Bitcoin Price Crash Wipes Out $25 Billion Gains in 24 Hours

Bitcoin has been struggling to recover, with its price recently dipping below $80,000, marking a significant loss. The downtrend intensified due to the broader market’s weakness, particularly the impact of US President Trump’s trade wars.

The decline in US stock markets since the beginning of the month has affected Bitcoin as the global economic climate worsens.

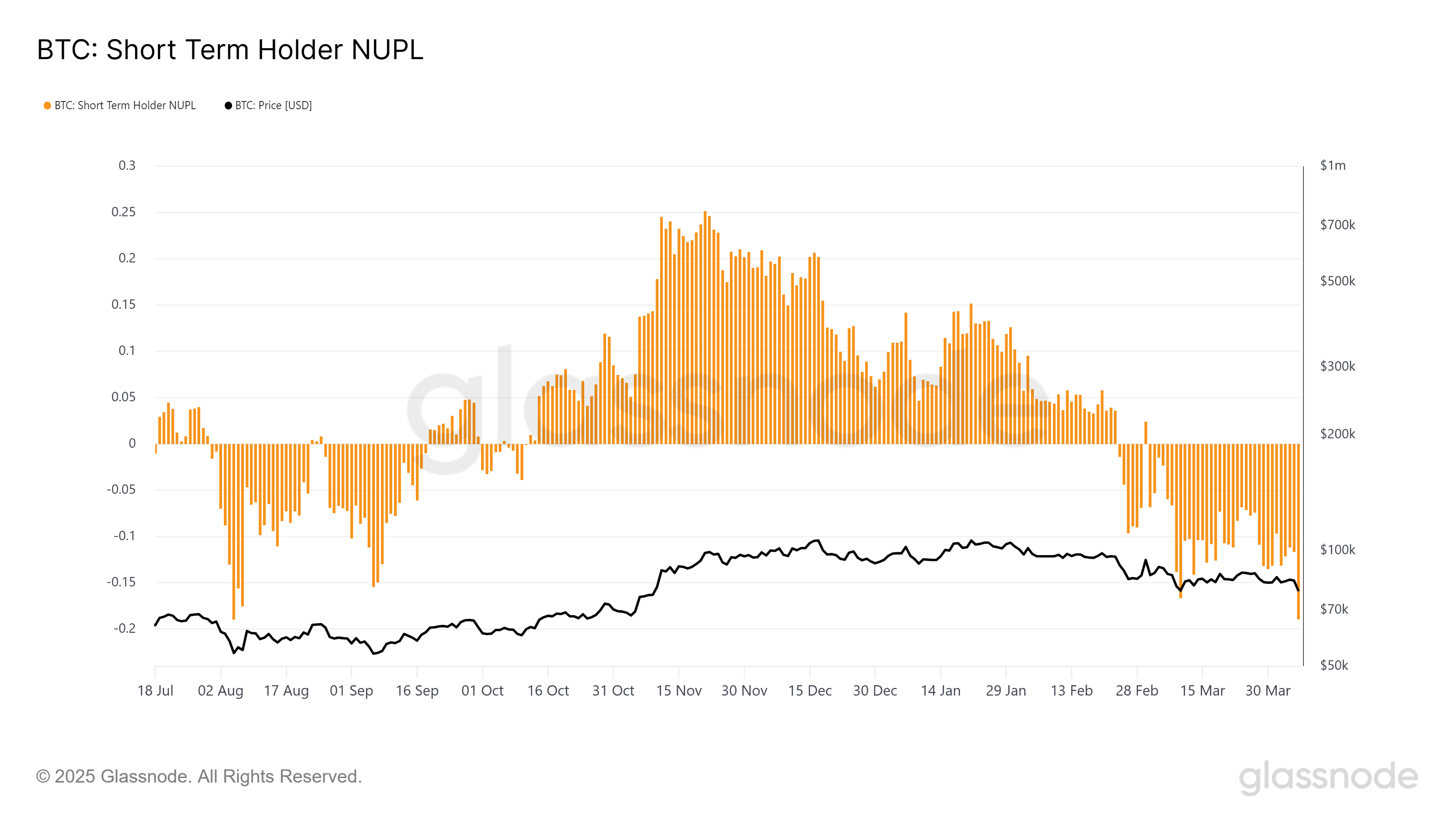

Bitcoin Investors Lose BigThe STH (short-term holders) NUPL (Net Unrealized Profit and Loss) has reached an 8-month high, signaling a potential shift in investor behavior. Rising losses in the short term indicate that Bitcoin may have gone through a period of capitulation, meaning that panic-driven selling has likely peaked.

