Don’t Miss Out: Grayscale’s New MakerDAO Trust Promises Big Gains for Crypto Investors!

The post Don’t Miss Out: Grayscale’s New MakerDAO Trust Promises Big Gains for Crypto Investors! appeared first on Coinpedia Fintech News

Grayscale Investments, the world’s largest crypto asset manager, has introduced a new investment product: the Grayscale MakerDAO Trust. This trust gives investors easy access to MKR, the token that powers MakerDAO, a key player in the decentralized finance (DeFi) world. In an X post, Grayscale published the link to its press release about the launch of MKR Trust.

Source : X (Formerly Twitter)

Why did Grayscale Choose MakerDAO?

Source : X (Formerly Twitter)

Why did Grayscale Choose MakerDAO?

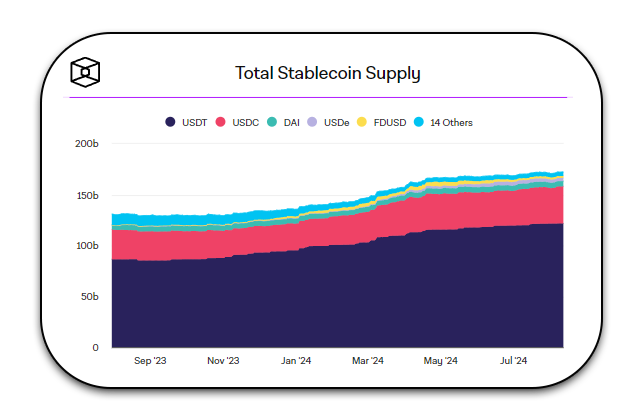

MakerDAO is a major player in the DeFi space. It is the issuer of the third largest stable coin DAI. It has a market value of over $5 billion. DAI is just behind Tether (USDT) and Circle’s USDC. A major reason for the market influence of MakerDAO is its ability to offer loans using real world assets.

Source : IntoTheBlock

Source : IntoTheBlock

MakerDAO is undergoing a major update called the “Endgame” plan. This change will lead to the creation of several smaller “subDAOs” that will handle different parts of the ecosystem. These updates are expected to strengthen MakerDAO’s position in DeFi..

Grayscale’s StrategyGrayscale’s new trust is part of its plan to offer more options for crypto investors. Rayhaneh Sharif-Askary, Head of Product and Research at Grayscale, said the trust allows investors to tap into MakerDAO’s potential. Despite a tough year for crypto, the MKR token has grown by 17% since January 2024. This makes MKR an appealing choice for those interested in the future of DeFi.

The Grayscale MakerDAO Trust works like Grayscale’s other single-asset trusts. It’s designed for accredited investors who want to invest in MKR without directly buying digital assets. But, as with other closed end trusts, the MakerDao trust’s share price can differ from the actual value of MKR.

What This Means for InvestorsThe launch of the MakerDAO Trust is part of a larger trend. Traditional financial products are evolving to include digital assets. Grayscale’s growing portfolio includes not only single-asset funds but also thematic funds that cover areas like decentralized finance and artificial intelligence.

As the crypto market matures, Grayscale is likely to continue offering new products. The MakerDAO Trust is a step in that direction, giving investors a straightforward way to engage with one of the most important projects in DeFi. Just last week, Grayscale has launched funds for Sui and TAO.