Experts Discuss Why Trump Might Be Tanking the Market on Purpose

Trump’s economic policies have created much uncertainty in the past few months, stunting stock markets and rocking investor confidence. However, as the United States faces a significant debt maturity of $7 trillion and high yields, theorists wonder whether Trump’s tariffs can get the Federal Reserve to bring interest rates down.

BeInCrypto spoke with Erwin Voloder, Head of Policy of the European Blockchain Association, and Vincent Liu, Chief Investment Officer at Kronos Research, to understand why Trump might be using tariff threats to boost American consumers’ purchasing power. They warn, however, that the risks far outweigh the benefits.

The US Debt DilemmaThe United States currently has a national debt of $36.2 trillion, the highest of any country in the world. This figure reflects the total sum of funds the federal government has acquired through borrowing to finance past expenditures.

In other words, the US owes foreign and domestic investors a lot of money. It will also have to repay certain loans in the next few months.

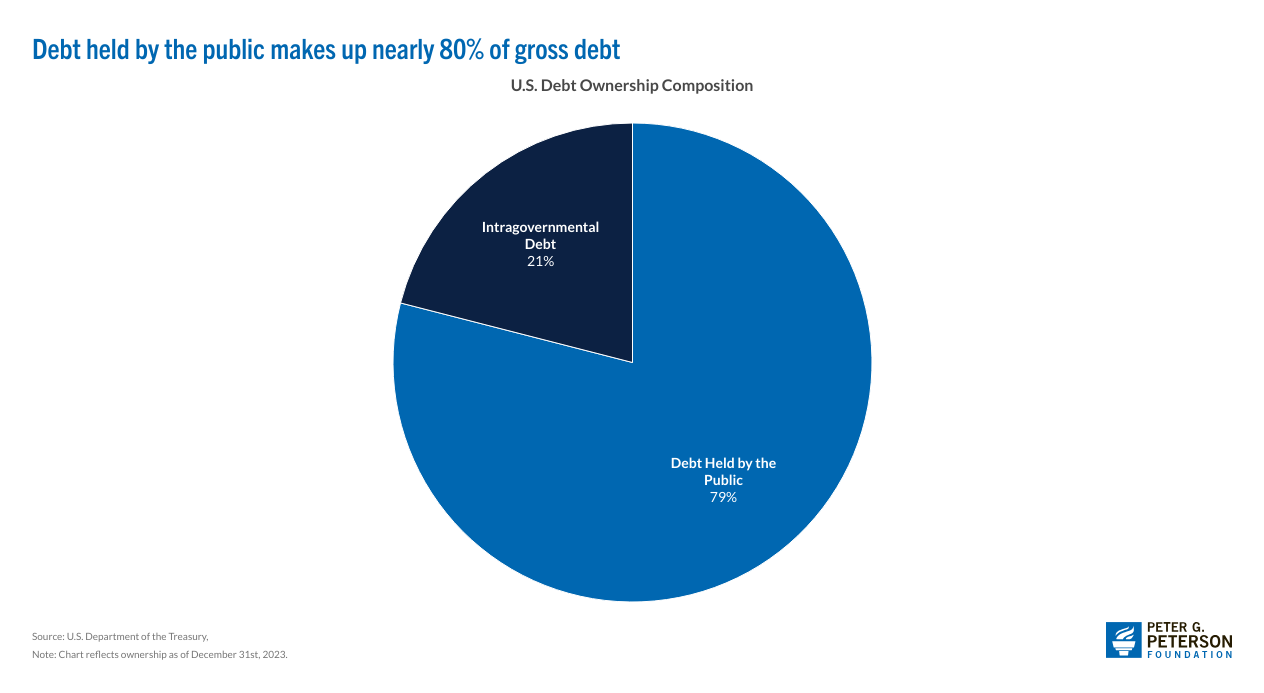

The public sector finances nearly 80% of the federal government’s gross debt. Source: Peter G. Peterson Foundation.

The public sector finances nearly 80% of the federal government’s gross debt. Source: Peter G. Peterson Foundation.

