Ethereum (ETH) Price Leaves Holders Torn Between Hope and Defeat

Ethereum (ETH) price attempted to surpass $2,700 this week but fell short of the target. Despite the pullback, the cryptocurrency notes a 3.50% increase in the last seven days.

But as the price wobbles around the same region, long- and short-term holders appear to have different views on ETH.

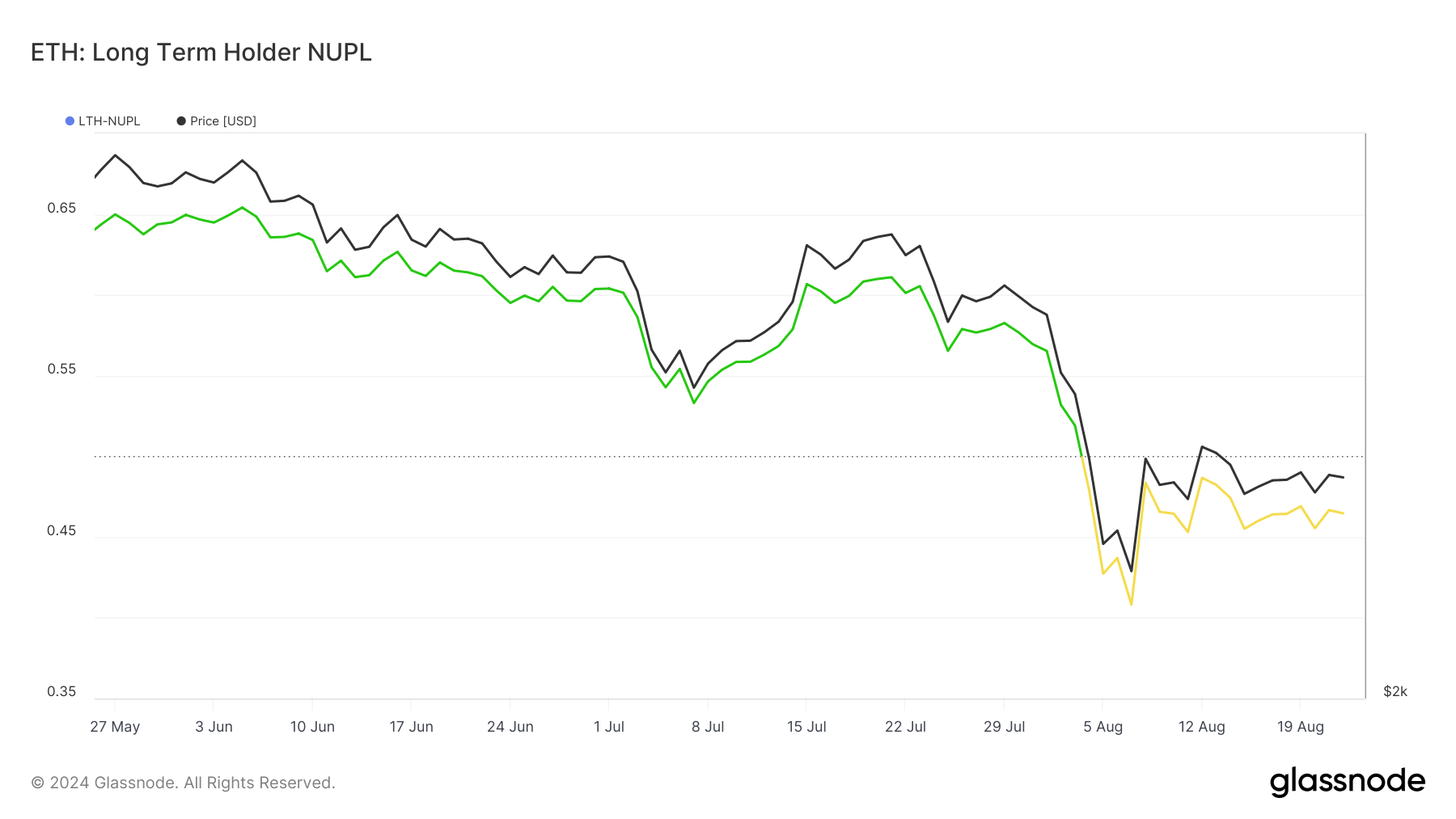

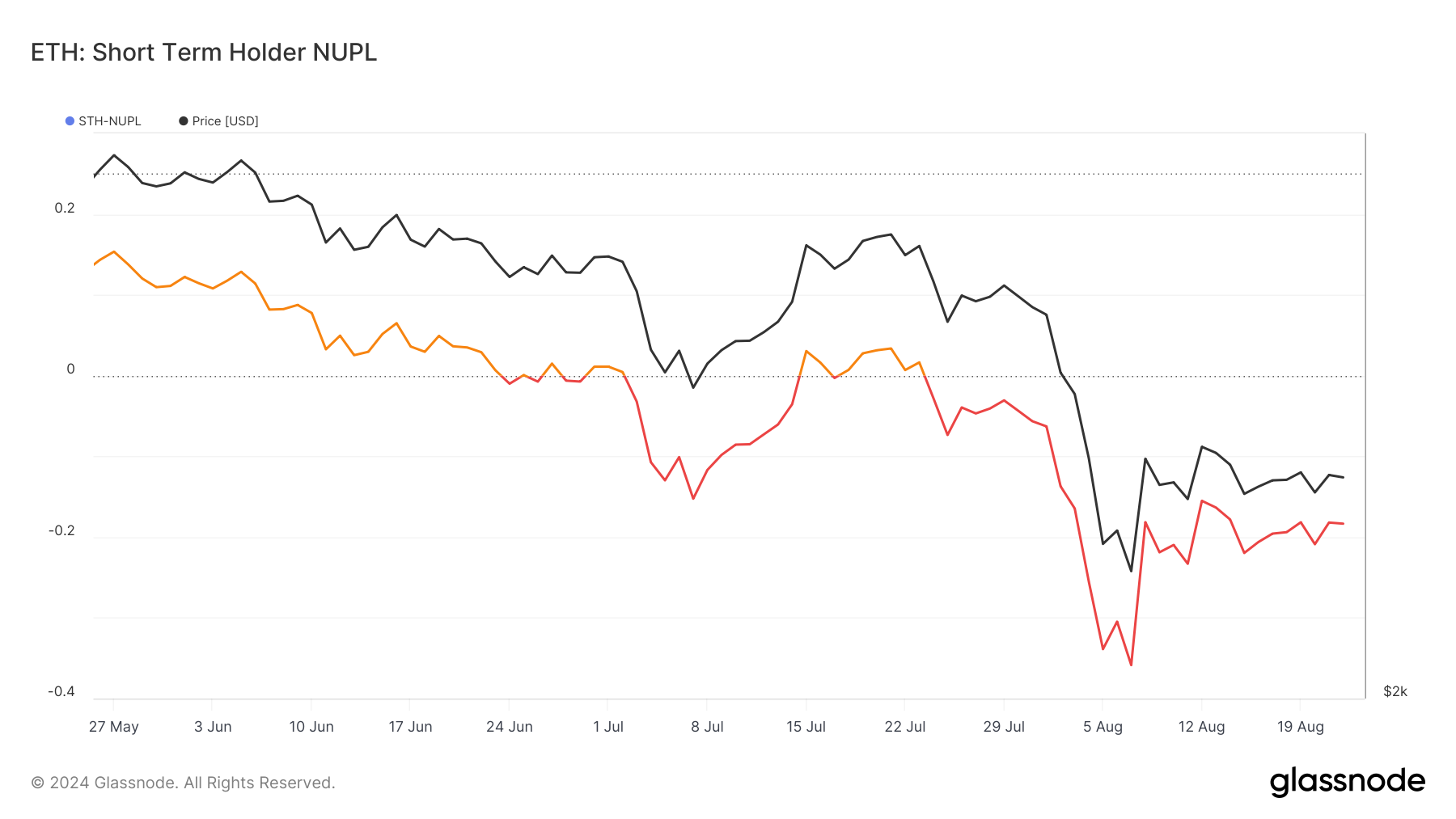

Ethereum Faces Mixed OutlookOne way to gauge investor sentiment regarding a cryptocurrency is by analyzing the Net Unrealized Profit/Loss (NUPL) metric. This indicator measures the level of unrealized gains or losses held by market participants, offering insights into the broader sentiment and psychology of holders.

The NUPL is divided into various segments representing stages like belief, greed, optimism, hope, and capitulation—each reflecting how investors feel about the asset at different times.

According to Glassnode data, the Long-Term Holder (LTH) NUPL for Ethereum is currently in the optimistic zone. This suggests that long-term holders still have confidence in ETH, viewing the recent price decline as a temporary phase.

Read more: How to Invest in Ethereum ETFs?

