$9.4B Worth Bitcoin Options Expiry: Will the Price Jump?

The post $9.4B Worth Bitcoin Options Expiry: Will the Price Jump? appeared first on Coinpedia Fintech News

Bitcoin and Ethereum are about to face a huge event. On November 29, a whopping $9.4 billion in Bitcoin options and $1.3 billion in Ethereum options are set to expire. This could lead to major swings in the crypto market, especially after the U.S. Thanksgiving holiday. So, what does this all mean? Let’s break it down.

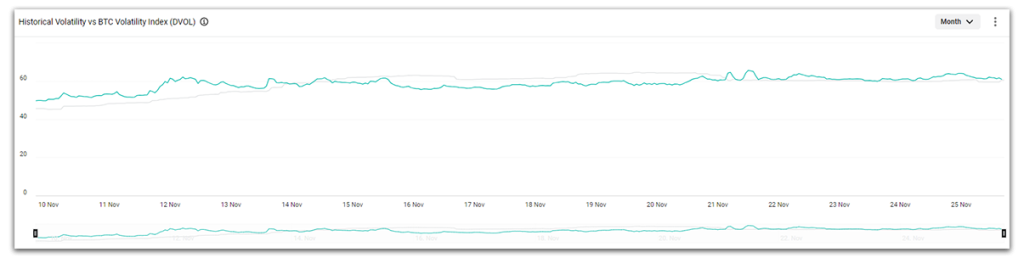

What’s at Stake?Here’s the thing: nearly half of all Bitcoin options—around $4.2 billion—are “in the money” (ITM). That means many traders are likely looking at a nice profit. The catch? Most of those are call options, meaning people are betting Bitcoin’s price will keep climbing. So, it’s possible we’ll see some big price action leading up to November 29. But don’t be surprised if things get bumpy. Similar expirations have caused drops in Bitcoin’s price before—about 3% in October—but this time could be different.

What Happens When Big Options Expire?

What Happens When Big Options Expire?

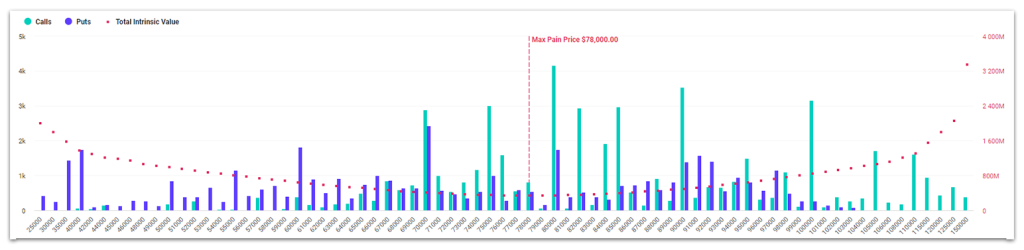

With so many ITM calls, there’s a chance the Bitcoin market could get pretty volatile. Traders will likely want to lock in profits, and that could move the price around. But what about the other side of the trade? There’s a lot of put options hanging around $70,000. However, experts think this isn’t where things are headed. They’re more focused on a range between $70,000 and $82,000, thanks to the “max pain” theory.

What’s Next for Bitcoin?

What’s Next for Bitcoin?

Now, let’s talk about those out-of-the-money (OTM) options—there’s about $5.2 billion in them. Most of these are puts, but rather than being bets that Bitcoin will drop, they’re more like insurance against a downturn. Still, the fact that Bitcoin’s price is sitting comfortably above the “max pain” level means that market makers might need to buy more BTC to cover their positions. If they do, it could help push the price even higher—closer to $100,000.

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; } .entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; } .entry ul.article-inside-link li:last-child { display: none; }- Also Read :

- Ripple News: $3.8B Tokenized Fund Launches on XRPL

- ,

With all this options expiry drama unfolding, Bitcoin’s price could see some wild swings. Will the market makers help push BTC to new heights, or will profit-taking send it lower? It’s a waiting game, and the big day is just around the corner.