Is the check dead? Debunking myths about paper payments

In the age of digital transactions and contactless payments, many have declared the humble paper check as an obsolete relic of the past. However, this claim is far from accurate. Despite the rise of electronic payment methods, checks continue to play a crucial role in various financial transactions, and their demise has been greatly exaggerated.

The enduring importance of checksWhile it’s true that the usage of checks has declined over the years, they remain an essential payment method for many individuals and businesses. Checks offer several advantages that make them indispensable in certain situations:

- Accessibility: Not everyone has access to digital payment methods or feels comfortable using them. Checks provide a familiar and straightforward way for individuals of all ages and backgrounds to conduct financial transactions.

(Image credit)

(Image credit)

- Recordkeeping: Checks offer a tangible paper trail, making them valuable for record-keeping purposes. This feature is particularly important for businesses that need to maintain detailed financial records for accounting and tax purposes.

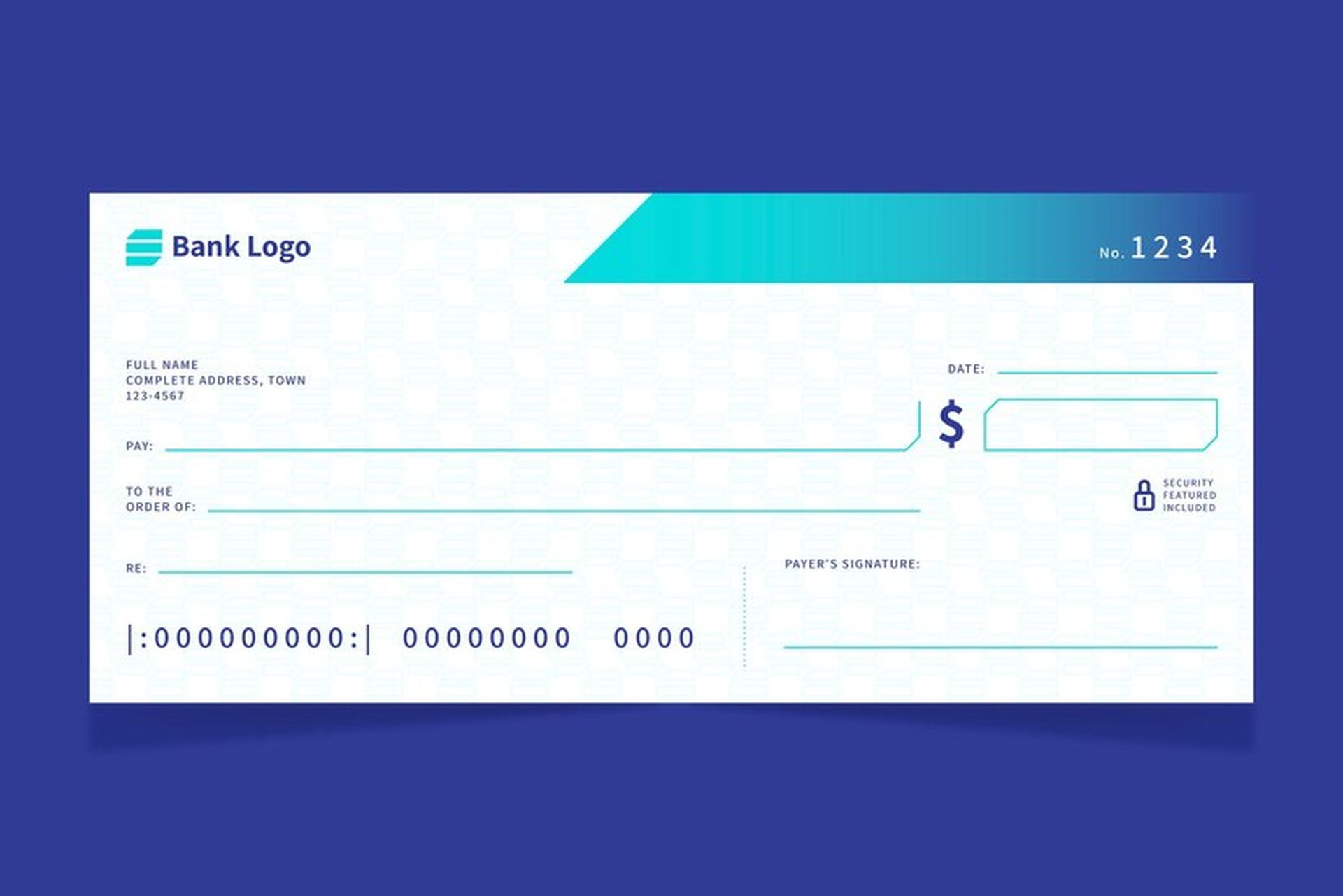

- Security: Contrary to popular belief, checks can be a secure payment method when used correctly. They require physical signatures and can be traced back to the issuer, providing an additional layer of security compared to some electronic payment methods.

- Flexibility: Checks can be used for various transactions, from paying bills and rent to making large purchases or settling legal obligations. Their versatility makes them a valuable tool in different financial scenarios.

Despite their continued relevance, several myths persist regarding the use of checks. Let’s address some of the most common misconceptions:

- Checks are obsolete: As discussed earlier, checks remain an essential payment method for many individuals and businesses. While their usage may have declined, they are far from obsolete and continue to serve important functions.

- Checks are inconvenient: While checks may require more effort than some digital payment methods, they are not necessarily inconvenient. For those who are familiar with the process, writing and depositing checks can be straightforward and efficient. Additionally, with the advent of mobile banking apps, depositing checks has become more convenient than ever.

- Checks are unsafe: When handled properly, checks can be a secure payment method. They require physical signatures and can be traced back to the issuer, making them less susceptible to certain types of fraud compared to electronic payments. However, it’s important to follow best practices, such as safeguarding checks and promptly reporting any lost or stolen checkbooks.

- Checks are expensive: While checks may involve some processing fees, the costs associated with their use are often minimal, especially for individuals and small businesses. Many financial institutions offer free or low-cost check-writing services, making checks an affordable payment option.

In certain situations, individuals may need to cash a check but lack proper identification, and one common issue that arises is how to cash a check without ID. This can be a challenge, as most financial institutions require a valid ID to cash checks as a security measure. However, there are alternative methods that can be explored, such as having the check endorsed by the issuer or providing other forms of identification like a utility bill or credit card statement.

The future of checksWhile digital payment methods continue to gain popularity, it’s unlikely that checks will disappear completely anytime soon. They serve specific purposes and cater to various demographics and industries that still rely on paper-based transactions.

However, financial institutions and payment processing companies still need to adapt and offer innovative solutions that bridge the gap between traditional and modern payment methods. This could include enhancing mobile check deposit capabilities, streamlining check processing, and improving security measures to further bolster the reliability and convenience of check-based transactions.

Ultimately, the decision to use checks or digital payment methods will depend on individual preferences, circumstances, and the specific requirements of each transaction. By understanding the myths and realities surrounding checks, consumers and businesses can make informed choices and leverage the payment methods that best suit their needs.

Featured image credit: Freepik