Ethereum Long-Term Holder Net Unrealized Profit/Loss. Source: Glassnode

Ethereum Long-Term Holder Net Unrealized Profit/Loss. Source: Glassnode

However, the situation is different for Short-Term Holders (STH). Data from on-chain analytics shows that the STH-NUPL currently resides in the capitulation zone. This indicates that short-term holders are less optimistic and do not expect ETH’s price to recover soon.

This bearish sentiment is likely linked to ETH’s recent price performance. At press time, ETH is trading at $2,661, reflecting a 21,9% decline over the last 30 days.

The drop implies that most recent buyers are holding ETH at a loss, which could reinforce their pessimistic outlook. If the price remains stagnant or declines further, it may be difficult for these holders to shift to a more positive sentiment.

Ethereum Long-Term Holder Net Unrealized Profit/Loss. Source: Glassnode

Ethereum Long-Term Holder Net Unrealized Profit/Loss. Source: Glassnode

Regarding ETH’s price outlook, analyst Michaël van de Poppe, founder of MN Capital, suggests that for Ethereum to have a shot at surpassing $3,100, it first needs to break through the $2,700 resistance level.

“Ethereum looks excellent, but it needs to continue climbing upwards. Crucial level to break: $2,700.There is nothing between $2,700 and $3,100, likely triggering a big upward run on altcoins,” van de Poppe shared on August 22.

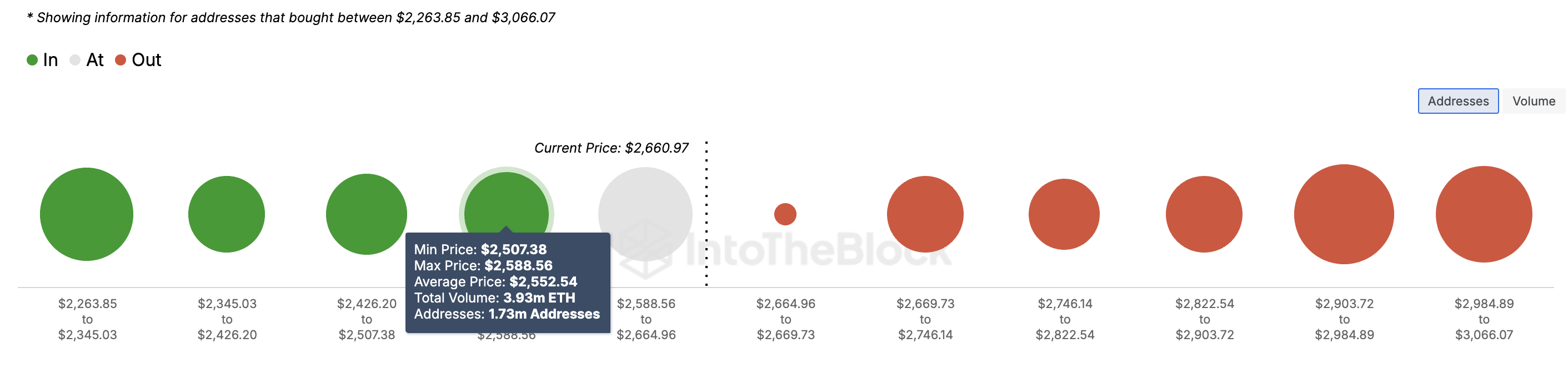

ETH Price Prediction: Will It Test $3,000?Concerning the short-term outlook, the In/Out of Money Around Price (IOMAP) revealed that ETH could build up on its recent increase. The IOMAP shows the number of addresses that purchased a cryptocurrency at a lower value than the current price, those who bought at the current price, and others who bought higher.

With this data, one can spot support and resistance and get insights into the next level the price can reach. The higher the number of addresses at a price range, the stronger the support or resistance at that level.

According to IntoTheBlock, 1.73 million addresses purchased 3.93 million ETH at an average price of $2,552. This number of addresses is more than those in the loss that accumulated between $2,699 and $2,867.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum In/Out of Money Around Price (IOMAP). Source: IntoTheBlock

Ethereum In/Out of Money Around Price (IOMAP). Source: IntoTheBlock

Therefore, Ethereum’s price is likely to surpass $2,900 in the short term. If this occurs, the path to reaching $3,100 could become easier. However, failing to break the overhead resistance might cause the price to retrace. If that happens, ETH’s price could drop to $2,426.

The post Ethereum (ETH) Price Leaves Holders Torn Between Hope and Defeat appeared first on BeInCrypto.