.

- Smart Contracts for Automation: Tokenization platforms often employ smart contracts to automate various processes, such as dividend distributions, ownership transfers, and asset management. This reduces administrative overhead, minimizes human error, and streamlines operations, leading to long-term cost savings for both companies and investors.

- Regulatory Clarity: Governments and financial regulators are increasingly recognizing the potential of tokenization and are developing frameworks to govern the space. This regulatory clarity is helping to legitimize tokenized assets and protect investors, making them more attractive to institutional investors who require a higher degree of legal certainty.

- Automated Compliance: With the integration of compliance protocols into smart contracts, tokenization platforms can ensure that all transactions are compliant with local laws, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. This not only enhances trust but also ensures that investors can participate without worrying about regulatory issues.

- Exposure to Traditional Assets with Blockchain Benefits: Tokenization offers a bridge between the traditional financial world and the innovative blockchain space, allowing investors to gain exposure to real-world assets while enjoying the benefits of blockchain technology, such as transparency, security, and automation.

- Access to Emerging Asset Classes: Tokenization enables the creation of new types of digital assets, such as tokenized carbon credits, intellectual property, or even patents. These new asset classes can further diversify an investment portfolio, offering more opportunities for growth and risk mitigation.

- Early Stage Investment Opportunity: As the RWA tokenization space is still emerging, early investors in tokenization companies have the potential to benefit from substantial capital appreciation as the market matures. With more industries, asset types, and countries adopting tokenization, the demand for tokenization platforms and services is likely to increase.

- Innovation in Financial Products: Tokenization is opening the door for new financial products that leverage blockchain’s capabilities. Startups in this space are developing customized, innovative financial products such as tokenized real estate investment funds, tokenized commodities, and even tokenized collectibles or NFTs backed by real-world assets.

- Sustainable Investment: As tokenization becomes more prevalent, there’s an increasing focus on green tokenization, where companies tokenize assets related to environmental sustainability, such as renewable energy projects, carbon credits, or eco-friendly real estate. Investors looking to align their portfolios with sustainability goals can tap into these emerging markets.

- Integration with DeFi: Tokenized RWAs can be integrated with decentralized finance (DeFi) platforms, enabling the creation of innovative financial products, such as tokenized loans, staking, or liquidity pools, which offer enhanced yields and liquidity to investors.

- Smart Asset Management: The evolution of AI and machine learning models integrated into tokenized platforms will allow for more intelligent asset management, providing investors with automated portfolio adjustments, risk management, and personalized strategies.

Investing in RWA tokenization companies represents a significant opportunity in a market that is poised for massive growth. The combination of increased liquidity, global access, cost reduction, and regulatory advancements creates a compelling investment thesis. Tokenization has the potential to disrupt traditional asset classes, democratize access to investment opportunities, and enhance transparency and security in financial markets. As the technology matures and adoption grows, RWA tokenization companies are well-positioned to capitalize on this shift, making them a valuable investment for those seeking to diversify their portfolios and be part of the future of finance.

Top 10 RWA Tokenization Companies To Invest In 2025Discover the top 10 RWA tokenization companies to invest in for 2025. These innovative firms leverage blockchain technology to transform real-world assets like real estate, commodities, and equities into tokenized investments. Explore their key features, growth potential, and how they are paving the way for greater liquidity, transparency, and fractional ownership in the asset market.

1. Blockchain App FactoryBlockchain App Factory is a leading technology company specializing in the development of blockchain-based solutions, with a particular focus on RWA tokenization. The company provides end-to-end tokenization services that enable the conversion of real-world assets like real estate, commodities, and more into digital tokens. Their blockchain platform ensures secure, transparent, and efficient transactions while enhancing liquidity and accessibility for investors worldwide. Blockchain App Factory has developed sophisticated solutions for tokenizing both tangible and intangible assets, making it a key player in the growing RWA tokenization market. As the demand for fractional ownership increases, Blockchain App Factory’s offerings position it as a highly attractive option for investors looking to participate in the future of asset tokenization.

With a team of experienced blockchain developers and financial experts, Blockchain App Factory integrates cutting-edge blockchain protocols to ensure maximum security and scalability. Their commitment to innovation and enhancing market liquidity makes them one of the top contenders in the RWA tokenization space for 2025.

Key Features:- End-to-End Tokenization: Blockchain App Factory offers a comprehensive tokenization solution, including smart contract development, compliance management, and asset digitization.

- Security & Transparency: Built on blockchain technology, their solutions provide secure and transparent transaction records.

- Fractional Ownership: Enables fractional ownership of high-value assets, increasing accessibility for smaller investors.

- Global Reach: Their platform supports cross-border token transactions, allowing global investor participation.

