3 US Economic Events Set to Drive Bitcoin Sentiment This Week

Crypto markets are bracing for what is arguably the most volatile week in 2024. Three US macroeconomic data events are on the calendar and have the potential to affect investors’ portfolios significantly.

Meanwhile, Bitcoin (BTC) is trading below $70,000, with prospects for more gains as the fourth quarter (Q4) has historically boded well for the pioneer crypto.

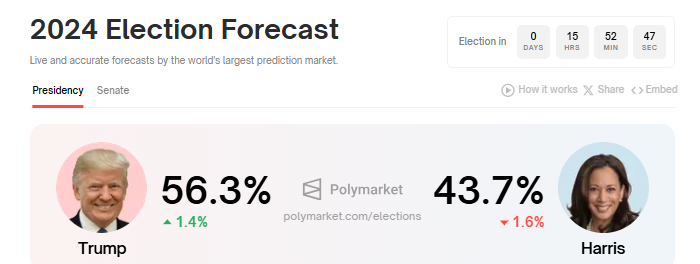

US Elections: Donald Trump vs. Kamala HarrisThe US market is approaching the climax of its political showdown between Donald Trump and Kamala Harris, from the Republican and Democratic parties, respectively, on Tuesday, November 5. Based on data on Polymarket, the US elections are only hours away, with Trump narrowly in the lead.

Read More: How Can Blockchain Be Used for Voting in 2024?

Donald Trump vs. Kamala Harris on US Elections. Source: Polymarket

Donald Trump vs. Kamala Harris on US Elections. Source: Polymarket

Nevertheless, Polymarket’s industry peer in the prediction market, Kalshi, shows an almost similar margin, with Trump leading by 52% against Harris’ 48%. This contrast reflects the differences in these platforms’ user bases. Notwithstanding, analysts anticipate a volatile day for Bitcoin.

The US election results could have significant implications for economic policy, regulatory environments, and investor sentiment. Depending on the winner, policies regarding cryptocurrency might change, potentially affecting Bitcoin price, with the sentiment spilling over to other crypto tokens.

“I’m expecting this week to be a real firecracker, with lots of volatility. The Key day will be Tuesday, as the US election voting comes to a close. If there is no clear winner as the day progresses, it could get quite scary for Bitcoin,” said Mark Cullen, an analyst at AlphaBTC.

Initial Jobless Claims: Labor Market GaugeBeyond the US elections, crypto markets will also monitor the initial jobless claims on Thursday, November 7. This economic data helps gauge the tightness or softness of the labor market in the US. While the job market has softened, unemployment rates remain low on an absolute basis.

Last week, US citizens filing new applications for unemployment insurance came in at 216,000 from the week ending October 25, down from the previous 228,000. However, there is a consensus forecast of 220,000.

High initial jobless claims in the Thursday report suggest increasing economic hardship and a weakening labor market. This could lead to decreased consumer spending and investment in traditional assets like stocks and bonds. Consequently, some investors may turn to alternative assets like cryptocurrencies as a hedge against economic uncertainty.

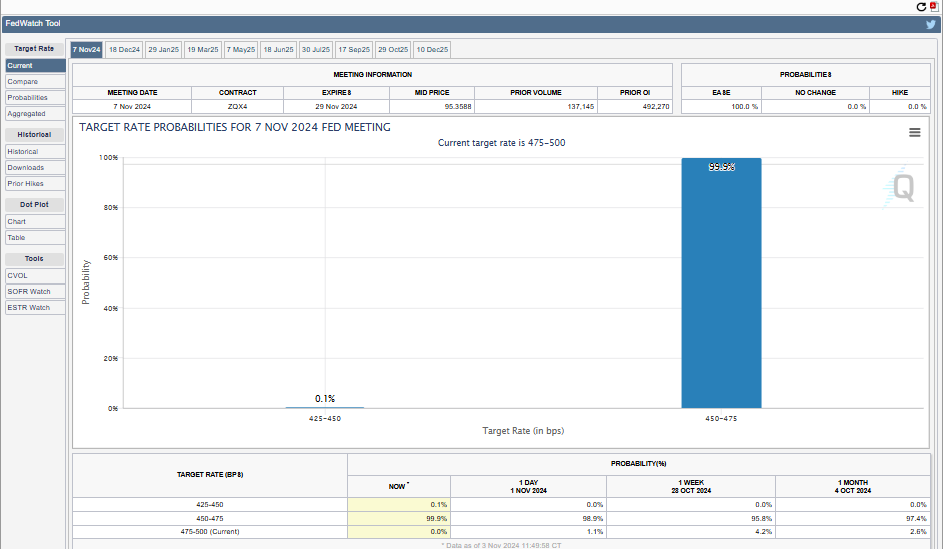

FOMC Interest Rate Decision and Jerome Powell SpeechOn Thursday, the Federal Open Market Committee (FOMC) will release minutes from its last meeting, followed by comments from Federal Reserve (Fed) Chair Jerome Powell. The Fed operates under a dual mandate: to keep inflation, as measured by the Consumer Price Index (CPI), at 2% annually, and to sustain full employment.

The FOMC’s November meeting is scheduled for next Wednesday and Thursday, with economists speculating on the possibility of another rate cut. At the previous meeting, the Fed reduced interest rates by 50 basis points (0.5%) as US CPI dropped to 2.4%.

Another rate cut may be likely as inflation nears the Fed’s 2% target, while the unemployment rate has risen from 3.7% to 4.1% this year, indicating potential softening in the job market.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Recently, Powell said the downside risks to employment have increased, hinting at more rate cuts to support economic growth before the situation worsens. Moreover, the FOMC’s forecast in September suggested that the federal funds rate could fall by another 50 basis points before the end of 2024.

With only November and December meetings remaining, likely, two 25-basis-point cuts are likely underway. Against this backdrop, the CME Fed Watchtool shows a 99.9% probability of a 25 bps rate cut in the Thursday US economic data release.

FOMC Interest Rate Cut Probabilities. Source: CME Fed Watchtool

FOMC Interest Rate Cut Probabilities. Source: CME Fed Watchtool

Meanwhile, Spotonchain anticipates a further upside for Bitcoin after the US elections and FOMC meeting, setting a BTC price target of $100,000 in 2024. The rally, Spotonchain says, will come regardless of who wins the elections.

“The market is entering its most volatile week with the US election and FOMC meeting, but this rally may be here to stay. Historically, the real bull run begins post-election, and we believe that whether Trump or Harris becomes the next president, BTC will continue its upward journey, potentially reaching 100,000 this year,” Spotonchain said.

At the time of writing, BTC is trading for $68,698, signifying a modest 0.34% surge since the Monday session opened.

The post 3 US Economic Events Set to Drive Bitcoin Sentiment This Week appeared first on BeInCrypto.