Acquirer Survey Shows Card-Linked Installments Help Merchants Boost Sales

There is a gap between acquirers’ self-reports and implementation. While 72% of acquirers say they support credit card-linked installment options online or in-store, only 3 out of 50 acquirers surveyed offer card-linked installments before or during checkout. These latest findings mirror our findings from late last year.

Acquirers point to technological constraints: 22% cite third-party integration constraints as a limitation to offering credit card-linked installment options. Another 18% say they leave it to consumers to work out pay later plans with their banks.

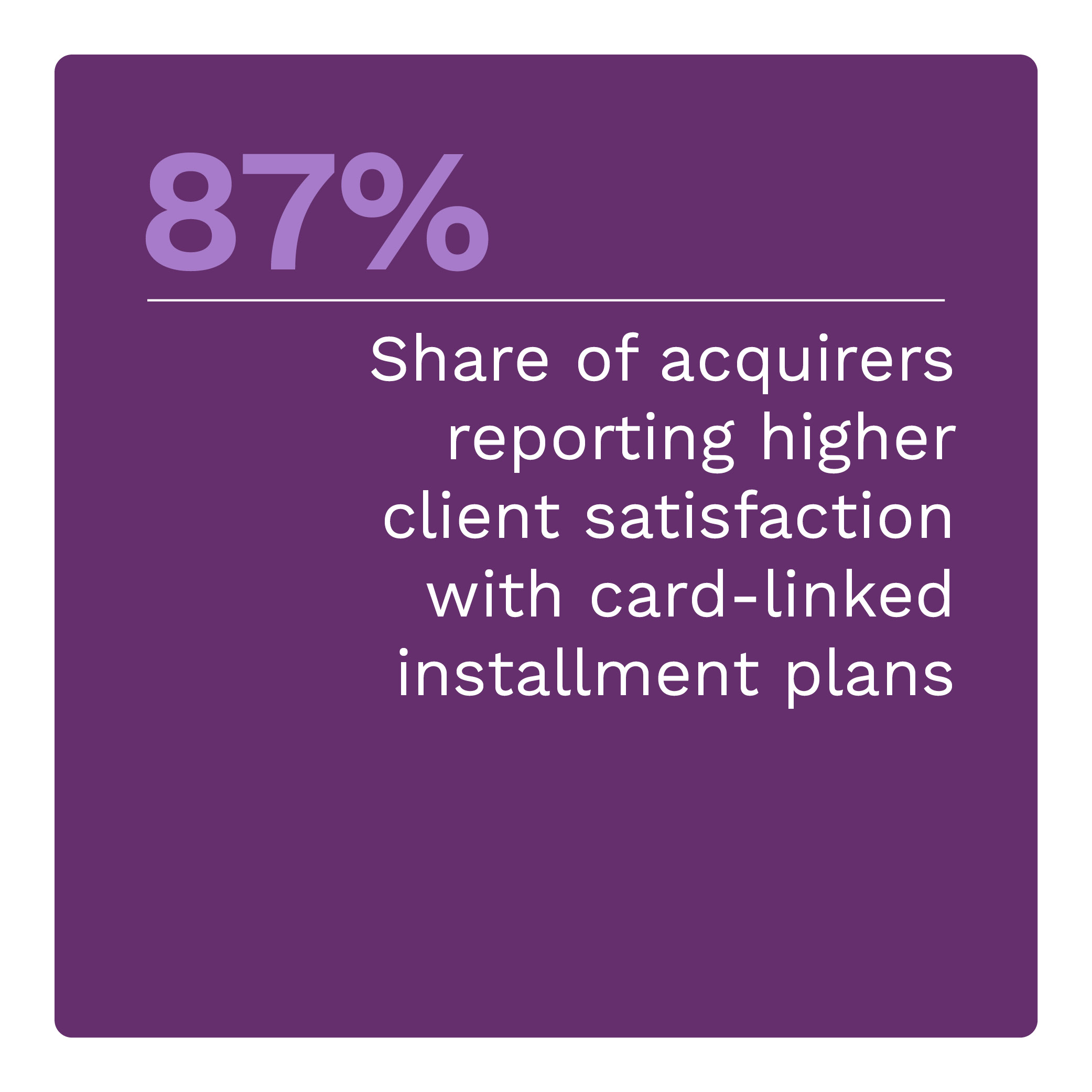

Despite these challenges, opportunities for growth in the pay later payments market remain large. Acquirers that innovate and integrate general-purpose card-linked installment plans more seamlessly can capture a larger market share.

These are just some of the findings detailed in “Navigating New Norms: The Use of Card-Linked Installment Plans in Online and In-Store Sales,” a PYMNTS Intelligence and Splitit collaboration. This edition examines consumers’ use of installment plans for completing common purchases by drawing on insights from an original survey of 50 acquirers that included acquirer executives with knowledge and leadership responsibilities in payments products or services for businesses and merchant monitoring and who have been working in the company for more than one year. We conducted this survey from March 5 to March 28.

Other key findings from the report include:

Nearly all acquirers support credit card-linked installment plans during checkout but lack the capability to do so.Many acquirers do not currently enable their business clients to use general-purpose credit card-linked installment plans before checkout. Notably, 45% of these acquirers plan to implement this feature. This is an increase of 15% among acquirers planning to support this installment type over the past six months. This highlights the growing recognition among acquirers that offering flexible payment solutions earlier in the customer journey could significantly affect purchasing decisions.