- Compliance-Focused: The company ensures that all tokenized assets comply with local and international regulations, fostering trust and reducing legal risks.

- High Growth in Tokenization: The increasing demand for RWA tokenization presents significant growth potential.

- Scalability: Blockchain App Factory’s scalable solutions can accommodate a wide range of industries, increasing its market reach.

- Early Market Entry: As an early adopter of RWA tokenization, Blockchain App Factory is well-positioned to benefit from market maturity.

- Strategic Partnerships: Its collaborations with real estate and financial institutions enhance credibility and future growth.

- Innovative Solutions: The company’s continuous investment in R&D ensures they stay ahead of industry trends, ensuring long-term success.

Inoru is a cutting-edge technology company that specializes in blockchain solutions, with a strong emphasis on RWA tokenization. The company helps businesses tokenize their physical assets like real estate, precious metals, and artwork, offering a seamless transition to digital ownership. Inoru’s platform leverages blockchain technology to create tokenized versions of real-world assets, improving liquidity and enabling fractional ownership. With a team of experienced blockchain developers and financial experts, Inoru has become a key player in the growing market of asset tokenization. Their customizable solutions provide clients with the ability to tokenize various types of assets, enabling broader investor participation and increasing asset accessibility.

Inoru’s focus on RWA tokenization is part of a broader strategy to disrupt traditional financial markets and create more inclusive investment opportunities. By simplifying asset transactions, Inoru aims to provide a secure, transparent, and cost-efficient way for individuals and institutions to invest in tokenized assets. The company’s user-friendly interface, coupled with high-level security measures, makes it an ideal choice for investors looking to enter the world of tokenized real estate, art, and other physical assets.

Key Features:- Asset Tokenization: Inoru offers comprehensive tokenization services for a variety of asset classes including real estate, art, and commodities.

- Smart Contract Development: Their platform utilizes smart contracts for seamless and automated asset transactions.

- Fractional Ownership: Investors can own fractions of tokenized assets, reducing barriers to entry.

- Blockchain Security: Ensures secure transactions with blockchain encryption, making asset ownership transparent and tamper-proof.

- Custom Solutions: Tailored services to meet the unique needs of different asset classes and industries.

- Explosive Market Growth: The rising demand for digital ownership and fractional investing presents substantial growth prospects for Inoru.

- Flexible Asset Tokenization: Its ability to tokenize various assets gives Inoru an edge in capturing diverse market segments.

- Blockchain Expertise: Inoru’s experience in blockchain technology positions it as a reliable and forward-thinking company in this space.

- Strategic Collaborations: Partnerships with key industries like real estate and art increase Inoru’s visibility and growth potential.

- Regulatory Compliance: Inoru’s commitment to regulatory standards makes it a safe and trustworthy platform for global investors.

Propy is a pioneer in the blockchain-powered real estate market, offering a cutting-edge platform for tokenizing real-world assets. With its primary focus on the real estate sector, Propy enables the tokenization of residential and commercial properties, allowing investors to buy, sell, and trade fractional ownership stakes securely on the blockchain. Their platform leverages advanced blockchain technologies to provide transparency, reduce transaction costs, and streamline the buying and selling process for tokenized real estate. Propy’s vision is to democratize real estate investments by making them accessible to a global audience, particularly smaller investors who previously had limited access to high-value properties.

Propy’s approach to RWA tokenization represents the future of real estate investing, with its platform offering fractional ownership, liquidity, and faster transactions. The company also ensures that each tokenized asset complies with local regulations, adding an extra layer of trust for investors. As real estate becomes increasingly tokenized, Propy’s comprehensive solutions are positioned to become a top choice for investors looking to participate in this booming market.

Key Features:- Real Estate Tokenization: Propy specializes in tokenizing real estate assets, including both residential and commercial properties.

- Fractional Ownership: Allows for fractional investment in properties, making it easier for small investors to participate in real estate.

- Blockchain Integration: All transactions are executed securely and transparently via blockchain technology.

- Global Reach: Propy’s platform facilitates cross-border real estate transactions, opening up global investment opportunities.

- Regulatory Compliance: The platform adheres to local and international regulations, ensuring legal security for investors.

- Explosive Growth in Tokenized Real Estate: Propy’s focus on real estate tokenization positions it in a rapidly growing market.

- Global Market Access: The ability to facilitate international transactions opens up vast investment opportunities.

- Liquidity Enhancement: By tokenizing real estate, Propy increases liquidity in an asset class traditionally considered illiquid.

- Early Market Leadership: As a leader in the tokenization of real estate, Propy is well-positioned to benefit from the market’s maturation.

- Scalability: Propy’s platform is scalable, allowing it to handle the increasing demand for tokenized real estate investments across the globe.

