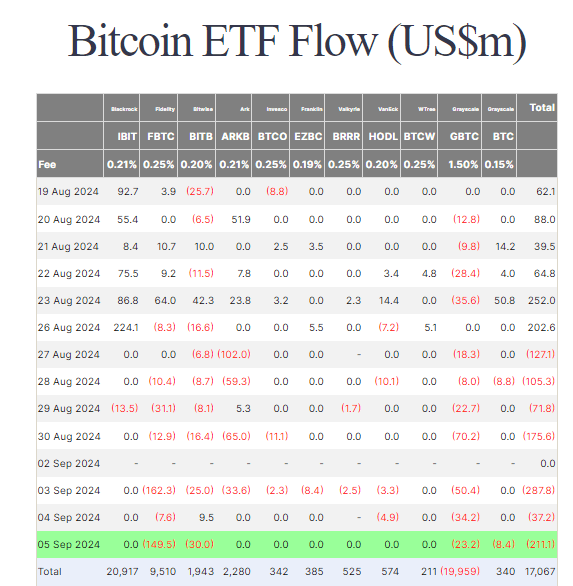

Bitcoin ETF outflows hit $211.1 million in one day, total surpasses $1 billion since August 27

Recent data from Farside reveals significant outflows from Bitcoin ETFs on Sept. 5, totaling $211.1 million. This marks the seventh consecutive trading day of outflows, with no ETF issuers reporting any inflows on Sept. 5. Four major issuers experienced notable outflows: Fidelity’s FBTC saw the largest drop with $149.5 million, followed by Bitwise’s BITB with $30.0 million, Grayscale’s GBTC with $23.2 million, and BTC ETFs with $8.4 million.

Since Aug. 27, over $1 billion has exited BTC ETFs, bringing total net flows to $17.1 billion. During this period, Bitcoin’s price has dropped from approximately $62,000 to $55,500.

BTC ETF Data: (Source: Farside)

BTC ETF Data: (Source: Farside)

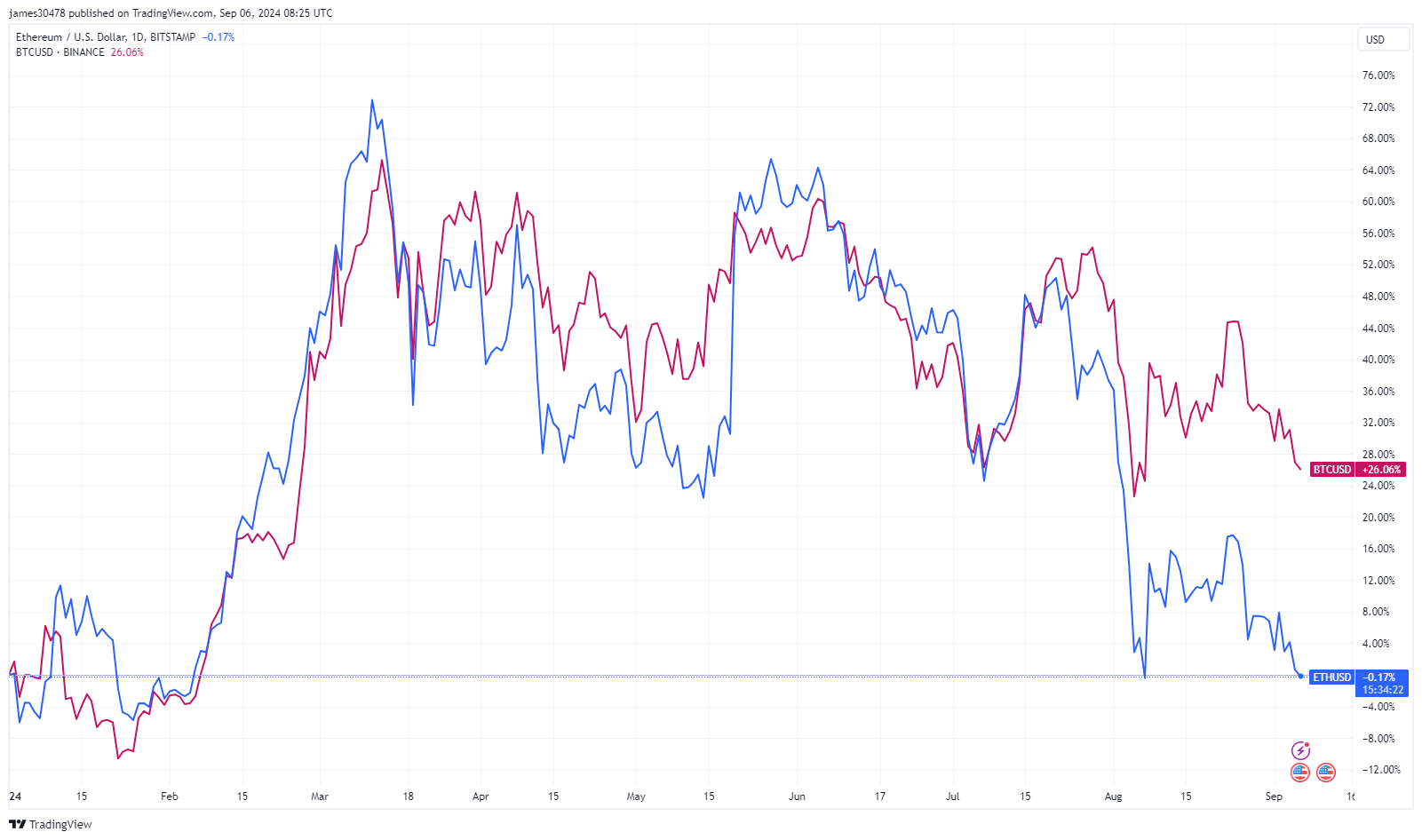

Ethereum ETFs have seen significantly less activity. There was a modest $0.2 million outflow, with most movement concentrated around Grayscale’s products. Grayscale’s ETHE saw a $7.4 million outflow, while ETH ETFs recorded a $7.2 million inflow. Despite these changes, total outflows for Ethereum ETFs have now reached $562.5 million, according to Farside data, and the price of Ethereum is now negative for the year.

BTCUSD VS ETHUSD: (Source: TV)

BTCUSD VS ETHUSD: (Source: TV)

The post Bitcoin ETF outflows hit $211.1 million in one day, total surpasses $1 billion since August 27 appeared first on CryptoSlate.