Fantom (FTM) Poised For 50% Rally, Here’s Why

The post Fantom (FTM) Poised For 50% Rally, Here’s Why appeared first on Coinpedia Fintech News

FTM, the native token of Fantom, is poised for massive upside momentum, as it has formed a bullish price action pattern on its daily time frame. Despite experiencing a price drop of over 56% in the recent decline, it appears that this downtrend is reversing.

Fantom (FTM) Technical Analysis and Upcoming LevelsAccording to CoinPedia’s technical analysis, Fantom (FTM) has found crucial horizontal support at the $0.60 level. Since September 2024, the token has bounced multiple times from this level, experiencing upside momentum. However, this time, the altcoin has shown a bullish divergence on its daily chart.

Source: Trading View

Source: Trading View

Bullish divergence is a technical analysis term that occurs when an asset’s price is making lower lows while a technical indicator, such as the Relative Strength Index (RSI), is making higher lows. Traders and investors often consider bullish divergence a potential signal to buy, anticipating a price bounce or reversal.

FTM Price PredictionBased on the recent price action, if FTM holds the crucial support at the $0.60 level, it is highly probable that it will soar by 50% to reach the $1.05 mark in the future.

Currently, FTM is trading near the $0.70 level and has shown signs of recovery, experiencing a price rally of over 9.5% in the past 24 hours. Looking at these price recoveries, participation from traders and investors is further skyrocketing. Data from CoinMarketCap reveals that FTM’s trading volume has soared by 26% during the same period.

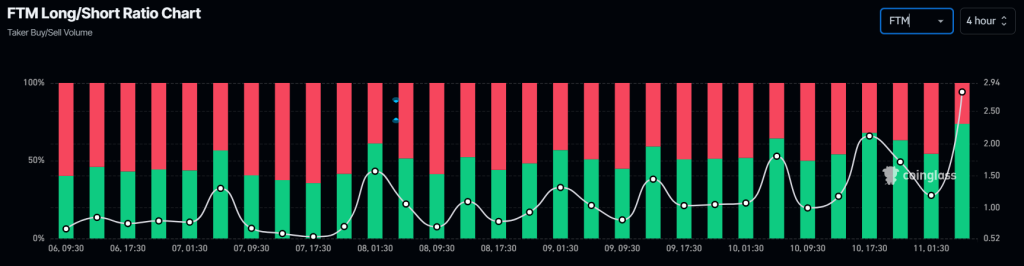

73.7% of Traders Long on FTMLooking at this bullish outlook, traders appear to be strongly betting on the altcoin, as revealed by the on-chain analytics firm Coinglass. Currently, the FTM Long/Short ratio stands at 2.80, indicating strong bullish market sentiment among traders.

Source: Coinglass

Source: Coinglass

Data further reveals that 73.7% of top traders currently hold long positions, while 26.3% hold short positions.

When combining these on-chain metrics with technical analysis, it appears that the bulls are back in support of FTM and could help it achieve its predicted target.