Red Swan is a trailblazer in the tokenization of real estate assets, providing innovative blockchain-based solutions for fractional ownership and investment. The company specializes in tokenizing commercial real estate properties, allowing investors to access high-value assets that were previously difficult to reach due to large capital requirements. Red Swan’s platform leverages blockchain technology to provide transparency, liquidity, and security to the real estate investment process. By issuing tokens representing ownership in a specific property, the company enables fractional ownership, allowing investors to own a portion of high-value commercial real estate without the need to purchase the entire asset. This opens up new opportunities for both institutional and retail investors.

Red Swan is committed to making real estate more accessible by using blockchain to simplify transactions, reduce fees, and streamline the investment process. Its innovative approach to RWA tokenization aims to democratize the real estate market, offering easier entry points for smaller investors while maintaining the high level of security and compliance required in real estate transactions. As the demand for tokenized real estate continues to grow, Red Swan is well-positioned to be a significant player in the space.

Key Features:- Commercial Real Estate Focus: Specializes in tokenizing high-value commercial real estate properties.

- Fractional Ownership: Provides opportunities for fractional ownership, lowering entry barriers for investors.

- Blockchain Transparency: Uses blockchain technology to ensure transparent, secure, and immutable transactions.

- Global Investment Access: Offers access to a global pool of investors, expanding the market for tokenized real estate.

- Compliance and Regulation: Adheres to local and international real estate regulations, ensuring legal security for investors.

- Growing Real Estate Tokenization Market: As real estate tokenization becomes more mainstream, Red Swan stands to benefit from increased demand.

- Diversified Asset Offering: With a focus on commercial properties, Red Swan appeals to institutional investors looking for high-quality assets.

- Global Reach: The platform’s ability to facilitate international investment broadens its market potential.

- Liquidity Enhancement: By enabling fractional ownership, Red Swan enhances liquidity in the traditionally illiquid real estate market.

- First-Mover Advantage: As one of the pioneers in commercial real estate tokenization, Red Swan is positioned to lead in this rapidly evolving market.

Token Capital is a leading player in the tokenization of real-world assets, focusing on providing businesses with the tools needed to tokenize their physical assets for greater liquidity and access. The company’s platform is designed to tokenize a wide range of asset classes, including real estate, art, and commodities, using blockchain technology to ensure transparency, security, and efficient transactions. Token Capital’s mission is to revolutionize asset ownership and trading by creating a more inclusive, global market where both institutional and retail investors can easily invest in tokenized assets.

The platform’s ability to tokenize assets across multiple industries makes it a versatile and highly attractive option for investors looking to diversify their portfolios. Token Capital provides a secure and compliant environment for businesses to digitize their assets, enabling fractional ownership and making previously illiquid assets more accessible. With the increasing demand for tokenization solutions, Token Capital is poised to play a significant role in the future of RWA tokenization, offering innovative solutions that bridge the gap between traditional asset classes and the decentralized finance (DeFi) ecosystem.

Key Features:- Multi-Asset Tokenization: Token Capital offers tokenization for a variety of assets, including real estate, art, and commodities.

- Fractional Ownership: Enables fractional ownership of tokenized assets, making it easier for small investors to access high-value markets.

- Blockchain Transparency: Utilizes blockchain technology to provide a transparent and secure record of ownership.

- Global Investment Access: Facilitates international investment, expanding the pool of potential investors for tokenized assets.

- Regulatory Compliance: Token Capital ensures that tokenized assets meet all legal and regulatory requirements, fostering trust with investors.

- Diverse Market Applications: The company’s focus on tokenizing multiple asset classes increases its market appeal and growth potential.

- Global Reach: Token Capital’s platform supports cross-border investments, attracting a global investor base.

- Rising Demand for Tokenized Assets: As the tokenization market grows, Token Capital stands to benefit from the expanding demand for asset digitization solutions.

- Liquidity Enhancement: Token Capital’s solutions increase the liquidity of traditionally illiquid assets, providing investors with greater flexibility.

- Strong Industry Partnerships: Its partnerships with various industries, including real estate and art, position Token Capital to capitalize on diverse market trends.

tZERO is a leading blockchain-based platform designed to tokenize real-world assets, offering innovative solutions for the creation, issuance, and trading of digital securities. The company focuses on bringing liquidity to traditionally illiquid markets, such as real estate, private equity, and commodities, by enabling the fractional ownership and trading of these assets through tokenization. tZERO’s platform leverages blockchain technology to ensure secure, transparent, and efficient transactions, allowing investors to trade tokenized securities in real-time. By digitizing ownership stakes in assets, tZERO is transforming the way investors access high-value markets and enhancing liquidity in previously hard-to-trade sectors.