Capitulation typically marks the bottom of a market downturn, suggesting that selling pressure could ease. However, the ongoing bearish sentiment in the broader market, driven by trade tensions and global economic uncertainty, still poses a risk for Bitcoin.

Despite the potential for a market bottom, short-term holders may still face continued pressure due to the broader financial context.

Bitcoin STH NUPL. Source: Glassnode

Bitcoin STH NUPL. Source: Glassnode

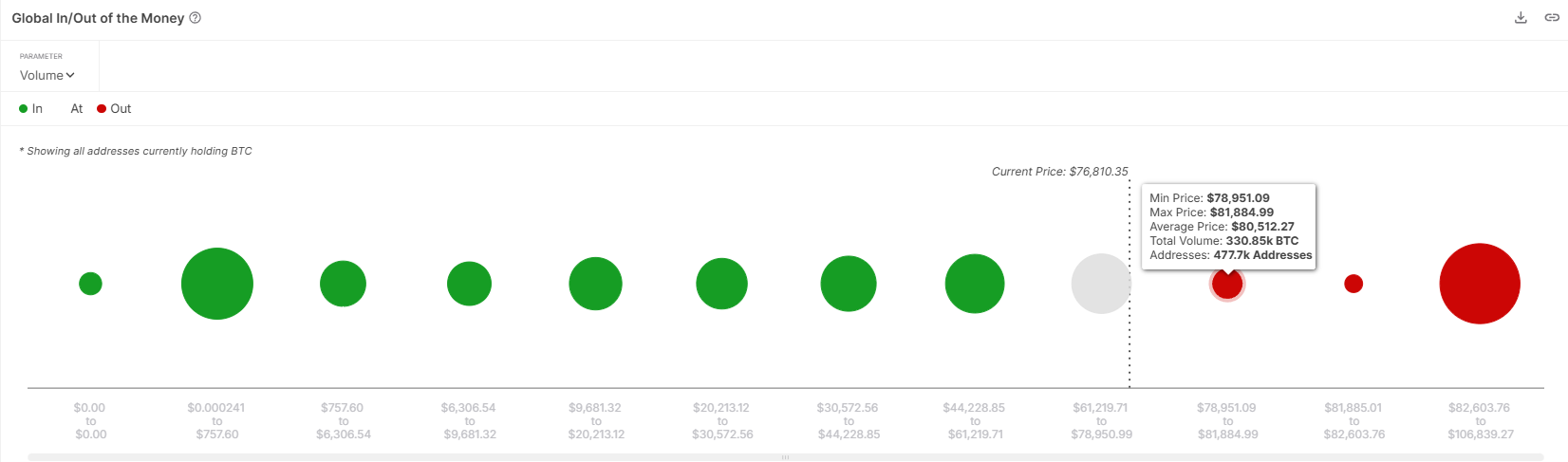

Bitcoin’s macro momentum has been largely influenced by recent financial market movements. According to the IOMAP (In/Out of the Money Around Price) indicator, over $25 billion in losses have been recorded in the last 48 hours.

About 330,850 BTC were bought between the $78,951 and $81,884 price range, but Bitcoin is now trading at $77,234, putting these investors in the red. This significant loss of profitability has led many potential new investors to hesitate, as the current market conditions do not seem favorable for short-term gains.

Bitcoin’s struggle to gain traction in the face of these losses is compounded by market conditions that deter fresh capital. The IOMAP data suggests that Bitcoin may face difficulty in bouncing back, as more investors could be reluctant to buy in the current environment, awaiting more stable conditions.

Bitcoin IOMAP. Source: IntoTheBlock

BTC Price Needs Support

Bitcoin IOMAP. Source: IntoTheBlock

BTC Price Needs Support

Bitcoin’s price crashed by 8% over the past 24 hours, trading at $76,775. The drop from $82,500 to its current level has caused significant losses for investors. Bitcoin is currently holding above its key support level of $76,741, but it remains vulnerable to further declines.

Moving forward, Bitcoin could continue to face mixed signals, possibly consolidating above the support level of $76,741. However, should macroeconomic conditions worsen, a drop to $74,000 or lower is possible. If Bitcoin fails to hold this support level, further declines may follow, extending losses for investors.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

The only way to invalidate the bearish outlook would be for Bitcoin to break above $80,000 and reclaim $82,503 as support. If Bitcoin can sustain this upward movement, it could start recovering the recent losses and regain investor confidence.

The post Bitcoin Price Crash Wipes Out $25 Billion Gains in 24 Hours appeared first on BeInCrypto.