When the government borrows money, it issues debt securities, like Treasury bills, notes, and bonds. These securities have a specific maturity date. Before this deadline, the government must pay back the original amount borrowed. In the next six months, the United States will have to pay back around $7 trillion in debt.

The government has two options: It can either use available funds to repay the maturity debt or refinance it. If the federal government opts for the latter, it must take out further loans to repay the current debt, increasing the already ballooning national debt.

Since the US has a history of opting for the refinancing option, direct repayment seems unlikely. However, steep interest rates currently complicate refinancing.

High Interest Rates: An Obstacle to Debt RefinancingRefinancing allows the government to roll over the debt, meaning it doesn’t need to find the money from available funds to pay off the old debt immediately. Instead, it can issue new debt to cover the old one.

However, the Federal Reserve’s interest rate decisions significantly impact the federal government’s ability to refinance its debt.

This week, the Federal Reserve announced that it will keep interest rates between 4.25% and 4.50%. The Reserve has steadily increased percentages past the 4% benchmark since 2022 to control inflation.

While this is good news for investors who expect higher yield returns on their bonds, it’s a bad outlook for the federal government. If it issues new debt to cover the old one, it would have to pay more in interest, which will strain the federal budget.

“In practical terms, even a 1% higher interest rate on $7 trillion equates to $70 billion more in interest expense per year. A 2% difference would be $140 billion extra annually– real money that could otherwise fund programs or reduce deficits,” Voloder told BeInCrypto, adding that “the US already has a national debt exceeding $36 trillion. Higher refinancing rates compound the debt problem, as more tax revenue must go just to pay interest, creating a vicious cycle of larger deficits and debt.”

This scenario indicates that the United States needs to proceed cautiously with its monetary policies. With looming debt repayment deadlines and concerns over inflation, the government should embrace stability over uncertainty.

However, the Trump administration seems to be doing the opposite by threatening its neighbors with steep tariffs. The main question is: Why?

Trump’s Tariff Policies: A Strategy or a Gamble?During Trump’s first and second terms in office, he has continuously toyed with a tariff policy targeting his neighbors Canada and Mexico and his longtime rival China.

In his most recent inaugural address, Trump reaffirmed his commitment to this trade policy, claiming it would bring money back into the United States.

“I will immediately begin the overhaul of our trade system to protect American workers and families. Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens. For this purpose, we are establishing the External Revenue Service to collect all tariffs, duties, and revenues. It will be massive amounts of money pouring into our Treasury, coming from foreign sources,” Trump said.

However, the ensuing uncertainty about trade relationships and consequent retaliatory actions from affected countries have inevitably created instability, causing investors to react sharply to the news.

Earlier this month, markets experienced a widespread selloff, driven by anxieties surrounding Trump’s tariff policies. These resulted in a sharp decline in US stocks, a drop in Bitcoin’s value, and a surge in Wall Street’s fear index to its highest point of the year.

A similar scenario also played out during Trump’s first presidency.

“Intentionally rising economic uncertainty via tariffs carries steep risks: markets could overreact, plunging and increasing percentages for a possible recession, as seen in 2018’s trade war drop,” Liu said.

Bitcoin’s One-Month Price Chart. Source: BeInCrypto.

Bitcoin’s One-Month Price Chart. Source: BeInCrypto.

Whenever traditional financial markets are affected, crypto also suffers by association.

“In the immediate term, Trump’s production-first, America-First economics means digital asset markets must grapple with higher volatility and less predictable policy inputs. Crypto is not isolated from macro trends and is trading increasingly in tandem with tech stocks and risk conditions,” Voloder said.

While some view Trump’s measures as careless and erratic, others see them as calculated. Some analysts have viewed these policies as a means to get the Federal Reserve to lower interest rates.

Is Trump Using Tariffs to Influence the Federal Reserve?In a recent video, Anthony Pompliano, CEO of Professional Capital Management, argued that Trump was trying to lower Treasury yields by intentionally creating economic uncertainty.

The President and his team are intentionally crashing the market.

Is this a master plan or are we watching uncontrolled destruction?! pic.twitter.com/Tbc0M9Rjxu