With its robust and scalable infrastructure, tZERO aims to become the go-to platform for tokenized asset trading, offering both institutional and retail investors a secure and compliant marketplace. The platform’s seamless integration with the broader decentralized finance ecosystem also enables investors to easily access liquidity and engage in trading without traditional intermediaries. As tokenization becomes more mainstream, tZERO is well-positioned to lead in the space, with its cutting-edge technology and commitment to providing transparency and regulatory compliance.

Key Features:- Tokenized Securities Platform: tZERO enables the creation and trading of tokenized securities, including real estate, private equity, and commodities.

- Real-Time Trading: Provides a marketplace for the real-time trading of tokenized assets, enhancing liquidity.

- Blockchain Security: Ensures that all transactions are secure, transparent, and immutable using blockchain technology.

- Fractional Ownership: Allows for fractional ownership of high-value assets, making them accessible to a wider range of investors.

- Regulatory Compliance: tZERO is committed to adhering to strict regulatory standards, ensuring that its platform meets all legal requirements.

- Massive Market Growth: With the increasing demand for tokenized securities, tZERO is positioned to capitalize on a rapidly expanding market.

- Liquidity in Illiquid Markets: By enabling the trading of traditionally illiquid assets, tZERO offers investors greater liquidity and flexibility.

- Scalable Platform: The company’s scalable infrastructure allows it to handle a wide range of tokenized assets, enhancing its growth prospects.

- Strategic Partnerships: tZERO’s partnerships with major financial institutions and blockchain projects enhance its credibility and investment potential.

- First-Mover Advantage: As an early player in the tokenized securities space, tZERO has established a strong foothold in the market, giving it a competitive edge in the future.

Polymath is a leading platform that focuses on simplifying the process of creating and managing security tokens. As one of the pioneers in the tokenization space, Polymath provides a robust and secure environment for businesses to tokenize real-world assets (RWAs), including real estate, equities, and commodities. The company utilizes blockchain technology to ensure that tokenized assets are fully compliant with existing regulatory frameworks, providing peace of mind to investors and issuers alike. Polymath’s approach to security token offerings (STOs) has made it a go-to platform for businesses looking to digitalize their assets in a regulated manner.

By offering a comprehensive suite of services including token creation, compliance management, and secondary market integration Polymath empowers companies to tokenize their assets with ease. The platform has gained considerable traction across multiple industries, including real estate, financial services, and art. As tokenization continues to evolve, Polymath is positioned to be a leading player in RWA tokenization, providing businesses and investors with the tools needed to navigate the new digital landscape.

Key Features:- Security Token Creation: Polymath provides an easy-to-use platform for creating and issuing security tokens for a wide variety of assets.

- Compliance-Driven Solutions: Ensures that tokenized assets adhere to regulatory frameworks, promoting security and transparency.

- Fractional Ownership: Facilitates fractional ownership of tokenized assets, making high-value assets more accessible.

- Blockchain Integration: Leverages blockchain technology to streamline transactions and ensure transparency.

- Industry Expertise: Polymath’s deep knowledge of both blockchain and financial markets positions it as a trusted player in tokenization.

- Strong Industry Reputation: Polymath’s reputation as an early mover in the security token space enhances its credibility and growth potential.

- Regulatory Compliance: Its focus on compliance ensures long-term viability in a heavily regulated space, making it a safe bet for investors.

- Broad Industry Applications: Polymath’s platform supports a variety of industries, increasing its market reach and diversification.

- Growing Demand for Tokenized Assets: As the demand for RWA tokenization continues to rise, Polymath stands to benefit from market expansion.

- Scalable Platform: The company’s scalable technology positions it well to handle the growing volume of tokenized assets.

Antier Solutions is a blockchain development company that offers a wide range of services, including RWA tokenization. With a focus on decentralized finance (DeFi) and blockchain-based financial services, Antier specializes in creating solutions that enable businesses to tokenize real-world assets such as real estate, gold, and commodities. Their expertise in blockchain technology allows them to build custom solutions tailored to specific industries, ensuring that tokenization is efficient, secure, and compliant with relevant regulations.

Antier’s RWA tokenization solutions offer enhanced liquidity, transparency, and fractional ownership for investors. Their team of blockchain experts and financial professionals work closely with clients to develop scalable solutions for digital asset management, providing businesses with the tools to tap into a new wave of investment opportunities. Antier’s ability to integrate blockchain with traditional financial systems has earned them recognition in the space, making them a prominent player in the growing RWA tokenization market.

Key Features:- Custom Blockchain Solutions: Antier creates tailored blockchain solutions for tokenizing various asset classes, including real estate and commodities.

- Fractional Ownership: The platform supports fractional ownership, democratizing access to high-value assets.

- Liquidity Enhancement: Antier’s solutions help increase liquidity in traditionally illiquid markets by allowing tokenized asset trading.

