Analyst Says Bitcoin Making ‘All the Right Technical Steps’ As BTC Starts Week Off With Rallies

A widely followed cryptocurrency analyst and trader is saying that Bitcoin’s (BTC) technicals are suddenly looking bullish.

The analyst pseudonymously known as Rekt Capital tells his 500,300 followers on the social media platform X that Bitcoin appears to be setting up for bigger moves to the upside.

“Bitcoin is performing all the right technical steps to reclaiming the channel bottom (black) as support:

- Weekly closed above the channel bottom.

- Retest the channel bottom as support.”

Source: Rekt Capital/X

Source: Rekt Capital/X

The analyst also says that Bitcoin Dominance (BTC.D) – which tracks the percentage of the total market cap that belongs to Bitcoin – is continuing to be bullish, implying a larger appetite for BTC than altcoins from investors.

“BTC dominance continues to make new highs. We haven’t seen highs like this in five years.”

Source: Rekt Capital/X

Source: Rekt Capital/X

In a video update, Rekt Capital tells his 87,800 YouTube subscribers that he believes Bitcoin’s cycle peak will not be reached until a year from now.

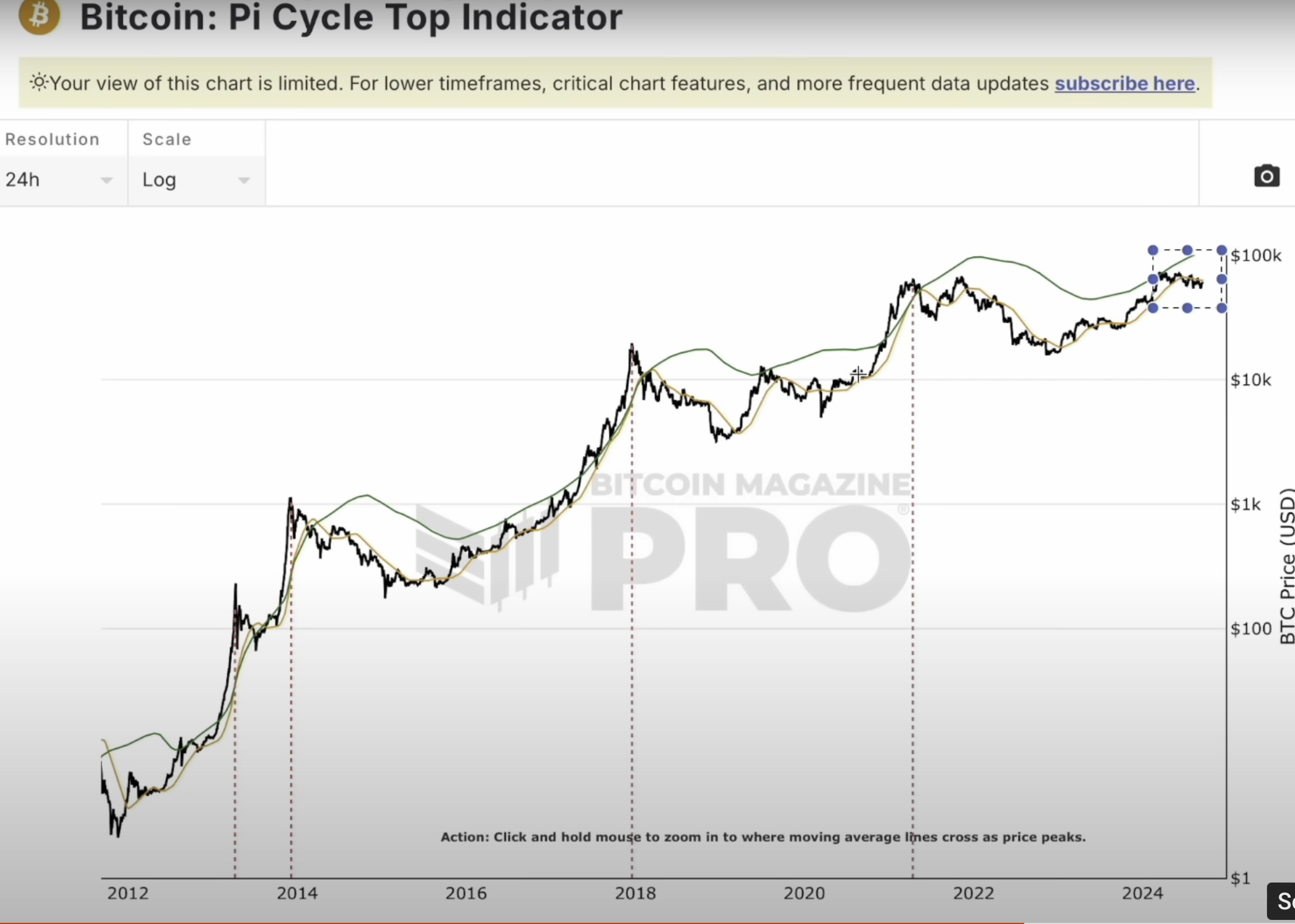

