Bitcoin Nears $57,000 as Markets Anticipate Rate Cut Following Weak US Job Data

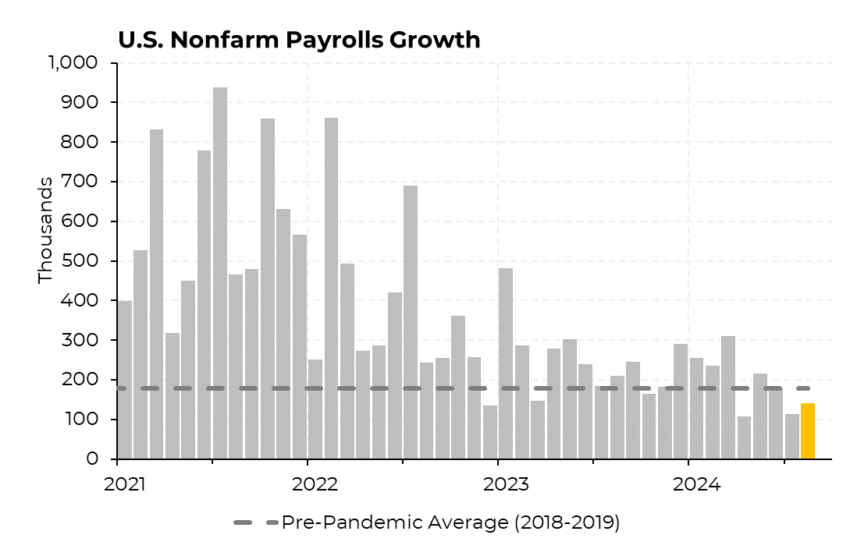

Markets anticipate a 50 basis point (bp) rate cut in September amid deteriorating US Job data. According to the US Non-farm Payrolls (NFP) data released on Friday, the US economy added 142,000 jobs in August, below the expected 164,000.

Due to this anticipation, Bitcoin shot up over 2% within 30 minutes.

Bitcoin Approaches $57,000At the time of writing, Bitcoin (BTC) is trading for $56,821, swiftly moving towards the $57,000 mark.

The August unemployment rate hit expectations, coming in at 4.2%. It means unemployment is back on the decline, after the 4.3% recorded in July.

“Big decline in “temporary layoffs” in August. That’s a key reason the unemployment rate went back to 4.2%. It looks like July’s big unemployment rate spike was mostly a fluke. But it’s undeniable the labor market is cooling off a lot (and could easily get worse),” Heather Long, Economic Columnist at the Washington Post, said.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

US NFP, Source: Department of Labor

US NFP, Source: Department of Labor

While these data show that the US job market has cooled off, they also indicate that there are clear warning signs. Nevertheless, a “soft landing” remains possible. In the immediate aftermath of the report, risk-on assets like Bitcoin jumped briefly, testing $57,000 in response to the greenback’s weakening over weak US job data.

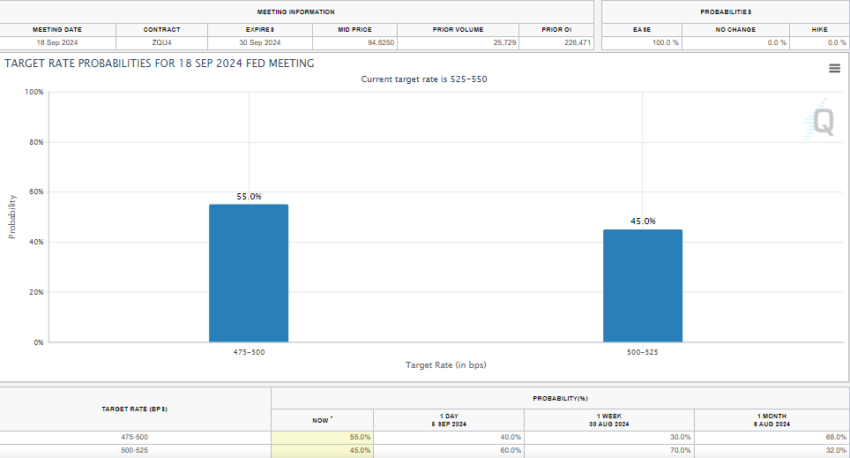

Fed Rate Cut Probabilities, Source: CME Watchtool

Fed Rate Cut Probabilities, Source: CME Watchtool

Based on the Fed’s CME Watchtool, markets are pricing in a 50bp cut in September, as probabilities jump from 30.5% to 55%. Meanwhile, the probability of a 25bp rate cut has since shrunk to 45%.

The post Bitcoin Nears $57,000 as Markets Anticipate Rate Cut Following Weak US Job Data appeared first on BeInCrypto.