- Regulatory Compliance: Ensures all tokenized assets meet local and international regulations, promoting investor confidence.

- Cross-Industry Expertise: Their experience across multiple sectors enables them to address the specific needs of different markets.

- Growing DeFi Market: As DeFi continues to grow, Antier’s solutions position it at the forefront of tokenization trends.

- Customizable Solutions: Antier’s ability to offer bespoke tokenization solutions attracts a wide range of businesses, increasing its market appeal.

- Blockchain Integration: Antier’s focus on blockchain technology makes it well-suited to meet the needs of the rapidly evolving tokenization market.

- Diversification Opportunities: Antier works across multiple asset classes, offering a broad range of investment options.

- Strategic Market Positioning: Antier’s early focus on RWA tokenization puts it in an advantageous position to capture market share as the sector matures.

Tokeny Solutions is a leading provider of tokenization technology that specializes in the creation and management of digital securities. With a strong emphasis on regulatory compliance, Tokeny offers an integrated platform for businesses looking to tokenize real-world assets, including real estate, equity, and fixed-income instruments. Tokeny’s platform enables companies to issue digital securities and manage them in a compliant manner, ensuring the integrity and transparency of tokenized assets.

Tokeny’s solutions cater to a wide range of industries, providing businesses with the tools needed to tokenize and trade assets in a secure, efficient, and scalable manner. With a focus on compliance and investor protection, Tokeny is well-positioned to capitalize on the growing demand for RWA tokenization, especially as blockchain technology continues to transform traditional financial markets.

Key Features:- Digital Securities Platform: Tokeny provides a platform to create and manage tokenized securities, offering a compliant and secure environment.

- Regulatory Compliance: Tokeny ensures that all tokenized assets are in full compliance with relevant regulations, protecting investors and issuers.

- Tokenization of Various Asset Classes: Supports the tokenization of a wide range of asset types, including real estate, private equity, and more.

- Seamless Integration: The platform integrates with existing financial infrastructure, enabling businesses to tokenize assets without disruption.

- Investor Protection: Provides tools for investor management, ensuring a secure and transparent process for all stakeholders.

- Increasing Tokenization Adoption: As tokenization becomes more mainstream, Tokeny’s strong regulatory compliance positions it to capture significant market share.

- Strong Industry Network: Tokeny’s connections with key financial institutions and regulators enhance its credibility and investment potential.

- Expanding Market Applications: The platform’s ability to tokenize various asset types increases its diversification and long-term growth prospects.

- Growing Demand for Digital Securities: The demand for compliant digital securities is expected to rise, benefiting Tokeny’s platform.

- Scalable Technology: Tokeny’s scalable technology ensures that it can handle increasing demand as the tokenization market continues to grow.

Kryptobees is an innovative blockchain development company that provides tokenization solutions for real-world assets, helping businesses and investors unlock the potential of digital ownership. Kryptobees specializes in creating blockchain-based platforms for tokenizing a wide array of assets, from real estate and commodities to luxury goods and fine art. By leveraging blockchain technology, Kryptobees enables the creation of secure, transparent, and divisible digital tokens that represent ownership in physical assets.

Kryptobees’ focus on RWA tokenization allows for greater liquidity and accessibility in traditionally illiquid markets. Their platform simplifies the process of asset digitization, enabling fractional ownership and making high-value assets accessible to a broader range of investors. Kryptobees also ensures compliance with local and international regulations, making its platform a trustworthy solution for businesses and investors alike. With blockchain’s ability to enhance transparency and reduce transaction costs, Kryptobees is poised to make a significant impact in the growing RWA tokenization market.

Key Features:- Tokenization of Diverse Assets: Kryptobees supports the tokenization of a wide variety of real-world assets, including real estate and luxury items.

- Blockchain Transparency: Utilizes blockchain technology to provide transparent and tamper-proof records of ownership.

- Fractional Ownership: Enables fractional ownership of tokenized assets, making it easier for small investors to participate.

- Global Market Access: Kryptobees allows for cross-border asset trading, expanding investment opportunities.

- Regulatory Compliance: Ensures all tokenized assets meet legal and regulatory requirements, fostering investor trust.

- Emerging Asset Classes: Kryptobees’ ability to tokenize diverse assets positions it well to tap into emerging markets.

- Increased Liquidity: By enabling fractional ownership and trade, Kryptobees enhances the liquidity of traditionally illiquid assets.

- Strong Market Positioning: As a provider of customizable tokenization solutions, Kryptobees can cater to a wide range of industries and investors.

- Blockchain Expertise: Kryptobees’ blockchain development expertise provides a competitive edge in the growing RWA tokenization market.

- Scalable Solutions: Kryptobees’ scalable platform ensures that it can accommodate the increasing demand for tokenization solutions.

