Bitcoin ETFs See $2 Billion Inflow as SEC Approves Options Trading for Major Funds

On October 18, the US Securities and Exchange Commission (SEC) approved a rule change that allows the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE) to offer options trading for multiple spot Bitcoin exchange-traded funds (ETFs).

This decision comes during a period of strong weekly inflows for Bitcoin ETFs, marking their best performance in around seven months.

SEC Greenlights Options TradingThe SEC’s filings revealed that both exchanges were authorized to list options for spot ETF products. However, while the NYSE has full approval for all products, CBOE’s listing excludes Grayscale’s Bitcoin Mini Trust.

“The Commission finds that the proposed rule change is consistent with Section 6(b)(5) of the Act,76 which requires that an exchange have rules designed to prevent fraudulent and manipulative acts and practices, to remove impediments to and perfect the mechanism of a free and open market, and to protect investors and the public interest,” the SEC stated in the two filings.

Read more: An Introduction to Crypto Options Trading

The exact launch date for these options has not been confirmed. However, ETF experts expect the approval to broaden access to crypto-related financial products on major US exchanges. This move will likely increase liquidity around Bitcoin ETFs, draw more participants to the market, and ultimately strengthen the industry.

Jeff Park, head of alpha strategies at Bitwise, highlighted the advantages of ETF options over existing BTC options on platforms like Deribit. He pointed out that ETF options offer cross-margining, which enables integration with multiple assets such as GLD.

Park emphasized that derivatives don’t directly affect Bitcoin supply but allow USD holders to hedge against Bitcoin exposure, which can reduce volatility. He also highlighted that ETF options can enable market conditions to significantly influence large assets like BTC.

“ETF options are the tightropes accelerating flows that convert Bitcoin’s potential energy into kinetic energy, all leading in one direction: higher,” Park concluded.

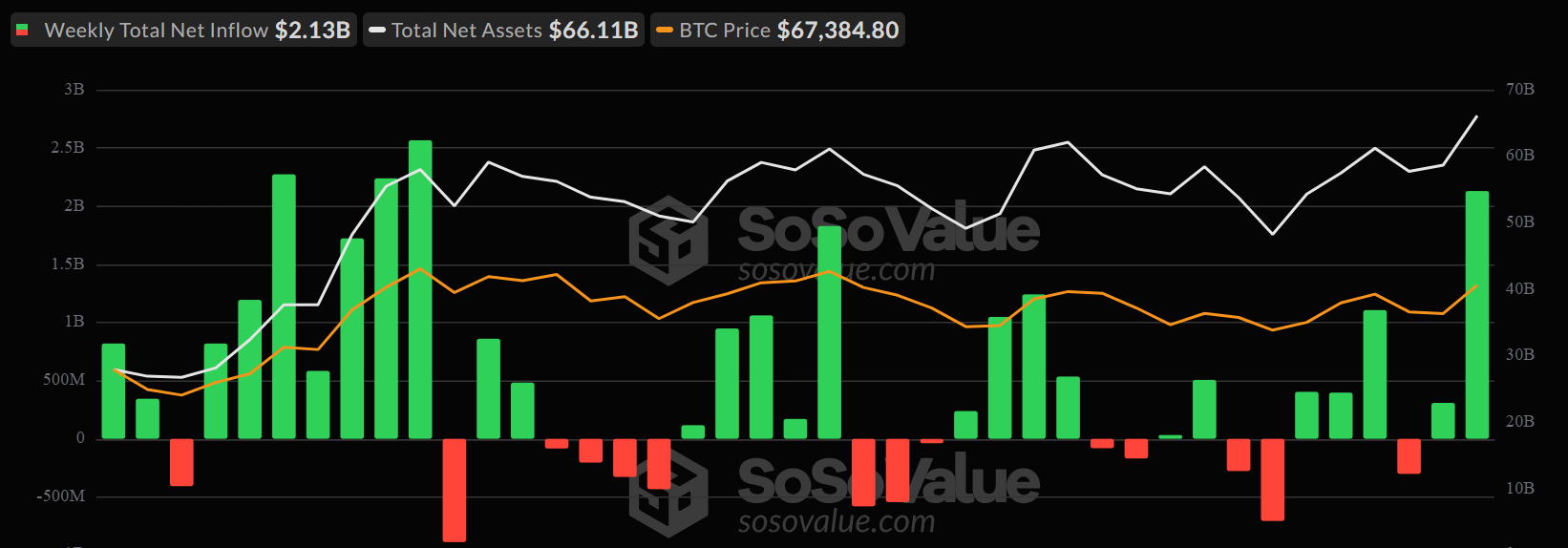

The SEC’s approval coincides with the ETFs experiencing a remarkable week of inflows. Data from SoSoValue revealed that Bitcoin ETFs collectively pulled in over $2 billion, extending their winning streak to six consecutive days. As a result, the ETFs have now reached $21 billion in total net inflows, driven by strong investor demand.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Bitcoin ETFs Weekly Flows. Source: SoSoValue

Bitcoin ETFs Weekly Flows. Source: SoSoValue

Nate Geraci, president of the ETF Store, believes this sustained momentum reflects the robust retail and institutional interest in Bitcoin ETFs. At this pace, he predicts that BTC ETFs could surpass Gold ETFs in market size within the next two years.

The post Bitcoin ETFs See $2 Billion Inflow as SEC Approves Options Trading for Major Funds appeared first on BeInCrypto.