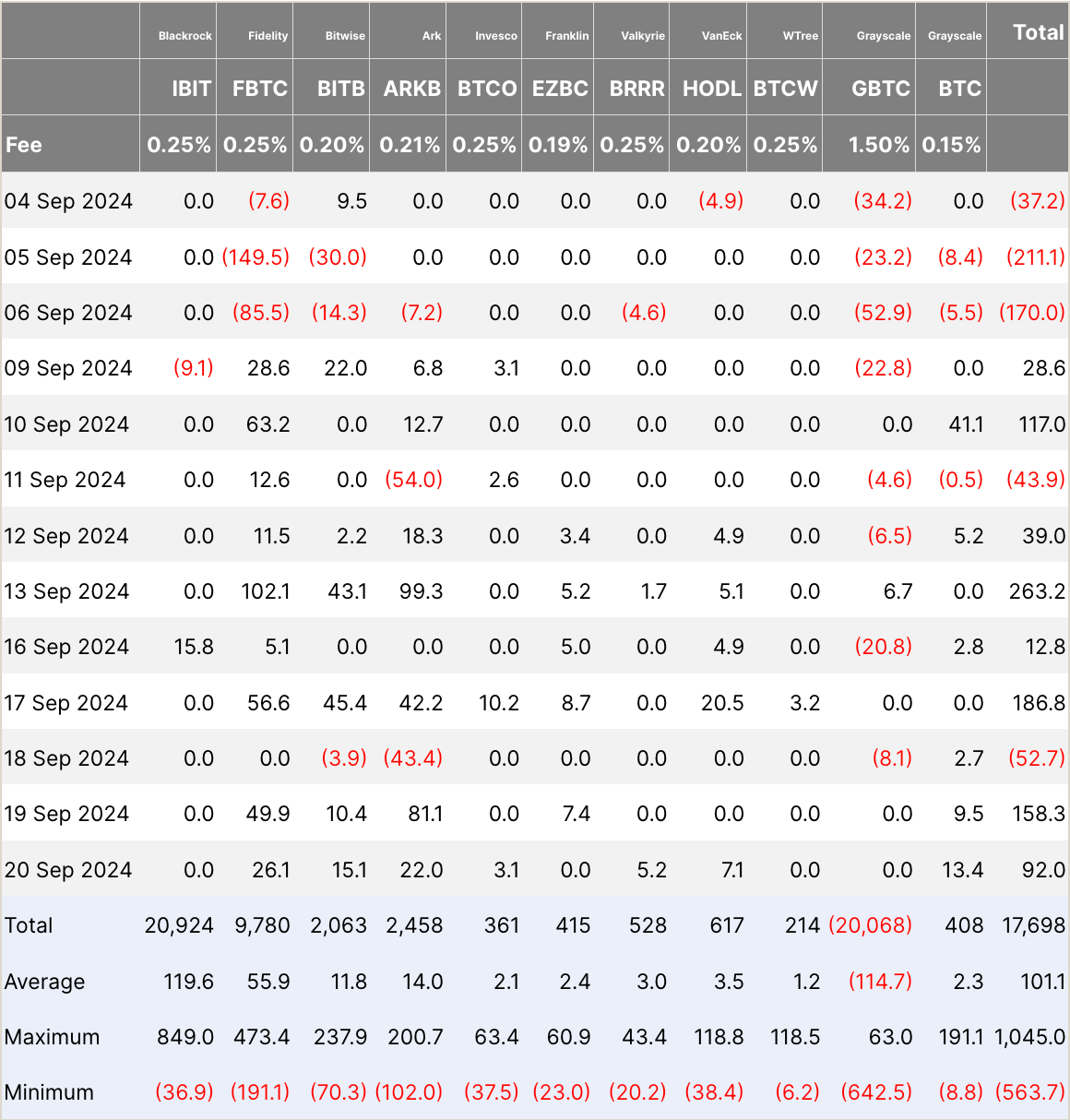

Bitcoin ETFs see $92 million inflow with only single net outflow in past 7 days

On Sept. 20, Bitcoin ETFs saw a total inflow of $92 million, reflecting broad-based interest across multiple funds, according to Farside data.. Fidelity’s FBTC led the market with $26.1 million in inflows, followed by Ark’s ARKB ETF with $22 million. Bitwise’s BITB ETF recorded $15.1 million, while Valkyrie’s BRRR and VanEck’s HODL ETFs added $5.2 million and $7.1 million, respectively. Invesco’s BTCO also contributed with $3.1 million in inflows, and Grayscale’s smaller BTC ETF saw $13.4 million.

No significant activity was noted from BlackRock’s IBIT, Franklin’s EZBC, WisdomTree’s BTCW, or Grayscale’s primary GBTC fund, which remained flat for the day.