When evaluating the top tokenization of real-world asset (RWA) companies, it’s essential to look for key strategies and factors that ensure the company is well-positioned for growth, innovation, and success in this emerging market. Below are some key strategies used to assess and check the top tokenization companies in the RWA space:

1. Regulatory Compliance and Legal Framework- Adherence to Regulatory Standards: A top RWA tokenization company must adhere to local and international financial regulations and compliance standards (e.g., KYC/AML regulations, securities laws, and tax compliance). This includes ensuring that tokenized assets are structured in ways that meet the legal requirements of the jurisdictions in which they operate.

- Legal Structure of Tokens: The company should have a well-defined legal structure for the tokens they issue, ensuring clarity on whether the token is treated as a security, commodity, or a utility token. A solid legal framework is vital for institutional adoption and investor protection.

- Engagement with Regulators: A proactive approach in engaging with regulators and policy makers is a good indicator of the company’s commitment to navigating the legal landscape and driving industry-wide regulatory clarity. This shows that the company is setting the groundwork for long-term sustainability and trust.

- Security and Scalability: The blockchain platform chosen for tokenizing RWAs should have high scalability, security features, and a proven track record of stability. Commonly used platforms include Ethereum, Solana, and Polkadot, but a company using private or consortium blockchains may also stand out for their security measures tailored to asset tokenization.

- Smart Contract Functionality: The effectiveness of smart contracts used to facilitate tokenized transactions is crucial. These should automate and streamline processes like asset transfers, dividend payouts, and ownership verification with minimal risk of human error. A robust smart contract framework with auditable code is essential for trust.

- Interoperability: Check if the company has developed a cross-chain interoperability strategy to ensure that tokenized assets can be traded and accessed across multiple blockchain ecosystems. Interoperability reduces barriers for investors and enhances liquidity.

- Diverse Asset Classes: Leading tokenization companies typically offer tokenization services for a wide range of real-world assets, from real estate to fine art, commodities, and private equity. This diversification reduces risk and expands market opportunities for investors. A broad asset selection indicates a company’s ability to target different investor segments and meet diverse needs.

- High-Value Assets: Evaluate whether the company is focusing on high-value assets like commercial real estate, luxury assets, or even businesses, which tend to attract institutional investors and high-net-worth individuals (HNWIs). Tokenizing such high-value assets can increase the company’s appeal to more affluent and institutional clients.

- Strategic Partnerships: Strong partnerships with financial institutions, banks, and investment firms suggest credibility and investor confidence. These partnerships help ensure the platform has access to capital, expertise, and additional resources to scale operations.

- Industry Collaborations: Collaborations with established blockchain organizations, real estate developers, and other relevant industry leaders can help a company tap into new markets, expand its product offerings, and gain the trust of stakeholders.

- Backers and Investors: Companies backed by well-known venture capital firms or industry giants are more likely to have the resources to scale their operations and drive innovation. Check for investor backing and look for names that indicate a strong financial foundation.

- Ease of Use: The user interface (UI) and overall experience of the tokenization platform are critical. Leading companies invest in user-friendly interfaces and intuitive features to attract both retail investors and institutional clients. The simpler and more accessible the platform, the better it is for mass adoption.

- Platform Accessibility: A strong RWA tokenization company should offer platforms that are accessible across devices (desktop, mobile) and allow users to easily monitor and manage their portfolios. Integration with third-party apps or DeFi protocols could be a plus.

- Customer Support and Education: Check if the company offers comprehensive customer support and educational resources to help investors understand how tokenization works, the benefits of tokenized assets, and the risks involved.

- Transparent Pricing and Fees: Transparency in the company’s pricing model, transaction fees, and other charges is essential to ensure that investors are not blindsided by hidden costs. Companies should provide clear, upfront information about how they charge for tokenization services, asset management, and transaction processing.

- Auditability and Track Record: Look for companies that provide full transparency about their operations, including third-party audits of their smart contracts, financial statements, and internal processes. A proven track record of successful asset tokenizations, with accessible audit trails, is a strong indicator of reliability.

- Public Relations and Reputation: Research the company’s reputation in the media and within industry forums. Strong relationships with thought leaders, a consistent media presence, and positive feedback from investors and clients are key signs of trustworthiness.

- Liquidity Solutions: Assess the liquidity solutions offered by tokenization platforms. Some of the leading companies ensure secondary market access where tokenized assets can be traded, either through exchange platforms or DeFi protocols. Higher liquidity makes tokenized assets more attractive by giving investors the ability to buy and sell assets with ease.

- Market Integration: Top tokenization companies focus on integrating tokenized assets with external financial markets and platforms. This includes partnerships with exchanges that list tokenized assets, allowing broader investor access and increasing the likelihood of liquidity in the marketplace.