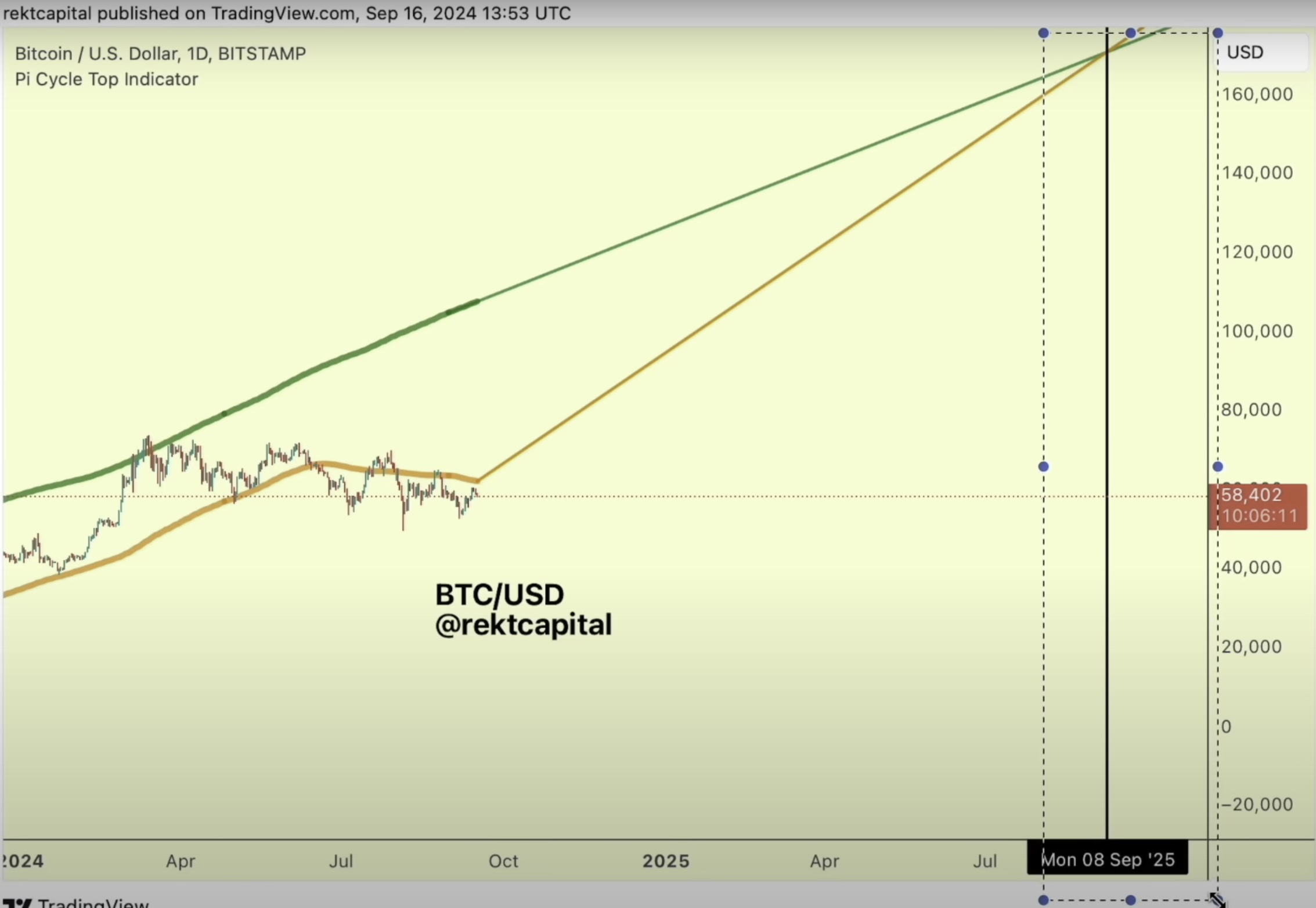

He references the Pi Cycle top indicator chart, which looks at price trends against the 111-day moving average (DMA) and a multiple of the 350 DMA. Generally, the crossover of the 111 DMA through the 350 DMA has correlated with market tops.

“We’re nowhere close to a bull market peak just yet, and we’re nowhere even in the conversation just yet, because we don’t even have convergence. We simply need to see price slowly start to incline, and as a result we’re going to see an incline in the PI cycle moving average. But at the moment I think we’re just going to get a repeat of history whereby we simply repeat historically recurring halving cycles and top out in September 2025.”

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

Source: Rekt Capital/YouTube

Looking at his chart, the analyst seems to suggest that Bitcoin may peak around the $175,000 level, potentially late next year.

Bitcoin is trading for $60,905 at time of writing, up more than 5% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Analyst Says Bitcoin Making ‘All the Right Technical Steps’ As BTC Starts Week Off With Rallies appeared first on The Daily Hodl.