BTC ETF flows (Farside Investors)

BTC ETF flows (Farside Investors)

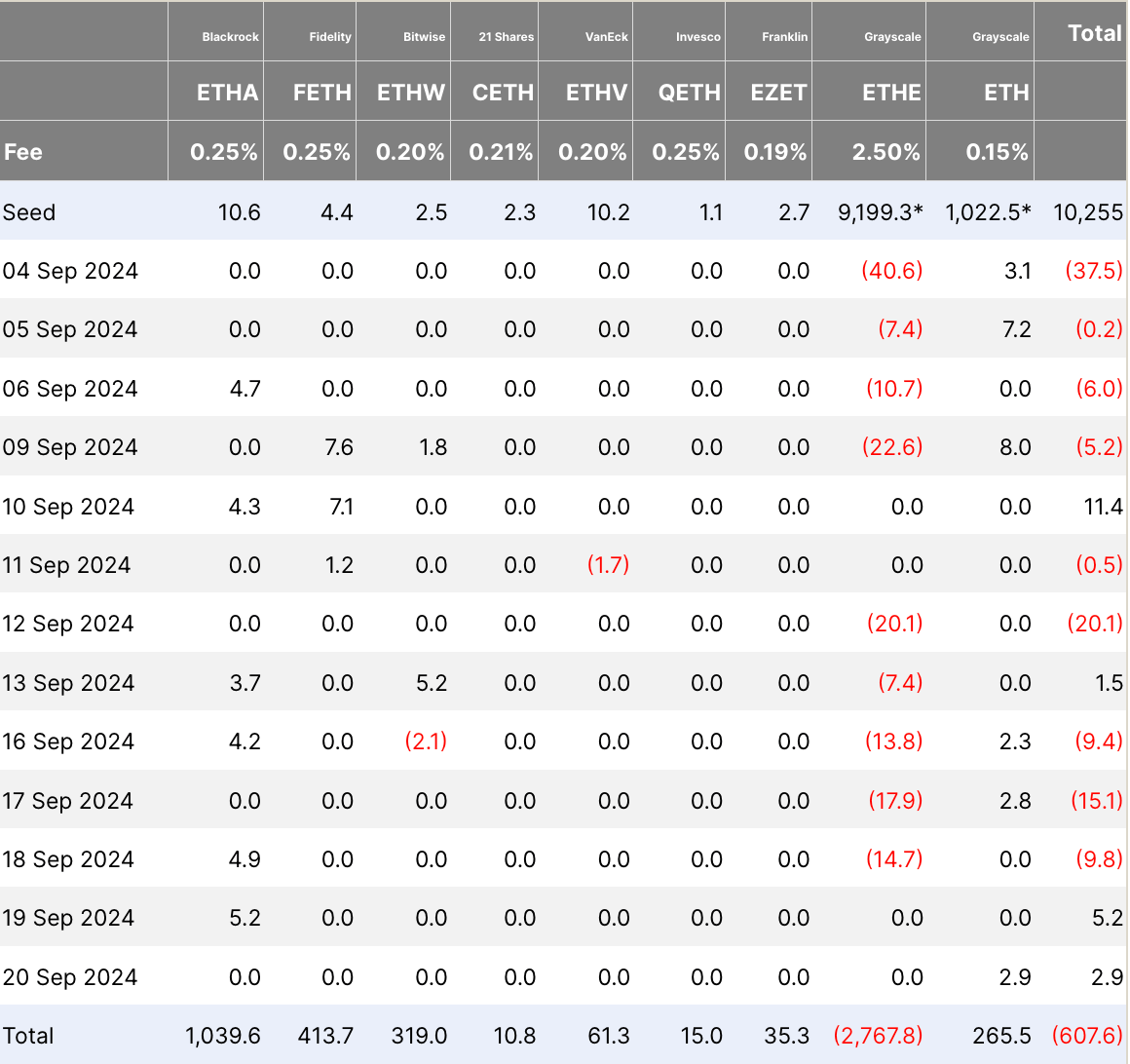

Ethereum ETFs, in contrast, were largely inactive, with a total inflow of only $2.9 million, entirely attributed to Grayscale’s mini Ethereum ETF, ETH. All other Ethereum ETFs, including those from BlackRock, Fidelity, Bitwise, 21Shares, VanEck, Invesco, Franklin, and Grayscale’s larger ETHE, recorded no inflows or outflows.

The marked difference in activity between Bitcoin and Ethereum ETFs highlights a focused institutional interest in Bitcoin exposure, while Ethereum ETFs saw limited engagement.

ETH ETF flows (Farside Investors)

ETH ETF flows (Farside Investors)

The post Bitcoin ETFs see $92 million inflow with only single net outflow in past 7 days appeared first on CryptoSlate.