- Cutting-Edge Technology: Companies that lead the field of tokenization often work on developing or adopting new technologies to enhance their platforms. This could include advances in AI to assess asset values, machine learning for predictive analytics, or advanced encryption techniques to further secure tokenized assets.

- Focus on DeFi and Smart Assets: Leading companies are often at the forefront of integrating tokenized assets with DeFi protocols and creating smart financial products that combine tokenized RWAs with decentralized applications, such as yield farming, liquidity pools, or decentralized lending platforms.

- Robust Security Measures: A top tokenization company must implement state-of-the-art security protocols, including multi-signature wallets, end-to-end encryption, and cold storage for tokenized assets. Regular security audits by independent firms are essential to identify vulnerabilities.

- Risk Mitigation: Evaluate whether the company provides sufficient insurance or risk mitigation strategies for tokenized assets, protecting investors against potential loss or fraud. Companies that can demonstrate effective risk management are more likely to gain investor trust.

- Successful Case Studies: A strong indicator of a top-tier tokenization company is a proven track record of successful tokenization projects. Look for companies that have already tokenized high-profile assets, including real estate portfolios, commercial buildings, or art collections, and have demonstrated the ability to create value for investors.

- Sustained Growth and Adoption: The company should show consistent growth in user adoption, increased trading volume, and an expanding client base, which suggests that the platform is gaining traction and meeting market demand.

To evaluate the top tokenization companies for real-world assets, you should look for firms that demonstrate regulatory compliance, strong blockchain infrastructure, diverse asset offerings, and a commitment to transparency, security, and innovation. Companies that excel in these areas are more likely to succeed in the fast-evolving RWA tokenization market, offering sustainable growth and value for investors while providing innovative solutions that disrupt traditional asset management and investment practices.

The Future of RWA Tokenization in 2025 and BeyondThe future of Real-World Asset (RWA) tokenization in 2025 and beyond holds tremendous potential to revolutionize traditional financial markets, unlock new investment opportunities, and reshape the way we think about asset ownership and liquidity. As blockchain technology matures and regulatory frameworks evolve, RWA tokenization will likely become an integral part of the global financial ecosystem. Below are key trends and developments that will shape the future of RWA tokenization:

1. Mass Adoption Across Asset Classes- Wider Range of Tokenized Assets: By 2025, we can expect further diversification of tokenized assets beyond real estate, including commodities (gold, oil), fine art, intellectual property, private equity, and even newer asset classes like carbon credits and sustainable projects. This will allow more investors to gain fractional ownership in traditionally illiquid and high-value assets.

- Tokenization of Personal Assets: As the market matures, even personal assets like vehicles, luxury goods, and collectibles may be tokenized, allowing individuals to unlock liquidity and trade assets that were traditionally harder to monetize.

- Global Investment Reach: Tokenization will continue to enable global access to assets, removing geographical and financial barriers for investors. For example, individuals in emerging markets will be able to invest in real estate or businesses in developed economies. Tokenized assets can be traded 24/7 on blockchain platforms, ensuring constant market access and liquidity.

- Fractional Ownership of High-Value Assets: Tokenization enables fractional ownership, which will allow smaller investors to participate in previously inaccessible markets, such as luxury real estate, private equity funds, or fine art. As more investors from different parts of the world engage with these markets, liquidity will significantly improve, providing more opportunities for diversification.

- Clearer Regulatory Guidelines: In the coming years, we can expect further development of regulatory frameworks to govern tokenized assets. Governments and regulators will continue to adapt existing financial laws and create new ones to facilitate tokenization while ensuring investor protection and financial stability. By 2025, we anticipate clearer guidelines on the legal status of tokenized assets, how they are classified (e.g., securities, commodities), and how they fit into existing tax structures.

- Institutional Adoption: As regulations become clearer, institutional investors, including banks, asset managers, and pension funds, will become more comfortable participating in the tokenization market. This institutional adoption will further legitimize the space and drive significant capital into tokenized asset markets.

- Tokenized Assets in Decentralized Finance (DeFi): In 2025 and beyond, tokenized real-world assets will increasingly be integrated with DeFi platforms, where token holders can participate in lending, borrowing, staking, or liquidity provision. For example, tokenized real estate could be used as collateral for DeFi loans, or tokenized equity could be staked for yield farming. This opens up new avenues for monetizing tokenized assets and creating more sophisticated financial products.

- Liquidity Pools and Yield Farming: As tokenized assets gain traction, DeFi protocols will create liquidity pools for these tokens, allowing users to earn returns by providing liquidity to the market. This will increase the utility of tokenized assets and provide more ways for investors to generate passive income.

