AMD’s desktop CPU share soars 10 percentage points in a year

AMD’s desktop CPU market share jumped nearly 10 percent in the last year, an analyst reported Thursday, on the heels of AMD’s strong rollout of its latest desktop gaming CPU. But overall CPU shipment growth dropped “well below seasonal norms,” because of slower Intel CPU shipments.

Mercury Research, which tracks the market share of PC CPUs from AMD, Intel, and Qualcomm, reported sweeping gains in most segments of the CPU market. A portion of the report specific to AMD was provided to journalists by AMD on Thursday, but confirmed by Mercury. Mercury then released a more comprehensive version of its report on Friday.

In general, because of the relatively low share of Qualcomm Snapdragon X CPUs, any share gains AMD realizes usually reflect a corresponding drop in Intel’s market share. However, Mercury said for the third quarter of 2024 Apple and Qualcomm collectively shipped about 10.3 percent of all CPUs, which was about flat with the quarter before.

Overall, CPU shipments weren’t as strong as before. “Third quarter, 2024 processor shipments were up modestly on a sequential basis, with growth that was well below seasonal norms,” Mercury principal analyst Dean McCarron wrote. ” The weakness was primarily due to Intel having much lower desktop CPU shipments compared to the second quarter, which the company attributed to customers drawing down inventory and slowing CPU purchases; this also impacted Intel’s mobile shipments which were slightly below seasonal norms but had positive growth. AMD was unaffected by any inventory adjustments and had approximately seasonal desktop CPU increases and well above seasonal increases in mobile CPU shipments in the quarter.”