Roughly half of firms fear business clients will switch to a firm that offers pay later options to customers. Anxiety about clients switching is clear among firms, both large and small. All recognize the critical value that installment plans represent to merchants. Offering flexible payment solutions is not merely an add-on service but a potential deal-breaker for many consumers. Acquirers recognizing this may need to adapt their services to keep and attract clients. Those that offer pay later options could secure a competitive advantage in keeping business clients.

Anxiety about clients switching is clear among firms, both large and small. All recognize the critical value that installment plans represent to merchants. Offering flexible payment solutions is not merely an add-on service but a potential deal-breaker for many consumers. Acquirers recognizing this may need to adapt their services to keep and attract clients. Those that offer pay later options could secure a competitive advantage in keeping business clients.

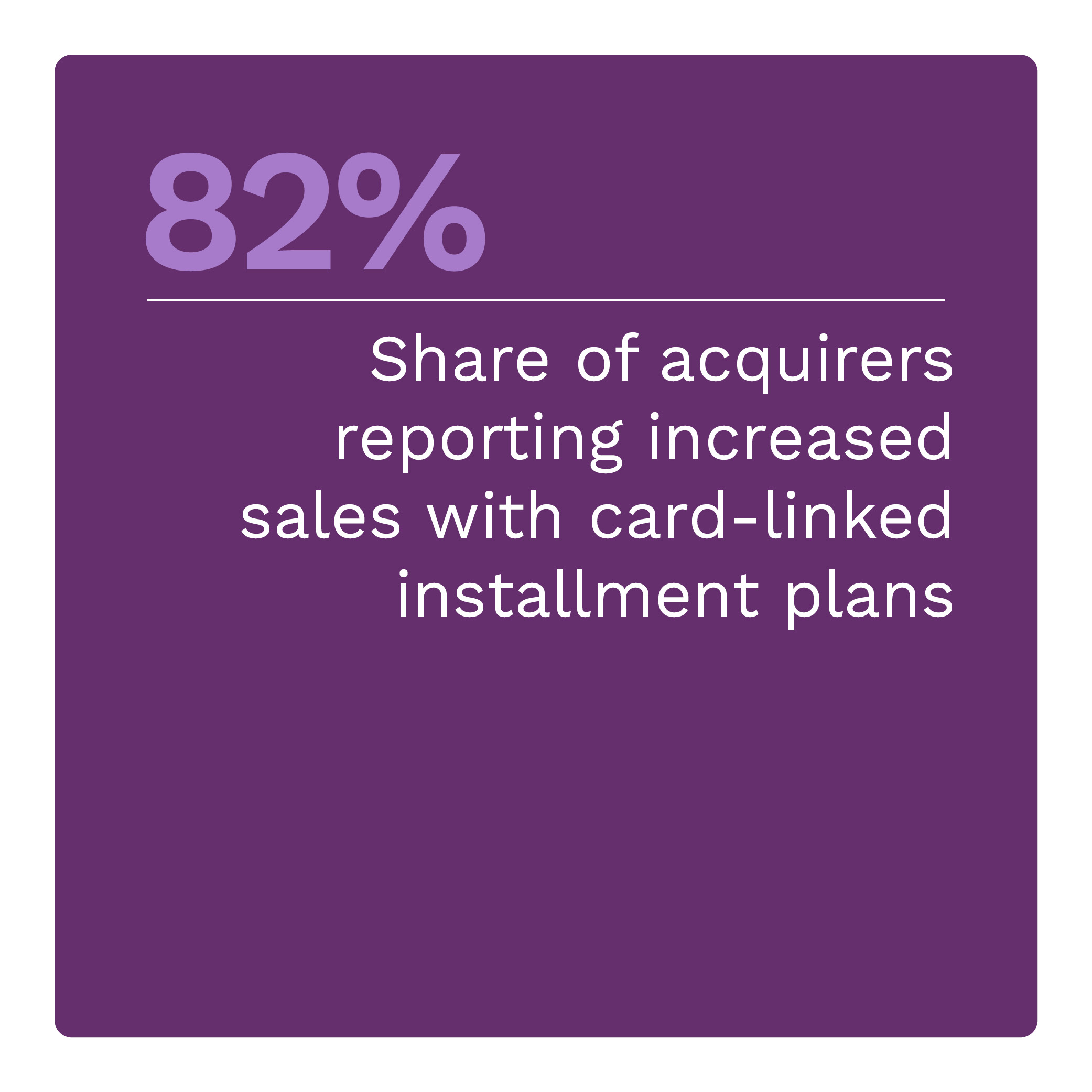

PYMNTS Intelligence finds that 82% of acquirers believe that providing card-linked installment plans increases sales volume. This is a substantial increase from the 64% who said the same six months ago. This increase shows the market is maturing, and consumers increasingly expect pay later options.

Fifty-two percent of acquirers plan to innovate installment payment capabilities in the next year. Still, all acquirers must consider enhancing their technological frameworks. Download the report to learn more about the benefits of offering card-linked installment options.

The post Acquirer Survey Shows Card-Linked Installments Help Merchants Boost Sales appeared first on PYMNTS.com.