- Cross-Chain Tokenization: To foster broader adoption, tokenization platforms will need to support interoperability between different blockchain networks. In the future, tokenized assets will likely be compatible across multiple blockchains (Ethereum, Solana, Polkadot, etc.), enabling more flexible trading and liquidity. Cross-chain tokenization will make it easier to access diverse tokenized assets and provide seamless transferability between platforms.

- Integration with Traditional Finance: Tokenized assets will also begin to be integrated with traditional financial systems, such as stock exchanges, clearing houses, and custodians. This could lead to hybrid financial systems where tokenized versions of traditional assets like stocks or bonds can be traded alongside their non-tokenized counterparts, enhancing market efficiency and liquidity.

- Advanced Smart Contracts: In the future, tokenization platforms will leverage more sophisticated smart contracts to automate various aspects of asset management, such as dividend distributions, ownership transfers, and governance mechanisms. These contracts will be able to handle increasingly complex tasks, reducing the need for intermediaries and administrative overhead.

- Governance and Voting: Tokenized assets will also allow for token-based governance models. For example, token holders could participate in governance decisions related to the management of the underlying assets (e.g., voting on property management decisions for tokenized real estate). This democratizes decision-making and gives investors more control over their investments.

- Immutable and Transparent Records: The blockchain’s inherent transparency will continue to provide immutable records for tokenized assets, giving investors greater confidence in asset provenance and ownership. This is particularly important in sectors like real estate and fine art, where provenance and authenticity can be difficult to verify.

- Real-Time Data: Tokenization platforms will also provide real-time updates and data streams related to the underlying assets (e.g., property values, market conditions, earnings reports), making it easier for investors to monitor the performance of their investments and make data-driven decisions.

- Sustainability in Tokenization: By 2025, the demand for green tokenization will likely rise. Investors and companies alike will tokenize assets related to sustainable projects, such as renewable energy, sustainable agriculture, and carbon credits. Tokenized carbon credits could become a major market, enabling companies to meet their sustainability targets while allowing investors to profit from the growing green economy.

- Tokenized Impact Investing: Tokenization will also facilitate impact investing in sectors like affordable housing, healthcare, and clean energy by enabling the creation of fractionalized, accessible investment products. This allows retail investors to contribute to positive societal and environmental outcomes while potentially earning financial returns.

- Real Estate Market Revolution: Real estate tokenization will likely become mainstream in the coming years, allowing for the creation of tokenized real estate funds, crowdfunding platforms, and global real estate exchanges. In particular, tokenization will make it easier to buy, sell, and manage real estate investments across borders, transforming the traditional real estate market.

- Property Rights and NFTs: Tokenization will blur the lines between traditional ownership and digital ownership, especially in areas like land or property rights. By 2025, we could see Non-Fungible Tokens (NFTs) used as a means of representing ownership of both digital and physical real estate, adding an additional layer of utility to NFTs.

- Simplified User Interfaces: As RWA tokenization platforms mature, the user experience will become more intuitive and accessible to non-technical users. In the future, tokenization platforms will feature user-friendly interfaces, making it easier for both institutional and retail investors to navigate the world of tokenized assets without requiring deep knowledge of blockchain technology.

- Wider Consumer Awareness: As blockchain-based investments and tokenized assets gain mainstream traction, consumer awareness will rise, leading to wider adoption. In the next few years, tokenization could become a mainstream investment vehicle, with tokenized assets offered through traditional financial intermediaries like brokers and wealth management firms.

The future of RWA tokenization in 2025 and beyond promises to fundamentally reshape the financial landscape. With increased liquidity, broader market access, clearer regulations, and the integration of emerging technologies like DeFi and smart contracts, tokenized assets will become more attractive to both individual and institutional investors. The ability to break down barriers of entry and democratize access to real-world assets will provide exciting opportunities for global investors, ushering in a new era of investment, financial innovation, and asset management. RWA tokenization represents a transformative step toward making financial markets more inclusive, efficient, and transparent.

ConclusionIn conclusion, the rise of RWA tokenization presents a unique opportunity for investors to diversify and tap into previously inaccessible markets. As we move into 2025, the top 10 RWA tokenization companies are positioning themselves as key players in this transformative space, offering innovative solutions that bridge the gap between traditional assets and blockchain technology. These companies are not only making it easier to invest in physical assets like real estate, art, and commodities, but they are also paving the way for a more transparent, liquid, and efficient financial ecosystem.

As the demand for digital ownership and fractional investment continues to grow, these companies are set to benefit from a rapidly evolving landscape. For investors looking to stay ahead of the curve, exploring opportunities in RWA tokenization is a smart move, with these leading companies providing the tools, platforms, and expertise necessary for success. As the tokenization market expands, 2025 promises to be a pivotal year for both the technology and the investors who embrace it.

Top 10 RWA Tokenization Companies To Invest In 2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.