BlackRock Wants Exchanges Using BUIDL as Derivatives Collateral

BlackRock is reportedly reaching out feelers to some of the world’s largest crypto exchanges for a potentially lucrative business deal. It wants them to allow BUIDL as collateral for derivatives trades, directly competing with Tether.

As of yet, few of the involved parties have gone on the record with specific details.

BlackRock’s Collateral StrategyBlackRock aims to integrate its BUIDL tokenized fund into crypto derivatives trading as collateral, according to a Bloomberg report. The BUIDL fund, officially called the BlackRock USD Institutional Digital Liquidity fund, has seen significant success this year, boosting real-world asset (RWA) tokens.

BlackRock, alongside its brokerage partner Securitize, is reportedly in talks with major crypto exchanges, including Binance, OKX, and Deribit, regarding BUIDL’s use as collateral. However, these discussions remain largely private. Deribit’s CEO, Luuk Strijers, commented only that the exchange is “reviewing” several tokens, including BUIDL.

Read more: What Are Tokenized Real-World Assets (RWA)?

“The BUIDL ecosystem keeps growing, and we see significant potential in traders using the fund as collateral,” claimed Securitize, in some of the only public comments on these talks.

A key motivator for BlackRock is simple: it wishes to compete with Tether’s dominance in the stablecoin market, just like other firms have attempted. BUIDL is not, strictly speaking, a stablecoin; nevertheless it shares several similarities. Its value is tied to one dollar, it invests in Treasury bonds, etc. However, BUIDL also pays interest to holders, unlike stablecoins.

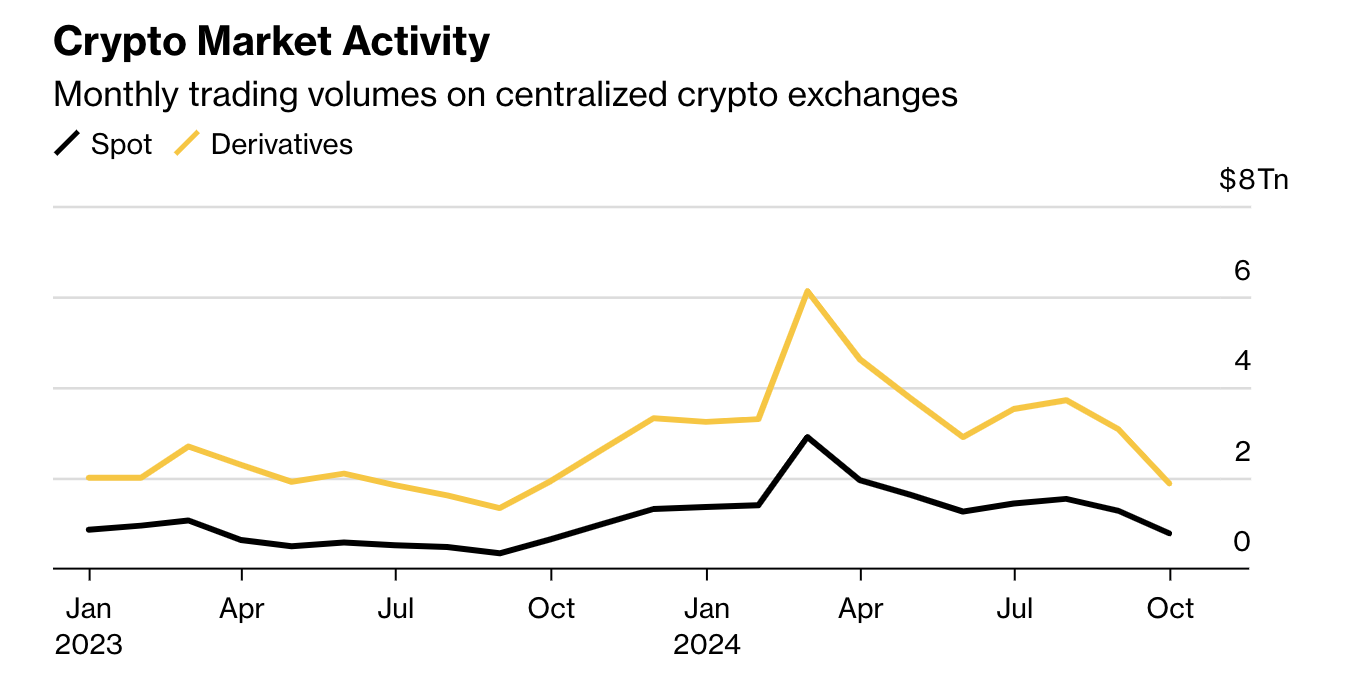

If major exchanges accept BUIDL as collateral instead of popular stablecoins like Tether, it could unlock a vast market. Centralized crypto exchanges handle massive trading volumes, with derivatives trades comprising the majority. By leveraging its expertise and connections in traditional finance, BlackRock stands to potentially earn billions if BUIDL gains traction in this space.

Crypto Derivatives Volume. Source: CCData

Crypto Derivatives Volume. Source: CCData

This is just one potential revenue stream that BlackRock is actively exploring. It purchased over $680 million in Bitcoin this week alone, after its ETF offering IBIT saw huge inflows. Regardless of BlackRock’s success with this particular play, its commitment to continued crypto investment seems ironclad.

Read more: What Is a Stablecoin? A Beginner’s Guide

Still, as Bloomberg pointed out, breaking into the stablecoin market is far from easy. Just this week, for example, PayPal’s own stablecoin PYUSD noticeably cratered in value. This likely explains why BlackRock is keeping its plans under wraps, cautiously evaluating BUIDL’s viability without making any major commitments.

The post BlackRock Wants Exchanges Using BUIDL as Derivatives Collateral appeared first on BeInCrypto.