Bitcoin’s Sharpe ratio surpasses Ethereum’s for first time since July 2022

The Sharpe ratio is a key financial metric used to evaluate an investment’s risk-adjusted return. It helps investors understand how much return they are receiving for the risk taken. It is calculated by dividing the difference between an investment’s return and the risk-free rate by the investment’s standard deviation (a measure of risk or volatility). A higher Sharpe ratio indicates a better risk-adjusted return.

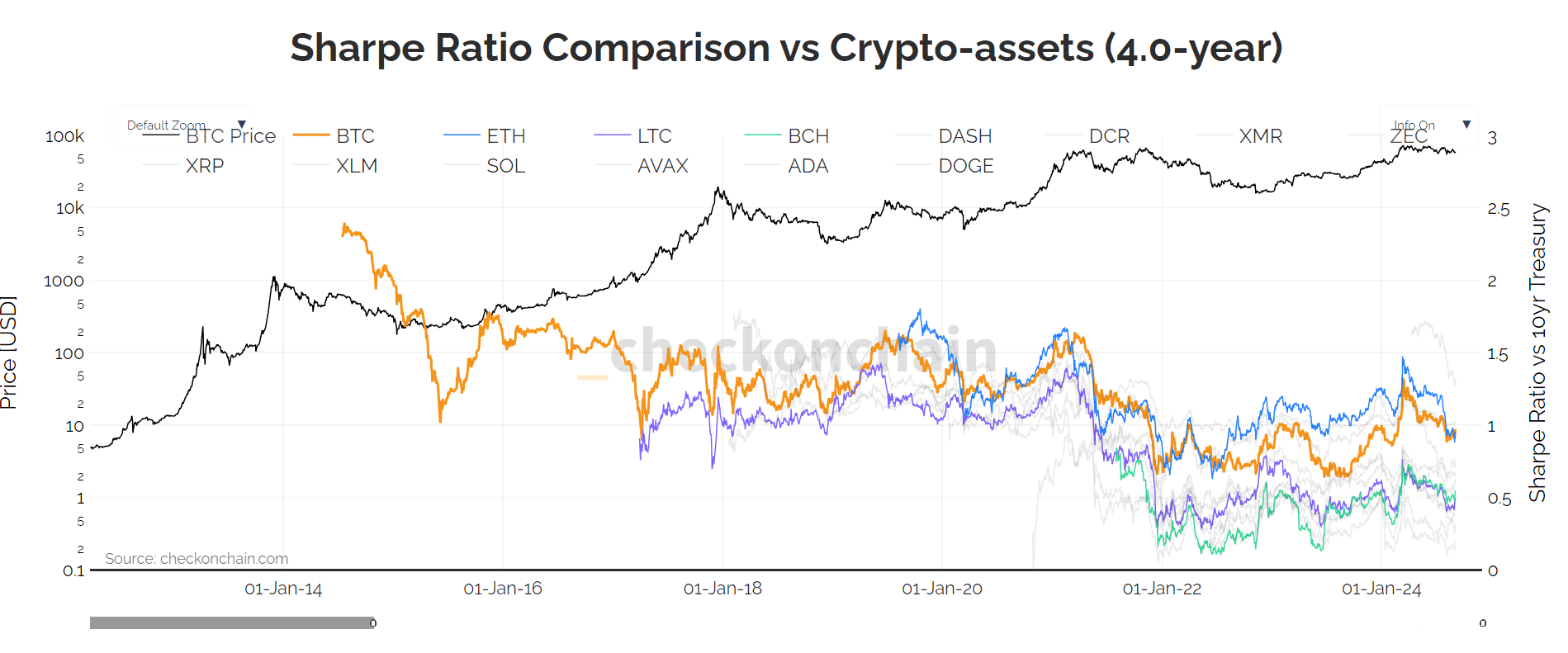

In the crypto market, the Sharpe ratio offers valuable insights. According to checkonchain.com, Bitcoin (BTC) currently has a Sharpe ratio of 0.97 on a 4-year rolling basis, indicating a strong performance relative to its risk. Notably, BTC’s Sharpe ratio has recently surpassed Ethereum’s (ETH) for the first time since July 2022, with ETH now at 0.95.

Among major digital assets, only Solana (1.32) and Dogecoin (1.00) boast higher Sharpe ratios than Bitcoin. Other significant coins, such as XRP and ADA, have decreased Sharpe ratios, reflecting weaker risk-adjusted returns. Forks of Bitcoin, like Bitcoin Cash and Litecoin, have even lower Sharpe ratios of 0.54 and 0.46, respectively.

Historically, BTC’s Sharpe ratio was much higher, reaching 2.33 in 2014, but it has been on a downward trend since then, indicating increasing risk or diminishing returns over time.

Sharpe ratio Comparison vs Crypto Assets: (Source: Checkonchain)

Sharpe ratio Comparison vs Crypto Assets: (Source: Checkonchain)

The post Bitcoin’s Sharpe ratio surpasses Ethereum’s for first time since July 2022 appeared first on CryptoSlate.