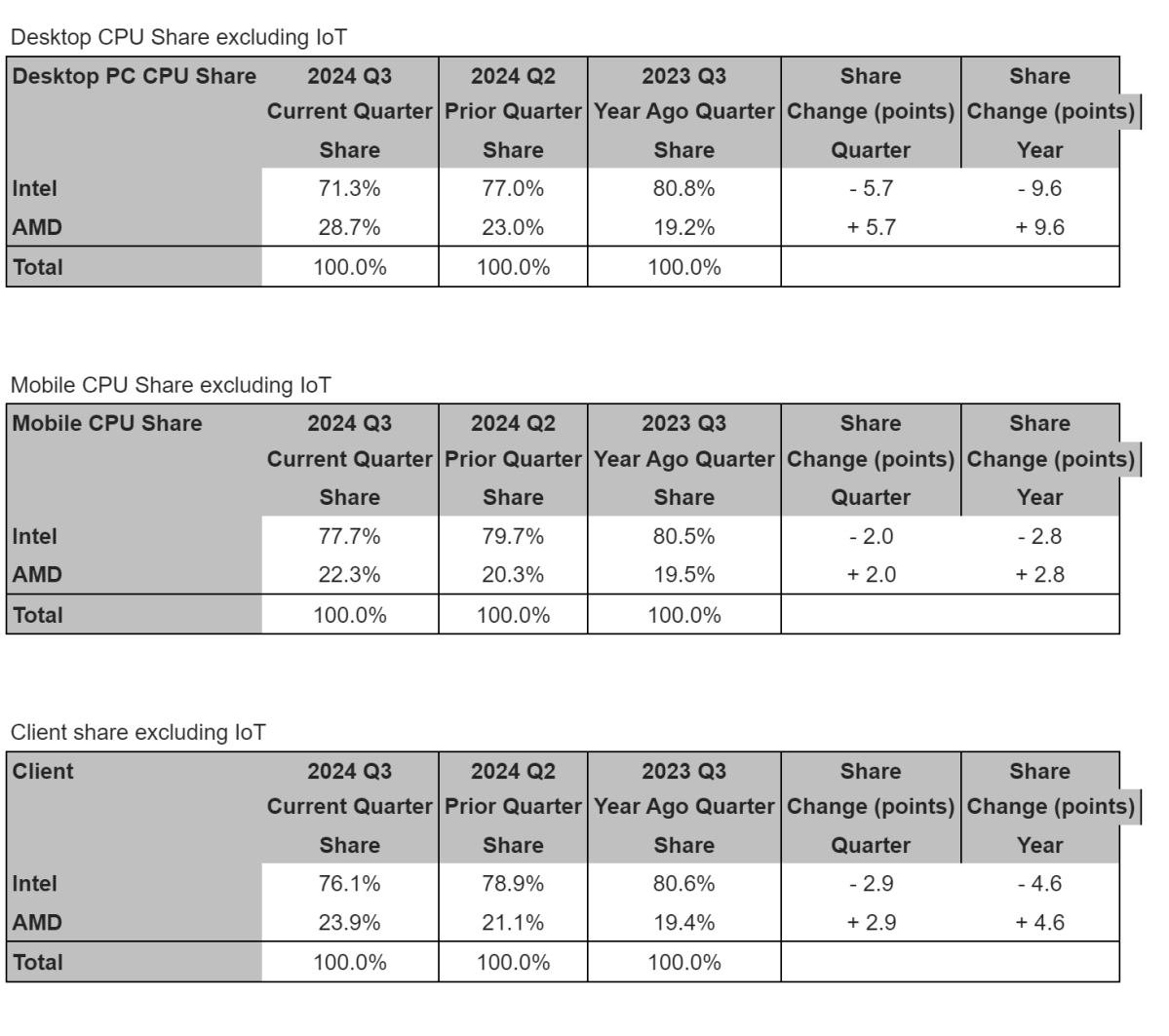

AMD surges, Intel doesn’tAMD’s results were excellent: The company’s desktop market share, in units, increased by 9.6 percentage points year-over-year, to 28.7 percent. In mobile, AMD now holds 22.3 percent of the CPU market, an increase of 2.8 percentage points. Intel typically holds 80 percent of the market, and AMD the other 20 percent. In overall client processors, that relationship still largely holds true: AMD sold 23.9 percent of all client CPUs during the period.

Intel’s market share in units essentially fell in mobile and desktop PCs, gobbled up by AMD.

Intel’s market share in units essentially fell in mobile and desktop PCs, gobbled up by AMD.

In desktops, at least, there’s evidence of strong momentum for AMD’s existing Ryzen 7000X, 8000G and 9000X chips — even with middling 9000X reviews and post-launch, performance-altering Windows updates. Mercury’s numbers report the last year’s worth of sales. But the future looks bright, too. AMD just launched its Ryzen 9000X3D chips this week, and our Ryzen 7 9800X3D review reflects the majority opinion: It “obliterates” Intel’s best.

Intel, of course, is wrestling with significant layoffs as well as buckets of red ink in its most recent earnings report. Analysts have begun to scrutinize Intel’s foundry plan, amid Intel complaints that it hasn’t seen a dime of the CHIPS Act money that’s been promised to build new fabs in the United States. President-elect Trump has threatened to at least rework the CHIPS Act, too.

Intel’s “client share excluding IoT,” or its share of the PC and Chromebook market,” fell 4.6 percent from the third quarter of 2023 to the same period of 2024, which AMD assumed.

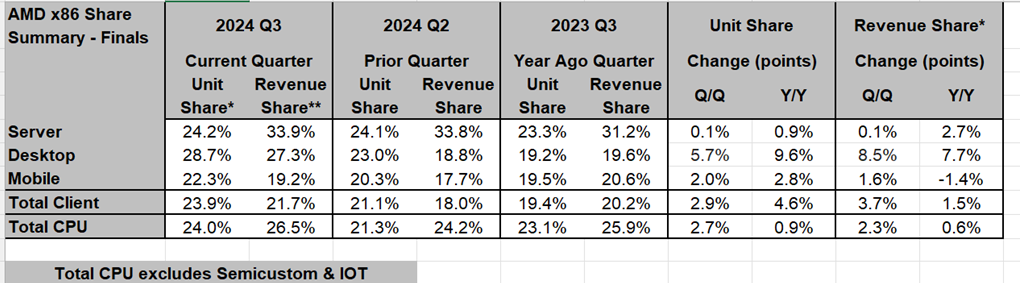

Mercury’s report was also excerpted (below) by AMD itself, with one caveat: Revenue numbers are calculated by AMD itself, and not Mercury, Mercury analyst Dean McCarron said. AMD claims that server revenue share — its market share of the total amount spent on servers, rather than units — hit 33.9 percent, a new record. The report also excludes semicustom chips AMD sells into game consoles, as well as chips that sell into Internet of Things (IOT) devices.

Updated at 9:37 AM on Nov. 8 with new information.