Coinbase Announces Its First AI-to-AI Crypto Transaction on Base Sepolia Network

On August 30, 2024, Coinbase, the US’ largest publicly traded crypto exchange, managed the first AI-to-AI crypto transaction.

This milestone, announced by Coinbase’s CEO Brian Armstrong, represents a significant leap toward a future where artificial intelligence’s intersection with the crypto industry is becoming more evident.

Coinbase Leverages AI Agents for Transactions in a Decentralized EconomyCoinbase conducted its first AI-to-AI crypto transactions using the Base Sepolia Network. Known for its scalability and low transaction costs, Base Sepolia provided the ideal environment for this event.

Coinbase employed its advanced Multi-Party Computation (MPC) technology to create a secure AI agent wallet. This ensured the transaction remained controlled and tamper-proof.

After creating and funding a wallet using a faucet method, the AI agent could seamlessly transfer crypto assets to another wallet. This wallet could belong to either a human user or another AI agent. It demonstrated the versatility and potential of AI-to-AI transactions in a decentralized ecosystem.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

The concept of AI agents conducting transactions autonomously is revolutionary. Traditionally, AI has been limited to processing information and making decisions based on pre-programmed algorithms. However, with the ability to manage and transfer assets without human oversight, AI agents can now operate within decentralized financial systems.

This development enables AI agents to transact with other AI entities, humans, and merchants. Furthermore, it allows AI agents to acquire resources, pay for services, and perform tasks that require financial transactions. All of these transactions can happen without human intervention.

“This is an important step for AIs to get useful work done. Today, if you give an AI agent a task and come back in a few days or hours, it can’t get useful work done. In part, this is a limitation of the technology itself, and products like devin.ai are getting closer to this. But the other reason is that AIs can’t transact to acquire the resources they need. They don’t have a credit card to use AWS, Github, or Vercel. They don’t have a payment method to book you the plane ticket or hotel for your upcoming trip. They can’t get through paywalls (for instance, to read a scientific article), promote their post on X with a paid ad, or use the growing network of paid APIs to integrate the data they need,” Armstrong elaborated.

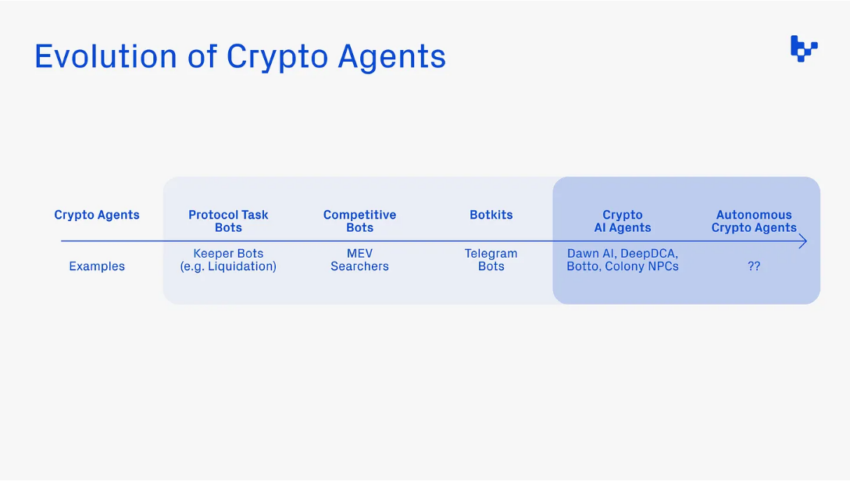

AI Agents in the Crypto Economy: Opportunities and Obstacles AheadIn a December 2023 report, Mason Nystrom, a Junior Partner at Pantera Capital, noted how bots have evolved into “robust AI agents” capable of autonomously handling complex tasks and making well-informed decisions. Nystrom also emphasized that building AI agents on cryptonative rails offers several key advantages. One of the primary benefits is AI agents’ ability to access capital through native payment rails, such as cryptocurrencies.

“Crypto rails present a meaningful improvement for giving AI agents access to capital over having them obtain access to bank accounts or payment processors (e.g. Stripe), or deal with the vast majority of other inefficiencies that exist in our offchain world,” he wrote.

Additionally, AI agents with wallet ownership gain the ability to hold digital assets, such as NFTs or yield-bearing tokens. This grants them digital property rights inherent to crypto assets. Such capability is particularly important for agent-to-agent transactions, where verifiable and deterministic actions are crucial.

“On-chain transactions are deterministic in nature—they either happened or didn’t—which means AI agents will be able to more accurately complete tasks on-chain than off-chain,” he remarked.

Evolution of AI Agents in Crypto-Economy. Source: Mason Nystrom

Evolution of AI Agents in Crypto-Economy. Source: Mason Nystrom

Despite AI agents’ promise in the crypto economy, Nystrom also identified significant challenges and limitations. One major limitation is that AI agents need to perform complex logic off-chain to optimize efficiency.

While on-chain transactions are deterministic and verifiable, the computational logic required for decision-making and task execution often needs to be processed off-chain. This condition introduces a layer of complexity and potential vulnerability, as the off-chain components may not have the same level of security and transparency as on-chain transactions.

Additionally, the quality of the tools given directly influences the effectiveness of AI agents. For example, an AI agent tasked with summarizing real-time news events needs access to web scraping tools, while an agent that engages in trading requires a wallet with key signing permissions. This reliance on external tools means that the capabilities of AI agents are inherently limited by the resources and infrastructure available to them.

Moreover, ensuring these tools are secure, reliable, and integrated seamlessly with blockchain technology remains a significant challenge.

Read more: AI in Finance: Top 8 Artificial Intelligence Use Cases for 2024

Coinbase’s latest initiative also strengthens the narrative of the intersection between AI and crypto, specifically blockchain. According to a January report from Grayscale Research, the intersection of AI and crypto could offer significant benefits in mitigating societal issues associated with AI. These problems include spreading misinformation and deepfakes.

Galaxy Digital Research adds another dimension to this discussion. It points out that blockchains can serve as a transparent, data-rich environment that AI models require for optimal performance. Although blockchains have limited computational capacity, their transparency and decentralized nature make them ideal for integrating AI in a way that enhances both security and trust.

The post Coinbase Announces Its First AI-to-AI Crypto Transaction on Base Sepolia Network appeared first on BeInCrypto.