Bitcoin All-Time High at $94K: What the Crypto Fear and Greed Index Reveals

The post Bitcoin All-Time High at $94K: What the Crypto Fear and Greed Index Reveals appeared first on Coinpedia Fintech News

Last day, the Bitcoin market reached a new all-time high of $92,326.13. Currently, the market is steadily inching upwards. Many Bitcoin investors believe that the market could climb further. Let’s use some key metrics to understand the potential future of this upward trend. Ready?

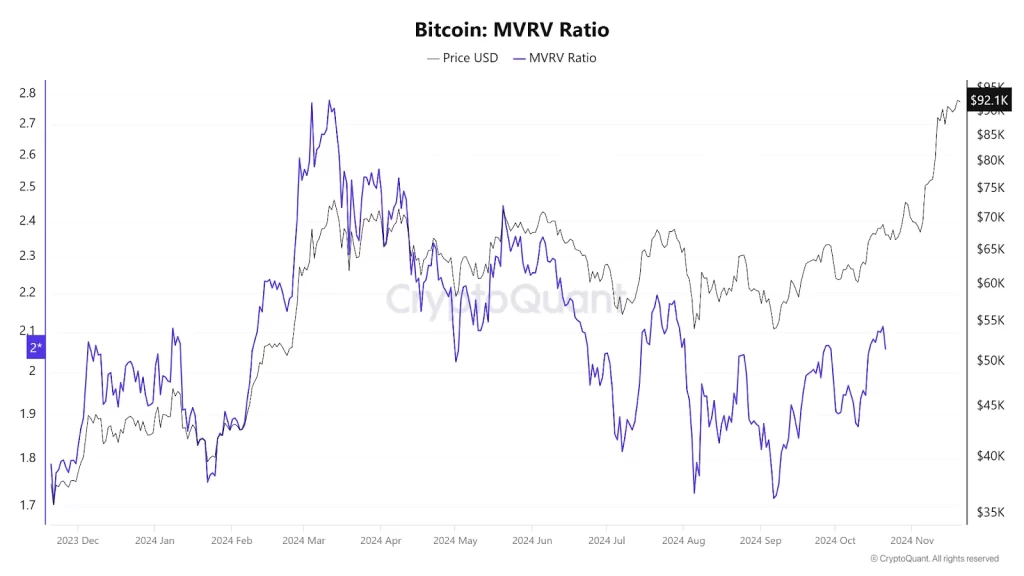

MVRV Ratio: A Signal for Market TopsRight now, the MVRV Ratio sits at the range of 2.05. In mid-March, when the market crossed the range of $73,000, it was at 2.75. On September 6, the ratio stood at 1.71. Since then, it has grown sharply. If the ratio exceeds the range of 2.75, it could indicate that a market top has been reached.

Fear and Greed Index: Understanding Market Sentiment

Fear and Greed Index: Understanding Market Sentiment

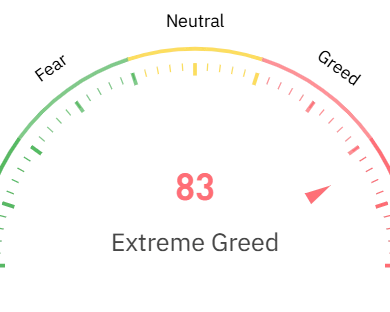

The crypto fear and greed index currently remains at 83, revealing the prevalence of the feeling of extreme greed among crypto investors. If the index crosses the level of 80, it is advisable to reassess risk management strategy, as such levels often precede a price correction.

Long-Term Holders Selling: Bitcoin CDD

Long-Term Holders Selling: Bitcoin CDD

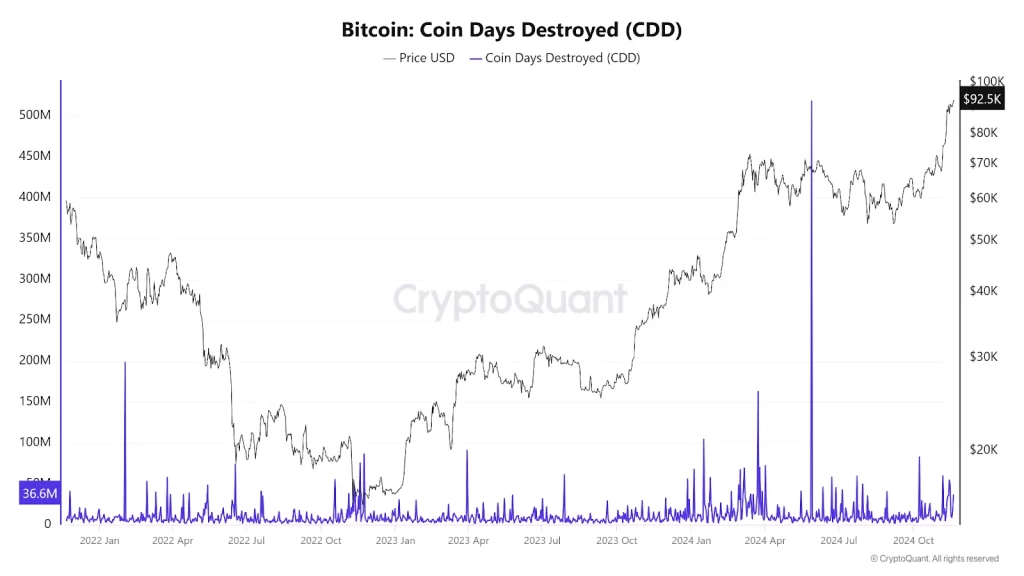

The Bitcoin Coin Days Destroyed index now stands at 36,654,904.70618499. The index tracks when long-held BTC is moved. A spike above 15 to 20 million CDD suggests that long-term holders are selling. Generally, such holders only sell when they believe further growth is unlikely.

Inter-Exchange Flow Pulse: Tracking Market Sentiment

Inter-Exchange Flow Pulse: Tracking Market Sentiment

The Inter-exchange Flow Pulse index right now sits at a range of 753.0127K. The index monitors Bitcoin movements between wallets and exchanges. A bearish signal occurs when large amounts of Bitcoin move to derivative exchanges. The chart shows a spike in exchange inflows.

In conclusion, key metrics like MVRC, F&G, CDD and IFP provide valuable insights for understanding Bitcoin’s market dynamics.