BlackRock’s Bitcoin ETF options approval set to enhance market liquidity and participation

The US Securities and Exchange Commission recently approved listing options on BlackRock’s iShares Bitcoin Trust (IBIT) spot ETF. This development provides investors additional tools for hedging or speculating on Bitcoin price movements. According to a recent report by CryptoQuant, the approval could increase liquidity and investor participation in the Bitcoin market, marking a further step toward broader institutional adoption.

CryptoQuant data shows that Bitcoin options on the Chicago Mercantile Exchange (CME) recorded a fresh high open interest of nearly $500 million on March 12, growing almost five-fold from their maximum level in 2023. Options may attract longer-term investors into Bitcoin, as option traders on the CME appear to have a longer-term investing horizon compared to futures traders. While most open positions in CME Bitcoin futures have an expiration date of one to three months, options consistently have many contracts with expirations of four or more months.

Bitcoin Open Interest (CryptoQuant)

Bitcoin Open Interest (CryptoQuant)

According to CryptoQuant’s report, options on the IBIT ETF could be a new instrument for investors to generate yield from holding Bitcoin by selling covered calls. Investors holding spot Bitcoin can sell call options and collect premiums, obtaining yield from their holdings in a regulated manner. Yields on CME Bitcoin futures currently stand at around 5% annualized for contracts with expirations over six months.

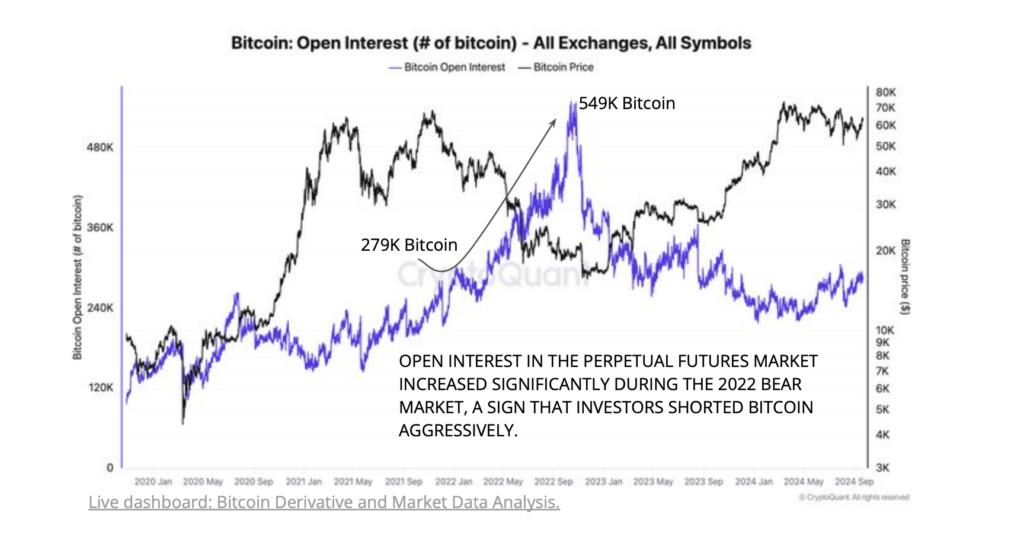

However, CryptoQuant states that introducing options could also increase the “paper” supply of Bitcoin, as investors can gain exposure without transacting in the spot market. This scenario has occurred in the perpetual futures market, where investors short Bitcoin during bear markets.

It’s worth noting that the product still requires the support of the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC), which have no official approval timeline.

The post BlackRock’s Bitcoin ETF options approval set to enhance market liquidity and participation appeared first on CryptoSlate.