Analysts debate ETF influence on Bitcoin suggesting $20k price without $17 billion inflows

Bitcoin ETFs have garnered significant attention in 2024, amassing over $17 billion in net inflows.

Senior Bloomberg ETF analyst Eric Balchunas suggests that without the success of Bitcoin ETFs, the digital assets’s price would hover around $20,000 instead of the current $60,000. He argues that ETF activity has been a key driver in Bitcoin’s price surge.

“Take the ETFs away from picture and btc price is probably around $20k”.

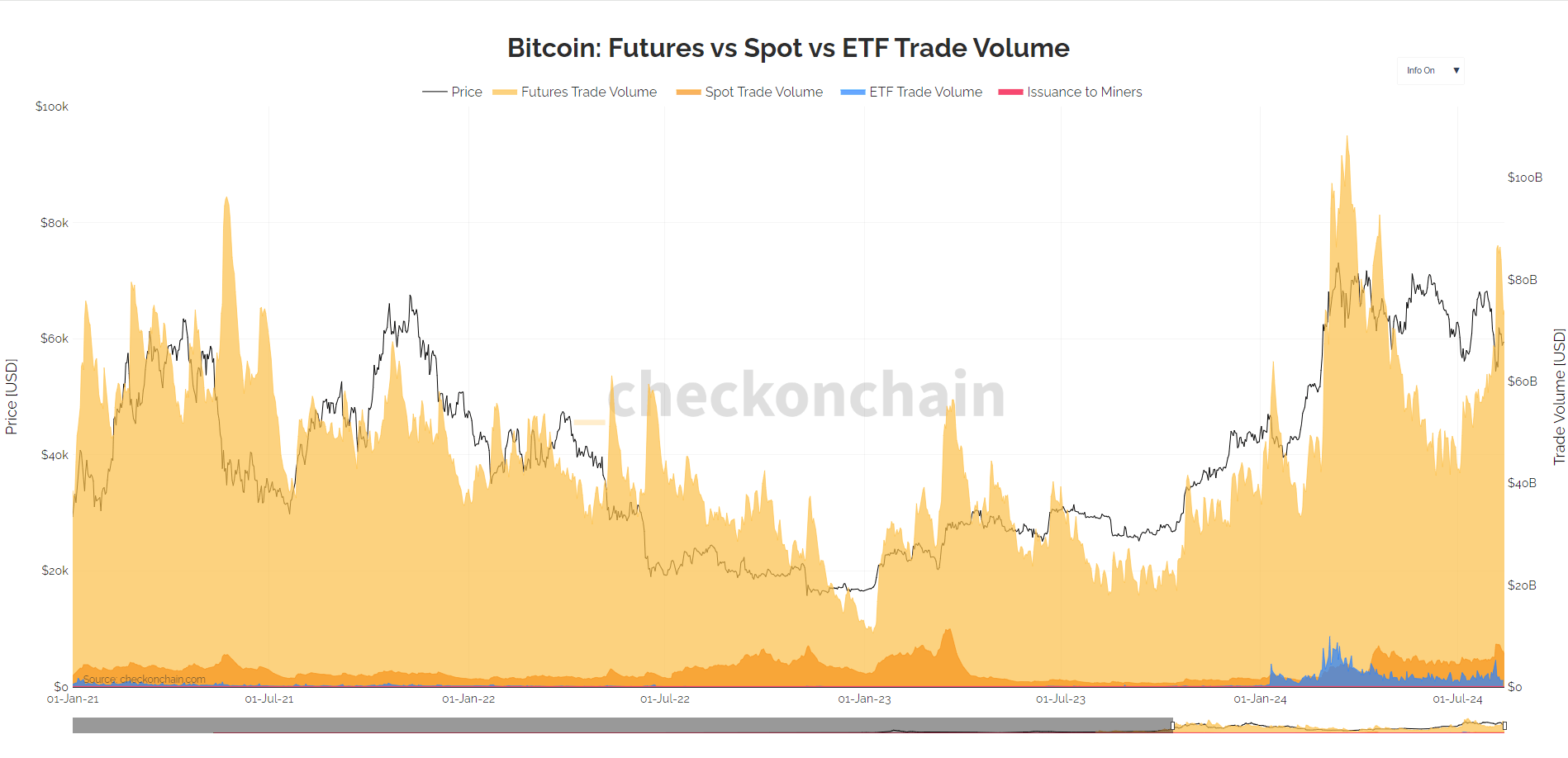

However, I disagree with Balchunas’s assessment. I’ve emphasized that the volume of Bitcoin ETFs is relatively minor compared to the futures market, which plays a more substantial role in influencing Bitcoin’s price.

As of Aug. 12, the futures trading volume has reached $74 billion, significantly surpassing the ETF trading volume, which stands at $1.3 billion, according to data from checkonchain.

Bitcoin: Futures vs Spot vs ETF Trade Volume: (Source: checkonchain)

Bitcoin: Futures vs Spot vs ETF Trade Volume: (Source: checkonchain)

I align more closely with the views of Checkmate, a well-respected analyst in the Bitcoin space. He highlights that net capital flows in the Bitcoin market amount to roughly $12 billion per month, with long-term holder supply changes around $1.6 billion, substantially larger than any given ETF inflow or outflow per month.

Bitcoin Comparing the Scale of ETFs, Capital Inflows, and LTH Spending: (Source: @_Checkmatey_)

Bitcoin Comparing the Scale of ETFs, Capital Inflows, and LTH Spending: (Source: @_Checkmatey_)

In essence, while ETFs are influential, they are not the primary force driving Bitcoin’s market. As Checkmate succinctly puts it,

“At best, the ETFs are 20% of the influence. They are important, but not the driver”.

The post Analysts debate ETF influence on Bitcoin suggesting $20k price without $17 billion inflows appeared first on CryptoSlate.